The grand vision of unified development across the entire financial sector on Hyperliquid has never been clearer.

Author: McKenna

Translated by: Deep Tide TechFlow

Introduction

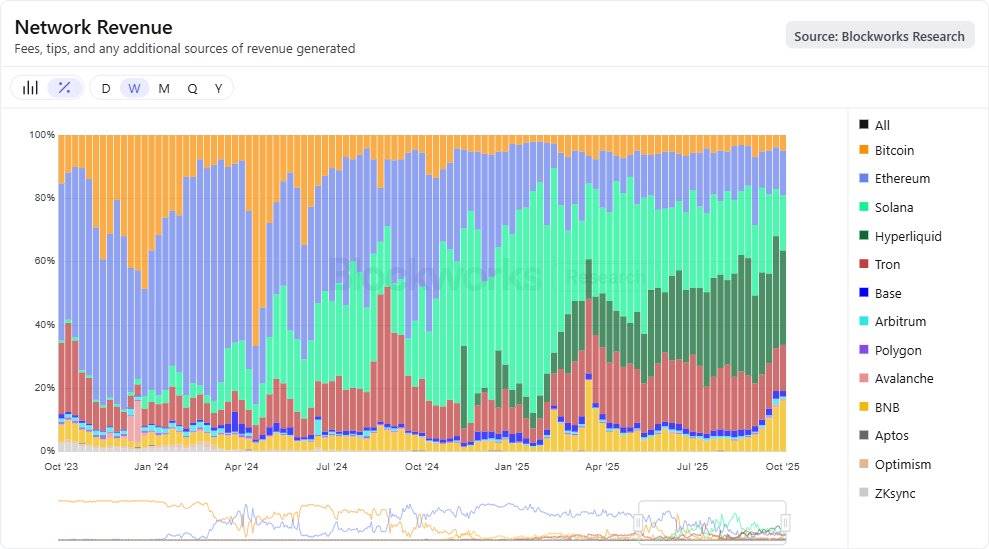

Hyperliquid is set to sweep the digital asset space between 2024 and 2025, finally achieving the long-awaited transformation from centralized traditional institutions to a fully permissionless, transparent, and global perpetual futures market. In a short time, Hyperliquid has become the number one revenue generator in the blockchain space, surpassing other general networks, all driven by a small team of just 11 people. This technological achievement is remarkable, showcasing the intelligence and strength of the Hyperliquid core team. We believe that Hyperliquid is one of the most important growth stories in the digital asset space, even surpassing the significant growth trend of stablecoins following clear regulations (through the GENIUS Act regulating stablecoin issuers).

Despite Hyperliquid's significant success, we believe it is necessary to take a step back and re-examine this argument from the ground up, incorporating a specific valuation framework. In revising our argument, we will review the rise of Hyperliquid, how it has significantly eroded the perpetual trading market share of centralized competitors, and further outline a more ambitious vision for the coming years—encompassing the entire financial system.

The Growth Story of Hyperliquid

Perpetual Trading

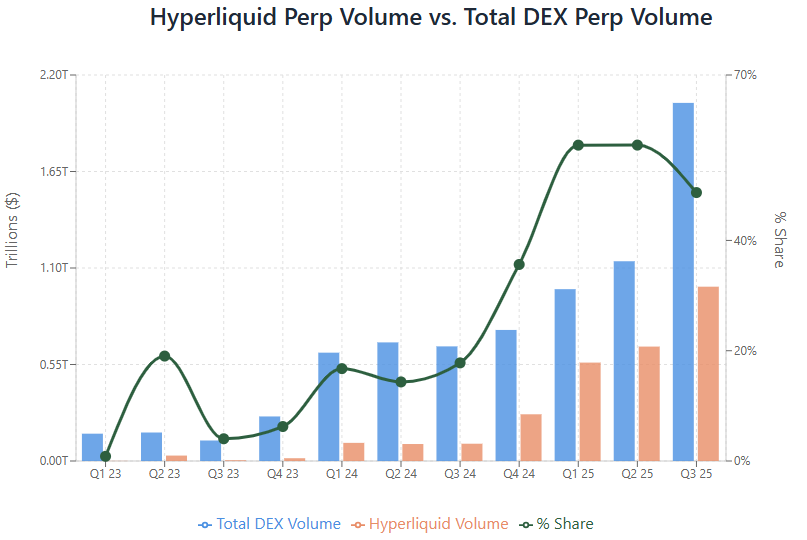

Hyperliquid Trading Volume vs Total Trading Volume of Decentralized Exchanges (DEX)

The rise of Hyperliquid is primarily attributed to its meticulously optimized protocol architecture for perpetual futures trading. HyperCore is the underlying trading and settlement engine of the Hyperliquid protocol, providing an off-chain experience close to that of centralized exchanges (CEX) for the first time, with millisecond-level trade execution speed and the implementation of session keys, allowing traders to easily execute orders without trade confirmations. Below is a brief review of all relevant perpetual futures trading statistics since the platform's inception:

Overall, since its establishment, Hyperliquid has completed a trading volume of $27.7 trillion, with users executing 16.5 billion trades.

In terms of quarterly sequential growth of perpetual trading volume in 2025, Hyperliquid grew by 110.72% in Q1, 16.27% in Q2, and 52.25% in Q3.

In August 2025, Hyperliquid set its highest trading volume record to date, with perpetual trading volume reaching $398 billion.

Quarterly Sequential Growth of Hyperliquid's Perpetual Trading Volume

Hyperliquid vs Centralized Exchange (CEX) Competitors

Hyperliquid Trading Volume vs CEX 14-Day Rolling Average (Data Source: Hypeflows.com)

In terms of perpetual market share, compared to centralized exchange competitors, Hyperliquid currently accounts for 10.7% of Binance's trading volume, 24.7% of ByBit's, and 22.7% of OKX's (based on a 14-day rolling average). Globally, Hyperliquid holds a 5.1% market share.

An important metric for all exchanges is Open Interest, which is the total number of contracts currently held. This indicates strong trader stickiness to the platform, using it as a primary trading venue due to factors such as performance, liquidity depth, and others. During 2025, Hyperliquid's Open Interest grew from $3.19 billion to $15.3 billion, an increase of +479%. Currently, Hyperliquid accounts for 5.3% of all crypto exchanges' Open Interest.

Fee Structure

Hyperliquid's fee structure includes a 0.45% taker fee and a 0.015% maker fee, with fees adjusted across different rate levels based on a 14-day weighted trading volume threshold. The taker fee can be reduced to 0.024%, while the maker fee can be reduced to 0% to incentivize market makers to provide deep liquidity for HyperCore's order book.

Additionally, Hyperliquid's fee structure is linked to traders holding and staking HYPE, offering a fee discount of 5%-40% based on staking levels, with staking balances ranging from 10k to 500k HYPE.

On average, Hyperliquid's revenue accounts for 0.0258% of trading volume, remaining stable.

Hyperliquid's Taker Fee and Maker Fee Structure

Hyperliquid Assistance Fund (AF)

The Hyperliquid Assistance Fund (AF) serves as a programmatic execution engine to repurchase HYPE tokens through the secondary market, directing 99% of the revenue generated by the Hyperliquid protocol to this fund. Revenue generated from taker fees, maker fees, spot trading fees, liquidation fees, and HIP-1 token listing fees is almost entirely redistributed to the AF.

To date, the AF has repurchased 32.2 million HYPE tokens through the secondary market, with a total investment of $692 million, currently valued at $1.48 billion, with a total unrealized profit and loss (PnL) of $788 million, marking a +113% unrealized return rate. The HYPE tokens held by the AF account for 9.56% of the circulating supply.

In 2024, Robinhood's net income was $2.95 billion (according to its Q4 disclosure data), repurchasing $257 million worth of HOOD stock, which accounted for 8.7% of its annual net income. Even if we take Apple, the company with the highest repurchase ratio among MAG7, as an example, it repurchased $95 billion worth of stock in 2024, accounting for 24.3% of its annual net income.

We present this data to illustrate two points: First, Hyperliquid's value has not been diluted; Second, even compared to traditional stock markets, its repurchase structure is unique in both the digital asset space and traditional stock markets.

