DEX has transitioned from an "experimental alternative" to a "credible competitor," and is expected to capture a majority market share in the next 2-3 years.

Written by: A1 Research

Translated by: Saoirse, Foresight News

Decentralized Finance (DeFi) has undergone significant structural evolution through multiple market cycles. While centralized exchanges (CEX) have consistently led in trading volume, decentralized exchanges (DEX) have been capturing market share from CEX in each cycle — and this time, the competitive gap between the two has narrowed to unprecedented levels.

The persistent market share difference has a clear core reason: decentralization itself brings fundamental infrastructure limitations. As a new type of financial infrastructure, blockchain has struggled to match CEX in speed, liquidity, and user experience for most of the past decade.

However, in each cycle, DEX has made significant strides in closing this gap. By 2025, we have reason to ask: Will decentralized exchanges (DEX) ultimately replace centralized exchanges (CEX)?

Periodic Dilemma: Why Has DEX Not Yet Surpassed CEX?

Research on multiple market cycles indicates that the infrastructure of DEX is gradually maturing, with each cycle laying the groundwork for the current landscape.

2017-2018: Experimental Exploration Phase

Early DEXs (like EtherDelta) operated directly on Ethereum Layer 1, with settlement times taking several minutes, a rudimentary user interface, and severely lacking liquidity. In stark contrast, Binance's scale expansion resembled that of a Web2 application — fast, liquid, and user-friendly, quickly attracting retail and institutional users.

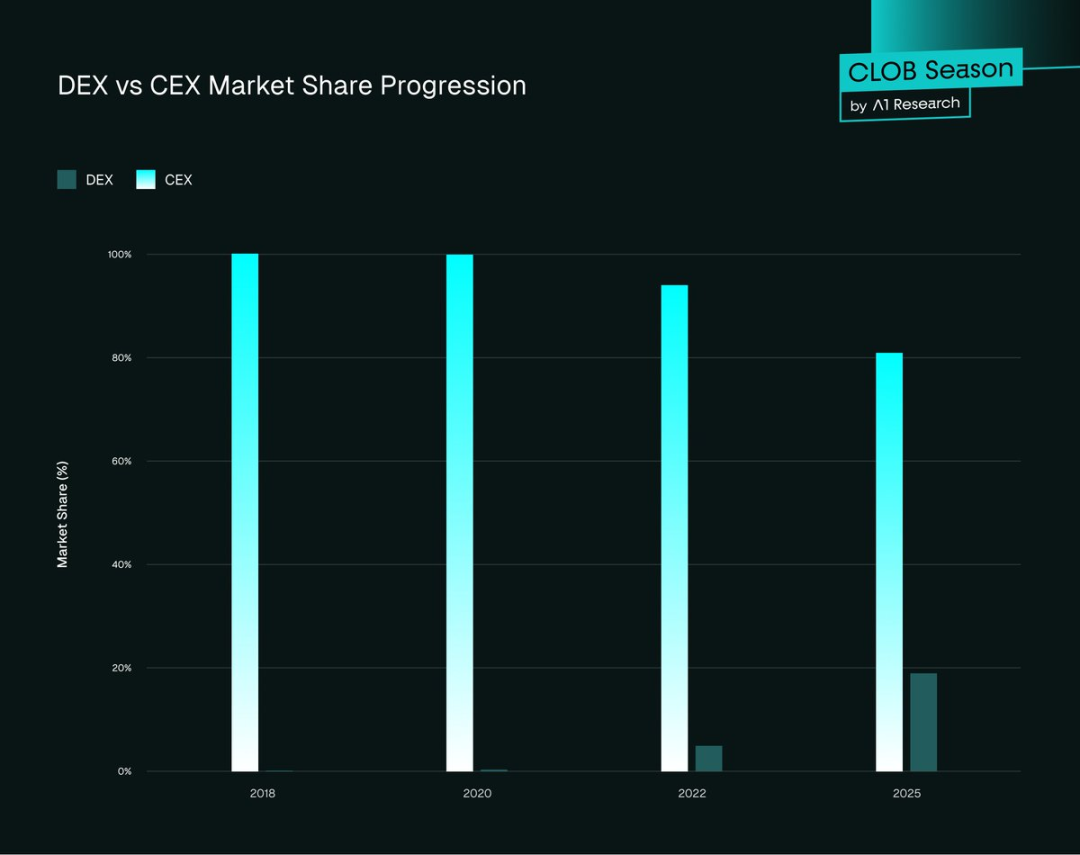

DEX Market Share: Approximately 0%

CEX Market Share: Approximately 100%

This early stage confirmed a key conclusion: decentralization is feasible, but performance and usability are major obstacles that need to be overcome.

2020: DeFi Summer Breakthrough Phase

The launch of the automated market maker (AMM) model by Uniswap was revolutionary. It required no order book, allowing anyone to provide liquidity "permissionlessly" — a substantial architectural innovation that appeared in DEX design for the first time. However, at that time, AMM primarily served "long-tail tokens" (niche tokens with low trading activity) and could not cover mainstream tokens with deep liquidity.

