Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

With Trump and Vance releasing mild statements regarding the China-U.S. trade war, both U.S. stock futures and the crypto market rebounded. This round of sharp declines is seen as a critical turning point in the crypto market cycle, with the deep deleveraging process effectively releasing previously accumulated systemic risks. According to data tracked by Glassnode, the funding rate in the crypto market has dropped to its lowest level since the 2022 bear market. This marks one of the most severe leverage resets in the history of the crypto market, indicating that speculative excesses have been systematically cleared out. According to Matrixport analysis, this round of "surrender-style selling" is historically significant, completely reshaping the entire crypto market's position structure, almost eliminating excessive leverage positions in the market, with only a few traders benefiting. As volatility gradually subsides, market signs indicate that new long positions are expected to be rebuilt.

However, due to the ongoing U.S. government shutdown, market anxiety remains difficult to dissipate. The federal government has initiated large-scale layoffs, and the U.S. Bureau of Labor Statistics has announced a delay in the release of the September CPI report until October 24. Currently, the issue of the U.S. government shutdown is at a critical juncture. Goldman Sachs' chief U.S. political strategist Alec Phillips expects that the government "shutdown" status is unlikely to extend beyond the military payroll date of October 15. Trump has also stated that he has instructed Defense Secretary Hegseth to "use all available funds" to ensure that military salaries are paid on time during the shutdown. Meanwhile, there are many market highlights this week. Federal Reserve Chairman Powell will speak in the early hours of Wednesday Beijing time, expected to provide guidance on the economic and monetary policy outlook; 2026 FOMC voting member and Philadelphia Fed President Harker will speak; the Federal Reserve will release the Beige Book on economic conditions; Fed Governor Waller will speak; and the third-quarter earnings season for U.S. stocks will officially begin.

Bitcoin has returned to $115,000, with its market cap share rising to over 59%. According to crypto analyst Mister Crypto, Bitcoin is re-testing the golden cross, a bullish technical pattern that historically precedes price increases and may trigger a significant rebound. ARK Invest's latest report states that Bitcoin's fundamentals remain robust, with network activity and profitability indicating strong demand, and long-term holders showing no signs of selling. Medium-sized investors are increasing their holdings, while large holders are reducing selling pressure, leading to a healthier market structure. Institutions are accelerating their adoption, with trusts and spot ETFs holding about 12.2% of Bitcoin's supply, indicating a deepening integration with traditional markets. On the macro front, controlled inflation, weakening employment, and a shift in Federal Reserve policy may provide support for Bitcoin. ARK also warns that 2025 may see greater volatility, but the long-term outlook remains positive. On-chain data analyst Murphy points out that Bitcoin whales continue to increase their holdings, showing a clear pattern of buying more as prices drop. Although there was a sharp decline on October 11, the psychological impact on large holders was much less than during the macro events in April and August of this year, and the speed of capital outflow has been more moderate than in previous instances. Additionally, with the continuous influx of large capital, the Bitcoin market has become more mature, and its response to sudden events is no longer characterized by blind panic or collective sell-offs. This marks the beginning of a major cycle shift from bull to bear, but the foundation of the bull market has not changed. The biggest uncertainty in the market currently is Trump, whose unpredictable policies may trigger short-term volatility.

Ethereum has rebounded above $4,100, with many whales re-establishing positions. BitMine reportedly bought 128,000 ETH after the market crash, valued at approximately $480 million. Additionally, on-chain analyst Eye revealed that a whale that previously sold over $4.23 billion in BTC to switch to ETH may be linked to former exchange executive Garrett Jin.

The vast majority of altcoins are not favored, with the altcoin season index dropping to 41. DeFiance Capital researcher Kyle warns that this round of declines may be a terminal event for the cycle, and many altcoin projects may never recover from failure. Crypto trader Eugene points out that the altcoin market has ended for the foreseeable future. The scale of wealth destruction this time, along with the manner of execution, will leave a long-lasting imprint on participants' minds. However, there are still structural trends in the crypto market; currently, based on on-chain data, the popularity of the BNB Chain has not faded, and the price of BNB has rebounded significantly to previous highs, potentially becoming a market focus and preferred destination for funds again.

It is worth mentioning that institutions are believed to be the buyers in this round of the largest liquidation in crypto history. Edward Chin, CEO of crypto hedge fund Parataxis, stated that he suspects we will hear news of some funds facing liquidation or market makers suffering heavy losses in the coming days or weeks, and the market may face a new wave of bankruptcies.

2. Key Data (as of October 10, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

- Bitcoin: $114,745 (YTD +22.90%), daily spot trading volume $91.7 billion

- Ethereum: $4,135 (YTD +23.63%), daily spot trading volume $55.8 billion

- Fear and Greed Index: 38 (Fear)

- Average GAS: BTC: 1 sat/vB, ETH: 0.131 Gwei

- Market share: BTC 58.8%, ETH 12.8%

- Upbit 24-hour trading volume ranking: XRP, ETH, BTC, SOL, ZKC

- 24-hour BTC long-short ratio: 48.62%/51.38%

- Sector performance: AI sector up 22.07%, Layer 2 sector up 14.56%

- 24-hour liquidation data: A total of 181,455 people were liquidated globally, with a total liquidation amount of $605 million, including $121 million in BTC, $218 million in ETH, and $43.54 million in SOL