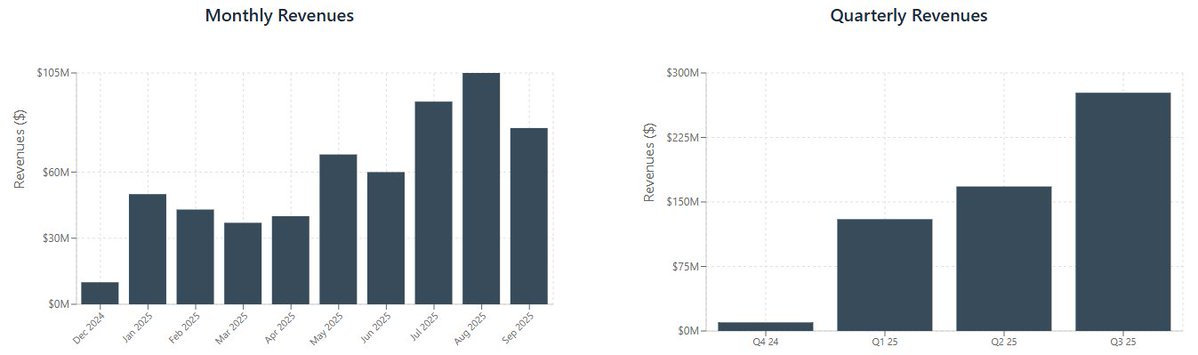

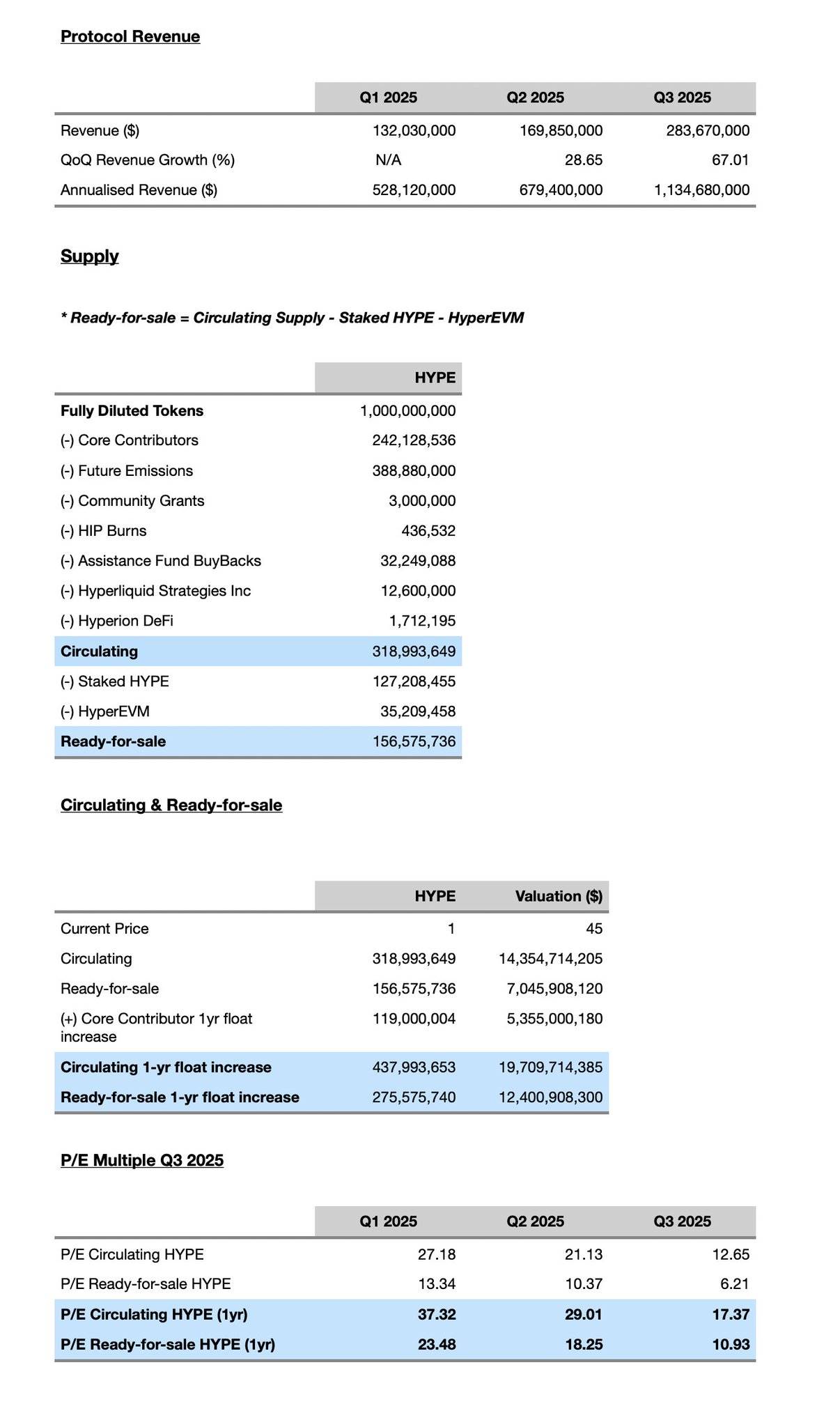

In a short time, Hyperliquid has become the highest revenue-generating Layer-1 protocol, with its growth driven by strong demand for outstanding decentralized trading products. Below is the continuous growth trend of Hyperliquid protocol's quarterly and monthly revenue:

Hyperliquid's Monthly and Quarterly Revenue

Hyperliquid has not only become the highest revenue-generating protocol in the digital asset space but has also utilized nearly all protocol revenue to accumulate its own tokens on HyperCore.

Network Revenue of All Major Public Chains (Data Source: blockworks.com)

HyperUnit Spot Market

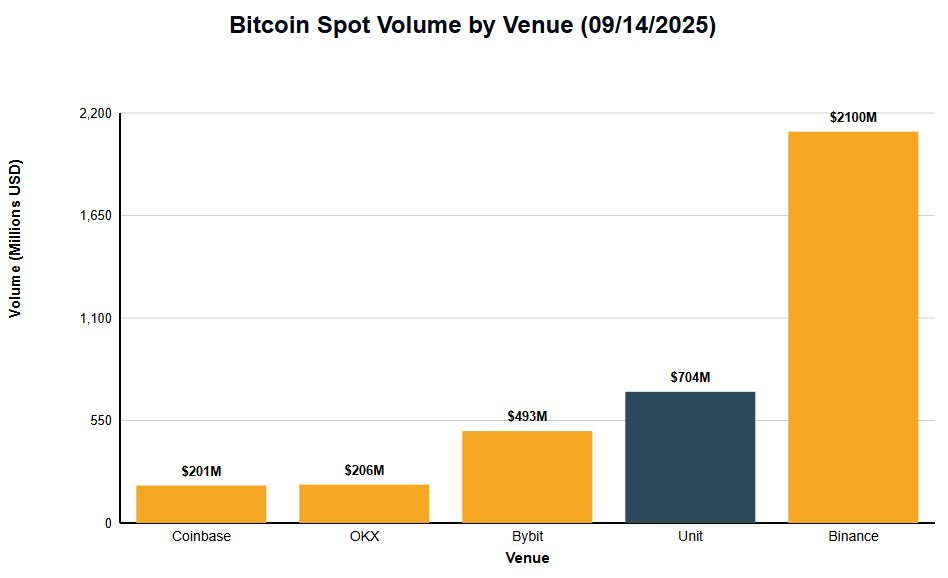

On September 14, 2025, HyperCore ranked second in Bitcoin spot trading volume among major centralized exchanges (CEX).

HyperUnit is an asset tokenization and cross-chain bridging layer that enables seamless spot trading of native assets (such as BTC, ETH, and SOL) on the HyperCore order book. Assets bridged through HyperUnit are converted into u-assets, which can be traded on HyperCore's order book and used in the emerging HyperEVM ecosystem, such as currency market protocols like Felix.

Assets are sent to a HyperUnit address on the native chain, then locked and minted as corresponding u-tokens on Hyperliquid at a 1:1 ratio. This allows native spot assets to achieve 1:1 support on HyperCore and HyperEVM.

As a case study to demonstrate how HyperUnit and HyperCore's trading engine efficiently support spot assets, from August 20 to 25, 2025, a Bitcoin whale deposited 22,769 BTC (worth $2.59 billion) into Hyperliquid via HyperUnit and converted UBTC into 472,920 UETH (worth $2.22 billion). This is one of the most significant public asset conversions to date, enabling seamless and permissionless trading through HyperCore's spot market.