As congestion on the Ethereum network intensified, gas fees skyrocketed from under 20 gwei to over 400 gwei, significantly increasing transaction costs; meanwhile, the trading interface experienced severe delays, leading professional traders to steadfastly choose CEXs like Bybit and Binance.

DEX Market Share: 0.33%

CEX Market Share: 99.67%

To address liquidity issues, Uniswap V3 launched "concentrated liquidity pools" in 2021 — a complex solution that allowed liquidity providers (LPs) to allocate liquidity within custom price ranges. Although the "impermanent loss" (IL) issue remained unresolved (causing many to hesitate in providing liquidity for small tokens), this was still a significant breakthrough: DEX transitioned from an "experimental protocol" to a "viable trading venue for specific market segments and certain traders."

2022: Trust Crisis Period After FTX Incident

In November 2022, the bankruptcy of FTX shook the entire industry: billions of dollars in user funds evaporated overnight, and trust in centralized custodians collapsed completely. In the following weeks, "Not your keys, not your coins" became a hot topic on Twitter (now X platform) in the cryptocurrency space, with traders turning to "self-custody."

As a result, trading volumes for DEXs like Uniswap and dYdX surged: Uniswap's trading volume exceeded $5 billion, and dYdX's trading volume skyrocketed by 400%, with a large number of users migrating from CEX to DEX. However, despite the positive momentum, core issues remained unresolved — poor wallet user experience, fragmented cross-chain liquidity, and a lack of fiat on/off ramps. As short-term panic subsided, user behavior gradually returned to normal, with many choosing CEX again.

DEX Market Share: Approximately 5%

CEX Market Share: Approximately 95%

In response, the DeFi ecosystem further innovated: launching cross-chain Uniswap routing features and optimizing user experience through wallets like Rabby Wallet and Phantom.

However, DEX still could not achieve the low latency levels of CEX. Although improvements in each cycle were incremental, the performance gap remained significant: blockchains still could not support professional-level trading, and the ultra-low latency "order book architecture" fundamentally conflicted with the design constraints of AMM.

2025: Turning Point

The market environment in 2025 underwent a qualitative change — infrastructure matured sufficiently to support "real competition" between DEX and CEX for the first time. High-performance blockchains, on-chain central limit order books (CLOB), direct fiat integration features, and low latency approaching that of CEX have all been fully integrated into on-chain protocols. Perpetual DEXs (Perp DEX) like Hyperliquid, Paradex, and Lighter are providing an on-chain trading experience "close to CEX functionality."

Liquidity aggregation, faster block confirmation times, and unified margin systems allow traders to execute various strategies directly on-chain from spot to derivatives, without facing the cumbersome obstacles of previous on-chain trading.

DEX Market Share: Approximately 19% (peaking at 23% in Q2 2025)

CEX Market Share: Approximately 81%

Although "functional parity" has not yet been achieved, DEX is no longer an "alternative" but has become a "direct competitor" to CEX.

Figure 1. Trend of Market Share Changes Between DEX and CEX

2025 Data Overview: CEX Still Dominates, DEX's Catch-Up Speed Accelerates

Data clearly shows: although CEX still dominates global liquidity, DEX is narrowing the gap cycle by cycle, quarter by quarter. From spot to derivatives, all segments are showing signs of "trading shifting on-chain."

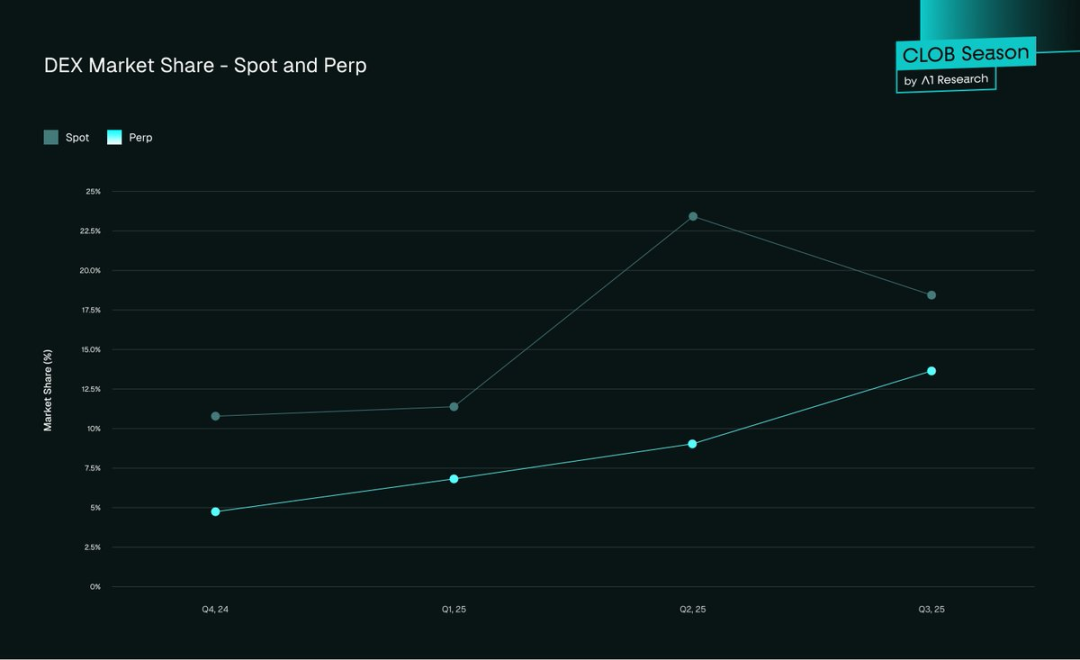

Spot Market: DEX's market share rose from 10.5% in Q4 2024 to 19% by the end of Q3 2025.

