Crypto Market Share 1% Out of $261T Asset: Goldman Sachs Crypto News

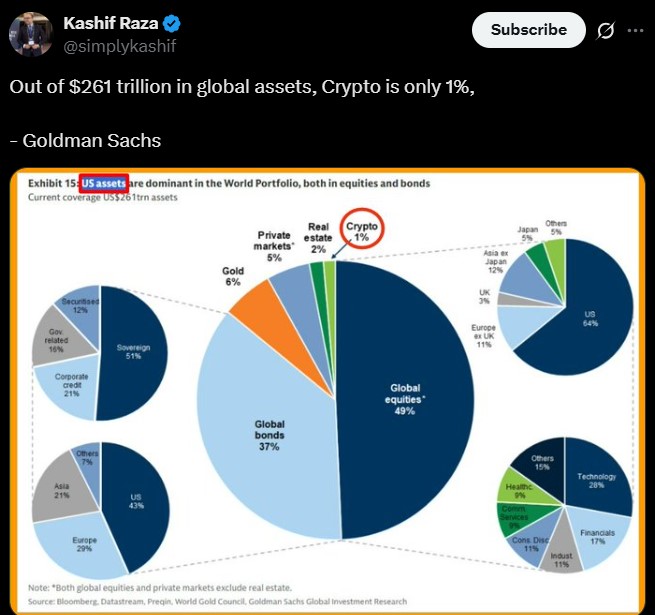

Big cryptocurrency news is going around in the finance world today: Goldman Sachs crypto report says that out of $261 trillion total assets in the world, only 1% is in coins like Bitcoin, Ethereum, and other altcoins. That is about $2.6 trillion.

This tiny crypto market share may look small, but it is actually a big opportunity for investors. In this article, we will explain the cryptocurrency share in total assets, how the US is dominating the market, why it is important, and what investors can expect next.

Cryptocurrency Portfolio Allocation: How the World Allocates Wealth

Goldman Sachs global asset report highlights how the wealth is distributed.

Source: Kashif Raza Bitinning Founder

Here is the breakdown:

-

Global Equity Market (Stocks): 49%

-

Global Bonds: 37% (Safe investments for big investors)

-

Gold: 6%

-

Private Markets: 5%

-

Real Estate: 2%

-

Crypto Market Share: 1% ( Just $2.6 trillion, the smallest part of all global assets)

This small part of cryptocurrency share in total assets shows how much growth potential the industry has. It is still new and very small compared to traditional investments.

US Dominance in Global Markets: A Monopoly in Motion

Today’s Goldman Sachs crypto news doesn't only involve how traditional and digital investments are distributed, but also shows the US crypto dominance , which is also backed by Donald Trump in his earlier X post.

The charts also show that the United States owns 64% of all global stocks and 43% of all bonds. In stocks, Technology (28%) and Financials (17%) are the largest parts.

According to Tom Serres , the US is also very strong in stablecoins. It is not a full monopoly, but it is very close — a “monopoly in motion.”

As per my analysis being a cryptocurrency expert, I believe with such a small share, digital assets are a good way to spread risk and not rely only on United States assets.

Why Out of $261T Total Assets 1% Crypto Market Share Matters?

Even though it is standing at 1% only, a small move of money from stocks or bonds into digital tokens could bring trillions of dollars into the market.

The total marketcap is now about $3.79 trillion, and it is growing every day. In 2025, ETFs focused on tokens, AI, and silver are getting huge investments. Countries like India, China, and Japan are also making clear rules for digital coins regulation, which makes investors more confident.

Major trends that every investor should watch

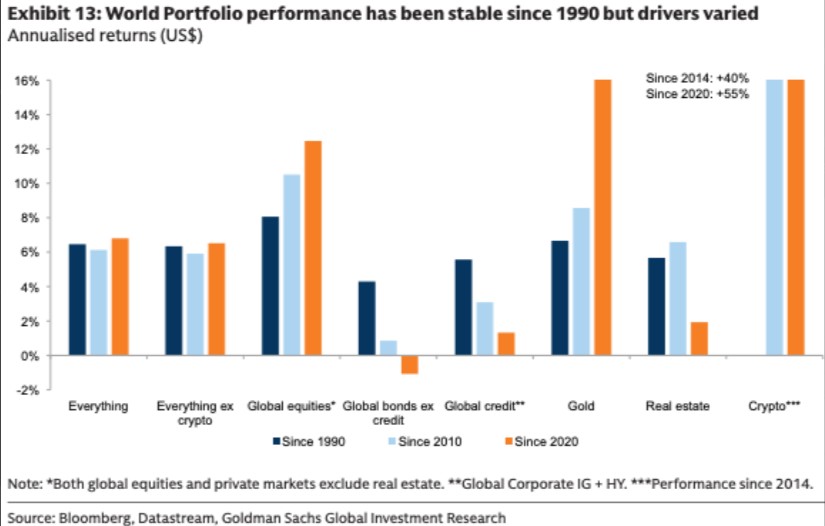

After careful industry research, there are three major trends fueling the crypto market news buzz in recent times.

-

Stock investment has grown since the 2008 crisis, but it is still below the 1990s level.

-

The US still dominates both stocks and bonds.

-

Alternatives like, gold, and cryptocurrency have grown, but they are still small matches with Goldman Sachs total asset report.

Conclusion

After the Goldman Sachs total asset report, if even a few percent of global coins move into the virtual marketplace, crypto market share in total assets could jump from 1% to 5%. That would mean trillions of dollars entering and pushing prices higher for Bitcoin, Ethereum, and other coins.

For anyone paying attention, now is a good time to think about adding these tokens to their portfolio. Even a tiny change in global allocation could create huge growth in the coming years.

Disclaimer: This article is for informational purposes only and does not give any financial advice. Always DYOR before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。