Uncertainty is the only certainty.

Introduction

On October 11, 2025, the crypto market experienced a historic bloodbath, with various crypto assets plummeting overnight. Bitcoin briefly crashed by 15%, Ethereum fell by over 20%, and many altcoins saw declines exceeding 70%. According to Coinglass data, within just 24 hours, the total liquidation amount across the network reached $19.3 billion, affecting over 1.67 million investors—resulting in a global crypto market capitalization evaporation of over $500 billion, setting a new record in the cryptocurrency space.

Data Source: Coinglass, Date: October 11, 2025

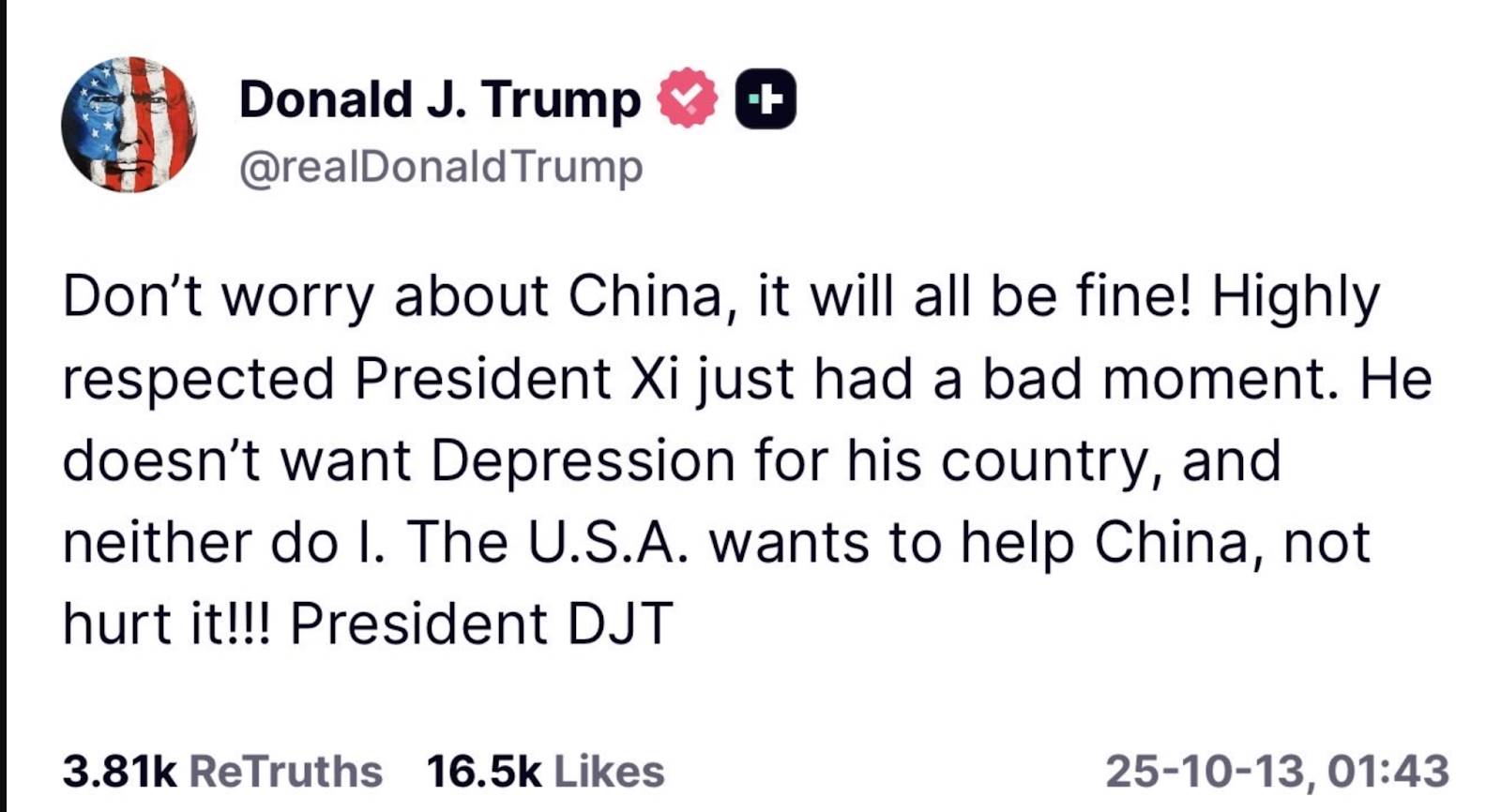

The trigger for this storm was widely attributed to a post by U.S. President Trump on social media, claiming he would impose a 100% tariff on all Chinese goods. However, as the script often plays out, after the market plunged into extreme panic, Trump quickly shifted his tone, signaling a willingness to negotiate with China. Market sentiment warmed after the crash, with Bitcoin recovering above $11,000 and mainstream cryptocurrencies generally rebounding over 10%.

This was not a random market fluctuation but a classic enactment of what seasoned traders call the “TACO” (Trump Always Chickens Out) strategy. Bitget Wallet Research will take you through a deep analysis of the origins and implications of this strategy in this article, exploring how it continues to stir the global financial markets, including cryptocurrencies.

I. Analyzing “TACO”: A Coward's Game Exposed by the Market

The so-called “TACO” strategy, an acronym for “Trump Always Chickens Out,” literally translates to “Trump always backs down.” This term was first introduced by Financial Times columnist Robert Armstrong to summarize Trump's erratic behavior in major decisions, especially regarding tariff policies. The core logic is that when policies trigger severe market volatility or economic pressure, the U.S. government often retreats quickly.

Source: Trump’s Truth Social post (left: Trump threatens tariffs, right: Trump softens his stance).

The “TACO” strategy typically presents a clear market transmission channel:

Release extreme threats → Trigger panic selling in the market → Retract threats on the brink of market collapse → Market rebounds sharply

For traders, this almost transparent script creates significant volatility and fosters a unique trading model. Each panic-driven decline may be seen by savvy speculators as an excellent buying opportunity, betting that Trump will not actually “pull the trigger.” This model is not an isolated case; looking back in history, we can clearly see its continuously repeating shadow.

II. Echoes of History: The Script Has Long Been Written