Futures Market: By the end of Q3 2025, DEX accounted for approximately 13%, a significant increase from 4.9% in Q4 2024.

Figure 2. DEX Market Share — Spot and Perpetual Contracts

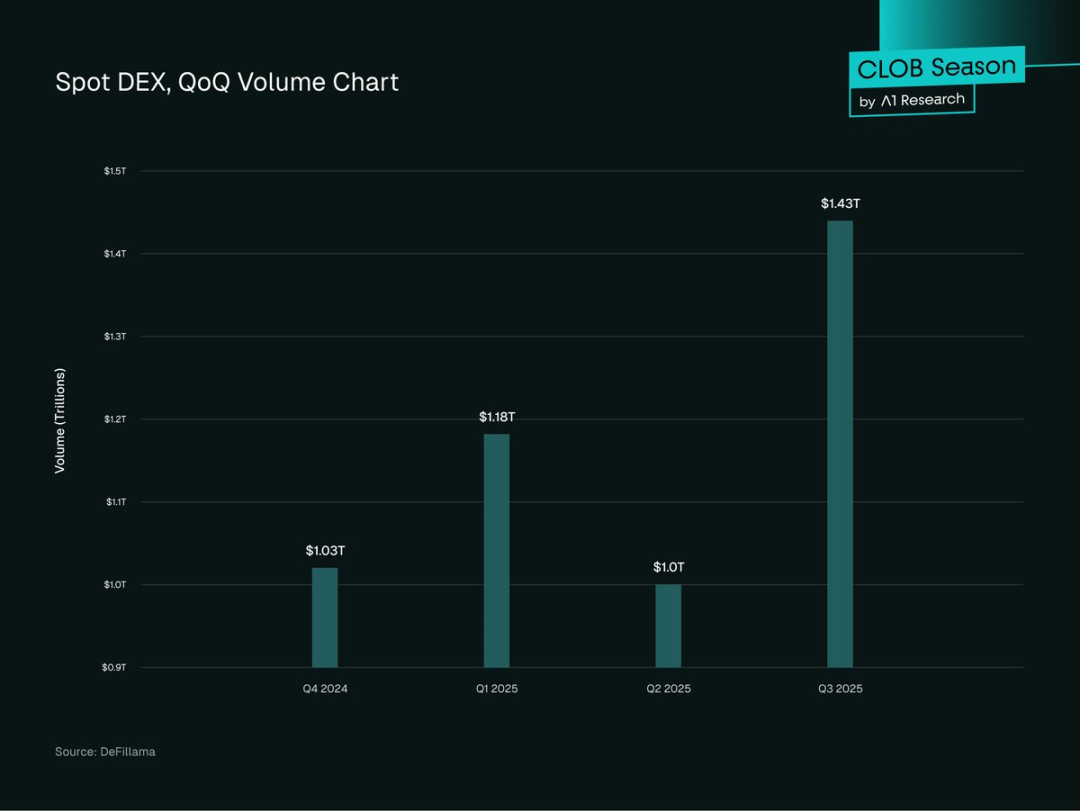

- Spot Trading Volume: In Q3 2025, DEX spot trading volume reached $1.43 trillion, a historic high — a 43.6% increase from $1 trillion in Q2 2025, surpassing the previous peak of $1.2 trillion in Q1 2025.

