Author: David, Deep Tide TechFlow

What can 7 years change?

In the crypto world, 7 years can turn a young person who stood for a photo at the Binance Labs incubator into a competitor that Binance has to take seriously.

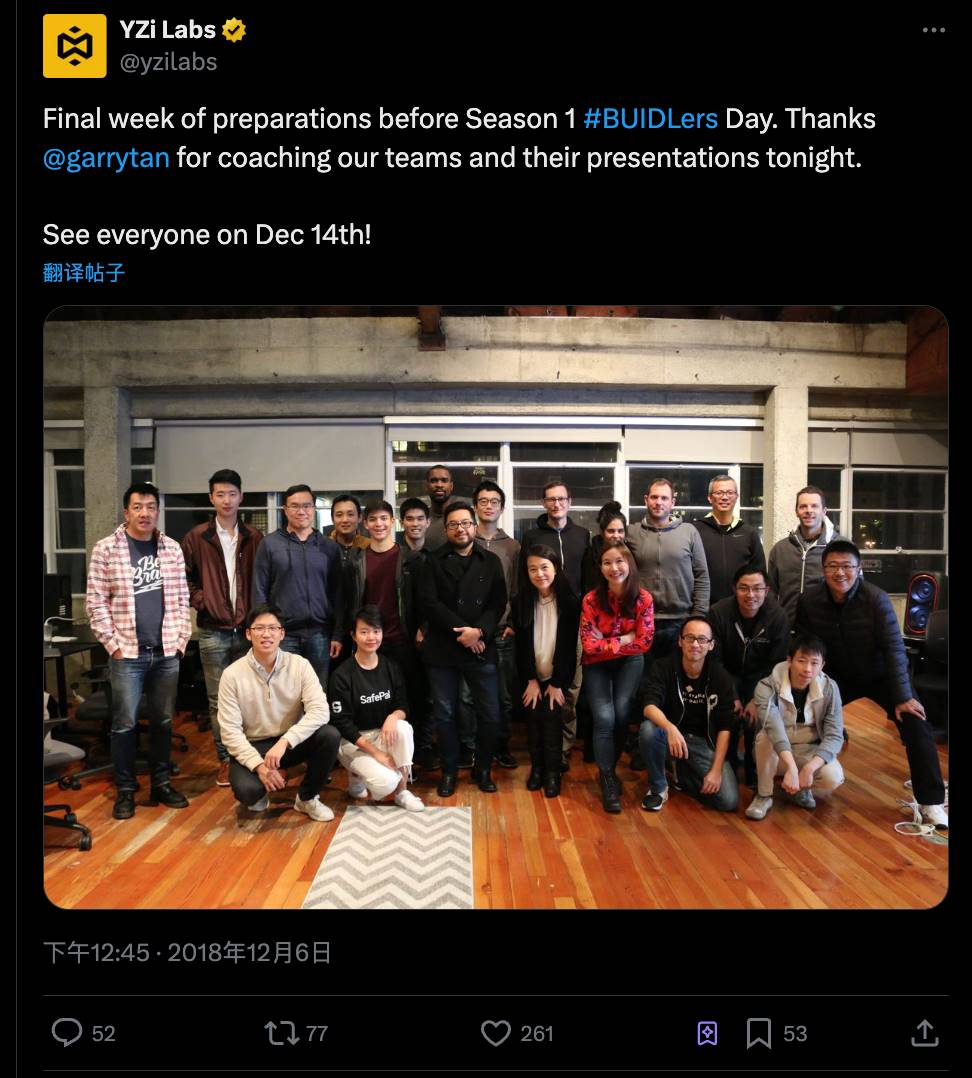

Recently, the following long-buried photo was suddenly unearthed, igniting a heated discussion on social media.

Just looking at the photo, you might think it’s just an ordinary group photo released by YZi Labs (formerly Binance Labs) in 2018, featuring Garry Tan, the head of the well-known venture incubator Y Combinator, giving guidance to the founders of new projects in the BUIDLers incubation program.