To date, HyperUnit has processed asset deposits worth $718 million, covering BTC, ETH, SOL, and FARTCOIN, providing a fully permissionless high-performance order book trading method for spot assets. Since its inception, the HyperUnit spot market has executed $40.5 billion in spot trading volume, with Bitcoin spot trading on Hyperliquid reaching $21.4 billion.

Additionally, HyperUnit has successfully provided first-day trading opportunities for several significant Token Generation Events (TGE), with recent examples including PUMP and XPL. We expect this trend to continue, as asset deposits increase and new high-end projects launch on TGE days, further boosting trading volume on the spot order book.

Builder Codes: The Liquidity and Distribution Flywheel of Hyperliquid

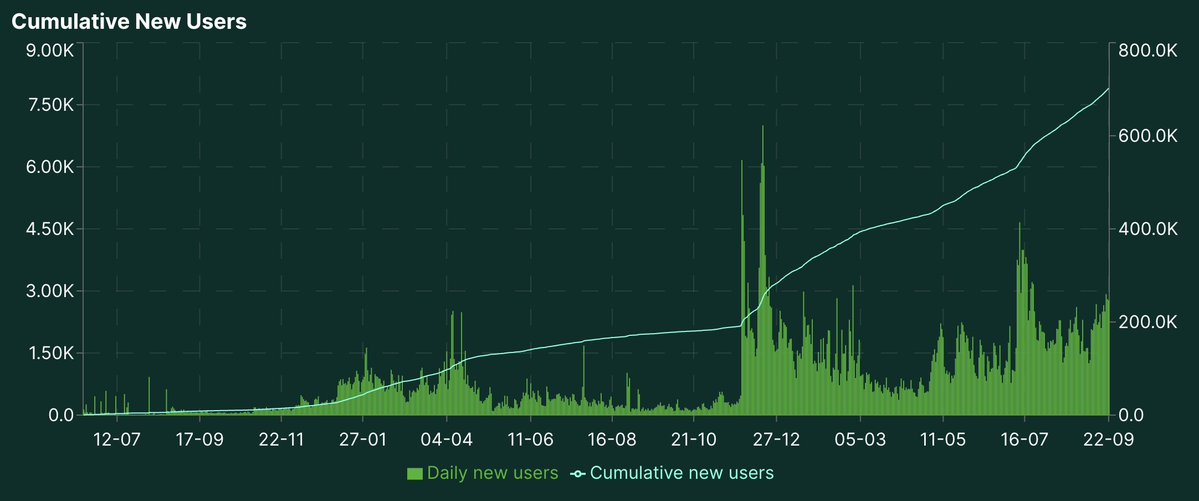

Daily and Cumulative New Users on HyperCore

Builder Codes are one of the most important components of the Hyperliquid protocol, opening distribution channels for new users and allowing third parties to connect directly to HyperCore's high-performance trading engine and liquidity. Third-party applications are responsible for building the front end and utilizing HyperCore as a direct back end to provide native perpetual contract trading services to their user base. To date, Builder Codes have generated over $30 million in revenue and attracted 169,900 new wallets to interact with HyperCore.

Paxos Labs recently indicated in its USDH proposal that Hyperliquid will become the default liquidity infrastructure, providing seamless and efficient spot and perpetual trading. Based on Paxos's USDH proposal, we believe the next phase of growth for Builder Codes will come from direct integration with fintechs and brokerage platforms. Builder Codes have already achieved significant success with crypto-native wallet providers (such as Phantom) and other crypto-native integrations (such as Axiom and BasedApp). Given that fintechs or prime brokers currently do not offer perpetual trading to their users, this will provide these platforms with a convenient way to offer perpetual trading to their large and well-funded user bases without needing to build back-end infrastructure or launch liquidity.

For businesses or larger players (such as fintech companies) with crypto-native user bases, it is hard to refuse such an easy way to integrate a new revenue line that not only brings benefits to users but also increases platform revenue. For example, Phantom generated $18.8 million in revenue through this integration alone in the third quarter. We expect multiple large fintech companies and brokerage platforms to directly integrate Builder Codes into their platforms, potentially attracting millions of new users to Hyperliquid and significantly increasing trading volume. Given that Interactive Brokers is exploring stablecoin deposits, we believe its 3.3 million customers may access perpetual trading through Hyperliquid's Builder Codes in the future. Other potential strong integration candidates include fintech company Revolut, which has 65 million customers.

Growth Analysis of Builder Codes in 2026

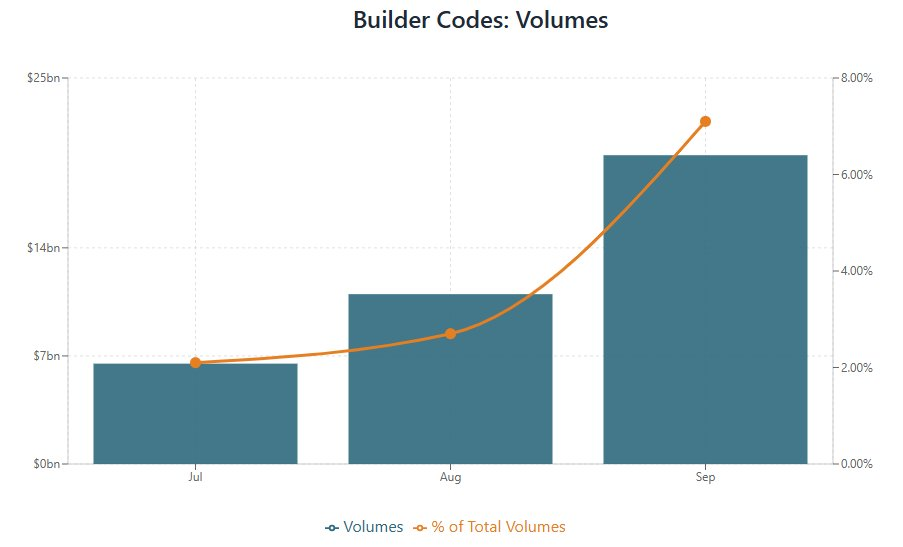

Assuming a builder fee of 0.05%, Builder Codes brought $20 billion in trading volume to Hyperliquid in September. It quickly grew to become a significant source of trading volume for the Hyperliquid protocol, accounting for 7.1% of the total trading volume of perpetual contracts in September:

Monthly Trading Volume of Builder Codes and Percentage of Total Perpetual Contract Trading Volume

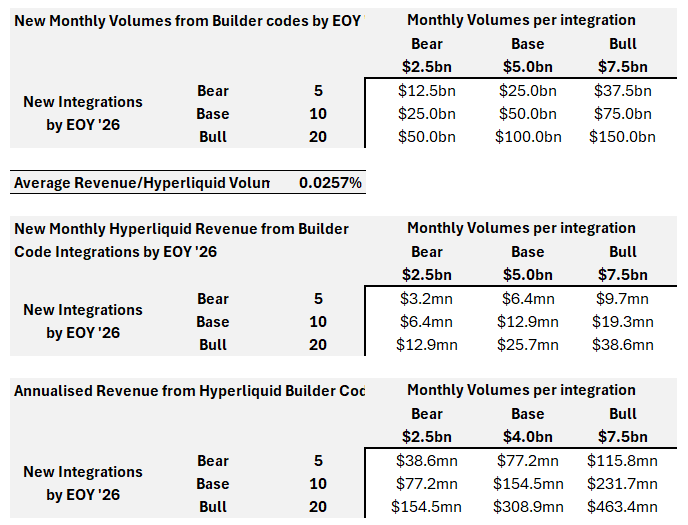

We conducted a scenario analysis on the impact of Builder Codes on Hyperliquid's revenue. Assuming an average revenue of 0.026% per unit of trading volume and setting a baseline scenario where there are 10 large Builder Code integrations by the end of 2026, with an average monthly trading volume of $5 billion for each integration, we expect these integrations to bring an annualized revenue of $154 million to Hyperliquid by the end of 2026:

2026 Builder Code Model Analysis

This would represent a 15.6% growth in Hyperliquid's revenue—excluding any natural growth from Hyperliquid's perpetual contract exchange and the overall growth of the perpetual contract market.