Figure 3. Quarterly Spot DEX Trading Volume Chart

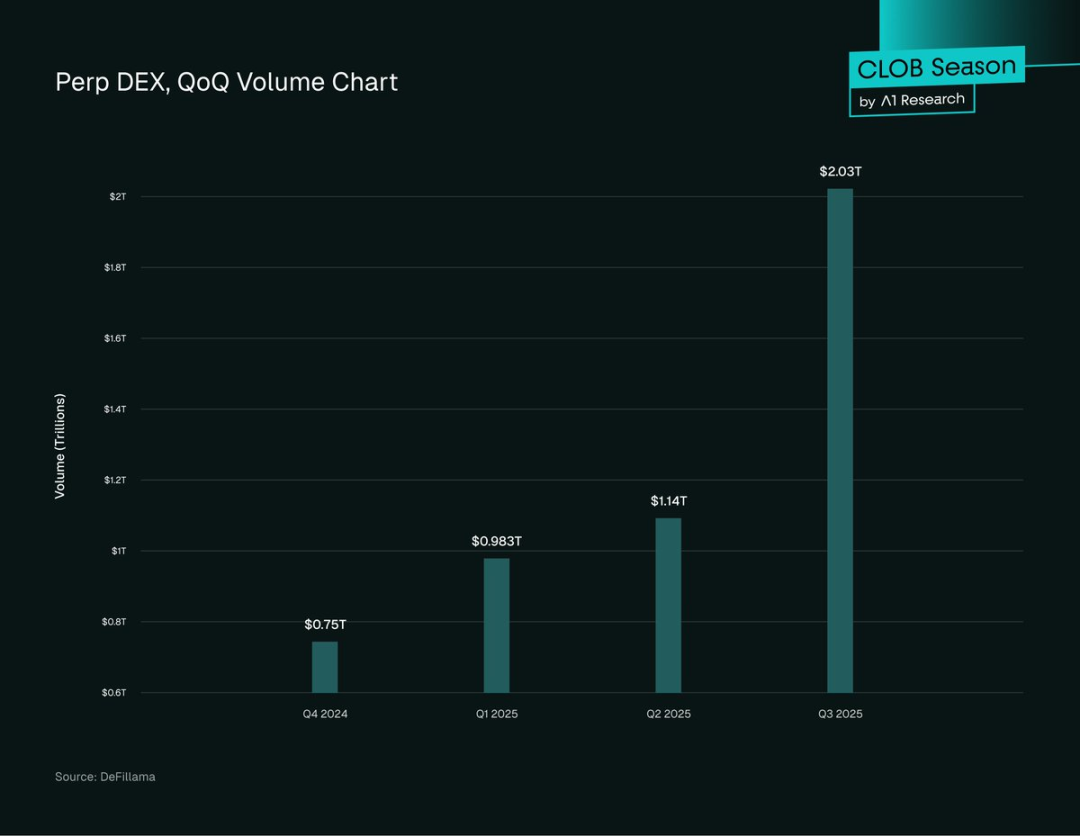

- Perpetual Contract Trading Volume: In 2025, DEX perpetual contract trading volume expanded significantly, reaching a cumulative on-chain total of $2.1 trillion by Q3 — a 107% increase from Q2 2025, and exceeding DEX's own spot trading volume.

Figure 4. Perp DEX Quarterly Trading Volume Chart

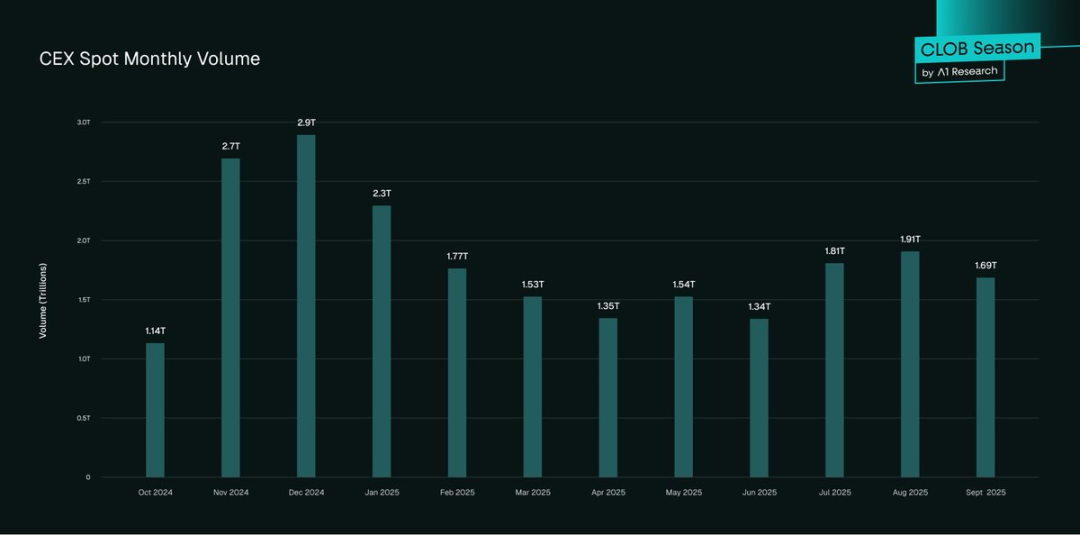

- CEX Performance: In Q3 2025, CEX spot trading volume is estimated to exceed $5.4 trillion, maintaining its dominant position, with a 25% increase from Q2 2025.

Figure 5. CEX Spot Monthly Trading Volume

- The trend direction is clear and accelerating: DEX spot trading volume increased by 43.6% quarter-on-quarter and 33% year-on-year; perpetual contract trading surged over 5 times in the past 12 months, with its share of total futures trading volume rising from 3.45% to 16.7%. If the current trend continues, 2025 will become a "turning point" for DEX market positioning.

Adoption Patterns

Although the adoption rate of DeFi is steadily increasing, growth is not uniform across different regions and user groups. Different markets, user characteristics, and institutional behaviors are shaping the global evolution path of DeFi. The following patterns reveal the growth hotspots of DeFi, the participation differences between professional users and retail investors, and the implications of these trends for the next phase of growth.

Uneven Global Distribution: The Asia-Pacific region is the fastest-growing area, with on-chain activity increasing by 69% year-on-year, followed by Latin America and Sub-Saharan Africa; North America and Europe still dominate in absolute trading volume but have lower growth rates (around 42%-49%). The growth momentum in Asia and Africa is particularly evident in low-fee on-chain microtransactions — reflecting the characteristic of "retail-driven natural growth."

