Binance’s Massive Sell-Off Raises Bitcoin and Ethereum Crash Fears

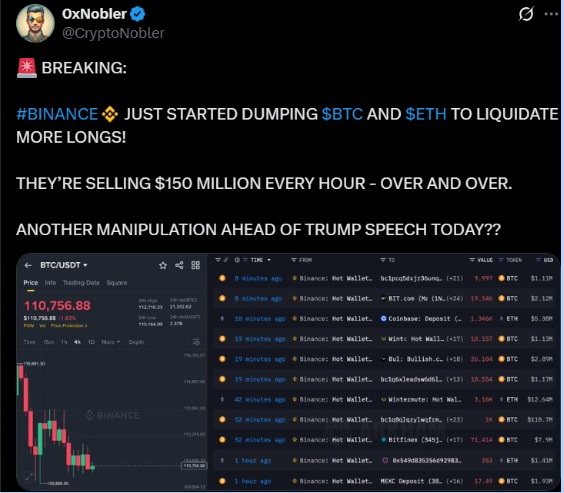

Binance has reportedly begun selling large volumes of Bitcoin and Ethereum. Market data suggests the exchange is offloading roughly $150 million worth of assets every hour. This pattern has drawn concern from traders who fear it could trigger widespread liquidations across leveraged long positions.

The reported sell-off coincided with sharp declines in Bitcoin’s price, which dropped near the $110,000 mark. Blockchain transaction trackers showed multiple large transfers from Binance’s hot wallets to other exchanges and unidentified wallets. Analysts say such movements often precede significant volatility in the markets.

Market Speculation Ahead of Trump Speech

These transactions have been emphasized at the right time to arouse speculation over market manipulation. Other observers indicate that the exercise could be linked to future political events in the coming days such as a speech planned by the former U.S. President Donald Trump later in the day.

Market commentators disagree on whether this represents strategic repositioning or intentional exertion to contemplate the leveraged traders. Although there is no statement by Binance, investors are wary due to the fact that liquidity and volatility are changing at a very fast pace.

The traders are being advised by the crypto experts to watch their wallets and practice discipline in risk management due to the uncertainty. The reaction of the markets to the situation may influence the sentiment in the long run in the broader ecosystem of digital assets.

Crypto Market Faces Further Decline as Fear Intensifies

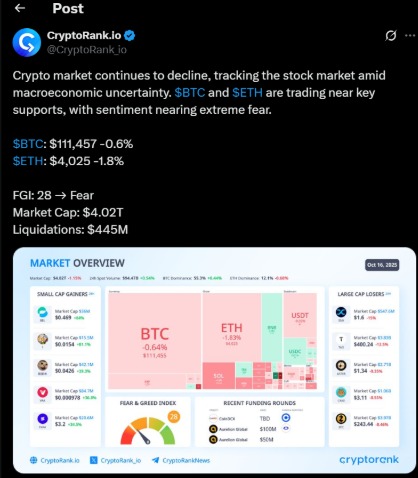

Market movement On October 16, 2025, the cryptocurrency markets remained in a downward trajectory after a more general decline in the global equity markets.

Both Bitcoin (BTC) and Ethereum (ETH) are trading at important areas of support as traders react to increasing macroeconomic uncertainty. The sentiment in the markets has gone further to the fear area, indicating the behavior of cautious investors.

Bitcoin dropped by 0.6% to $111,457 and Ethereum dropped 1.8% to 4,025, according to CryptoRank.io . The overall market value of all cryptocurrency fell to an amount of 4.02 trillion, a consistent decline of 1.15% per day.

The Fear and Greed Index (FGI) showed a score of 28, indicating an obvious movement towards fear. In the meantime, total liquidations were at 445 million which meant that there was high volatility and unwinding of leveraged positions.

Despite the widespread decline, small-cap tokens showed mixed results, with some recording notable gains. Bitcoin maintained dominance at 55.3%, while Ethereum’s markets share fell slightly to 12.1%. Analysts note that sustained selling pressure could test key support zones further, especially if macroeconomic headwinds persist.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。