The person in the center wearing a black outfit is indeed Garry, but the focus is behind him:

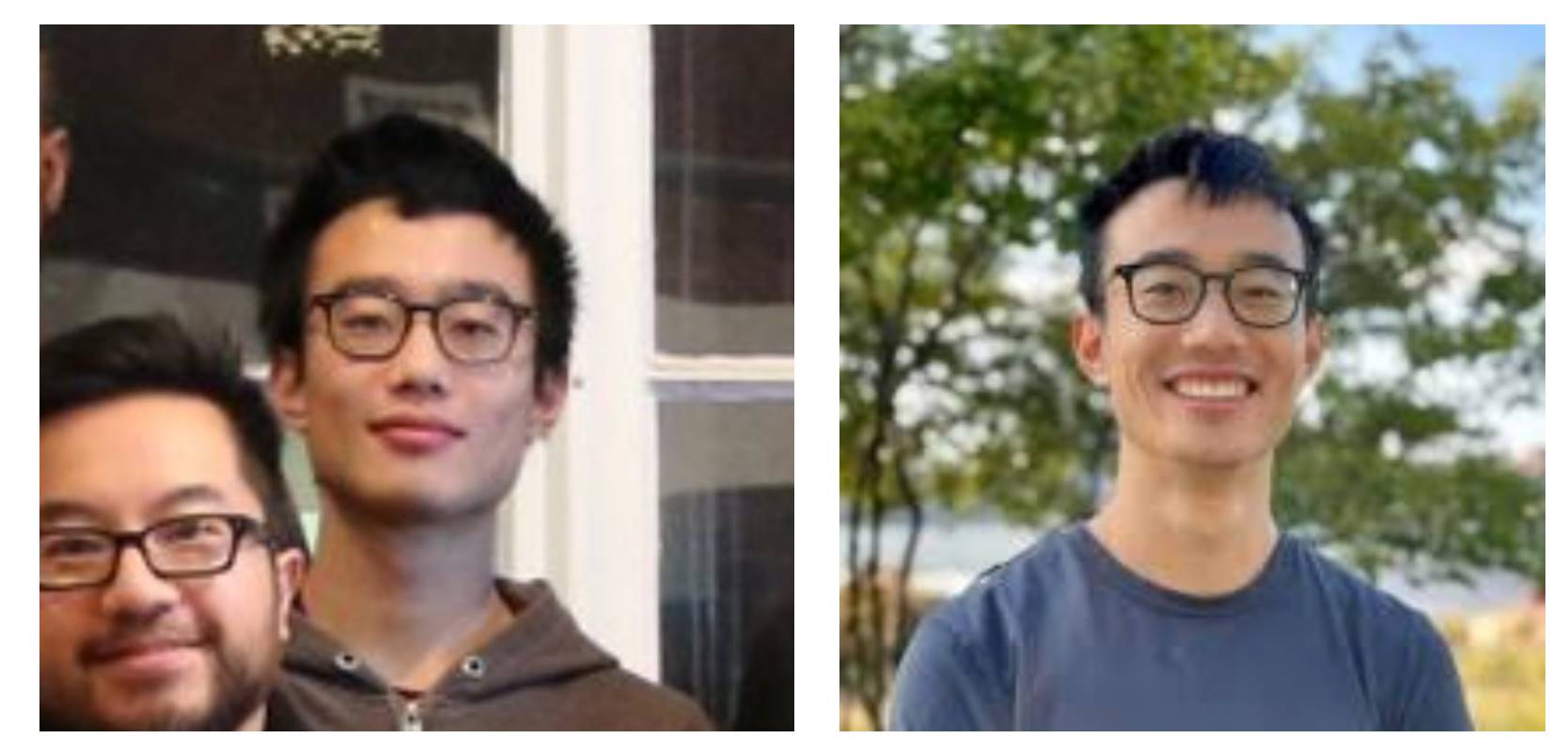

The bespectacled young man in a light sweater, looking somewhat inexperienced, bears a striking resemblance to Jeff Yan, the current founder of Hyperliquid. If you zoom in on this photo and compare it with Jeff's recent public photos, the similarities in features are indeed quite high.

Considering Hyperliquid's current position in the Perp DEX space, with daily trading volumes often reaching billions of dollars, it has, to some extent, become a direct competitor to Binance's contract business. Therefore, the significance of this photo goes beyond mere "archaeology."

The comments section quickly exploded.

Many people tagged Jeff's account chameleon_jeff to ask if he was indeed the same person, while some pointed out that Binance may have inadvertently nurtured a competitor.

Regardless, if the photo is authentic, then the transformation of a technical founder from an incubator learner to a giant challenger in 7 years is itself a case worth dissecting.

Early Years in Prediction Markets, Jeff Ahead by N Versions

The archaeological find regarding Jeff in the above photo is not without basis; stronger evidence comes from the official records of Binance Labs.

