Despite the fact that most meme coin traders are losing money, the infrastructure providers building the trading ecosystem are capturing a significant portion of the market's value.

Written by: Will Owens

Compiled by: Saoirse, Foresight News

Key Points

Currently, meme coins account for about 30% of the trading volume on Solana decentralized exchanges (DEX), down from 60% in January.

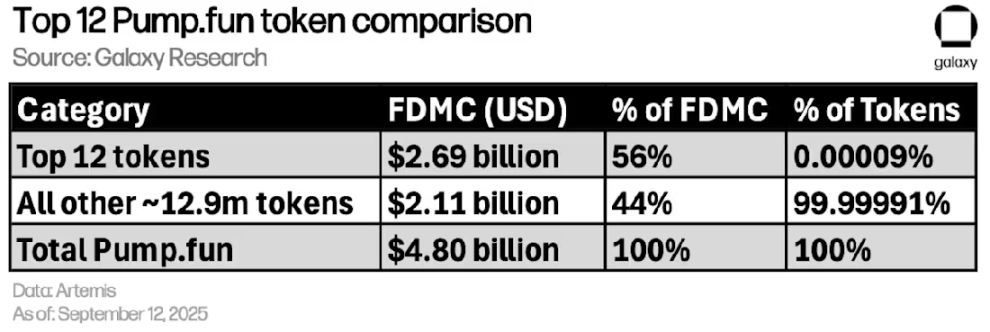

Of the approximately 12.8 million tokens issued on the Pump.fun platform, only 12 tokens (0.00009%) account for over 55% of the platform's total fully diluted market cap (FDMC).

The total fully diluted market cap (FDMC) of tokens on the Pump.fun platform exceeds $4.8 billion.

This figure accounts for over 85% of the total fully diluted market cap of all tokens issued on Solana, with no other platform coming close.

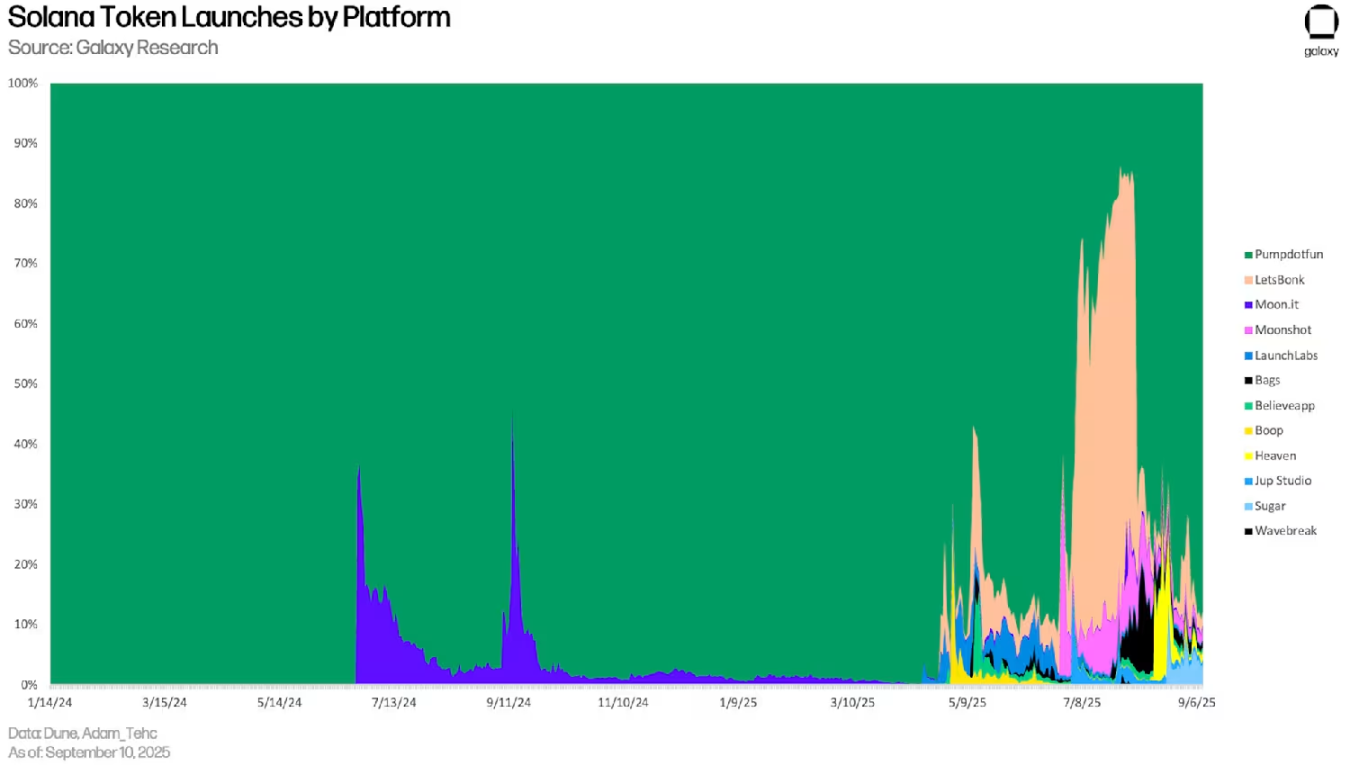

Since its launch, Pump.fun has maintained an absolute dominance in the market share of Solana issuance platforms, only briefly surpassed by other platforms twice.

This summer, the only recent competitor to briefly surpass Pump.fun was the Bonk.fun platform.

The median holding time for Solana meme coins is about 100 seconds, down from the previous 300 seconds.

This short-term speculative behavior highlights the increasingly "high-frequency trading" and "player versus player (PvP)" competitive nature of the trading market.