Institutional Participation Characteristics: Institutional adoption of DeFi exhibits unique patterns. Large trading firms are increasingly using "cross-platform routing" — integrating liquidity from CEX and DEX to optimize trade execution efficiency and hedge positions. This "hybrid model" indicates that professional traders no longer view DEX as a "high-risk alternative" but as a "complementary trading venue."

Token Issuance Preferences: Most new projects choose to "issue on DEX first" — utilizing DEX for initial price discovery before seeking CEX listings. The reason is that DEX token issuance is "permissionless and fee-free"; however, well-funded projects often opt for CEX listings to achieve broader token distribution.

Total Value Locked (TVL) in DeFi: By the third quarter of 2025, the total TVL in DeFi protocols reached $157 billion, a historic high — with over 50% of the TVL related to DEX protocols and liquidity pools. Ethereum dominates the total TVL in DeFi with approximately 63% share.

Active Trader Scale: CEX still holds an advantage in user numbers, with over 300 million registered users globally (Binance alone has 290 million users); in contrast, DEX has about 10 to 15 million monthly active users — although fewer in number, these users possess a more "DeFi-native attribute" and have richer trading experience.

In summary, DEX continues to narrow the competitive gap with CEX, but what truly brings DEX closer to CEX performance levels is the evolution of its core trading architecture. The next breakthrough will be driven by the "on-chain order book (CLOB) model" — a model that combines the advantages of decentralization with the efficiency of CEX and traditional finance (TradFi).

Breaking the AMM Barrier: The Era of High-Performance CLOB DEX

Automated Market Makers (AMM) drove the first wave of DeFi, achieving "permissionless trading," but there are significant shortcomings in efficiency, price discovery, and capital utilization. The new generation of "on-chain Central Limit Order Book (CLOB) DEX" marks a structural leap in DEX architecture.

Taking Hyperliquid as an example, it demonstrates the possibility of "combining CEX-level performance with on-chain transparency": by reintroducing the order book mechanism into a decentralized system, it addresses traders' core reliance on CEX — delays, execution accuracy, and capital efficiency, especially in limit orders and derivatives trading.

Delay: Average confirmation time [only 0.07 seconds] (achieved through the HyperBFT consensus mechanism) — comparable to mainstream CEX, far faster than AMM DEX (2-30 seconds).

Liquidity Depth: On-chain CLOBs like Hyperliquid set a new benchmark for decentralized liquidity — the platform can handle up to 200,000 orders per second, with an open contract value of [6.5 billion dollars], and a deep order book can accommodate large trades with minimal price impact. For mainstream trading pairs like Bitcoin (BTC) and Ethereum (ETH), slippage (the deviation between the transaction price and expected price) is below 0.1%, comparable to CEX. This sharply contrasts with AMM: even though AMM optimizes through structures like ve (3,3), the slippage and impermanent loss issues remain unresolved. However, less active "niche trading pairs" on Hyperliquid still face wider spreads, indicating that liquidity depth varies across different markets.

Trading Fees: Hyperliquid's CLOB design significantly reduces trading costs — the average taker fee for futures trading is about 0.035%-0.045%, and for spot trading, about 0.07%, with makers also receiving small rebates. This fee level is comparable to top CEX and far lower than typical AMM swap fees (0.3%-0.5%). Unlike AMM, traders do not have to bear the costs of impermanent loss or inefficient routing, making CLOB more capital efficient for active and institutional traders.

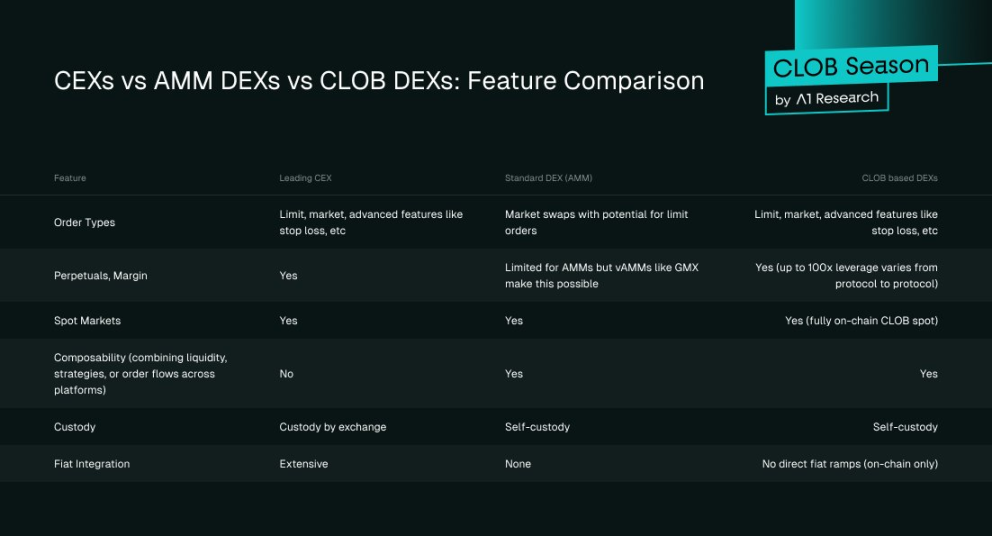

Figure 6. CEX vs Automated Market Maker DEX vs Order Book DEX: Functional Comparison

