Introduction

Author: @0xBenniee

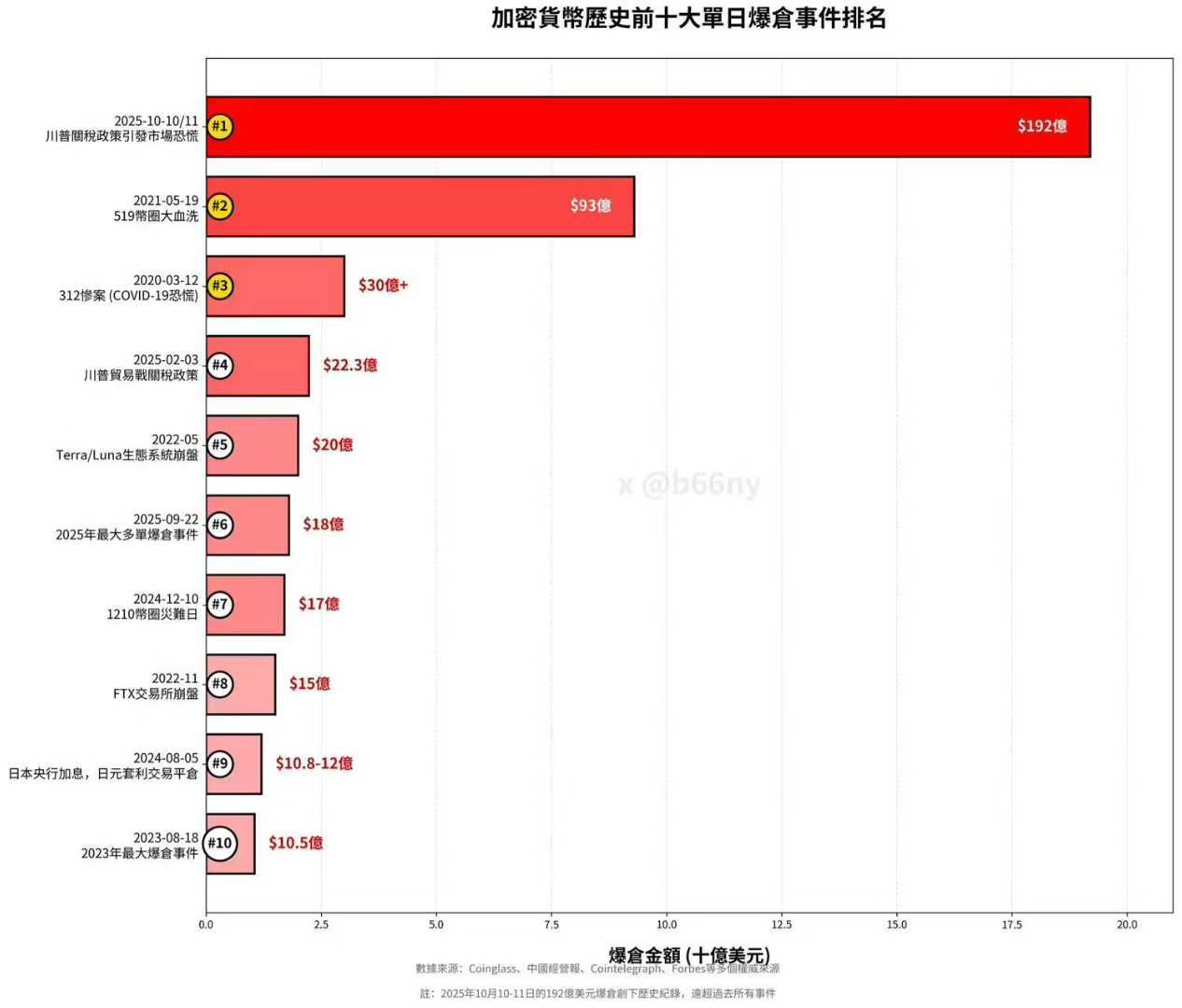

A tweet from Trump on the evening of October 11 sent both the crypto market and U.S. stocks into a panic. The contract market experienced an unprecedented chain liquidation within just a few hours, with a total scale reaching $19.2 billion, setting a historical record.