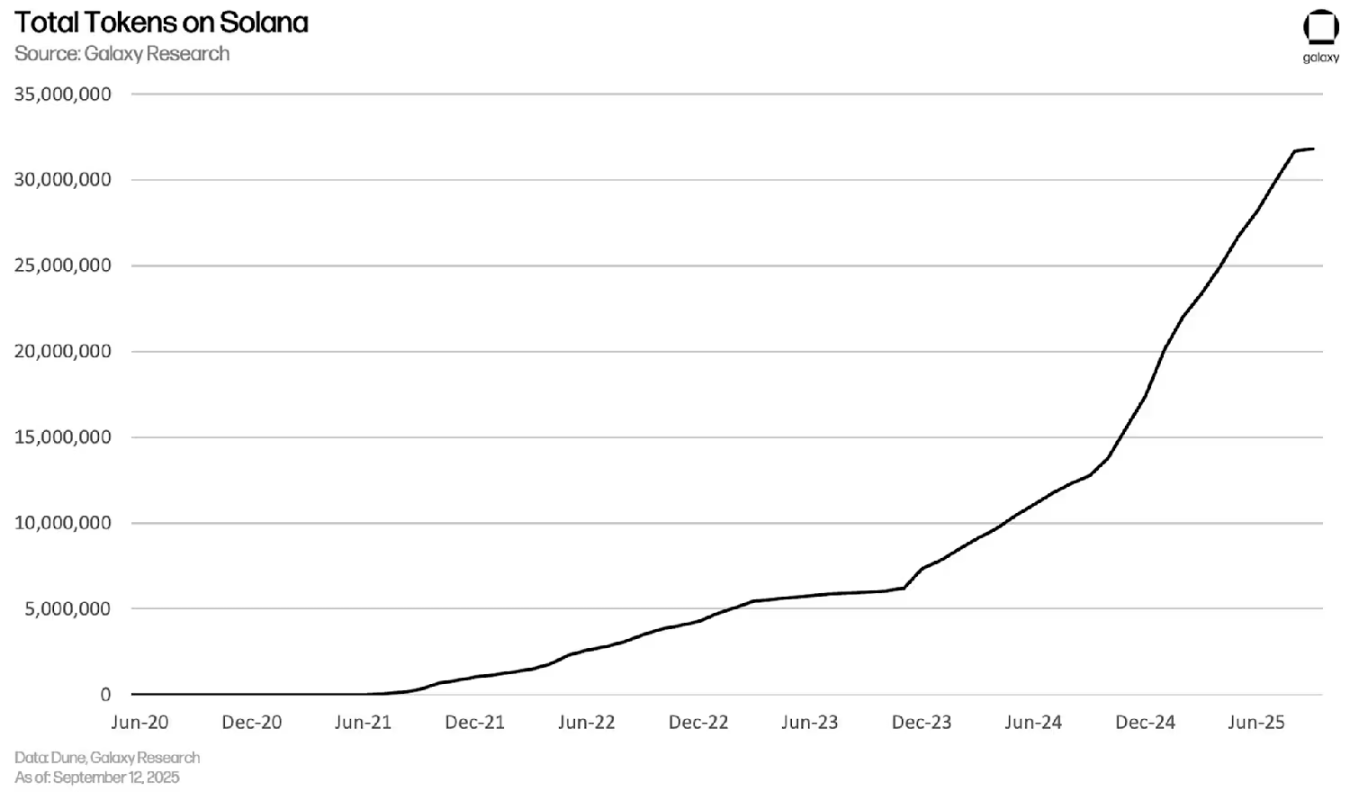

The number of tokens on the Solana blockchain has now exceeded 32 million, while this number was less than 8 million before the launch of Pump.fun in January 2024.

This means that the number of tokens has grown by over 300% in less than two years.

Meme coins serve as an attractive "gateway" in the cryptocurrency space, drawing new users to wallets and decentralized exchanges (DEXs).

The meme coin ecosystem exhibits a "power law distribution" characteristic, where a few tokens account for the vast majority of market value.

Meme coins are an important pillar of the cryptocurrency market, yet they often carry a stigma and are surrounded by controversy. Most meme coins either trend towards zero over the long term or are outright scams, leading skeptics to dismiss them as worthless assets — and fairly so, as the vast majority of meme coins indeed fit this description. Like all trading, the meme coin market is essentially a zero-sum game: one trader's gain must come from another trader's loss. However, unlike assets with potential cash flow or actual utility, meme coins have little value beyond their cultural significance, making losses not only more common but often more severe. In the 2024 Galaxy Research Report, we discussed these market dynamics and noted that the existence of meme coins should not be completely ignored. A year later, this field has become more complex and more significant.

Although joke tokens have existed since the early days of cryptocurrency (such as Dogecoin launched in 2013 and the now-forgotten Coinye West the following year), the modern era of meme coins began with the price surge of Dogecoin in 2017. This was followed by the emergence of Shiba Inu, then BONK and Dogwifhat on the Solana blockchain, culminating in the launch of the Pump.fun platform in early 2024. This issuance platform has spawned millions of meme coins such as MOODENG, Pnut, and TROLL.

Pump.fun has fundamentally changed the industry landscape. It has lowered the barrier to issuing meme coins to nearly zero: for just a few dollars and without any programming skills, anyone can create a token that is instantly tradable, liquid, and issued based on a "bonding curve." This marks a structural shift in the meme coin space — a surge in token issuance, with issuance platforms becoming the "new mainstream model."

Pump.fun homepage, a typical representation of "radical speculator" culture

Altcoins often claim to have some form of "utility" (such as governance rights, fee sharing, access to services, etc.), while meme coins, by definition, lack any utility. Their core function is to serve as "cultural tokens" that embody ideas, unite communities, and shape collective identity, with no other use.

The core logic of trading meme coins is not based on asset fundamentals but rather on a behavior that can be termed "cultural arbitrage": predicting or seizing the opportunity of attention cycles. For example, buying into a meme coin before it gains popularity due to a trending TikTok, but before the market realizes its hype.

In the long run, the vast majority of participants in meme coin trading will ultimately lose money, and in many ways, this trading is indistinguishable from pure gambling. However, to completely disregard this field would be overly hasty and overlook its significant implications.

The meme coin ecosystem faces numerous challenges, especially on the Solana blockchain — which dominates the total trading volume of meme coins. In the initial minutes after token issuance, "snipers" and "packers" seize a large supply of tokens, laying the groundwork for subsequent market sell pressure. The median holding time for meme coins is measured in seconds, as traders quickly buy and sell new trading pairs to earn short-term profits.

However, meme coins have become a permanent fixture in the crypto market. In an increasingly digital world, the existence of purely cultural assets is inherently reasonable. More importantly, meme coins play the role of a "gateway" to cryptocurrency: they attract new retail users to use wallets and decentralized exchanges (DEXs), who might otherwise never engage with such products. For many, meme coins are the first step into the crypto-native infrastructure, opening the door for deeper participation in DeFi.

Market Size and Trading Activity

Since the beginning of 2024, the meme coin market has expanded at an astonishing rate. On the Solana blockchain alone, over 32 million different tokens have been created — a scale that was unimaginable before the launch of Pump.fun. By optimizing user experience and removing the technical barriers to issuing tokens, the entire ecosystem has undergone a fundamental transformation. Previously, issuing tokens required manual management of liquidity pools and significant capital investment; now, anyone with internet access can issue tradable tokens at a very low cost.