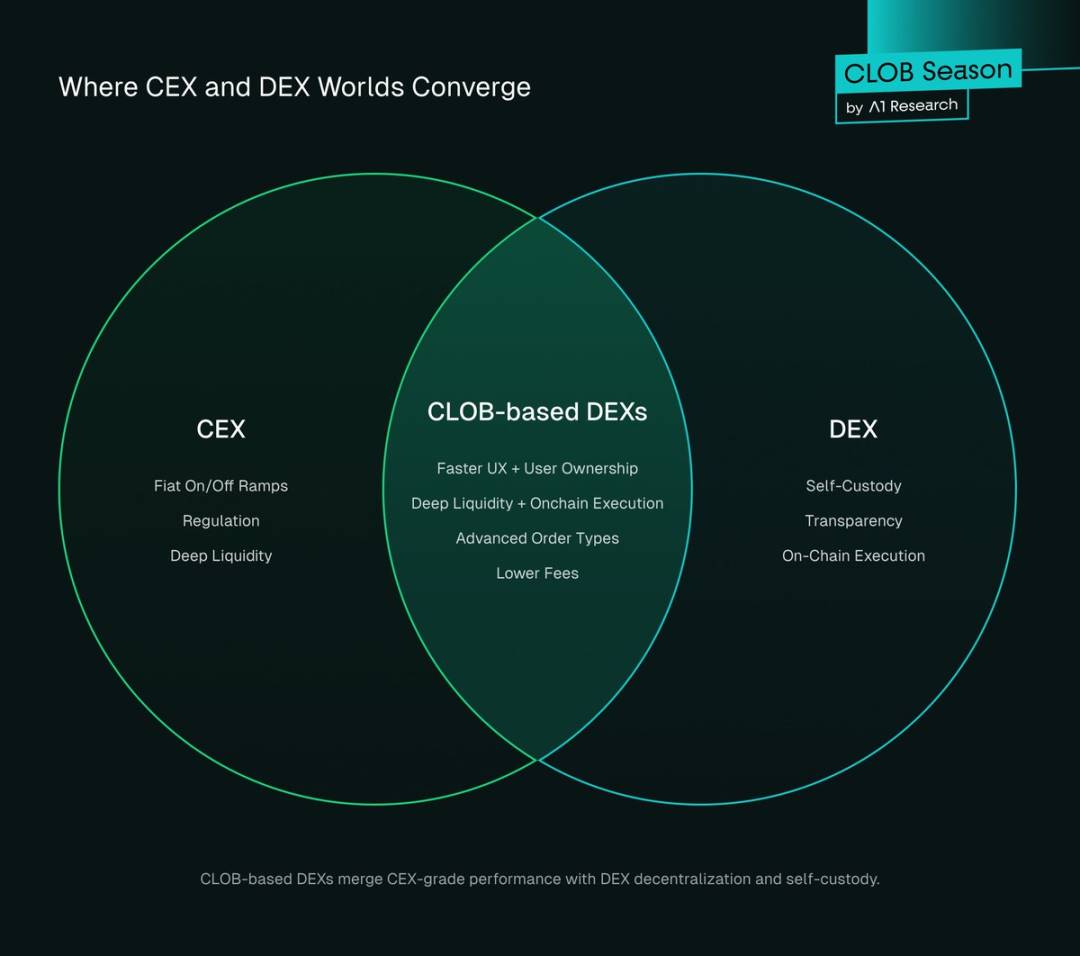

CLOB-based DEX represents the "fusion direction" of CEX and DEX — possessing both the high performance and deep liquidity of CEX, while also enjoying the self-custody, transparency, and on-chain execution advantages of DEX.

Figure 7. Intersection of CEX and DEX Fields

Why Are Traders Turning to DEX?

Traders may choose decentralized platforms over custodial ones due to "ideological alignment," but what truly drives migration is the "tangible improvements" DEX offers in security, cost efficiency, or operational convenience. CEX's past market dominance was primarily due to its smoother user experience and deeper liquidity.

Today, DEX is gradually catching up — by 2025, DEX not only achieves "near CEX functional parity" but also establishes competitive advantages in specific areas. Current DEXs exhibit three structural advantages: decentralized characteristics with CEX-level user experience, extremely low (or even zero) fees, security, and access to a "fair market."

1. Decentralization + CEX-Level User Experience

DEX inherently possesses two major advantages:

Transparency: On-chain settlement allows transactions to be traceable, liquidity verifiable, and typically provides "proof of reserves," enabling users to audit protocol activities independently;

Self-Custody: Traders always control their assets, completely avoiding the risk of CEX hacks — as of mid-2025, the total amount stolen from CEX due to hacks has exceeded [2.17 billion dollars].