Why is Trump so eager at this moment? Why is he reigniting a new round of trade conflict?

To understand this, we must look back at the history of the United States over the past thirty years and see how it has repeatedly "rebooted the system" during crises.

This article will outline how the U.S. has relied on external wars, financial expansion, and industrial transfer to resolve internal crises through four economic and war cycles, and based on this, propose three possible future directions.

"Financial Assets and Crisis Indicators"

First, let's look at two sets of key asset comparisons with gold:

Copper/Gold (representing electricity and industrial activity) and Oil/Gold (representing energy and inflation expectations).

The shaded areas marked in the charts correspond to the four major economic crises the U.S. has experienced over the past thirty years.

(Data source: MacroMicro.me)

From the two charts, it is not difficult to see that both ratios have once again reached turning points within historical ranges. While it is still uncertain whether this indicates the arrival of a new round of systemic crisis, this signal is sufficient to indicate that the global financial cycle is entering a new critical point.

"Reviewing Four Major Historical Nodes: How the U.S. Responded"

- The Gulf War of 1990: At that time, the U.S. economy was facing severe recession and inflationary pressures. The U.S. government successfully shifted domestic economic contradictions through the Gulf War, stabilizing social confidence while seizing the opportunity to control Middle Eastern oil supplies, stabilizing energy prices, and further consolidating the petrodollar system and the dollar's hegemonic position globally.

- China's Accession to the World Trade Organization (WTO) in 2001: At that time, the U.S. lacked larger overseas markets and hoped to digest excess capacity through globalization by outsourcing manufacturing overseas. China's accession opened new export and investment channels for U.S. capital and provided a complete manufacturing system for the global supply chain. The U.S. transferred internal manufacturing pressures abroad through globalization, while China rapidly became the "world's factory," forming a deeply intertwined economic cycle between the U.S. and China.

- The 2008 Subprime Mortgage Crisis: Excessive leverage among residents triggered a financial system explosion, with the bankruptcy of Lehman Brothers serving as the catalyst. The U.S. restarted the economy through low interest rates and quantitative easing fiscal stimulus, but more liquidity was released into the global market. Meanwhile, China launched a "4 trillion" plan post-crisis, prioritizing fiscal expansion and investment, initiating a new growth cycle through large-scale infrastructure construction. China thus became a "infrastructure madman," gradually converting resident leverage into national and local fiscal leverage, taking on the responsibility for global growth.

- The COVID-19 Pandemic in 2020: The U.S. economy faced a complete shutdown, and the Federal Reserve initiated unprecedented quantitative easing, rapidly increasing national leverage and surpassing historical debt levels. The bankruptcy of Silicon Valley Bank exposed systemic risks, but Powell temporarily resolved the crisis through extreme easing and liquidity injection. The U.S. completed its economic restart at the cost of inflation and debt, once again transferring the crisis to the global stage through excessive money issuance.

"Learning from History: What Trump Wants to Achieve Now"

Now, what Trump seeks is not just an economic recovery, but a new industrial revolution centered on technology.

In the current context of high debt, high inflation, manufacturing relocation, and heavy fiscal pressure, the U.S. urgently needs a new narrative to reshape confidence and capital flows.

The "technological spiral to the sky" is precisely the answer he is trying to create and a card he must play to Make America Great Again.

"The U.S.-China Game Between War and Debt"

In the face of crisis, the traditional U.S. solution has always been the same—prioritize shifting contradictions externally; if that fails, then seek internal peace.

Historically, the U.S. is one of the few countries that has "enriched" itself through war. Whether in World War I or World War II, the U.S. achieved primitive accumulation of wealth amid the flames of war in other countries, completing economic rebalancing through production expansion and dollar output brought about by war.