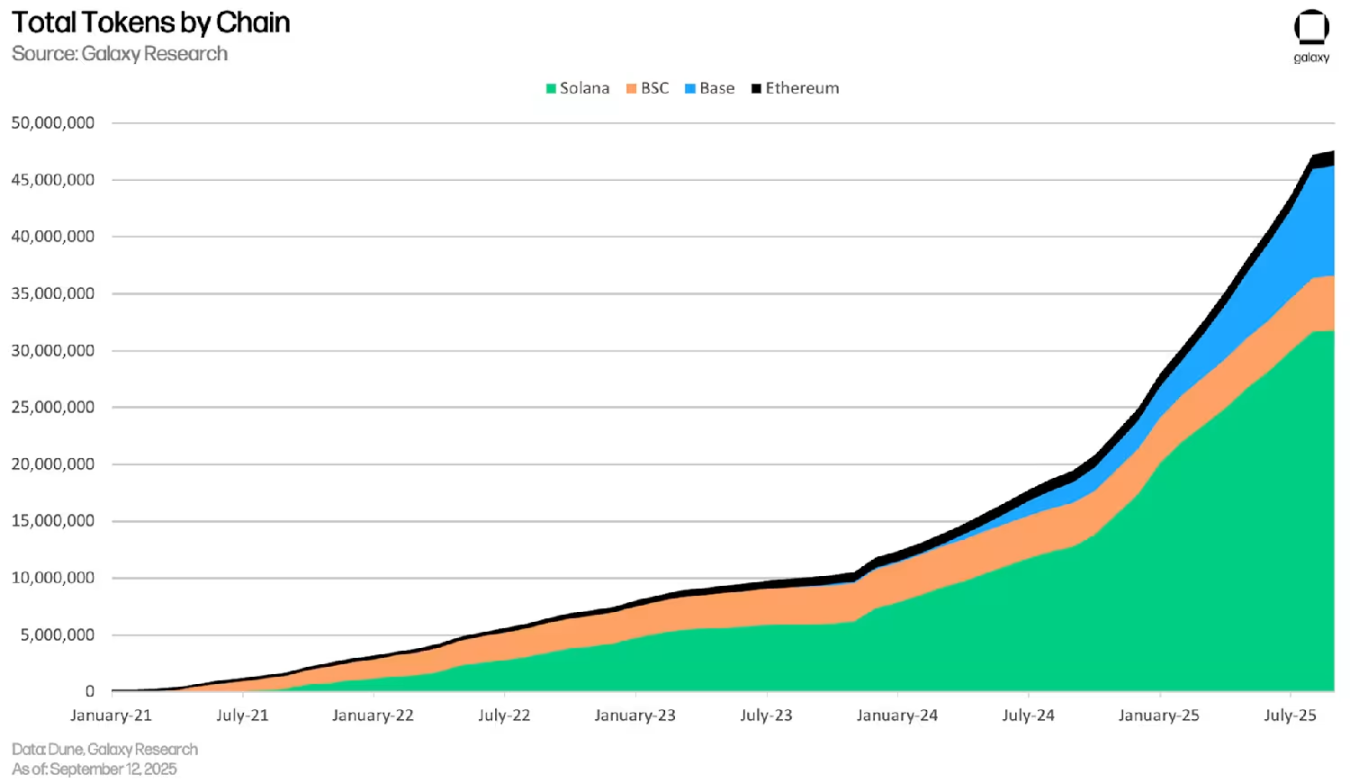

The high throughput and low fees of the Solana blockchain make it a natural breeding ground for token issuance, with the number of tokens far exceeding that of other blockchains. However, in terms of meme coin spot trading volume, the Binance Smart Chain (BSC) dominates — thanks to platforms like four.meme. Recently, the TGE of AsterDEX has further boosted the overall attention on the BSC ecosystem.

Total number of Solana tokens

When expanding the view to Ethereum, Base chain under Coinbase, and BSC, this trend still holds. The total number of tokens created on these blockchains exceeds 57 million, with Solana accounting for 56%, leading the pack. The Ethereum blockchain has gathered more "traditional/community" meme coins, such as PEPE, MOG, SPX6900, etc.; the meme coin market on the Base chain continues to grow, particularly excelling in the SocialFi meme coin sector like Zora. In short: Solana is the core battleground for popular meme coins and cultural trends, Ethereum is the gathering place for mature meme coins, while the Base chain holds an advantage in the segmented issuance platform market (especially in artificial intelligence (virtual assets) and social (Zora) fields).

Notably, the Base team recently announced plans to build a cross-chain bridge from its Ethereum L2 to Solana, which will enable liquidity interoperability between the two chains.

Number of tokens across different blockchains

Next, we analyze the competitive landscape of different meme coin issuance platforms. This summer, Pump.fun briefly lost some market share to Bonk.fun, but has since regained its absolute dominance in the Solana token issuance market. The competition in the issuance platform space is exceptionally fierce: new platforms continuously emerge, attempting to achieve differentiated competition through adjustments in incentive mechanisms or brand positioning, but these competitive advantages often vanish quickly.

Sometimes, new platforms attract market attention briefly by introducing niche innovations. For example, HeavenDEX attempted to innovate its token economic model, quickly attracting liquidity and users, but soon after, its market share rapidly declined. This is a common trend in the cryptocurrency market: traders quickly shift to the next "potential token," all competing to see who can seize the opportunity the fastest.

Although the attention span of Solana traders is comparable to TikTok short videos, Pump.fun's market position remains solid. Currently, the token issuance platform market exhibits a "winner-takes-all" pattern.

Token issuance volume across platforms

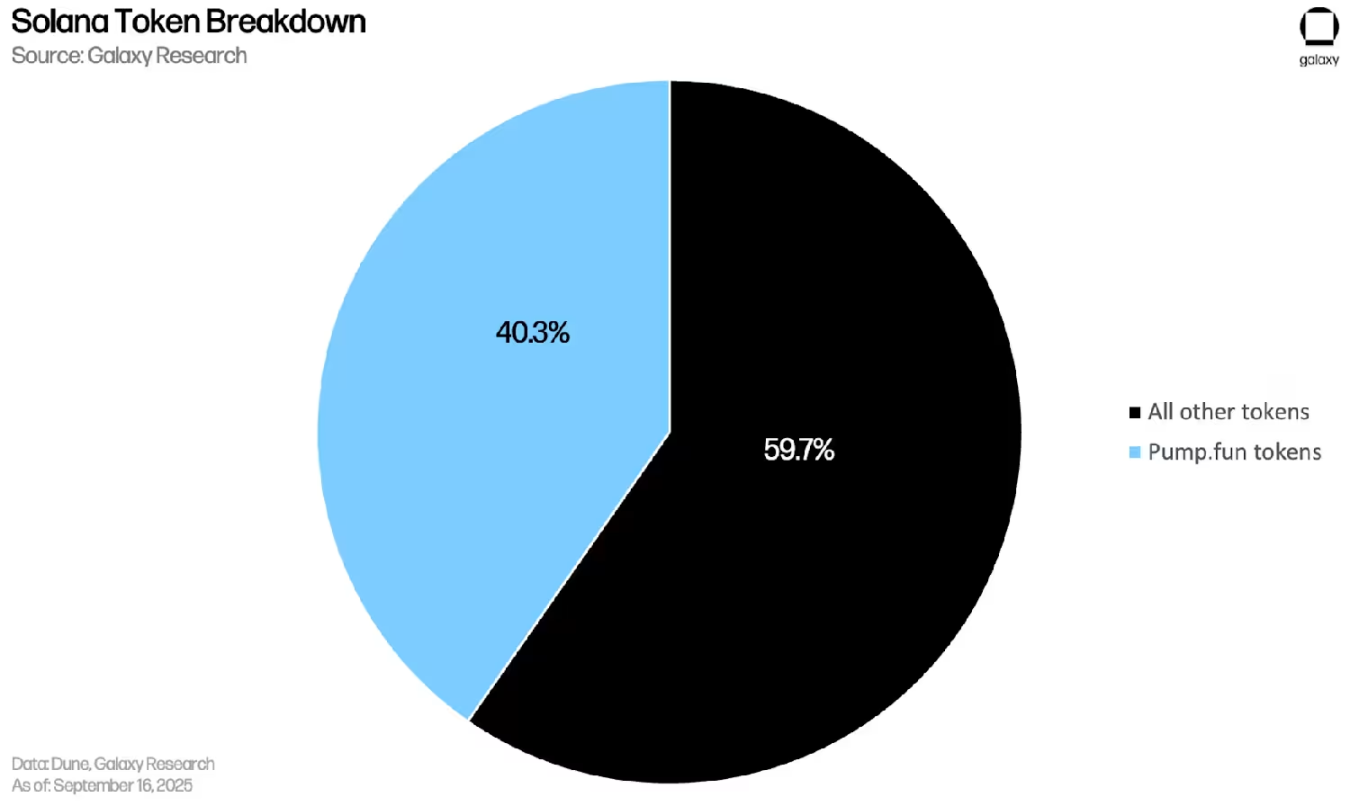

Of the approximately 32 million tokens on the Solana blockchain, Pump.fun alone has contributed about 12.9 million. It can be said that this platform has achieved the "industrialization" of Solana token issuance. No other platform can compete with it, as its issuance volume even exceeds the total issuance volume of all its competitors combined.