This high-risk game has not played out for the first time. Over the past few years, from the U.S.-Mexico trade dispute to U.S.-China trade frictions, traces of the TACO strategy are everywhere, with various assets dancing along, forming a highly regularized response pattern.

Data Explanation: The data in the table is compiled from publicly available historical information. Due to the timing of policy announcements being based on Eastern Time, there may be discrepancies in different statistical measures; thus, the data is approximate and only reflects the basic market trend.

From historical data, we can clearly see that as a representative of economic fundamentals, the Dow Jones Index directly reflects the market's immediate expectations, dropping when threats arise and rebounding after calming signals appear. Gold plays a crucial role as a safe haven, with its price showing a clear negative correlation with market risk appetite. In most cases, cryptocurrencies, represented by Bitcoin, are classified as high-risk assets, with their price movements highly correlated with U.S. stocks, often exhibiting more extreme fluctuations, demonstrating a significant “leverage effect.”

However, it is worth noting that as this script is repeatedly enacted, the market has begun to exhibit two subtle yet profound changes.

First, the market's response pattern has evolved from passive reaction to proactive anticipation. A key piece of evidence is that in recent events, when calming signals were issued, gold prices did not fall as they had in the past; instead, they remained elevated. This indicates that market concerns about long-term policy credibility and uncertainty have surpassed the optimism brought by short-term benefits. Bitcoin's price movement also corroborates this, as its price had already risen before the calming news was announced, digesting the reversal expectations, leading to weakened upward momentum when the positive news was released. This shows that traders have learned to “front-run,” making the game more anticipatory and complex.

Second, the events highlight Bitcoin's complex dual attributes at this stage, dynamically oscillating between its roles as a “risk asset” and “digital gold.” Although Bitcoin often fell alongside U.S. stocks during the initial market panic, exhibiting pure risk asset characteristics, its independent safe-haven function occasionally shone through, such as in August 2019, when it ignored the downturn in U.S. stocks and instead rose sharply alongside gold. This inconsistency in behavior indicates that Bitcoin's market attributes are far from fixed; its response to geopolitical shocks will depend on the prevailing market consensus, capital flows, and the nature of the shock event—this oscillation itself is one of its current core characteristics.