This logic continues to this day—when internal divisions, high inflation, and overwhelming debt arise, the U.S. will look for an "external outlet," using war, trade wars, or technological revolutions to reshape the global order.

China's path, on the other hand, is quite the opposite. China's response resembles a structural adjustment that cuts off the root of the problem—when external pressures rise, China does not choose to shift the crisis but stabilizes the system through fiscal expansion, industrial upgrading, and internal deleveraging.

Behind the tariff war is essentially a game of income distribution and economic pressure. The leverage at the resident level is nearing its limit, but there is still room for leverage at the national level.

In contrast, the U.S. fiscal space is nearly exhausted, with federal debt already exceeding 100% of GDP. Frequent disputes between the two parties over increasing debt have led to government shutdowns, and any further borrowing will incur political costs for the next governing cycle.

Now, the U.S. urgently needs a new narrative to bring dollars back, rebuild trust. External wars and technological revolutions have become the most direct means.

The core of the technological revolution lies in energy and raw materials. The key materials supporting all of this—rare earths—are controlled by China.

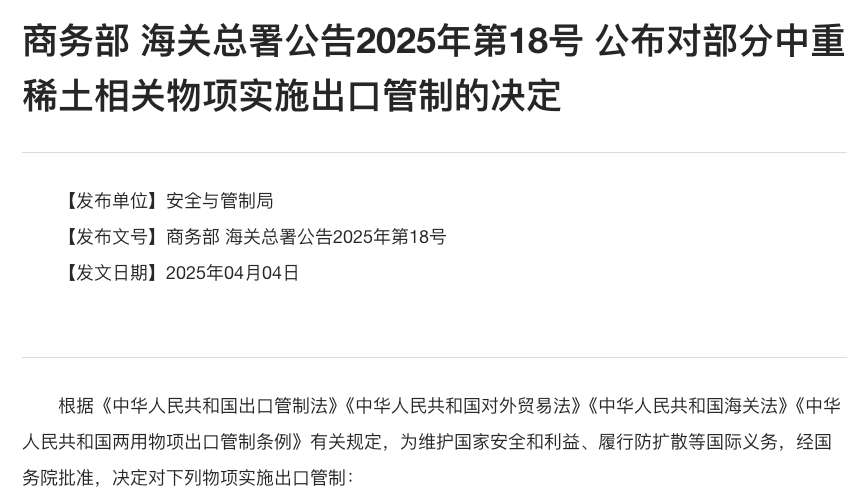

In October 2025, China will further expand restrictions on more rare earth elements and related processing equipment and technology, adding several rare earth elements (such as holmium, erbium, thulium, europium, and ytterbium) to the restricted list and setting more licensing requirements for the export of rare earth magnets, recycling, processing equipment, and technology. This means that almost all upstream high-performance magnetic materials and key components for military industry must be approved by China for export.