Readers may recall some celebrity-issued tokens, such as Kanye West's TRUMP coin. The teams behind these popular tokens did not use conventional issuance platforms but instead collaborated directly with the decentralized finance protocol Meteora within the Solana ecosystem — this protocol provides dynamic liquidity infrastructure, allowing issuance teams to manually configure liquidity pools and manage token distribution. This approach gives the issuance teams more control while reducing the risk of "bots" or "snipers" accumulating large amounts of tokens at low prices in the early stages.

Composition of Solana Tokens

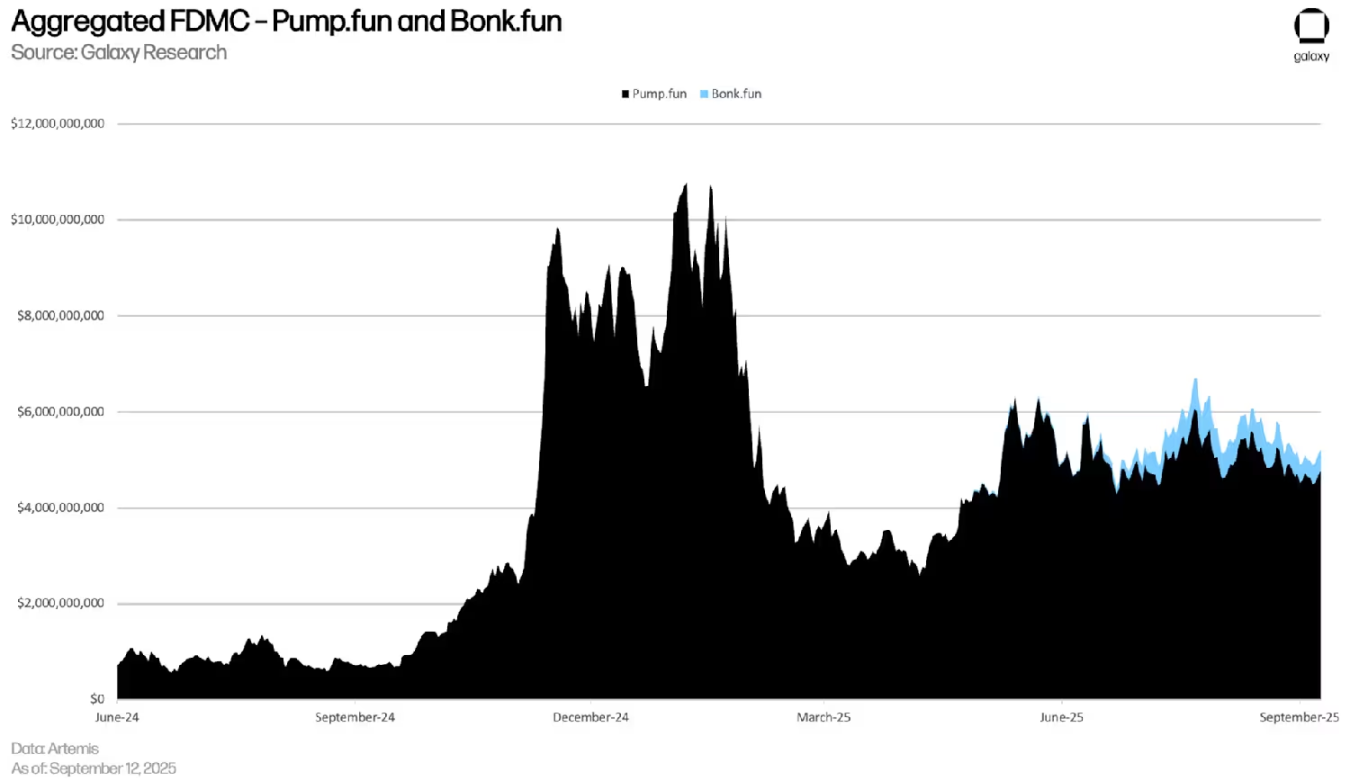

The distribution of market value also exhibits similar characteristics. Currently, the total fully diluted market cap (FDMC) of tokens on the Pump.fun platform has exceeded $4.8 billion, far surpassing its closest competitor. In the chart below, black represents the total fully diluted market cap of Pump.fun, while blue represents that of Bonk.fun; Pump.fun's market cap peaked above $10 billion in January.

Total Fully Diluted Market Cap of Pump.fun vs. Bonk.fun

This market scale reveals two key pieces of information: first, meme coins have reached a scale that cannot be ignored — tens of millions of tokens with market caps in the billions; second, the field exhibits a high degree of centralization: Solana dominates other blockchains, Pump.fun dominates Solana, and within Pump.fun's tokens, a very small number of tokens account for the vast majority of the market value.

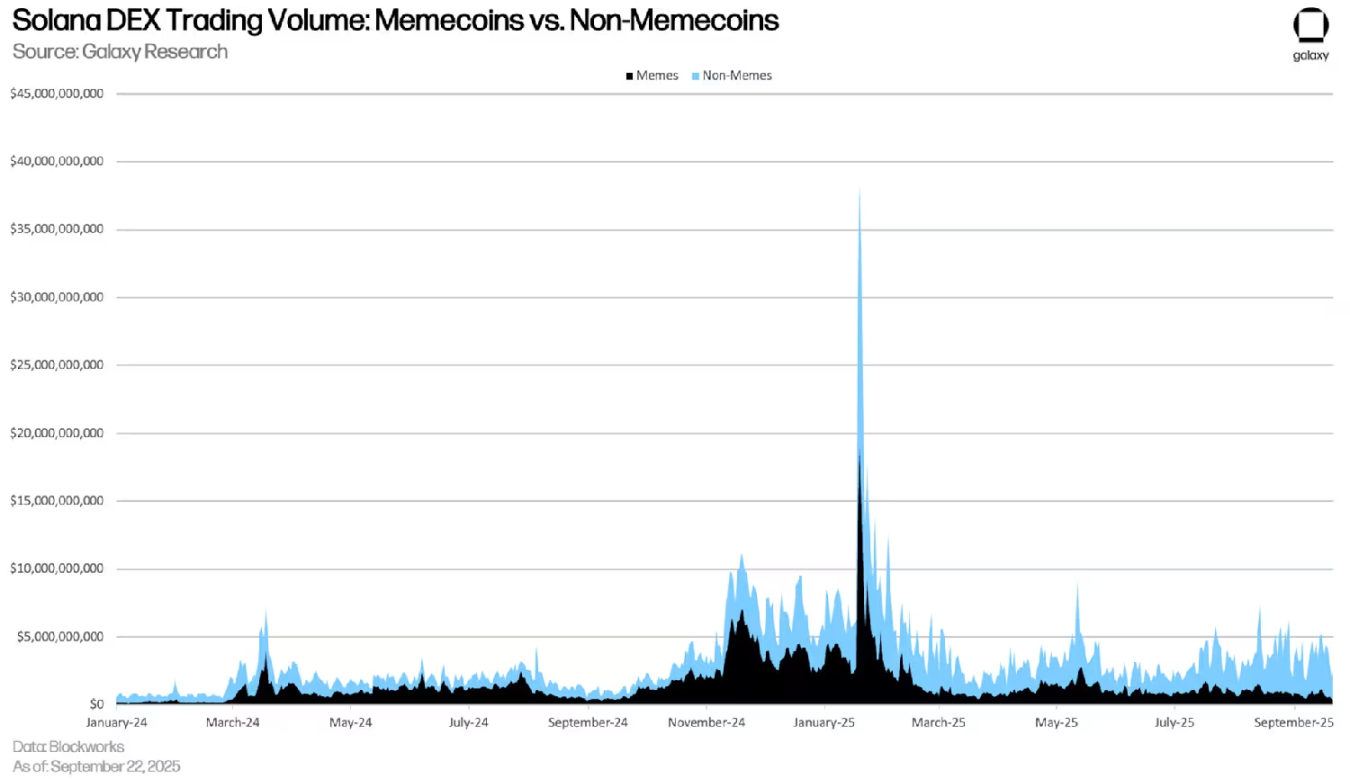

Although the trading volume of Solana decentralized exchanges (DEX) has performed impressively during this cycle, observing the trend of meme coin trading's share is also quite meaningful. Data from Blockworks shows that over the past year, the proportion of meme coin trading volume relative to total DEX trading volume has been steadily declining, with a significant peak occurring only when Trump launched the TRUMP token.