III. The New Normal in the Crypto Market: When “Tweets Govern the Market” Becomes the Alpha of the Crypto World

The repeated enactment of the “TACO” strategy is profoundly reshaping the ecology of the crypto market, pushing its inherent high volatility to a new extreme.

The most direct impact of this strategy is the comprehensive upgrade of the market's gaming dimensions. Value analysis based on project fundamentals or on-chain data has not become obsolete, but on top of that, a high-frequency macro gaming battlefield dominated by “tweets” and “headline news” is quietly taking shape, occupying an increasingly important position. Notably, the main players in this new battlefield have expanded from the former crypto-native KOLs and whales to traditional financial (TradFi) capital wielding substantial funds and public figures with significant social influence. This is not only a change in participant identity but also a clear signal of the crypto market's accelerated integration into the global macro narrative.

In this new dimension, the structural opportunities and risks in the market are simultaneously amplified. The proliferation of algorithmic trading has intensified the market's “knee-jerk reflex,” with programmatic models capable of capturing information and executing large-scale operations in milliseconds, making sudden “waterfall” and “rocket” price movements increasingly common. A single late-night tweet can trigger hundreds of millions of dollars in derivative liquidations at dawn in Asian markets—this is both the ultimate manifestation of risk and an inevitable arbitrage window born from the new structure.

However, what truly needs contemplation is: what long-term effects will this unique “wolf is coming” effect bring?

As traders gradually adapt to this “threat-reversal” script, the market's initial response to similar negative news is becoming increasingly dulled, often accompanied by resistant buying during downturns. But this harbors a unique and significant risk in the crypto market: if an extreme policy is genuinely implemented without subsequent easing, due to the lack of traditional financial market buffers like circuit breakers, investors accustomed to counter-trend operations may face devastating blows due to inadequate preparation, potentially triggering a spiral market collapse.

Looking ahead, it is foreseeable that as long as this political game of creating crises to gain leverage continues, “TACO trading” will not disappear. Traders will focus more on finding short-term opportunities within this predictable volatility, thereby shaping sharper “V-shaped reversal” patterns. At the same time, as the market deepens its understanding of this model, the game will become more complex, with simple reversals potentially evolving into more unpredictable composite patterns. In this context, the key to winning in the market will no longer be determining the direction of the trend but predicting the timing of the “reversal.”

IV. Navigating Through the “Trump Noise”: Survival Rules for Investors

In the face of such a volatile market, how should investors position themselves? First, one must respect leverage and control risk. The “TACO” market is a “meat grinder” for high-leverage contract traders; in news-driven extreme markets, any high-leverage position can instantly go to zero, so reducing leverage and maintaining sufficient margin is the primary survival rule to navigate volatility. Second, learn to rise above the noise and return to common sense. Instead of obsessing over when the next reversal will occur, it is better to take a long-term view and focus on the project's long-term value. In times of panic, it is far more important to consider whether what is in front of you is a “discounted quality asset” or a “falling knife” than to fixate on candlestick charts. Finally, from a practical standpoint, ensure proper asset allocation to achieve diversified hedging. Do not put all your eggs in one basket; appropriately allocate assets of different risk levels in your investment portfolio to effectively buffer against unknown risks.

Conclusion: Uncertainty is the Only Certainty

Essentially, the “TACO” strategy is a projection of geopolitical games in the financial market. From trade wars to the bloodbath in the crypto market, it repeatedly proves that in today's highly interconnected world, amplified by social media, the words of a single individual can stir global market turmoil. This also reminds us that what drives the market is not just cold economic data but also the unpredictable nature of human emotions—greed and fear.

For every investor involved, recognizing and understanding this pattern may not guarantee victory in every battle, but it can at least help maintain clarity and make more rational decisions when the storm arrives. Because in this era, the greatest certainty may very well be the uncertainty brought about by macro politics itself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。