However, in the past, DEX's "execution infrastructure" has always been a shortcoming: user interfaces were rudimentary, liquidity was highly fragmented (leading to high slippage costs), and settlement was slow and costly. Traders tolerated the risks of CEX only because CEX could provide speed and usability. With the launch of dYdX, the infrastructure shortcomings began to improve; and the emergence of Hyperliquid has led to an "exponential upgrade" in the DEX experience.

By 2025, CLOB DEXs represented by Lighter, Paradex, and Bullet have emerged — these DEXs are comparable to CEX in speed and efficiency (some scenarios even better), while retaining the core advantages of decentralization.

The experience upgrades of modern DEX include:

User Experience / Interface Innovation: The trading dashboards of Hyperliquid, Paradex, and Lighter can compete with Binance in design and responsiveness;

Liquidity Transformation: AMM is gradually being replaced by on-chain CLOB, achieving deep order books, narrow spreads, and low slippage;

Seamless Onboarding Process: Wallet integration, one-click trading, fiat on-ramps, and guided tutorials make the onboarding process of DEX sometimes faster than the KYC process of CEX.

For example, Hyperliquid achieved a trading volume of $655.5 billion in Q2 2025 — the core reason DEX can achieve such a massive trading volume is that it provides a CEX-level user experience and usability without sacrificing asset custody and transparency.

2. Zero Fee Model

The biggest difference between the business models of DEX and CEX lies in the trading fee structure. CEX has long relied on "taker/maker commissions, rebates, and affiliate marketing revenue" for profit, while DEX is reconstructing this economic framework.

Taking perpetual contracts as an example: Binance charges a 0.020% fee for makers and a 0.040% fee for takers; whereas emerging DEXs like Paradex and Lighter have completely eliminated trading fees. They adopt a model similar to Robinhood (a U.S. zero-commission brokerage) — not charging users direct trading fees but generating revenue through "market makers paying for order flow access and execution priority."

For instance, Paradex pioneered structured models like "Retail Price Improvement (RPI)" and "Payment for Order Flow (PFOF)": enhancing the quality of trade execution for users while ensuring sustainable revenue for the protocol. This model replicates Robinhood's innovative logic for retail stock trading but is entirely based on an on-chain environment and is more transparent.

The impact of zero-fee DEX is profound:

Disrupting CEX Affiliate Economics: Zero fees change the traditional charging model of CEX — although traders do not need to pay taker/maker fees, the protocol can still generate revenue through PFOF, RPI, and premium features, reducing reliance on affiliate commissions and reshaping the reward mechanism of the trading ecosystem;

Lowering Market Participation Barriers: Professional/VIP traders at CEX can obtain rebate discounts through "high trading volumes," but most users must pay standard rates and are highly sensitive to "fee reductions" or "zero fees" — zero-fee DEX precisely meets the needs of this user segment;

Restructuring Incentive Mechanisms: DEX offers on-chain referral programs, governance rewards, token airdrops, liquidity rewards, etc. — although not as stable as CEX's affiliate sharing, they are more closely aligned with users' actual activities.

Although trading fees may seem small, they can have a significant impact on large-scale trading: for active users, even minor rate differences can accumulate to substantial costs over time (especially in the perpetual contract market). The rise of zero-fee or ultra-low-fee DEX may force CEX to reassess their pricing models — consistent with Robinhood's impact on stock brokerage fees. In the long run, "fee compression" will shift the competitive focus from "pricing" to "liquidity depth, execution quality, and comprehensive financial services."

It is worth noting that mainstream CEXs are strategically laying out decentralized infrastructure, which may ultimately affect their market dominance: for example, Binance co-founder CZ is advising the DEX Aster based on the BNB chain, while publicly stating that Binance is increasing its investment in "non-custodial businesses" and "on-chain businesses."

Bybit and other large CEXs have also begun to take action: either integrating on-chain trading functions or directly investing in emerging DEX infrastructure. For these institutions, this move serves both as a "risk hedge" and reflects their understanding — the next phase of growth in the exchange industry may revolve around "on-chain, interoperability, and community alignment."

3. Security, Accessibility, and Market Fairness

DEXs possess core characteristics of "trustlessness" and "risk resistance": users always control their assets, funds cannot be seized, and protocol rules are immutable; audit records are permanently stored on-chain, ensuring that even if the platform team disappears, the market can still operate normally, and users need not worry about "arbitrary rule changes" or "discriminatory treatment."

At the same time, DEXs provide "permissionless global access": traders can operate 24/7 without completing KYC, applying for listing permissions, or being restricted by geographical areas; any token can be listed instantly without fees or centralized review processes; additionally, DEXs can seamlessly integrate with other DeFi protocols and smart contract applications, forming a "highly composable ecosystem."

The market mechanisms of DEXs also exhibit transparency: open-source code, verifiable liquidity, and on-chain order books significantly reduce the possibility of "selective market manipulation"; their architecture minimizes "operational errors during market volatility," assuring traders that — at the times when market stability is most needed, DEXs can operate reliably.

On October 9-10, 2025 (in the author's time zone), the cryptocurrency market experienced the "largest liquidation event in history": influenced by President Trump's announcement of "100% tariffs on Chinese imports," over $19 billion in leveraged positions were liquidated, affecting 1.6 million traders. During this period, CEXs like Binance experienced system instability, while decentralized protocols like Aave protected $4.5 billion in assets through "risk-resistant oracles," and Hyperliquid maintained transparent operations and stable uptime throughout.