Solana DEX Trading Volume: Comparison of Meme Coins and Other Tokens

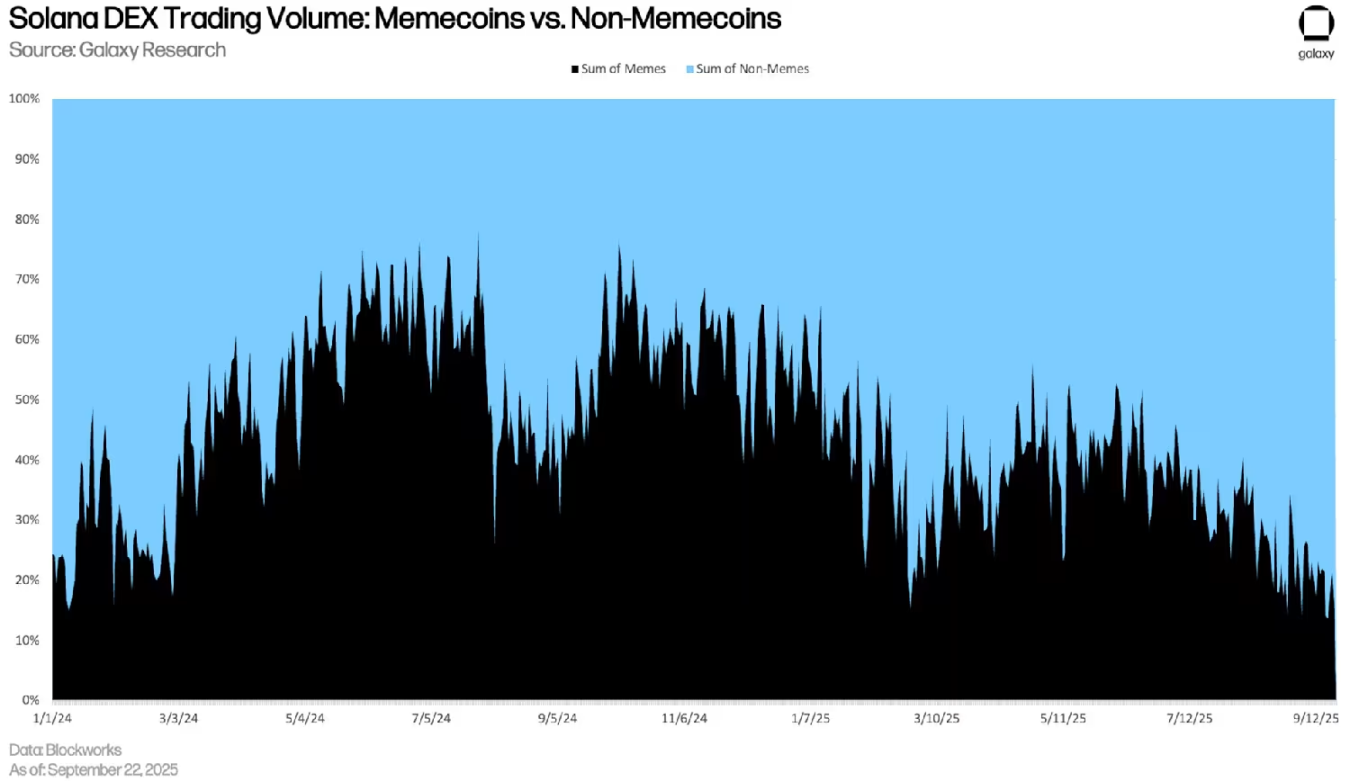

From the 100% stacked area chart below, it can be seen that in the fourth quarter of 2024, meme coin trading volume accounted for more than 50% of the total trading volume on Solana DEX, but it has now dropped to 20%-30%. This indicates that the activity of SOL/USDC trading pairs, stablecoin exchanges, and other DEX trades has surpassed that of meme coins. Although Pump.fun has lowered the barrier to issuing meme coins, it has also, to some extent, driven the "maturation" of the meme coin market: the endless issuance of tokens has led to dispersed liquidity and competition among them, making it difficult for individual tokens to replicate the parabolic price increases of leading meme coins from late 2023 to early 2024. Additionally, with the launch of competing chain trading applications (especially Hyperliquid's perpetual futures products), the overall trading volume of meme coins has been further diverted.

Solana DEX Trading Volume: Comparison of Meme Coins and Other Tokens (Stacked Chart)

On-chain Dynamics

Market scale data helps us understand the vastness of the meme coin system, while users' on-chain behavior aids in analyzing the operational patterns of these assets. One of the most notable features is that meme coin trading exhibits strong short-term, high-frequency trading characteristics, and the value distribution follows a power law.