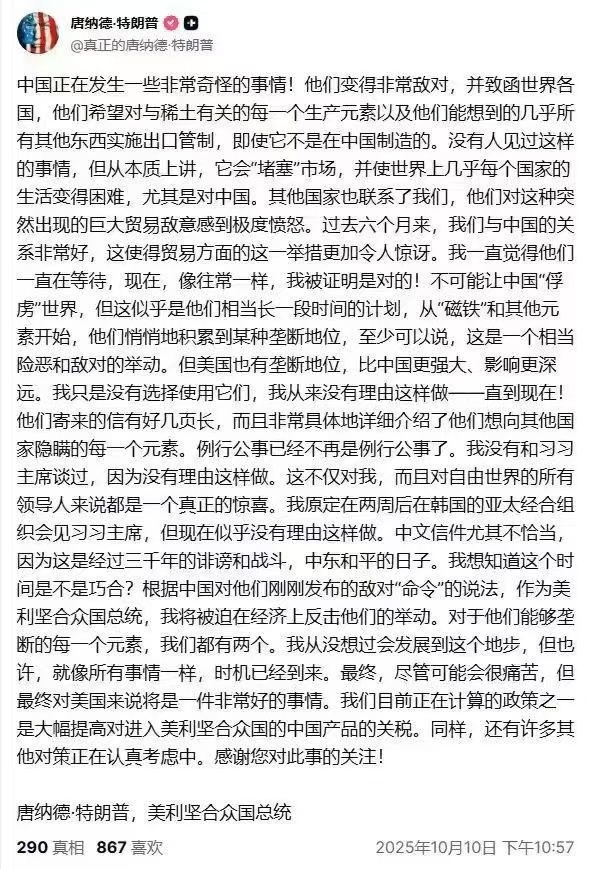

The issuance of this bill has enraged Trump. In a late-night tweet, he accused China of "weaponizing resources," calling it a "direct threat to the U.S. technology system."

China's control over the rare earth industry chain is equivalent to planting a "supply chain landmine" at the bottom of the U.S. technology and military industry system. This time, the U.S. wants to initiate a localized war, while China chooses to cut off the root of the problem.

China's national leverage still has room, while the ratio of U.S. federal debt to GDP has already exceeded or is close to 124%. Once China no longer rigidly defends the exchange rate, the borrowing limit of the renminbi has significant room for release.

In other words, the U.S. is borrowing against the future, while China is borrowing against structural time.

"Future Paths: Three Open-Ended Outcomes"

1. U.S. Victory, Technological Prosperity, Dollar Survival.

Trump is betting on technology. If the U.S. can completely reconstruct its industrial chain in AI, semiconductors, aerospace, and military industries, and complete the internal circulation of high-end manufacturing, then this technological revolution will not only be an economic recovery but also a "reconstruction of the dollar system."

Technological breakthroughs will attract global capital back to the U.S., driving a new round of asset inflation and industrial dividends. The dollar will once again become the anchor of global growth, and the technology sector of U.S. stocks will redefine valuation ceilings.

This will be a victory of innovation over war, and the last "peace card" that the U.S. can play to maintain its hegemony.

2. U.S. Failure, Dollar Credit Collapse, Gold Rebirth.

If the technological revolution fails, and U.S. debt continues to expand while fiscal revenue stagnates, then "dollar credit" will become the biggest bubble.

Once the debt crisis spreads, U.S. Treasuries will no longer be seen as risk-free assets, and international capital will quickly seek alternative value anchors.

Gold, silver, rare metals, and assets with intrinsic value will become the new core of safe havens.

The collapse of the dollar system will not cause the world to collapse, but will return "credit" to real metals and resources. At that time, whether Bitcoin can still hold its narrative as digital gold—only time will tell.

3. China's Rise, Revaluation of Global Financial Assets.

China has not chosen war, nor has it chosen inflation; it has chosen "time."

When national leverage replaces resident leverage, and fiscal tools and industrial policies gradually take over growth momentum, the borrowing space of the renminbi and structural adjustments will release new financial imagination.

If China can stabilize the exchange rate, relax capital flows, and promote capital market reforms and state-owned enterprise dividends, this will lead to a systematic revaluation of assets.

The core assets of the financial market—high dividends, resources, and technology manufacturing chains—will be re-priced globally.

This is another form of victory, not relying on war or money printing, but on structural resilience and the compounding of time.

At that time, it will be an era of mindlessly bullish views on the Chinese economy, an era that belongs to us.

Conclusion

The cycle of economic cycles never stops. The debts of the dollar, the rebirth of gold, and the game between major powers with the renminbi are all just the prologue to a new order. History does not simply repeat itself, but humanity will always awaken at the same edge.

This time, we all stand at the intersection of a new era.

References:

- https://www.reuters.com/world/china/china-tightens-rare-earth-export-controls-2025-10-09/?utm

- https://www.mofcom.gov.cn/zwgk/zcfb/art/2025/art_9c2108ccaf754f22a34abab2fedaa944.html?utm

- https://sc.macromicro.me/

- https://tradingeconomics.com/united-states/government-debt-to-gdp

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。