Ethereum Accumulation Returns Amid Renewed Whale Activity

Ethereum accumulation is back in focus as the famous crypto whale group 7 Siblings starts buying again. The group has begun purchasing large amounts of ETH during the recent market dip. Their buying shows strong confidence in Ethereum’s future value.

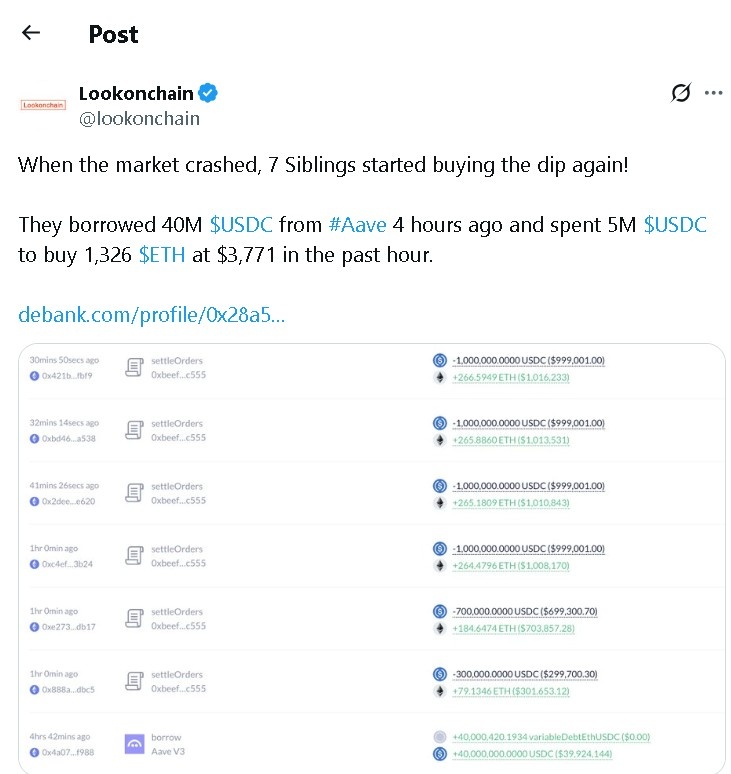

According to on-chain analyst Yu Jin from BlockBeats, the 7 Siblings borrowed $40 million USDC from the lending platform Aave. They used $5 million USDC from that amount to buy 1,326 ETH at an average price of $3,771.

This planned move shows their ongoing large-scale purchase during crypto dips, a strategy that has often brought them big profits in the past.

A Pattern of Profitable Timing

The 7 Siblings group is known for buying Ether when prices fall and holding it until strong recoveries happen. Their Ethereum accumulation strategy usually happens when prices are near the bottom, showing their good sense of crypto space timing.

In August 2024, they bought 100,000 ETH at about $2,270 each after a 15% drop. In April 2025, they bought 25,000 at around $1,700 after a 10% fall. These moves are much like now, showing the group thinks $3,700 is a good price to buy again.

Leverage and Confidence in Market Recovery

Borrowing 40 million USDC from Aave gives 7 Siblings significant leverage to increase returns if prices rise. This large Ethereum accumulation shows they believe the recent drop is short-term.

By buying a lot of coin now, they are likely aiming for a rise toward $4,000. Such leveraged buying usually indicates strong institutional confidence in Ether's medium-term outlook.

Traders often see these whale moves as on-chain indicators of possible crypto space recovery. In the past, similar actions by 7 Siblings have led to short-term rallies, showing their influence on ETH price dynamics.

Market Reaction and Technical Outlook

Observers are keeping a close eye on this large-scale purchase as ETH works to stay above $3,700.Analysts say that when whales keep buying, it often encourages more retail traders to enter the market.

If ETH holds above $3,700, it could move toward $4,000, a key resistance level from before. Trading data shows this accumulation is rising, and volumes stay steady despite recent price changes.

Many see this as a positive sign. The market correction may be ending. Even with economic uncertainty, large investors continue to back Ether. Their interest in the asset remains steady.

Strategic Accumulation in a Volatile C rypto Space

The repeated success of 7 Siblings shows that timing and access to funds are key in large-scale Ethereum acc umulation . Using stablecoin loans shows their confidence in this altcoin and in DeFi platforms like Aave.

By using borrowed funds, the group increases its market exposure without selling other assets. This approach is becoming popular among institutions looking for flexible ways to invest in crypto.

7 Siblings are buying more coins. This shows they believe in its long-term value. Prices are moving up and down, but big investors are still active. This may mean the market is close to a bottom.

If history is a guide, big purchases during dips often come before price gains. Investors watching these on-chain moves focus on Ether staying above $3,700 and possibly reaching $4,000 soon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。