Hyperliquid Enters the Stablecoin Boom

USDH: Hyperliquid's Native Stablecoin

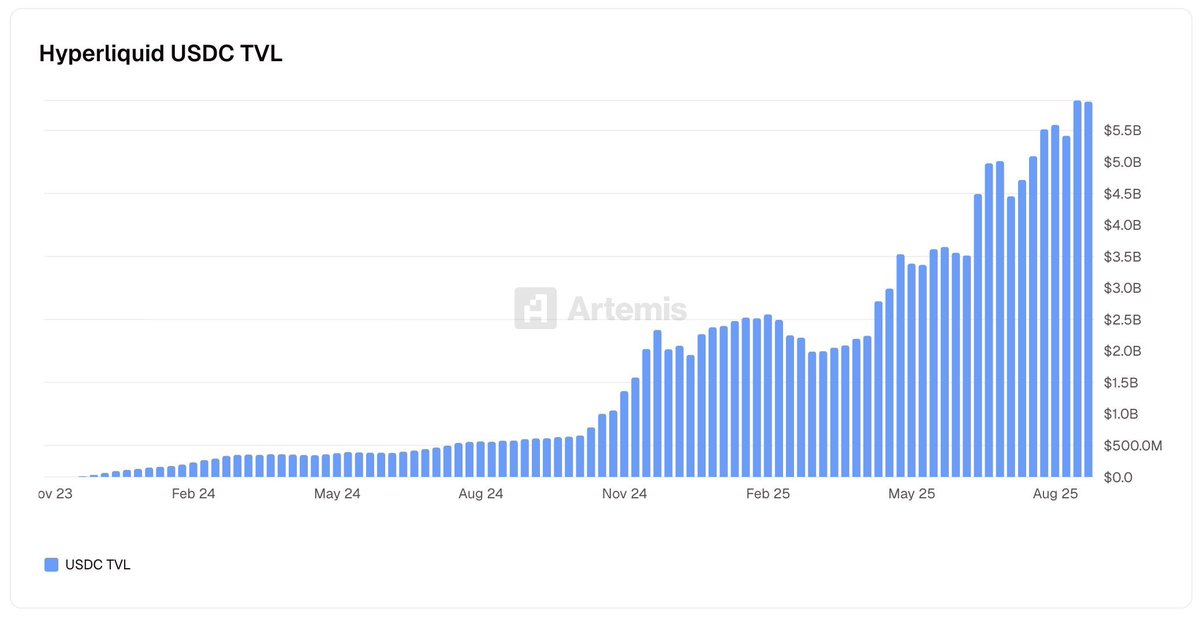

Total USDC Bridged to HyperCore

Hyperliquid has recently entered the upcoming stablecoin boom with its native stablecoin, USDH. USDH is a fiat-backed native stablecoin used as a quote and collateral asset on HyperCore.

So far, well-known stablecoin issuers like Circle and Tether have benefited the most from the treasury yields supporting USDC/USDT. USDH aims to change this situation by returning 50% of the revenue generated by USDH to the Assistance Fund for purchasing HYPE on the secondary market.

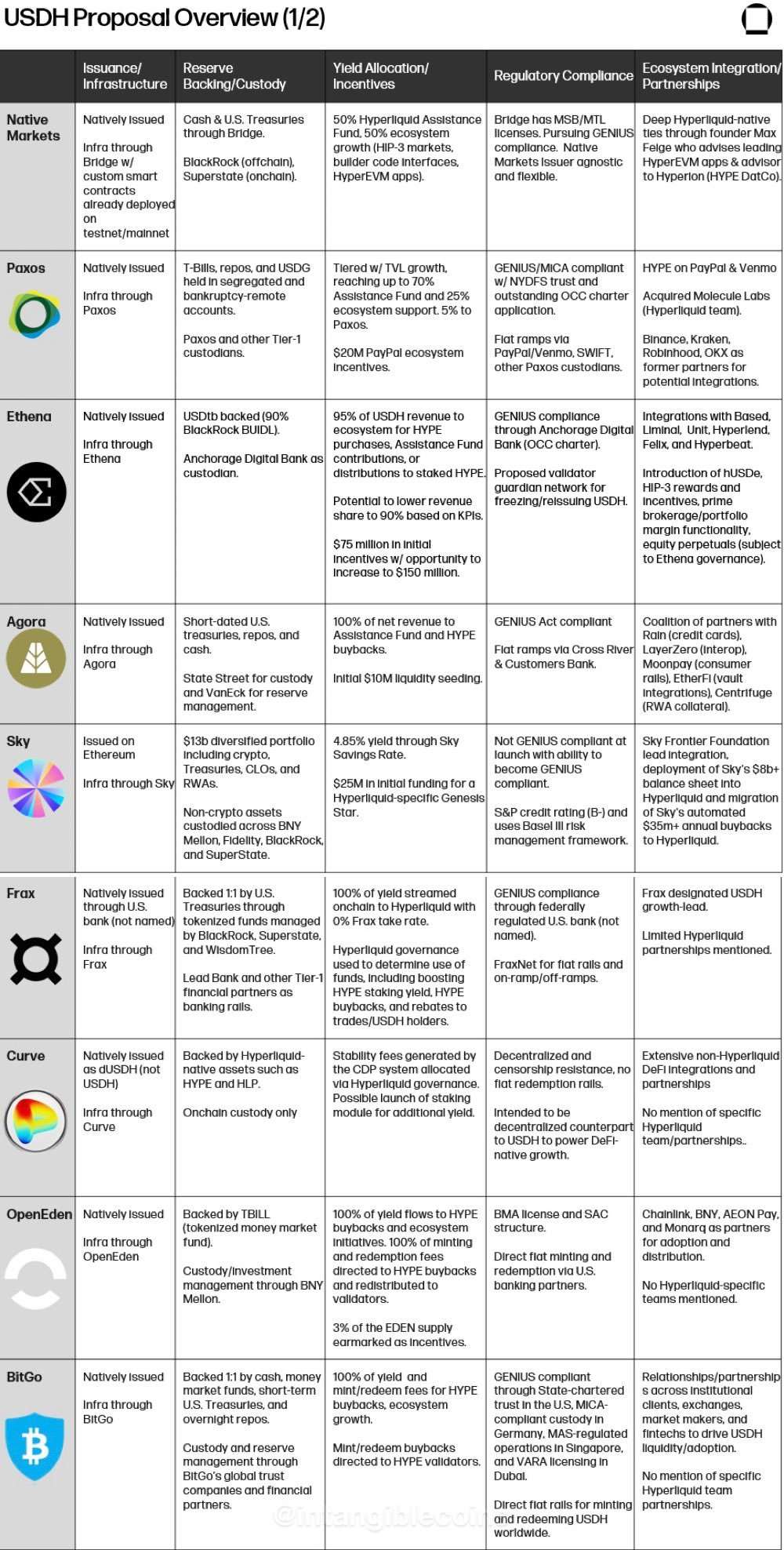

USDH has received multiple proposals from several well-known institutional players, including Paxos/PayPal, Agora, Ethena, BitGo, and Native Markets. These proposals detail their respective custodians, treasury yield distribution, compliance with the newly passed GENIUS Act, and proposed partnerships. Among these, the proposal from Native Markets has been approved through Hyperliquid's governance mechanism.

Currently, Hyperliquid holds approximately $5.6 billion in Circle USDC on HyperCore, primarily benefiting Circle and Coinbase rather than the Hyperliquid ecosystem. Based on the deposited USDC and the Federal Reserve's recent dot plot providing forward guidance (projecting a 75 basis point rate cut by the end of 2025), assuming 100% conversion to USDH, this would bring an annual revenue of $98 million to the protocol for repurchasing HYPE.

Regarding USDH, Circle recently launched native USDC and CCTP V2 on HyperEVM and began purchasing HYPE on the secondary market, in addition to seeking to become a validator. This move is significant as it reflects Circle's complete alignment with Hyperliquid, facilitating a full institutional funding channel in and out through Circle Mint and launching DeFi protocols on HyperEVM, especially emerging currency market protocols. Plans include achieving seamless deposit and withdrawal functionality between HyperEVM and HyperCore through CCTP V2, covering 14 other blockchains.

Although some well-known proposals did not secure USDH's code, many proposals will continue to advance and deploy stablecoins with different codes. This ultimately means that Hyperliquid will host multiple fiat-backed stablecoins and several stablecoins aligned with its ecosystem, all possessing mature funding channels and enterprise-grade tracks. We expect major payment providers like PayPal and Venmo to make progress in the emerging Hyperliquid stablecoin ecosystem through direct integration of funding channels, potentially opening doors for PayPal's 400 million users and 35 million merchants.