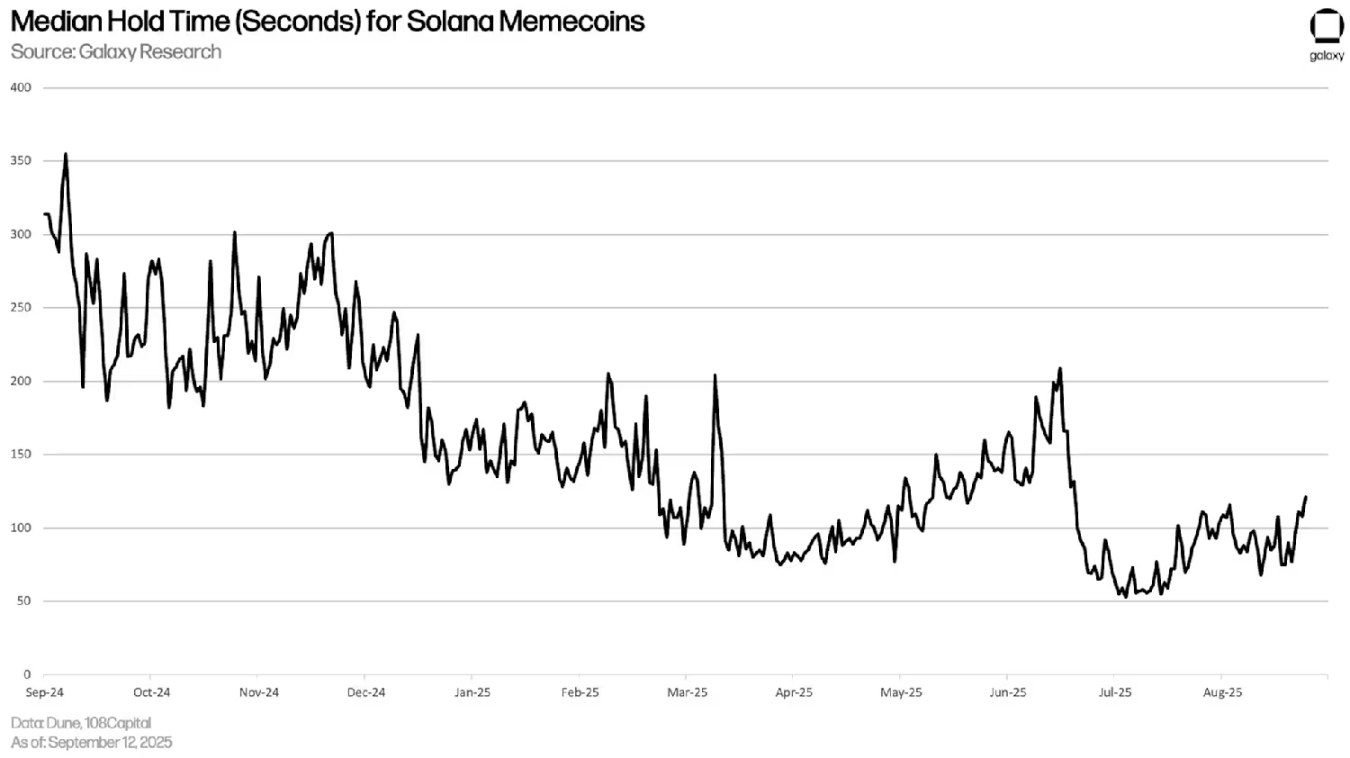

The first key metric is the holding period. For wallets that complete a "buy - sell all" operation within 7 days, the median holding time for Solana meme coins has dropped to about 100 seconds, far below nearly 300 seconds a year ago. This means that ordinary participants do not hold a token for hours, let alone days — they frequently switch trading targets, earning a few percentage points of short-term profit through competition with other traders (essentially a PvP trading game).

Visualization of Solana "Trading Frontline"

The underlying infrastructure further reinforces this trading model. The Axiom platform has introduced an "instant trading" feature, allowing traders to complete order transactions with just one click. Completing trades on a "1-second candlestick" has become effortless, creating a high-frequency trading environment. Especially when combined with human nature — most market participants are more inclined to panic sell at price bottoms rather than take profits after price increases — it is not difficult to see that for the vast majority, the "expected return" of such trading is essentially negative (excluding token issuers, insiders, and KOLs, which will be elaborated on later).

Median Holding Time of Solana Meme Coins (Seconds)

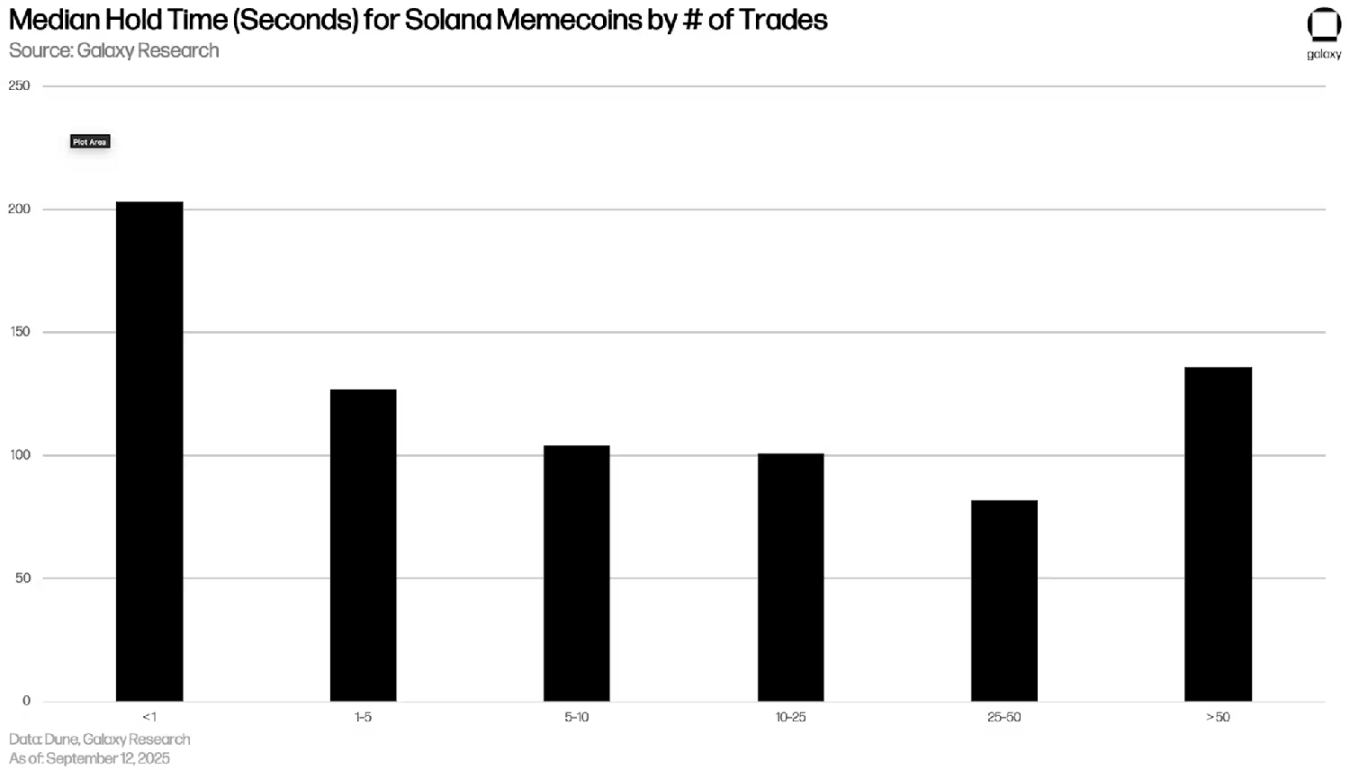

The following chart shows the median holding time divided by daily trading frequency over the past year: wallets with fewer than 1 trade per day have a token holding time of over 200 seconds; as trading frequency increases, the median holding time sharply decreases to the range of 80-120 seconds; only in the most active wallets (more than 50 trades per day) does the holding time slightly extend.

Overall, the holding time for various wallets holding meme coins is only a few seconds.

Median Holding Time Divided by Daily Trading Frequency

The power law distribution characteristic of the value of tokens on the Pump.fun platform is astonishing: among nearly 12.9 million tokens issued on this platform, only 12 tokens account for more than half of the total fully diluted market cap (FDMC). The total market cap of these 12 tokens reaches $2.69 billion, accounting for 56% of the platform's total market cap of $4.8 billion, while the remaining 44% of the market cap is divided among the other millions of tokens.

In other words, a small number of tokens, which account for only 0.00009% of the total number of Pump.fun tokens, control the majority of the platform's value.

The operational model of the meme coin ecosystem is almost akin to a lottery: almost all newly issued tokens will crash within hours, with only a very few able to stand out due to sustained market attention. For the vast majority of traders, meme coins are essentially a game with "expected returns being negative," but these "standout exceptions" continue to stimulate speculative behavior, leading people to keep "gambling in the casino."

