The cryptocurrency market has experienced the largest liquidation event in history. On the morning of October 11, many crypto investors waking from their dreams thought they had misread the market.

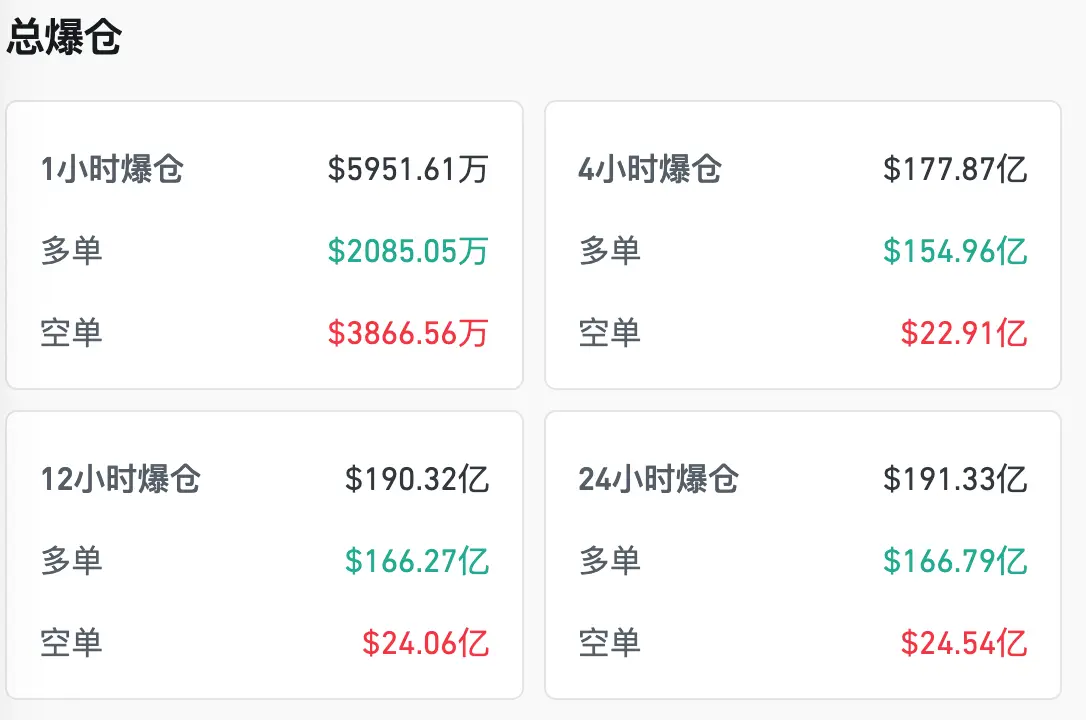

According to Coinglass data, as of 8 AM on the 11th, the liquidation amount in 24 hours reached $19.1 billion, with 1.62 million people liquidated globally. The largest single liquidation occurred on Hyperliquid - ETH-USDT, valued at $203 million.

In the crypto market, blood flows like a river.