USDH Proposal (Galaxy Research)

Hyperliquid's Aligned Stablecoins

The Hyperliquid Foundation has announced a new stablecoin-focused proposal aimed at providing a permissionless native solution for stablecoin issuers.

This native solution offers stablecoin issuers a 20% reduction in trader fees, 50% better maker fees, and a 20% increase in trading volume contribution when quoted as a spot trading pair or collateral asset on the HIP-3 deployment market on HyperCore.

These measures ultimately further accelerate Hyperliquid's liquidity flywheel, incentivizing liquidity provision and trading volume growth while driving the conversion of USDC to USDH, thereby generating further revenue from aligned stablecoins.

To become an aligned stablecoin on Hyperliquid, issuers must enable permissionless quote assets, with deployers required to stake 800,000 HYPE, and quote token deployments requiring 200,000 HYPE staked, totaling 1 million HYPE staked by issuers to receive the aforementioned benefits. Additionally, 50% of off-chain earnings must be shared with the protocol, directly entering the Assistance Fund for HYPE repurchases on the secondary market.

The aligned stablecoin proposal aims to lay the foundation for Hyperliquid to become the settlement layer for the next generation of payment and personal financial technology. Hosting all finance means a full entry into the upcoming stablecoin race. As quoted in Hyperliquid's announcement, "The blockchain that hosts the future of finance should also become the premier stablecoin chain."

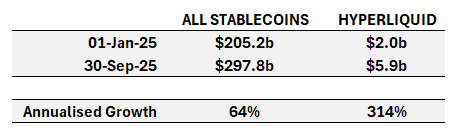

Similar to Builder Codes, we conducted a scenario analysis to speculate on the potential state of the Hyperliquid stablecoin market by the end of 2026. The scale of stablecoin deposits on the Hyperliquid chain has significantly expanded—from $2 billion at the beginning of the year to $5.9 billion by the end of the third quarter, achieving a 314% annualized growth rate, compared to an overall stablecoin market annual growth rate of 64%.

Hyperliquid's USDC Growth Rate in 2025 (January to September 2025)

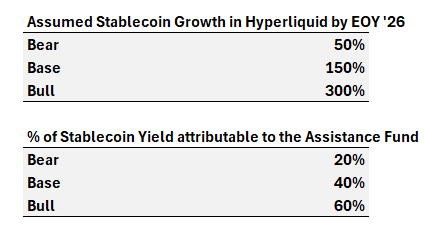

Hyperliquid achieved significant USDC growth during 2025, with a remarkable growth rate from January to September. However, as Hyperliquid reaches scale this year, growth rates are expected to slow in 2026. As a baseline forecast, we assume a growth rate of 150% for USDC by the end of 2026 (EOY '26).

Hyperliquid USDC Growth Rate to End of 2026

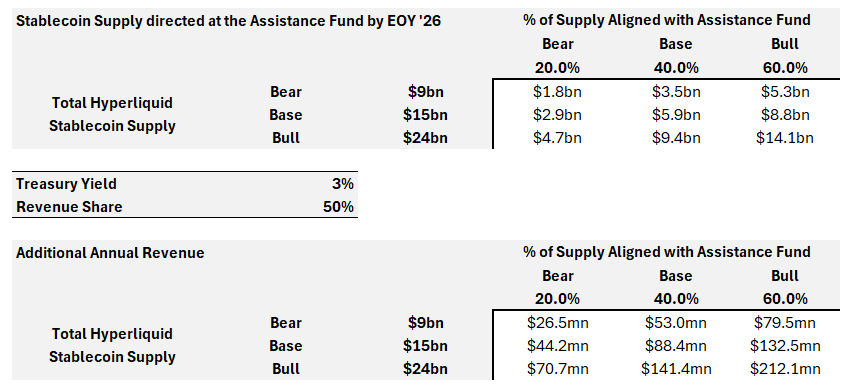

Crucially, we expect USDC's dominance to significantly shift towards Hyperliquid-aligned stablecoins with the implementation of the aforementioned USDH proposal. Assuming, based on the latest FedWatch probabilities, that treasury yields drop to 3%, and that 50% of the yields supported by stablecoins flow to the Assistance Fund according to the USDH proposal, we anticipate that the protocol will generate an additional $110 million in annual revenue by the end of 2026:

2026 Aligned Stablecoin Model Analysis

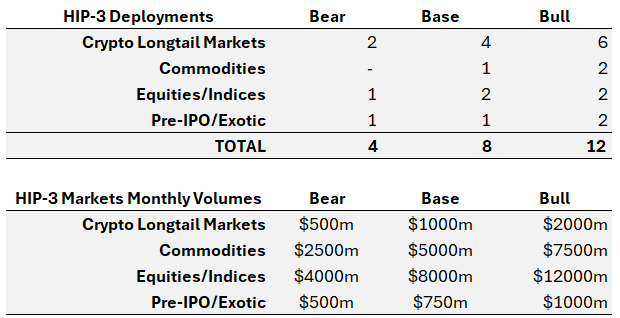

HIP-3: Builder-Deployable Perpetual Contract Market

HIP-3 is a new Hyperliquid Improvement Proposal aimed at transforming the exchange's perpetual contract listings into a permissionless on-chain native solution, freeing them from the validator approval listing process. This change allows anyone to create their own native perpetual market on HyperCore without permission.

With HIP-3, each market has its own order book, and new market deployments on HyperCore occur through a Dutch auction process that runs every 31 hours, with an expected 282 new markets deployed annually. To deploy an order book on HyperCore via Dutch auction, each entity must stake 500,000 HYPE.

HIP-3 provides deployers with maximum flexibility for extensive customization in market features, including Oracle integration, designated collateral assets, fee parameter settings, and the ability to add additional deployer fees on top of base fees.

HIP-3 opens HyperCore to traditional markets such as indices, stocks, forex, commodities, bonds, and other non-traditional markets like political prediction markets and pre-IPO markets.

We are moving towards a digital era where people are more inclined to hold digital dollars. There is considerable friction between funding channels and transfers to brokerage accounts. Additionally, traders are accustomed to trading perpetual contracts, as they are the derivative contracts that end users find easiest to understand and express market views. Hyperliquid's goal is to host all finance, and this statement should be taken literally: any market with an available Oracle will be tradable on HyperCore.

Given that HIP-3 has not yet launched, it is currently difficult to record the potential trading volume these markets may achieve. We have already seen several excellent teams announce their plans to launch perpetual markets through HIP-3, including:

Kinetiq's Launch: Kinetiq is a leading liquid staking protocol on Hyperliquid and announced Launch in July, a HIP-3-based "exchange-as-a-service" infrastructure product designed to help teams deploy new perpetual markets.

Ventuals: On October 6, Ventuals announced they would launch a perpetual exchange for pre-IPO companies with 10x leverage through HIP-3.

HyperUnit's trade.xyz: As mentioned earlier, HyperUnit is a key component of the Hyperliquid ecosystem, facilitating spot trading activities on HyperEVM. They shared news about trade.xyz, which is speculated to be their decentralized perpetual exchange launched through HIP-3.

These teams will immediately create new perpetual market activities, contributing to Hyperliquid's economic system. HIP-3 markets can charge fees up to 2x—Hyperliquid charges the same fees for HIP-3 trading volume, while deployers can earn up to 50% of the fees. Therefore, HIP-3 serves as a scaling mechanism for Hyperliquid without compromising its unit economics.