Comparison of Top 12 Tokens on Pump.fun with Other Tokens

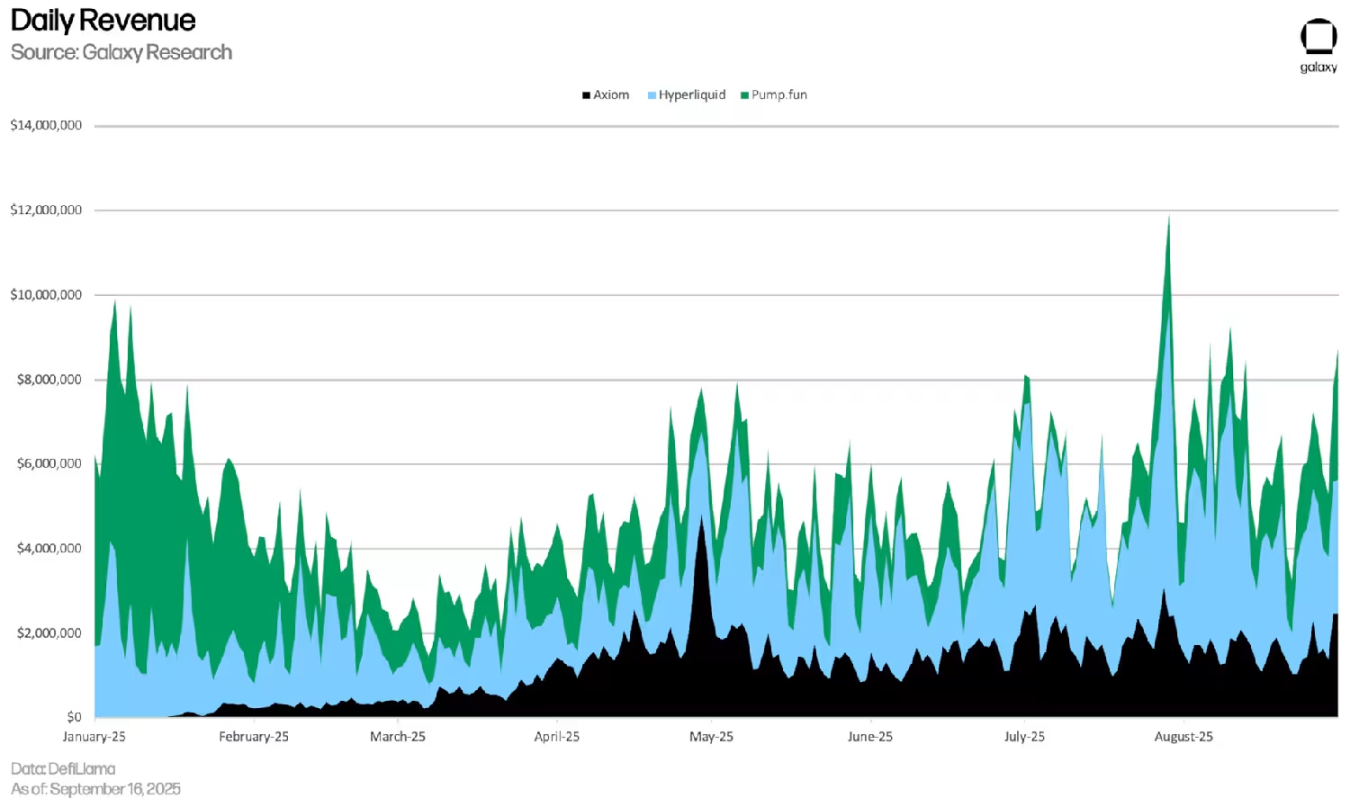

Although most meme coin traders are losing money, the infrastructure providers building the trading ecosystem are capturing a significant portion of the market's value. The chart below compares the revenue of Pump.fun, Axiom, and Hyperliquid (though not focused on meme coins, it is included for comparison). Notably, the Axiom team is very small (fewer than 10 people) but has achieved monthly revenues in the millions of dollars by charging fees to meme coin traders.

Value does not flow to the tokens themselves but to the platforms and tools that support token issuance and trading.

Meme Coin Ecosystem Stack

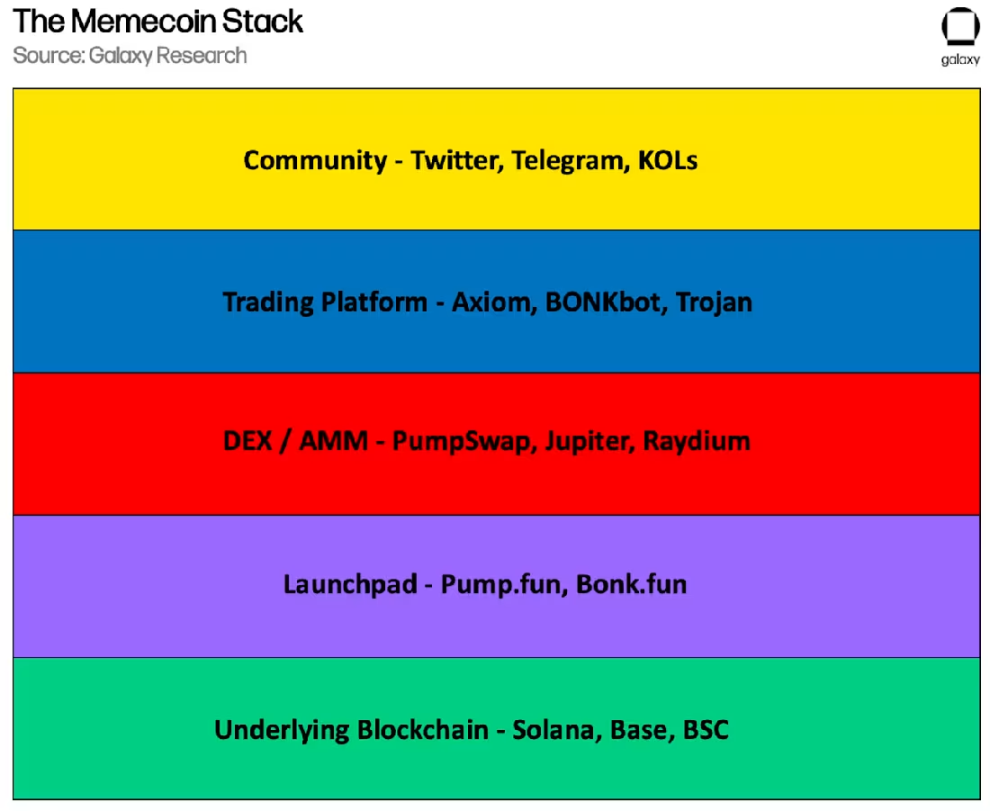

The meme coin ecosystem can be understood as a layered "ecosystem stack," with each layer built upon the foundation of the layer below:

Underlying Blockchain

The vast majority of meme coin activity is concentrated on the Solana blockchain. The chain's low fees, high throughput, and alignment with "radical speculative culture" make it the dominant blockchain for PvP trading.

The Base chain and BSC chain also host a significant amount of meme coin activity; while the token scale on the Ethereum blockchain is larger, its trading culture is relatively less "brutal."

Issuance Platforms

Pump.fun has significantly lowered the barrier to issuance, allowing anyone to easily create tradable tokens. Its bonding curve model ensures that tokens have liquidity at the time of issuance.

Competitors like Bonk.fun, Believe, and HeavenDEX have emerged but have not been able to maintain a significant market share. Data shows that the issuance platform market exhibits a "winner-takes-all" pattern.

DEX Aggregators / AMMs

After token issuance, trading occurs on automated market maker (AMM) platforms. Pump.fun operates its own internal AMM platform, PumpSwap, to retain liquidity, while broader price discovery is achieved through platforms like Jupiter, Raydium, and Orca.