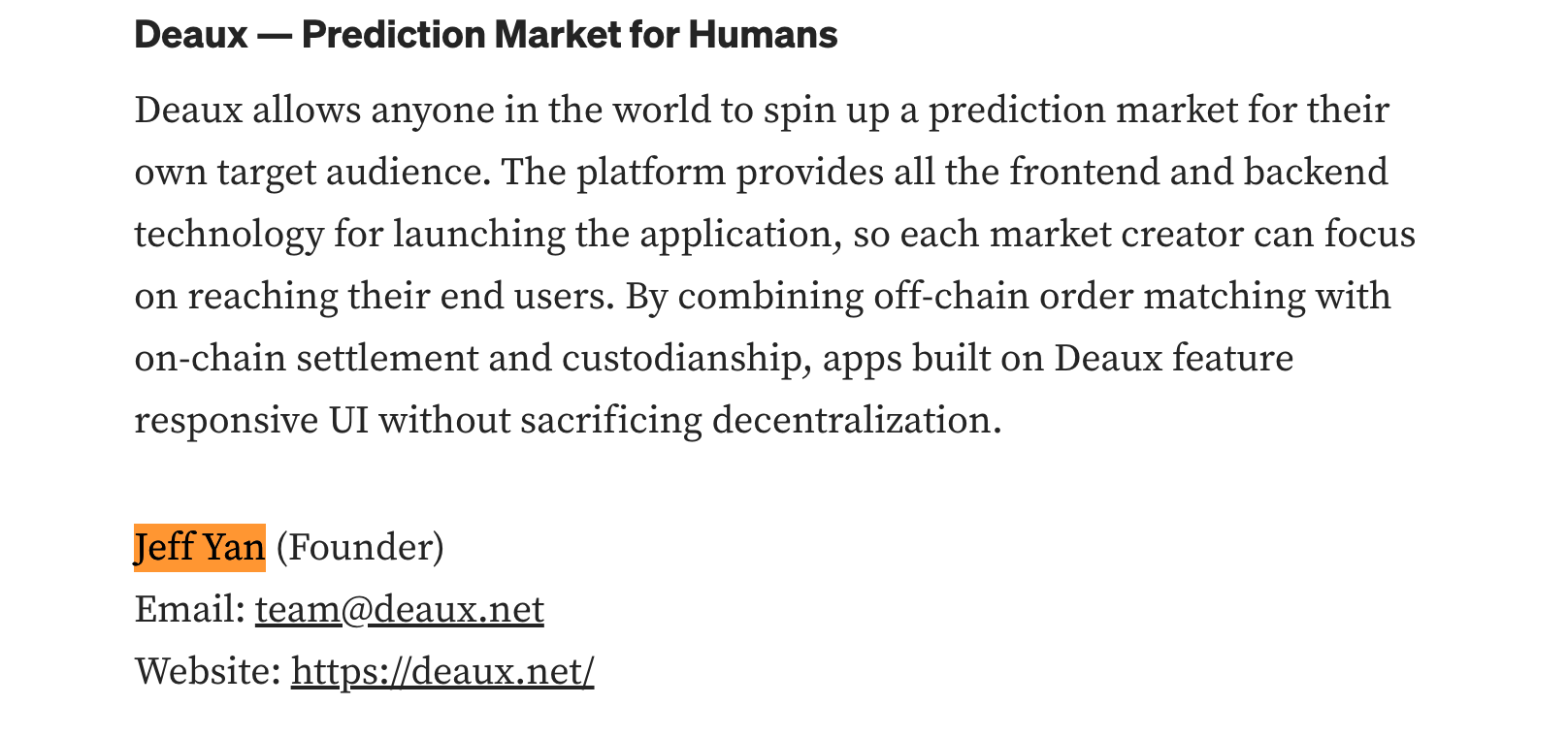

In a Medium article they published, a project named Deaux appeared in the list of Season 1 incubation projects in 2019, and the founder was none other than Jeff Yan.

What is Deaux? Simply put, it is a decentralized prediction market platform.

From the description at the time, Deaux aimed to:

Allow anyone to create prediction events on-chain, where users could bet on these events, with prices determined by market supply and demand. It employed a hybrid architecture, with order matching done off-chain and final settlement executed on-chain.

This design was quite advanced in 2018, requiring both performance and decentralization, providing a crypto infrastructure for prediction markets.

Indeed, this is also what platforms like Polymarket are doing today. From this perspective, Jeff was ahead by N versions.

This is not just hindsight praise. From the publicly available information that can still be found, Deaux's design philosophy emphasized on-chain/off-chain hybrid, high-performance order matching, and decentralized settlement, which also bears similarities to today's Hyperliquid.