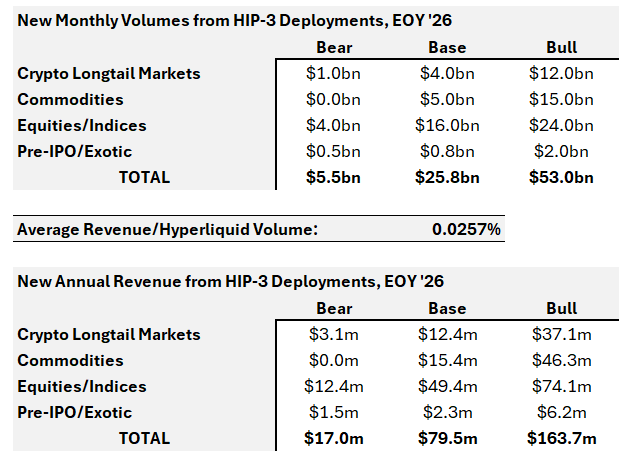

Given that HIP-3 supports the creation of new perpetual markets, we believe its impact may be greater than that of Builder Codes, which only provided further access to HyperCore's current perpetual markets. HIP-3 perpetual instances will support crypto assets, but more importantly, it may extend to commodities, stocks and indices, as well as pre-IPO/non-traditional markets. As a baseline scenario, we believe there will be 15 strong HIP-3 perpetual integrations online by the end of 2026, collectively bringing over $40 billion in monthly trading volume to the protocol:

Assuming a fee rate of 0.0225%, this would generate an additional annualized revenue of $12 million as a baseline scenario:

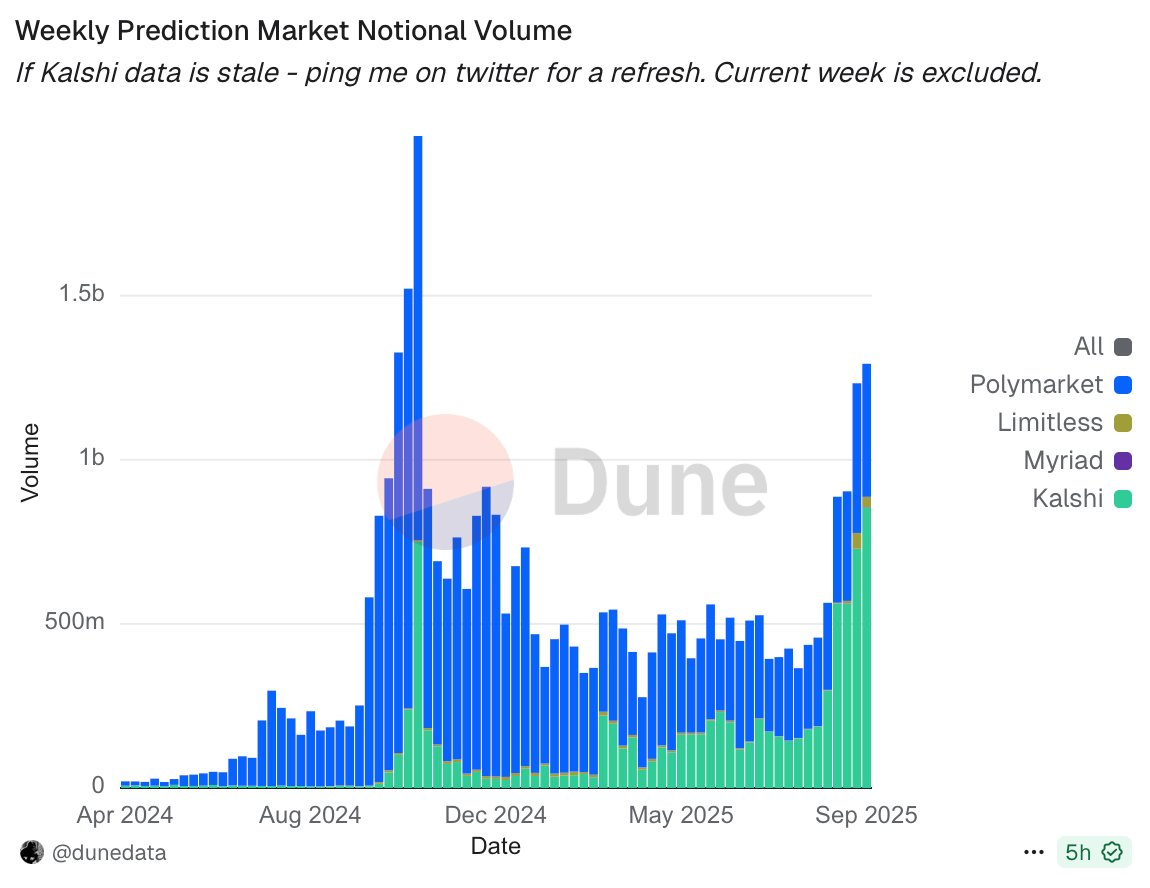

HIP-4: Event Markets and Multi-Betting

Weekly Prediction Market Trading Volume (Polymarket and Kalshi)

HIP-4 is a brand new Hyperliquid protocol improvement proposal aimed at introducing binary markets similar to prediction markets, such as Kalshi and Polymarket, which have driven significant adoption primarily through political predictions.

Prediction markets like Kalshi and Polymarket have attracted considerable attention, with nominal trading volumes exceeding $11 billion weekly, and cumulative trading volumes reaching $8.2 billion and $27.9 billion, respectively.

While HIP-3 introduces builder-deployed perpetual order books, it does not support prediction markets in their current form, as the marked price can only change by 1% at a time, which does not support binary payout structures.

In response to the Hyperliquid team, Jeff has expressed views on event perpetual contracts, suggesting it is more appropriate to view them as permissionless spot deployments characterized by full collateralization, no liquidation, or continuous funding costs.

HIP-4 also opens the possibility for introducing multi-betting (Parlays). Multi-betting refers to multiple independent single bets, typically used in sports betting, providing a convexity effect without leverage.

In summary, HIP-4 aims to redefine how markets are deployed on Hyperliquid and pave the way for Hyperliquid to enter the emerging prediction market trend, with the potential to compete with rivals like Polymarket and Kalshi.

Hyperliquid Digital Asset Treasury

Hyperliquid, like many other well-known protocols, is well-positioned to capture the emerging digital asset treasury wave, which aims to acquire underlying assets to hold on its balance sheet. Through stocks listed on NASDAQ, accredited investors will be able to gain exposure to HYPE without having to self-custody the assets. As we know, HYPE has poor distribution on centralized exchanges (CEX), currently limiting its accessibility, especially for users in the U.S. Digital Asset Treasuries (DATs) like Hyperliquid Strategies Inc. plan to address this accessibility issue by the end of 2025.

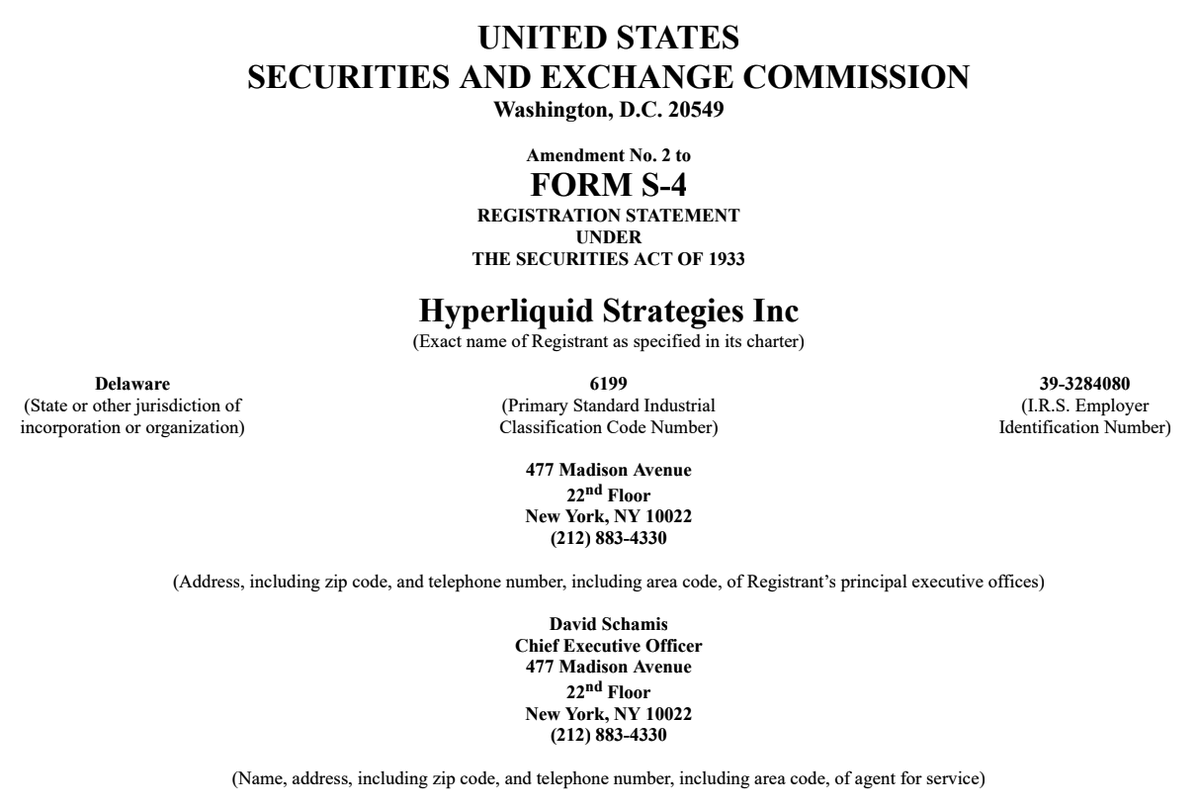

Hyperliquid Strategies Inc (NASDAQ: PURR)

Hyperliquid Strategies Inc is a newly established treasury company focused primarily on acquiring HYPE, formed through the merger of Sonnet BioTherapeutics and Rorscach I LLC. The new stock ticker HSI will be listed on NASDAQ.