This event highlighted the stark contrast between "trust and stability": the credibility of CEXs was damaged, while on-chain platforms maintained operational continuity. It demonstrated the "operational advantages of transparent settlement mechanisms during market shocks" and accelerated the trend of "migration to DEXs."

These characteristics further validate the "structural advantages" of DEXs, while also complementing the "performance and cost advantages" brought by modern CLOB and AMM improvements, collectively driving the competitiveness of DEXs.

Future Outlook

CEXs remain indispensable in areas such as "fiat on-ramps and off-ramps, compliant products, insurance services, and trusted entry points for new users/institutions"; meanwhile, DEXs excel in "core value scenarios of decentralization" — such as on-chain transparency, user self-custody, innovative financial product issuance, and privacy protection features.

Increasingly, more traders (especially mature traders and institutions) are beginning to "operate across ecosystems": utilizing CEX liquidity to complete "fiat and cryptocurrency exchanges" (on-ramps and off-ramps), while relying on DEXs to execute trades, implement DeFi strategies, and achieve self-custody of assets. This "dual-platform model" is rapidly shifting from "exception" to "norm." However, if technological advancements and DEX adoption rates maintain their current pace, DEXs are expected to ultimately achieve "market dominance."

Catalysts to Watch

Technological advancements have significantly enhanced the capabilities of DEXs; if breakthroughs can continue in areas such as "liquidity depth, capital efficiency, seamless fiat integration, and regulatory clarity," it will further accelerate the adoption of DEXs and narrow the gap with CEXs. Here are the key catalysts:

On-chain CLOB Expansion: Existing networks like Hyperliquid, or future "application chains," can provide "deep liquidity + sub-second latency"; if they can achieve similar liquidity depth for "less active niche trading pairs," the remaining "execution gap" will significantly narrow, attracting more mature day traders to switch to DEXs.

Composability and New Product Categories: Perpetual contracts have become a "differentiated advantage area" for DEXs; currently, "on-chain options trading" is still largely unfeasible — if breakthroughs occur in this area, it is expected to attract a large influx of retail and institutional TVL (Total Value Locked) into DEXs.

Regulatory Clarity and Convergence: As CEXs like Binance face restrictions in multiple jurisdictions, regulators are beginning to explore frameworks that recognize "non-custodial platforms as legitimate market venues." Singapore and Japan have initiated testing or research on "compliant DeFi sandboxes," and other countries are expected to follow suit. Such regulatory clarity will "promote the mainstreaming of DEXs" — allowing users and institutions to participate without "regulatory uncertainty," thereby enhancing trust in the DeFi ecosystem.

On-chain Dark Pools and Privacy Protection: On-chain dark pools provide DEXs with "confidential trading venues," supporting large trades executed "without disclosing the public order book." This privacy can prevent "front-running" and "liquidation sniping," attracting institutional participants who "seek efficient trading while avoiding malicious operations." By enhancing confidentiality and reducing manipulation risks, dark pools will accelerate institutional adoption of DEXs.

Brand and Fiat Innovations: Emerging "decentralized fintech" startups like PayPal and Stripe may combine "bank-level support" with "seamless fiat channels" — further undermining CEXs' advantages in "fiat on-ramps and off-ramps."

Conclusion: The Inevitable Rise of DEXs

Data clearly indicates the trend of DEX market share expansion: by Q4 2024, DEXs accounted for 10.5% of spot trading and 4.9% of perpetual contracts; by Q3 2025, these proportions are expected to soar to 19% and 13.3%, respectively — with an average quarterly growth rate of about 25%-40% across different segments. Based on the current growth trajectory, the following predictions can be made:

By mid-2027, the market share of DEX spot trading may exceed 50%;

By early 2027, the market share of DEX perpetual contract trading may also exceed 50%.

Even in a "conservative growth scenario," DEXs are expected to surpass the 50% market share threshold within two years, completing the transformation from "niche alternative" to "dominant platform."

Governments around the world are increasingly intervening in the construction of DeFi frameworks: Singapore and Japan have initiated DeFi sandbox testing, and institutions like the SEC and MiCA are also expected to launch similar frameworks. This will promote the "legalization of non-custodial platforms," allowing more individuals and institutions to participate in DEXs "without legal concerns."

Events like the "black swan event" on October 9-10 have proven that in terms of "transparent liquidation handling," the structural advantages of DEXs far exceed those of CEXs — when CEXs encounter system failures, DEXs like Hyperliquid can still maintain full normal operations. This indicates that DEXs are not only superior in "ideology" but also more reliable in "actual operations."

Looking ahead, on-chain dark pools and more composable liquidity layers are set to be implemented, further attracting mature traders and institutions; DEXs based on CLOB are nearing CEX-level execution efficiency, and if privacy protection features are integrated, they will form a "value proposition that CEXs find difficult to match."

The competitive trajectory clearly indicates that 2025 will be a "turning point" for DEX development — it has transitioned from an "experimental alternative" to a "credible competitor," and is expected to capture a majority market share within the next 2-3 years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。