Jeff saw the right direction and designed a reasonable plan, but Deaux failed to take off. Its website is now defunct, and its social media accounts have been stagnant since 2019.

The cost of being ten steps ahead may simply be a matter of timing.

The crypto market in 2018 had just fallen from the peak of a bull market into a winter, with users focused on when coin prices would rebound rather than how to make money with on-chain prediction markets. More importantly, the crypto infrastructure at the time, such as public chain performance, wallet experience, and user education, was not mature enough.

A product that requires frequent trading and is sensitive to delays would struggle to provide a smooth experience under the technological conditions of that time.

However, not succeeding in a project does not mean failure. Around 2020, Jeff founded Chameleon Trading, which is the predecessor of Hyperliquid. Whether in prediction markets or derivatives trading, it is essentially a game of "order matching + risk management."

This time, he set his sights on perpetual contract trading, a more mature market with more rigid demand and clearer users.

At the same time, the timing was just right. After FTX collapsed in 2022, trust in centralized exchanges plummeted, igniting a demand for decentralized trading.

But Jeff did not take the old route of replicating Uniswap or dYdX; instead, he chose a more challenging but thorough path by creating his own L1 chain.

Moreover, it does not rely on external liquidity providers but allows users to participate directly in market making through the HLP (Hyperliquid Liquidity Provider) mechanism. More aggressively, it adopted a zero-fee model, relying on token economics and ecological growth to support operations.

From Deaux to Hyperliquid, you can see the continuity in Jeff's projects: both are on-chain/off-chain hybrids, high-performance order books, and decentralized settlements.

Only this time, he chose the right track and hit the right timing.

The Invisible Founder

Interestingly, despite the growing discussion about that photo on X, Jeff himself has never commented on it.

Looking through Hyperliquid's Twitter account, you can hardly find personal photos or life shares from Jeff, only product updates, technical documents, and occasional memes;

And on Jeff's personal account, there is also little focus on building a personal brand, with more discussions on products and optimizations, as well as his views on the market. His last tweet was still from September 23.

This relatively low-key style seems to contradict the crypto industry's emphasis on strong marketing and attention-grabbing. Most founders are keen on AMAs, podcasts, and conference appearances, turning their personal brands into part of the project.

But Jeff appears to be on a different path, hiding behind the code and product, responding to doubts with trading volume and user growth. Perhaps this is one of the reasons he has made it from the Binance Labs incubator to where he is today, not overly concerned with external noise and focused on creating coherent products.

From Apprentice to Competitor

From an apprentice in the 2018 incubator to a leading player in perpetual contract DEX by 2025, the reason why old photos related to Jeff sparked discussion is simply that people are impressed by Jeff's persistence and that the projects incubated by Binance Labs back then may now have become competitors.

From the perspective of onlookers, do you think Binance is raising a tiger to trouble them?

The crypto industry has always advocated for disruptive innovation and open innovation. Previously, Binance Labs resembled a more inclusive incubator, choosing openness over control.

Comparing the incubator to a martial arts school might make this easier to understand:

The master teaches you martial arts, but cannot require you to follow him forever. You can go out and open your own school, even challenge the master. It’s hard to say this is "betrayal"; it feels more like a form of inheritance.

If Binance Labs only invested in "non-competitive" projects or worried that the founders of incubated projects would grow larger, could it still be called an incubator?

Therefore, an incubator cannot demand loyalty.

Conversely, Binance Labs may have invested in the right person, a potential founder, even if that founder later creates a product that competes with the parent company.

From a longer-term perspective, as an industry giant, Binance's value is not just how much money it makes, but also in promoting the prosperity of the entire crypto ecosystem. If Binance were to stop incubating because of the "potential to nurture competitors," that would be truly shortsighted.

More importantly, competition can be beneficial for the industry and its players.

The rise of Hyperliquid forces other exchanges to continuously improve in product experience, fee structures, transparency, and even wealth effects.

Users have more choices and can vote with their feet.

In a sense, what Jeff is doing is akin to what Binance did when it challenged traditional exchanges:

Using better products to redefine "what an exchange should look like." Only this time, the target of the challenge has shifted from Coinbase and Bitfinex to Binance itself.

So what can we learn from this spectacle?

Perhaps the true insight of this story is not the dramatic surface of "Binance nurtured a competitor," but something deeper:

Knowledge can spread, talent can flow, competition can occur, and ideally, everyone can benefit from the crypto ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。