HSI is led by Bob Diamond, founding partner of Atlas Merchant Capital, who previously served as CEO of Barclays and held senior management positions at Credit Suisse and Morgan Stanley. Additionally, David Schamis, Chief Investment Officer of Atlas Merchant Capital, who previously served as Managing Director at J.C. Flowers, is also involved.

Upon completion of the transaction, Hyperliquid Strategies Inc is expected to hold approximately 12.6 million HYPE tokens (valued at $578 million) and at least $305 million in cash investments. HSI is expected to complete the transaction in the fourth quarter of 2025.

Participants include well-known institutions such as Paradigm, Galaxy Digital, Pantera, and D1 Capital.

On September 4, 2025, HSI submitted an S-4 filing to the U.S. Securities and Exchange Commission (SEC), indicating that the merger is being formalized for shareholders.

Hyperliquid Strategies Inc S4 Filing

Hyperion DeFi (NASDAQ: HYPD)

Hyperion DeFi is a rebranded entity of Eyenovia Inc, with a core focus on acquiring HYPE through HyperEVM, as well as staking and yield generation strategies.

According to a news brief on September 25, Hyperion DeFi holds 1.71 million HYPE, with an average purchase price of $38.25.

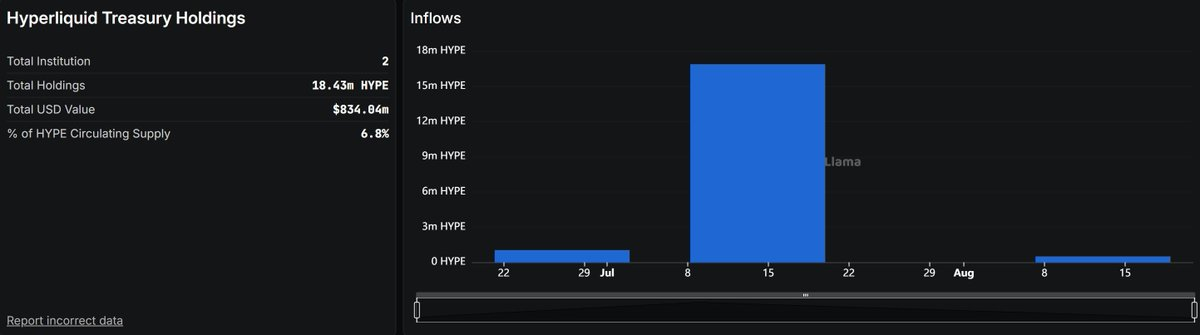

Sonnet and Hyperion DeFi currently hold a total of 18.43 million HYPE, valued at $834 million, and these tokens have been permanently removed from circulation.

HYPE Holdings of Hyperliquid Strategies Inc and Hyperion DeFi

Core Contributor Unlock Plan

The accounts of Hyperliquid's core contributors hold 238 million HYPE tokens, accounting for 23.8% of the total supply. These tokens will begin to unlock monthly after November 29, 2025.

We believe it is unreasonable to assume that 23.8% of the token supply will be fully allocated to 11 team members. The tokens allocated to core contributors after the genesis event will be locked for one year and will complete their vesting schedule between 2027 and 2028. In some cases, the vesting period may even extend beyond 2028. We believe this indicates that the supply after 2028 may be allocated to future core contributors and could account for 3%-6% of the core contributor supply.

Hyperliquid core contributors have the right to sell tokens. However, it is also unreasonable to assume they will directly destroy the spot order book from an execution perspective. In reality, there are many ways to transfer the core contributor supply to large entities seeking additional HYPE exposure, which would be simple ownership transfers without directly affecting the spot order book.

We are not saying that core contributors will not sell directly on the spot order book, but we emphasize that there are many other ways to complete the supply transfer without causing direct selling pressure. We note that some people infer selling pressure from the monthly unlocks, but we believe this concern is exaggerated. The Hyperliquid team has demonstrated complete consistency from day one and has not deviated from this in any way.

Robinhood founder Vlad Tenev sold 3.8 million shares of Robinhood Class A stock and holds 50.2 million shares of Class B stock that have not yet converted, while Robinhood's market capitalization reached $111.2 billion. We make this comparison because we believe Hyperliquid's future growth potential is comparable to that of Robinhood.

Given Hyperliquid's grand long-term vision and the substantial work that remains to be done, we expect Jeff and other core contributors to maintain the same team consistency. The unlocking and selling of HYPE will send clear signals, and if sold directly on the spot order book, it will be executed in batches.

Valuation Framework

In this report, we include various scenario analyses to infer the revenue potential of Hyperliquid's three main growth drivers:

Continued expansion of Builder Codes.

Launching stablecoins aligned with Hyperliquid and allocating part of the revenue to the Assistance Fund.

Launching HIP-3 markets, expected to achieve over $40 billion in monthly trading volume by the end of 2026.

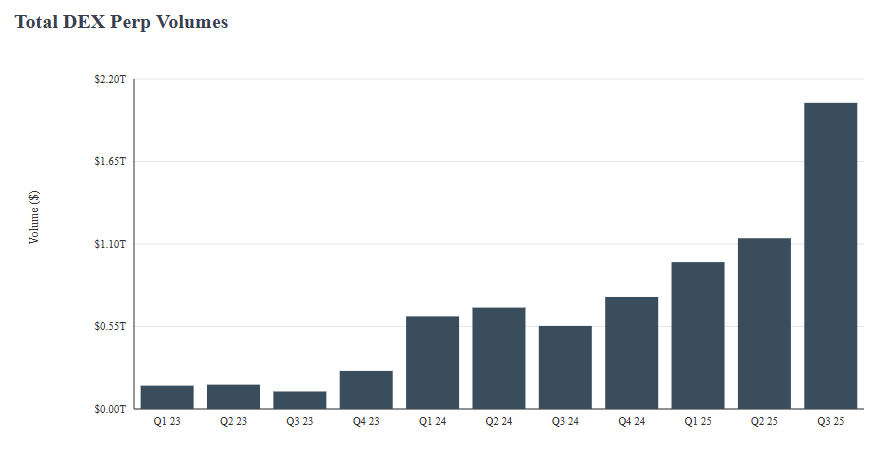

In addition, we believe Hyperliquid's core perpetual contract exchange will continue to achieve organic growth. Decentralized perpetual contract exchanges are significantly capturing market share from centralized exchanges (CEXs), a trend that is very evident: in the first three quarters of 2025, trading volume on decentralized perpetual contract exchanges grew by 125% year-over-year.

