Digital Assets Outlook: Tokenized Investment Reshape Portfolio by 2030

According to the recent report on the State Street 2025 Digital Assets Outlook, institutional investors are moving faster on the adoption of digital assets, and most of them believe that they will increase their exposure by two times in the coming three years.

Financial portfolios across the globe are becoming strategic growth, efficiency, and innovation centred on tokenization, blockchain, and emerging technologies.

Strategic Growth Drives Digital Asset Adoption

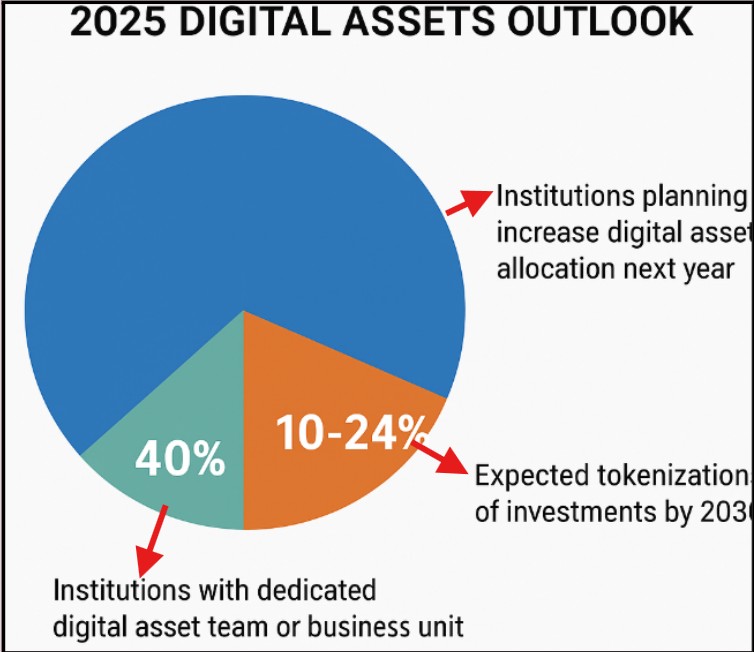

Nearly 60% of surveyed investors intend to increase their digital asset allocation in the coming year. Average exposure is expected to double by 2028, demonstrating growing confidence in tokenized investments as a long-term approach rather than a short-term experiment.

Joerg Ambrosius, President of Investment Services at State Street, stated:

"Institutional investors are no longer in the experimentation phase. Digital assets have become a strategic tool to grow, innovate, and increase efficiency."

Source: State Street Official

Private Markets Lead Tokenization Efforts

The report cites the first two asset classes that will be most likely to be tokenized as the private equity and the private fixed income. The process of tokenization is regarded as a way of opening liquidity and efficiency in traditionally illiquid markets.

More than 50% of the sampled institutions expect that 10-24% of their investments will be implemented in tokenized assets by 2030, indicating a major change in investment strategies.

Key Advantages Driving Adoption

Digital assets and tokenized investments offer several critical benefits:

-

Greater Transparency: 50% of investors cite improved transparency as a major advantage.

-

Faster Trading: 39% report shorter execution and settlement periods.

-

Reduced Compliance Costs: 32% anticipate significant cost savings, with nearly half projecting over 40% in operational efficiency gains.

These factors are transforming how institutions manage portfolios, making digitally built assets an integral part of long-term strategy.

Source: Official Website

Dedicated Teams and Emerging Technologies

The survey reveals that 40% of institutions have already formed dedicated digital asset teams, with another 20% planning to do so. Blockchain and digital transformation initiatives are increasingly embedded into institutional strategy.

Donna Milrod, Chief Product Officer at State Street, notes:

"The change is not only technical but strategic. Many clients are creating in-house teams to lead digital asset initiatives."

Emerging technologies like Generative AI (GenAI) and quantum computing are seen as accelerators. Over half of respondents believe these technologies will enhance investment processes, complementing digitally built asset programs rather than replacing them.

New Technology as Accelerators.

Generative AI (GenAI) and quantum computing are regarded as major catalysts of investment processes. More than half of the respondents think that these technologies will be more influential than tokenization or blockchain. However, the majority see them as an addition, which will improve programs but not displace them.

Crypto Adoption 2025

According to the Global Crypto Adoption Index 2025, there is a gradual global increase. Global ownership is at 12.4% with India and the U.S. leading the adoption. The average crypto adoption rate is 14.3% in countries with internet penetration of more than 85% as opposed to 6.7% in less-connected countries.

Patterns of regional growth also demonstrate this change:

-

India, Pakistan, and Vietnam, in APAC, have a year-on-year crypto activity growth of 69%.

-

Growing by 63% is Latin America, where retail and institutional adoption are.

-

North America experienced growth of 49% with the approval of spot Bitcoin ETFs.

-

Europe achieved a 42% increase, which was supported by a robust institutional participation.

The emergence of Eastern Europe, especially Ukraine, Moldova, and Georgia, is also an indication of grassroots activity due to economic uncertainty and mistrust in conventional finance.

The Road Ahead

State Street’s 2025 outlook confirms that virtual assets and tokenization are reshaping institutional investment strategies. With dedicated teams, blockchain integration, and support from AI and quantum computing, tokenized investments are poised to become a core pillar of portfolio management, driving growth, efficiency, and innovation across global financial markets. What do you think can digital assets ever replace Reserve Gold

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。