Once a niche experiment for crypto traders seeking refuge from volatility, stablecoins have evolved into one of digital finance’s most essential instruments. They now function as digital stand-ins for traditional currencies, typically pegged 1-to-1 to the U.S. dollar, allowing users to hold and transfer value without the price swings of bitcoin or ethereum.

Essentially, a stablecoin is a type of cryptocurrency designed to maintain a stable value relative to a fiat currency, most often the U.S. dollar. Instead of fluctuating wildly like most digital assets, it aims to stay fixed at $1. Issuers accomplish this stability by backing each token with assets such as cash, U.S. Treasury bills, or other reserves. In short, stablecoins can be the calm in crypto’s often stormy seas.

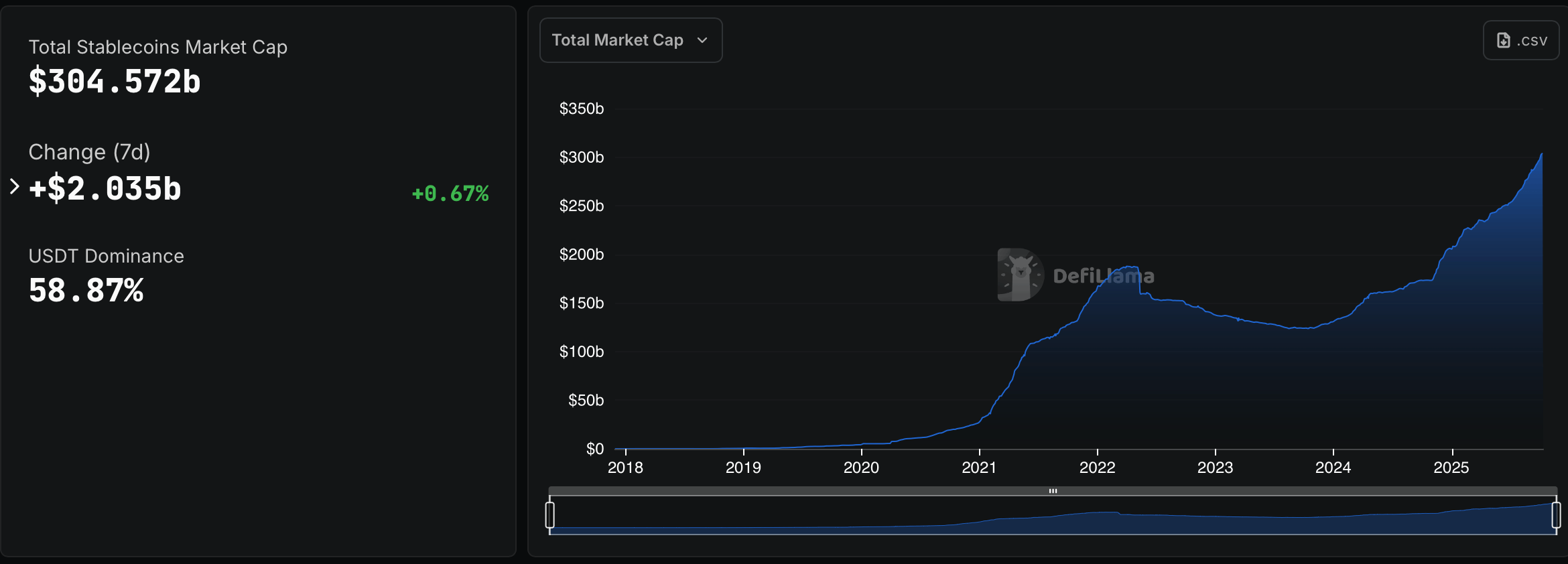

Source: Defillama.com

People gravitate toward stablecoins for a few simple reasons — speed, cost, and reliability. Transactions typically settle in seconds, fees are often fractions of a cent, and holders can escape the volatility that plagues most cryptocurrencies. For many users outside the United States, stablecoins also offer something their local currencies can’t always guarantee: stability and access to global markets.

Tether ( USDT) remains the industry’s heavyweight, as defillam.com stablecoin stats show it commands 58.87% of the total stablecoin market with a capitalization of about $179.3 billion. Circle‘s USDC follows at $74.77 billion, while Ethena’s USDe has climbed into the third spot with $14.29 billion. Together, those three stablecoins account for more than 85% of the sector’s total value.

Below the top trio, dai (DAI), sky dollar (USDS), and Blackrock‘s BUIDL round out the next tier, each hovering between $2.6 billion and $5 billion in market capitalization. Paypal’s PYUSD, introduced just last year, has quietly crossed $2.5 billion — a sign that corporate-issued stablecoins are gaining traction.

Meanwhile, fiat-pegged crypto token issuers like Falcon Finance’s USDf, First Digital’s FDUSD, and Ripple’s RLUSD are carving out niche roles, collectively contributing to a more diverse and competitive stablecoin ecosystem.

The stablecoin market’s rise from under $3 billion in 2018 to more than $300 billion in 2025 represents a staggering 100x expansion in just seven years. That growth has mirrored — and in many ways enabled — the broader development of decentralized finance (DeFi) and crypto-based payment systems.

As centralized exchanges, DeFi protocols, and fintech firms increasingly rely on stablecoins for liquidity and settlement, digital fiat tokens have become an indispensable layer of modern crypto infrastructure. This week’s $2 billion rise signals sustained trust in the sector alongside protection from this week’s crypto market fallout for many traders.

If current trends continue, the stablecoin market could soon rival the GDP of small nations. The question isn’t whether they’re here to stay — it’s how deeply they’ll integrate into everyday finance.

- What is the total stablecoin market cap right now?

As of the seven days ending Oct. 11, it stands at $304.57 billion. - How much has it grown recently?

The market added $2.035 billion in the past week, a 0.67% increase. - Which stablecoin is the largest?

Tether ( USDT) leads with 58.87% market dominance among the value of all stablecoins. - How long have stablecoins been around?

The first major stablecoins emerged around 2014, but explosive growth really began in 2020 with the rise of DeFi and other macroeconomic changes. - Why are stablecoins important?

They bridge traditional finance (TradFi) and blockchain systems, providing liquidity, speed, and reliability across borders. - Are all stablecoins backed by dollars?

Most are U.S. dollar-pegged, and some are backed by other assets, like U.S. Treasuries or algorithmic mechanisms. Others are based on alternative fiat currencies from different nation-states. - What’s next for the stablecoin market?

Expect greater integration into payment systems, continued institutional adoption, and ongoing regulatory shaping.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。