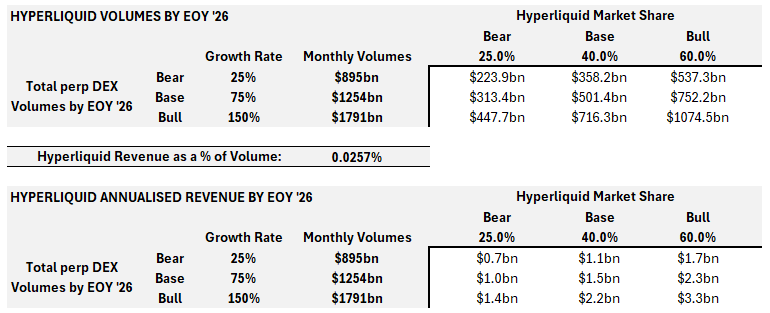

We expect this trend to continue, and despite the emergence of many competitors in recent weeks, we believe Hyperliquid will maintain a 40% market share in perpetual contract activity. Below is a scenario analysis of the total trading volume growth of decentralized perpetual contract exchanges by the end of 2026, along with our expectations for Hyperliquid's market share. These forecasts are based on the platform's organic growth, excluding the trading volume from HIP-3 and Builder Codes:

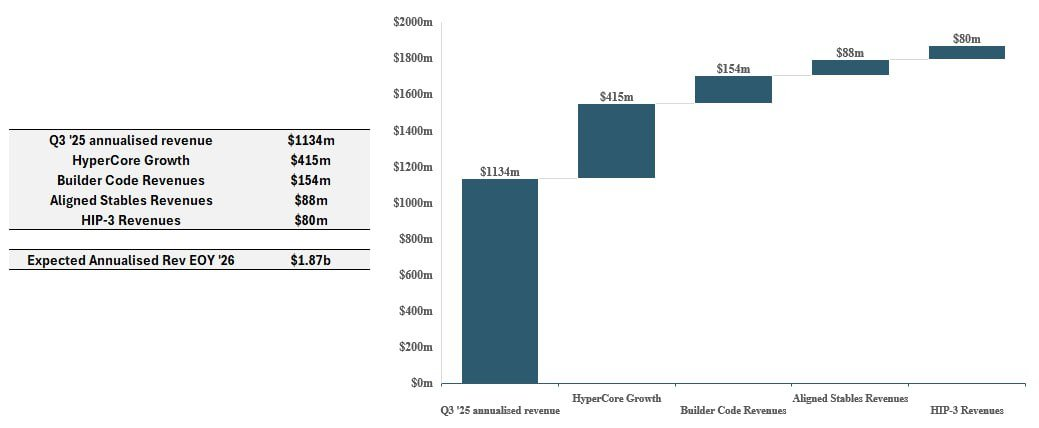

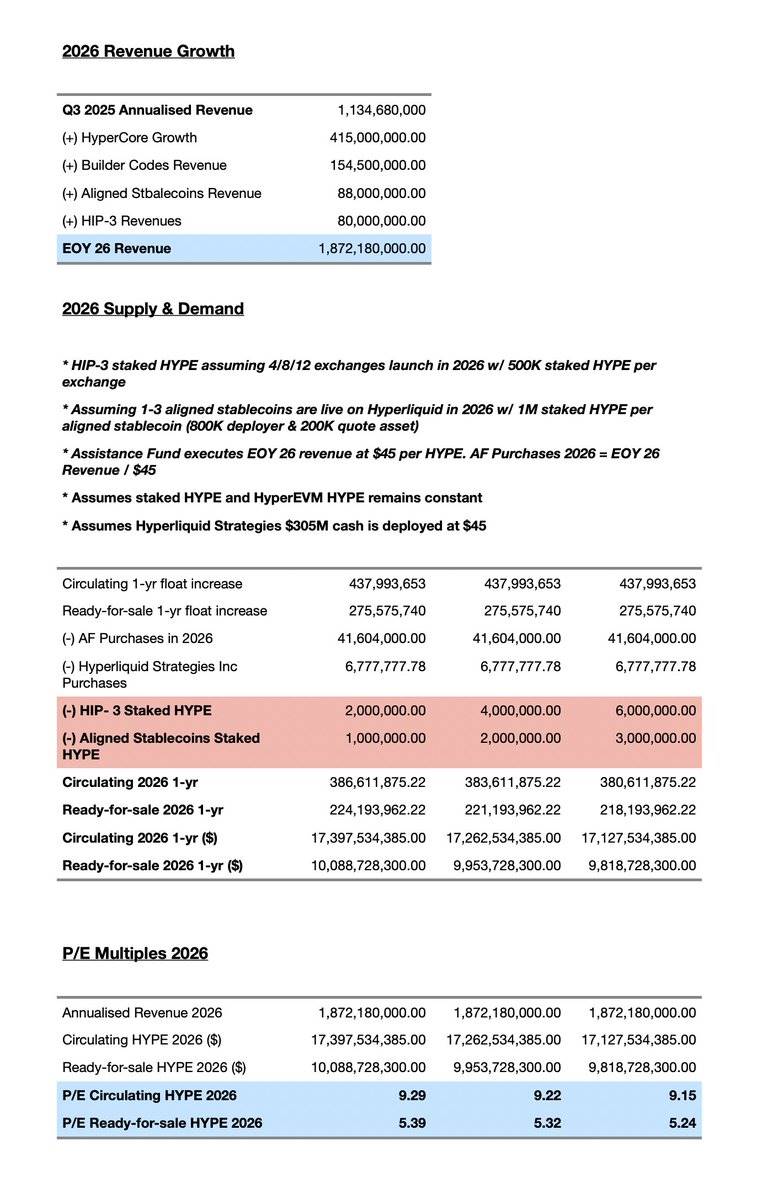

Considering the above factors, we believe the baseline scenario is that Hyperliquid's annualized revenue will reach $1.9 billion by the end of 2026, representing a 70% increase from the annualized revenue of Q3 2025.

Hyperliquid Q3 2025 Annualized Revenue and Core Contributor Floating Growth One-Year Analysis

Hyperliquid 2026 Revenue Forecast and Core Contributor Floating Growth One-Year Analysis

2026 Forecast

Hyperliquid will continue to eat into centralized exchanges (CEX) market share in the perpetual trading market, a trend driven by the liquidity flywheel and further accelerated by traffic enhancement from Builder Codes. We predict that by the end of 2026, Hyperliquid will capture 15%-25% of Binance's perpetual trading market share and 7.5%-15% of the global perpetual trading market.

Well-known fintech companies and brokers will begin offering perpetual trading services to users, achieved through direct integration of Builder Codes. These integrations will significantly enhance the protocol's revenue.

Hyperliquid will launch multiple fiat-pegged stablecoins, driving 50% of treasury yields back to the Assistance Fund. Additionally, we expect many institutions participating in the USDH proposal to advance plans to launch fiat-pegged stablecoins on Hyperliquid. By the end of 2026, we expect the issuance of USDH to exceed $5 billion, while the total issuance of other Hyperliquid-aligned stablecoins will exceed $2 billion.

HIP-3 will support multiple active perpetual markets, focusing on trading targets including indices, stocks, forex, and commodities. Most deployed HIP-3 markets will use USDH as the pricing asset, further solidifying USDH's position and driving the migration from USDC to USDH on HyperCore.

Hyperliquid will expand into the Real World Asset (RWA) space, allowing 1:1 backed tokenized stocks to be traded on the spot order book. This will go beyond traditional market trading through HIP-3 perpetual contracts, becoming the platform with the deepest liquidity for on-chain access to traditional markets.

DATs (Dynamic Asset Pools) centered around Hyperliquid will perform exceptionally well, naturally driving the value of HYPE upward. We also expect many other DATs to be announced and launched in 2026, with these asset pools adopting differentiated strategies, particularly focusing on HIP-3 and HyperEVM.

Multiple applications for Hyperliquid spot ETFs may emerge in 2026 to improve accessibility for qualified investors. Given that Hyperliquid is the highest-revenue protocol in the digital asset space, we expect to attract significant institutional interest. At that time, Hyperliquid's annual revenue could exceed $2 billion.

Conclusion

We believe that as institutions gradually embrace digital assets as an asset class, the public markets are entering a growth investment opportunity. Previous market cycles have left a profound psychological impact on participants, and we are approaching a turning point where several key businesses are beginning to scale significantly, generating substantial cash flow, attracting top talent, and expanding consumer-facing product offerings. In this context, investing in top teams with exceptional execution capabilities and accompanying their growth stories in the coming years is our core philosophy.

Arete Capital's liquidity investment approach is not about active trading in public markets but rather about seeking a few extraordinary investment opportunities with deep value and achieving investment returns with a long-term perspective. Hyperliquid remains our core liquidity investment choice, perfectly embodying our growth investment approach within the aforementioned investment philosophy. With the arrival of HIP-3, bringing traditional markets on-chain through perpetual contracts, and its role in the stablecoin growth story (such as USDH), we can clearly see that a significant part of the financial system is being introduced to HyperCore and HyperEVM. The grand vision of unified development across the entire financial sector on Hyperliquid has never been clearer.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。