- BTC medium to long-term trend channel: upper line ($118,440), lower line ($116,095)

- ETH medium to long-term trend channel: upper line ($4,281), lower line ($4,196)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of October 10)

- Bitcoin ETF: -$4.5 million

- Ethereum ETF: -$175 million

4. Today's Outlook

- Portal to Bitcoin goes live on the mainnet today

- CME plans to launch SOL and XRP futures options on October 13

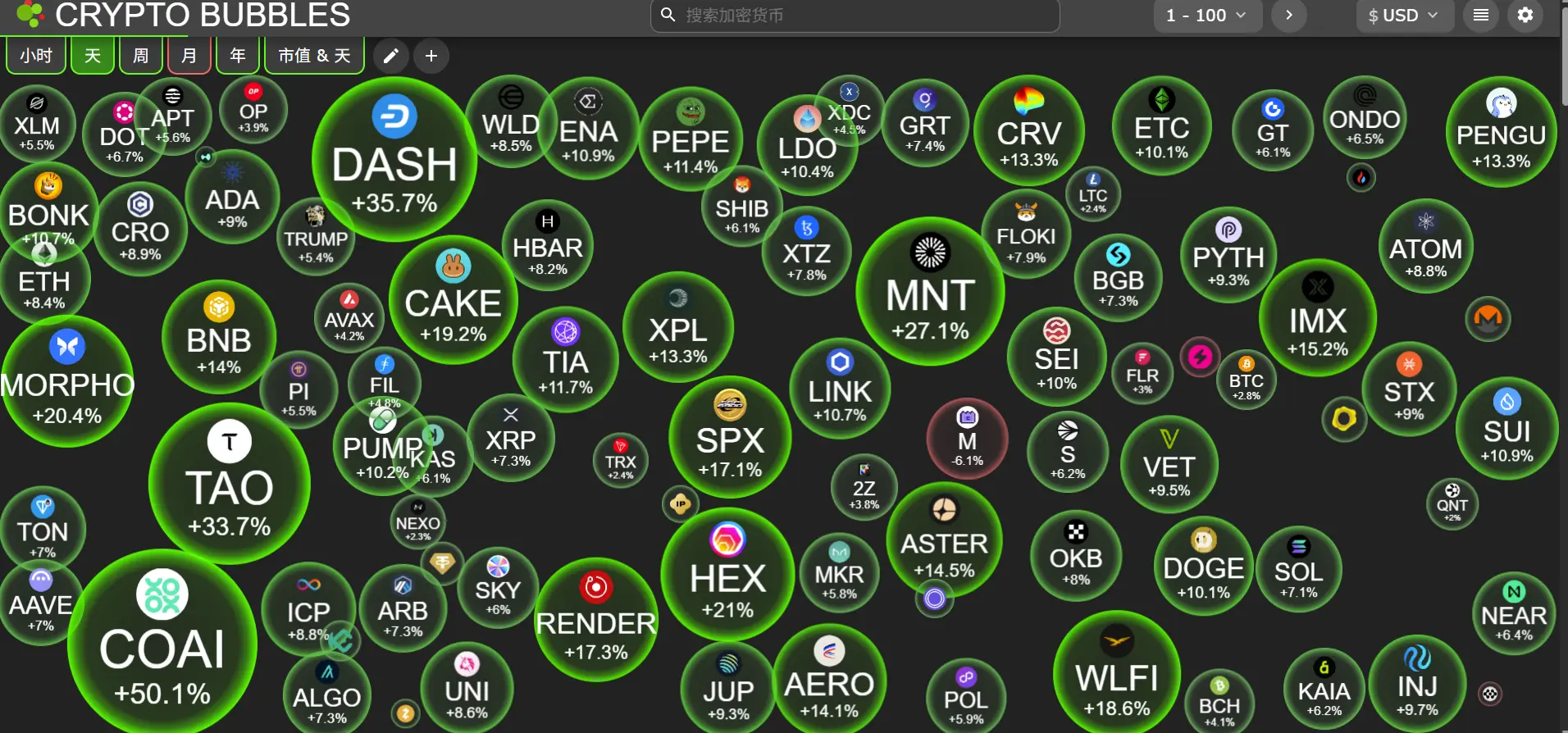

The largest gainers among the top 100 cryptocurrencies by market cap today: COAI up 53.8%, DASH up 35.7%, TAO up 33.7%, MNT up 27.1%, HEX up 21%.

5. Hot News

- Binance: Compensation related to the de-pegging of financial products has been paid out $283 million, and the total compensation amount is still being calculated and processed

- Forbes: Trump is one of the largest Bitcoin investors in the U.S., holding approximately $870 million in Bitcoin

- Microsoft Defender has a vulnerability that allows bypassing authentication and uploading malicious files

- The total supply of stablecoins has risen to a historical high of $301.5 billion

- Tether co-founder’s stablecoin project STBL has continued to de-peg after launching USST

- Circle: No plans to issue a Hong Kong local currency stablecoin, but open to cooperation on HKD stablecoins

- Whale Garrett Jin claims he is "not related to the Trump family," and the related transactions are "not insider"

- The funding rate for cryptocurrencies has dropped to its lowest point since the 2022 crash

- Base co-founder: The listing fee for some tokens on a CEX is as high as 9%, calling for permissionless on-chain listings

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。