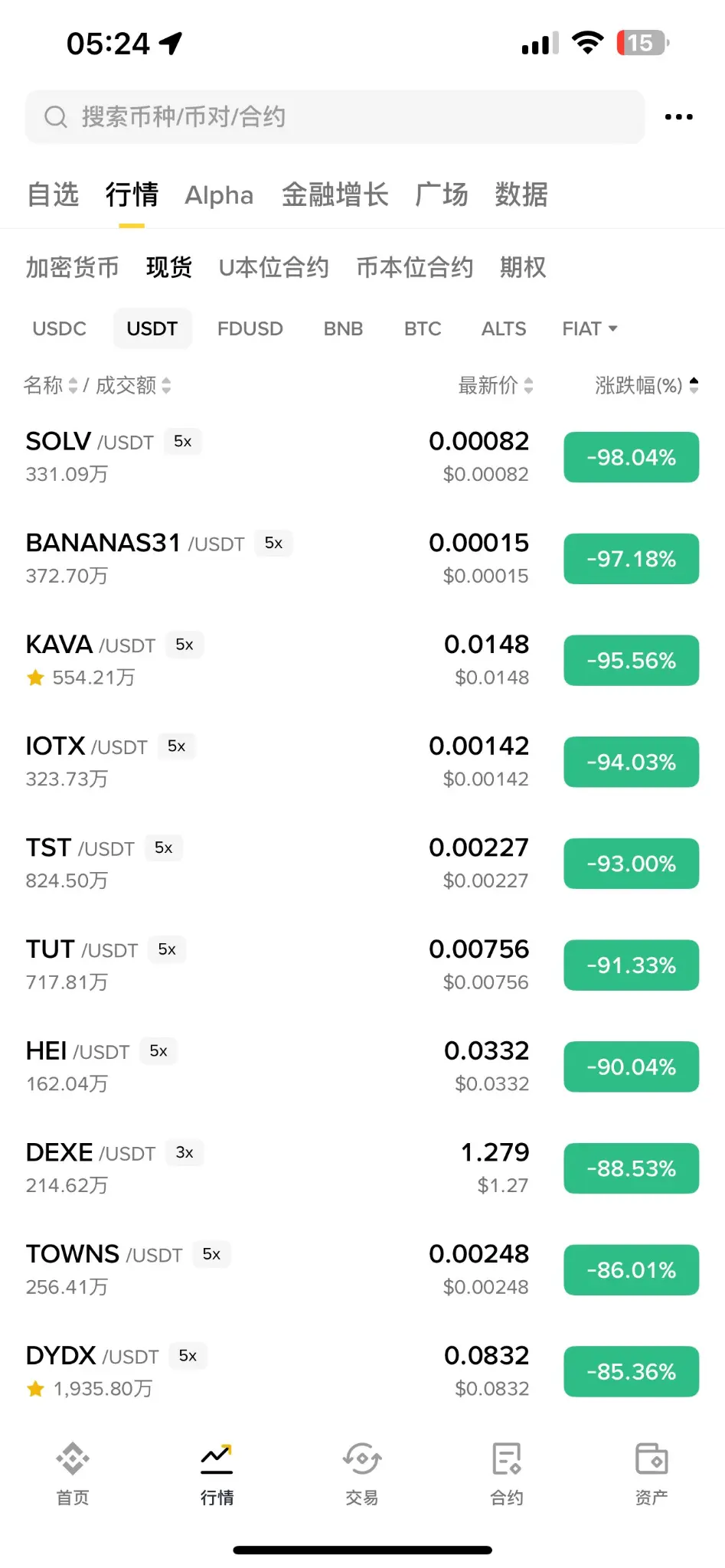

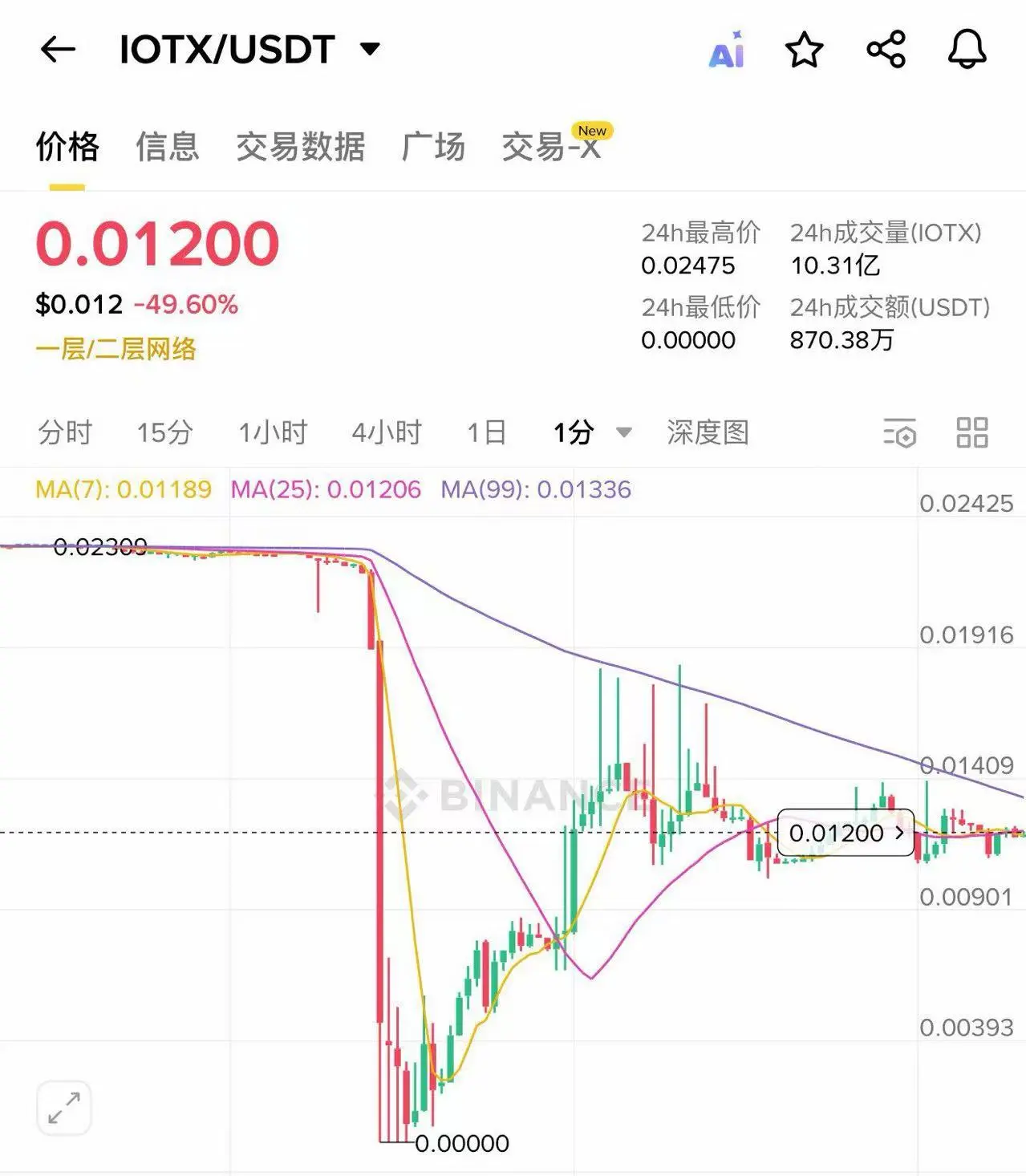

Behind the astonishing liquidation amount, although Bitcoin and Ethereum have rebounded slightly, with a 24-hour drop of 7% and 11% respectively, many altcoins have directly faced a total collapse. Numerous crypto projects saw declines of over 90%, and even mainstream wrapped tokens like WBETH and BETH experienced severe drops. The price of IOTX was even driven down to 0, and stablecoins also faced de-pegging, with USDE de-pegging to 0.62 before re-pegging. Binance also experienced downtime due to excessive load at one point.

Trump's Flip-Flop Ignites the Market

On the evening of October 10, Trump threatened to increase tariffs on China via his social media platform, and at 5 AM on the 11th, he declared a 100% tariff increase, which directly triggered a chain reaction of declines in the crypto market.

The sharp drop in altcoins may stem from issues with market makers. According to crypto KOL @octopusycc, the plummeting of altcoins is entirely due to the problems of proactive market makers, who are unable to adequately hedge.

According to his analysis, the funds in the hands of market makers are limited, and this limited capital leads to differentiated liquidity supply across various projects, categorized into Tier0, Tier1, Tier2, Tier3, and Tier4. The most funding is allocated to Tier0 and Tier1 projects, while Tier2 and Tier3 projects receive only incidental support. After Jump's collapse, many projects fell into the hands of proactive market makers. Therefore, at the moment Trump confirmed the reintroduction of tariffs, there wasn't enough capital to support all projects. This meant that only large projects could be guaranteed stability. The funds originally allocated to support smaller projects were even redirected to larger Tier0 and Tier1 projects. This resulted in a situation where, when the market faced massive sell-offs, market makers simply did not have sufficient funds to place orders, leading to a lack of counterparties and causing prices to plummet.

Currently, the portion of proactive market makers providing capital in the crypto market is nearing saturation, with a large amount of funds concentrated on major projects. The number of projects launched this year has been excessive, already overburdened and unable to adequately hedge, while the market also lacks sufficient derivatives to provide liquidity for hedging.

Of course, with danger comes opportunity; some have turned the downturn into a chance. For instance, users who opened short positions even took profits, and some users bottom-fished mainstream coins and wrapped tokens, seeking fortune in risk. A crypto KOL showcased their operations, earning $8 million in a short time by bottom-fishing USDE and BETH.

Some rejoice while others lament; more investors and the entire crypto market face the challenge of "post-disaster reconstruction."

The market teaches us two lessons: one is that investing is the art of risk management, and the second is that as long as you don't leave the table, there will always be opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。