Author: BitPush

On October 10, this seemingly ordinary Friday became the "Judgment Day" for the crypto market.

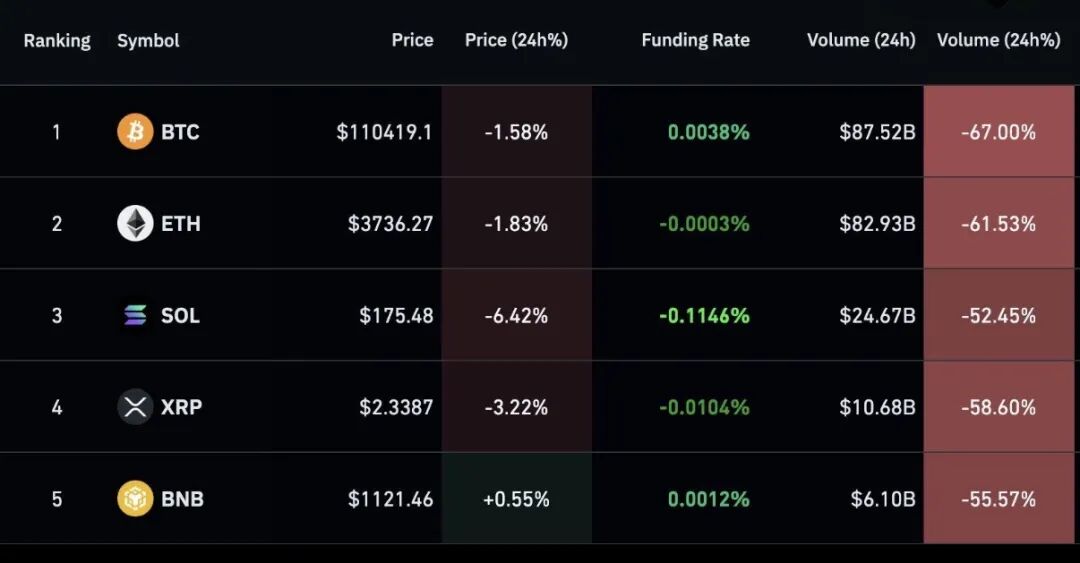

In just one hour, the market collapsed, with over $20 billion in leveraged positions liquidated. Bitcoin plummeted by 15% at one point, and the trading depth of altcoins evaporated instantly. With screens turning red and accounts hitting zero, the entire market fell into a collective nightmare.

A single spark ignited a widespread explosion

The starting point of this storm was not complicated. Escalating trade frictions and the sell-off of risk assets triggered a wave of panic. However, what truly caused the market to spiral out of control was the internal chain reaction within exchanges.

The full-margin system of centralized exchanges (CEX) was seen as a "magic tool" for improving capital efficiency during a bull market, but in extreme market conditions, it became a catalyst for disaster.

From "diversifying risk" to "taking it all"

Over the past year, the stablecoin USDe, supported by mainstream exchanges, became a popular collateral asset. Its widespread use allowed leverage to expand like a snowball, but it also buried hidden dangers.

When the prices of BTC and ETH plummeted and triggered the system's liquidation threshold, the automatic liquidation program began to sell off collateral.

The result: a massive sell-off of USDe occurred simultaneously, and the market's absorption capacity collapsed instantly. Within minutes, USDe dropped to $0.65 on Binance, making the stablecoin the most unstable entity.

The illusion of high returns

Even more outrageous, Binance had previously launched a USDe financial product with an annualized return of 12%—a seemingly stable high-yield product that relied on circular borrowing.

Some institutions and large holders repeatedly leveraged USDe as collateral through channels like Binance Loans, then reinvested the funds back into financial products to amplify returns.

As long as prices remained stable, this strategy looked like a money-printing machine; but once it decoupled, all positions instantly backfired, and the leverage chain completely broke.

System freeze, users liquidated

During the high-pressure moments of price collapse, many traders found that the Binance system was delayed and withdrawals were sluggish. Watching their account balances plummet to zero, they found themselves unable to click on anything.

By the time trading resumed, positions had already been "liquidated," and thousands of people experienced a forced risk education.

The industry's cold and hot reactions

After the storm, the industry's reactions were polarized.

Star, the founder of OKX, spoke out on the X platform, stating that this incident exposed the structural flaws of centralized exchanges; the CEO of Crypto.com publicly called for regulatory intervention.

On the other hand, the undercurrents among peers were even more intriguing. Some feigned concern while others secretly rejoiced—after all, victory in competition sometimes comes from the misfortunes of rivals.

Conclusion: Liquidation is not just about positions

This crash was not just about the liquidation of leverage; it was also a judgment on the risk control logic of exchanges.

Pursuing trading volume and encouraging high leverage while ignoring the systemic risks of collateral assets—when the tide goes out, no one bothers to cover up who was swimming naked.

The crypto world has never lacked wealth myths, but every tragedy serves as a reminder to the market: there is no high return that does not come with an invisible clause stating "risk is borne by the investor."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。