I. Core Judgments and Market Expectation Anchoring

The core contradiction in the macro market recently focuses on the Federal Reserve's "policy split" and "information vacuum"—these two factors have caused short-term market volatility while laying the groundwork for structural benefits in the long term.

The macro foundation is clear: the market consensus believes that the Federal Reserve will cut interest rates by another 25 basis points at the October meeting. Powell's previous signals of "flexible dovishness" have effectively anchored short-term rate cut expectations, opening up space for subsequent easing policies.

Direct Impact on the Crypto Market:

- Liquidity-driven price increase: The expectation of rate cuts has strengthened the market's confidence in "liquidity easing," leading capital to flow into the crypto market in pursuit of high returns, pushing Bitcoin to a short-term high of $126,000, confirming positive market sentiment;

- Scarcity value further solidified: Continuous easing policies will dilute the purchasing power of fiat currencies, while Bitcoin, as an anti-inflation, non-sovereign store of value, has its long-term narrative reinforced—currently, the correlation between Bitcoin and gold is higher than that of U.S. stocks, directly reflecting this "hedging property."

II. Market Consolidation Under the "Information Fog" of Policy: Not a Logic Failure

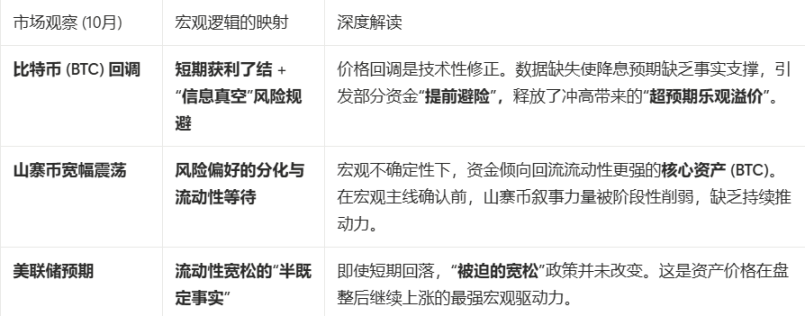

The current pullback of Bitcoin from $126,000 to $121,000, along with altcoins experiencing wide fluctuations, is essentially a normal reaction of the market digesting high-level risks and waiting for macro data confirmation, rather than a breakdown of previous macro logic.

III. The Practical Impact of Policy Game and Market Psychology

The current "policy split" and "information fog" of the Federal Reserve have directly led to intensified short-term market consolidation and increased volatility, which can be broken down into two aspects:

1. Dovish Consensus Provides "Emotional Support"

Powell's flexible stance, combined with the mainstream tendency within the Federal Reserve towards "preventive rate cuts," has formed a psychological expectation in the market for "long-term liquidity easing"—this is the core "emotional support" that allows the current crypto market to maintain a high range. As long as the Federal Reserve does not explicitly rule out the possibility of rate cuts, the market's fear of a "bear market" will not be fully triggered.

2. "Information Vacuum" Triggers Risk Premium Release

Due to the government shutdown, the delay in the release of key economic data has turned the October Federal Reserve meeting into a decision-making process "flying in the dark"—this uncertainty translates into "excessively optimistic premiums" when the market rises, and into "uncertainty risk premiums" when emotions cool down. The current market pullback is a phased release of this portion of risk premium.

IV. Transition of Market Psychology and Strategic Outlook: Consolidation is for the Next Round of Upward Momentum

The current market consolidation is essentially a natural transition of investor psychology from "mindless optimism" to "cautious observation," not a trend reversal, but more likely a buildup of momentum for the next round of upward movement.

Focus shift and trend confirmation are key: the market's core focus has shifted to "delayed release of key economic data"—if the data resumes release and indicators such as employment and inflation show economic weakness, it will provide "factual support" for the Federal Reserve to cut rates. At that time, the suppressed liquidity will be concentratedly released, and Bitcoin is likely to maintain strong momentum, once again challenging new highs.

In short, the ultimate formation of the crypto market trend relies on the combined verification of "macro data + Federal Reserve actions."

Macro Calendar

This Week

Next Week

Next Week

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。