This layer of infrastructure ensures that tokens can be traded instantly by anyone, at any time, and from anywhere, 24/7.

Trading Bots and Automation Tools

Execution speed is the core competitive advantage in meme coin trading. Tools like Axiom, BONKbot, and Trojan help users "sniper" newly issued tokens (buying them the moment they become tradable) and achieve instant transactions.

This infrastructure further shortens the median holding time of tokens, transforming the market into a highly "player versus player (PvP)" competitive environment — making it nearly impossible for new traders to achieve substantial profits in this environment.

Community

The community on X platform (formerly Twitter) and Telegram groups are the core channels for meme dissemination, and they also coordinate "pump and dump" promotional activities. Community members have a strong motivation to drive up token prices, substituting collective belief for fundamental asset support.

This layer of infrastructure also distinguishes two types of meme coins: one type is "PvP lottery-style" tokens, while the other is "PvE (player versus environment)" meme coins — the latter may develop into long-lasting "fervent communities" or cultural movements (such as SPX6900, MOG, TROLL, FARTCOIN, etc.).

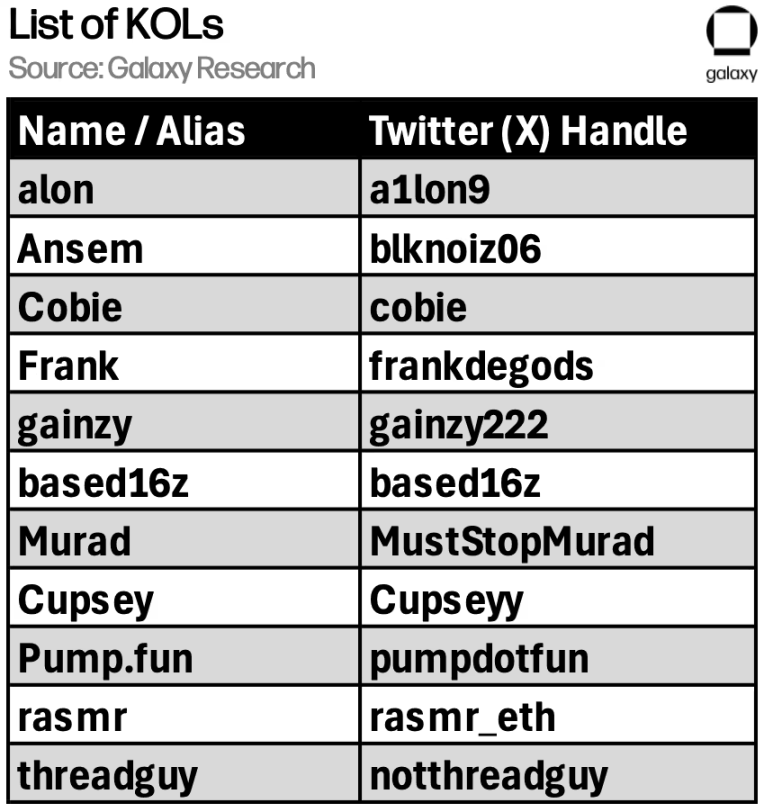

KOLs play a crucial role in this layer…

Due to the significant influence KOLs have in "promoting" or "suppressing" meme coins, the following is a list of core active accounts on the X platform that drive the narrative around meme coins (not an exhaustive list):

Note: CT is an abbreviation for "Crypto Twitter."

Key Opinion Leader List (Simplified)

"Creator Capital Market"

An important trend that has recently emerged in the meme coin space is the rise of the "creator capital market." In September 2024, Pump.fun launched a new project called "Project Ascend," positioning tokens as a direct monetization channel for content creators. This mechanism abandons the previous model of paying a fixed percentage fee to token developers, instead adopting a "dynamic floating rate" linked to the token's market value: tokens with lower market caps pay a higher percentage of transaction fees to creators (providing more funds for growth for new projects), while tokens with higher market caps reduce their rates. For example, tokens with a market cap below $300,000 pay a much higher fee percentage to creators than those with a market cap of $20 million.

At the same time, a new group of "Pump.fun live stream creators" has begun to emerge. These content creators directly link token issuance with platform live streaming, creating an immersive experience of "trading + interaction," bringing three significant advantages:

Early participation rewards: Viewers who join early in the live stream and buy potential tokens can quickly gain profits as the live stream gains popularity.

Viral dissemination incentives: Token holders have a strong motivation to share live stream content and attract new viewers — because the token price performance is directly linked to market attention, sometimes even employing extreme promotional tactics.

Innovation in the creator economy model: Live stream creators earn income from token trading fees that far exceed the advertising or subscription revenue shares of traditional platforms like Twitch and Kick, making "tokenized live streaming" a powerful alternative to traditional monetization models.

Whether this model can sustain long-term remains to be seen — if traders focus solely on token speculation and neglect the live content itself, it may lead to a loss of control over the model. However, in the short term, the alignment of interests between creators and traders gives Pump.fun the potential to become a native financial platform of the "attention economy."

Risks

Meme coins carry a unique set of risks within the cryptocurrency space, which also explains why most market participants choose to stay away from meme coin trading.

Many tokens that have not been issued through standardized platforms generally carry risks associated with their underlying smart contracts, the most common being the "honeypot" trap: these tokens only allow buying but prohibit selling. On price charts, honeypot tokens display a series of steep rising green bars, misleading ordinary traders into believing there are explosive profits, only to discover they cannot close their positions when they attempt to sell. Once developers extract enough value, the token price can crash instantly.

Example of a honeypot scam price chart: new buyers can push up the price but cannot sell

Another persistent risk is "rug pulls." Even seemingly "reputable" tokens often crash after initial hype fades. Developers and insiders typically hold large amounts of tokens (sometimes through hidden "side wallets") and may sell off large quantities when retail investors provide liquidity. Additionally, for tokens with liquidity pools controlled manually, providers may suddenly withdraw liquidity — meaning even small sell orders can lead to price crashes. Traders often find out too late: when liquidity for a trading pair is withdrawn, its actual available liquidity may be reduced to just a few dollars or even lower.

After liquidity is withdrawn, the trading pair on Dexscreener shows: essentially impossible to trade (Note: this token has no connection to Tesla)

Meme coins are also susceptible to "vampire attacks": copycat tokens can surpass the original by attracting more market attention (often aided by internal small groups or paid KOL promotions). For example, a token named "67" may successfully launch on the Bonk.fun platform but then see a nearly identical copycat with a stronger background appear on the Pump.fun platform, ultimately surpassing the original. Even if traders make accurate judgments and capture trends early, they may still incur losses by buying the "wrong version" of the token.

Finally, regulatory risks are always present. Although U.S. regulators have recently taken a "wait-and-see" approach to meme coins (only clearly stating that they "are not securities"), the ambiguous boundary between "harmless gambling" and "retail exploitation" makes them easy targets for political regulation — once regulations tighten, trading volumes may shrink significantly. A typical case is the LIBRA token: Argentine President Javier Milei promoted this token on social media, but shortly after its issuance, it crashed, leading to millions of dollars in losses for traders, while insiders, including Hayden Davis, profited by millions. Such events further reinforce the negative narrative of "meme coins exploiting retail investors."

Outlook

Meme coins are not a fleeting trend but a lasting component of the cryptocurrency "attention economy." Their significance lies more in the "cultural + financial" infrastructure they build.

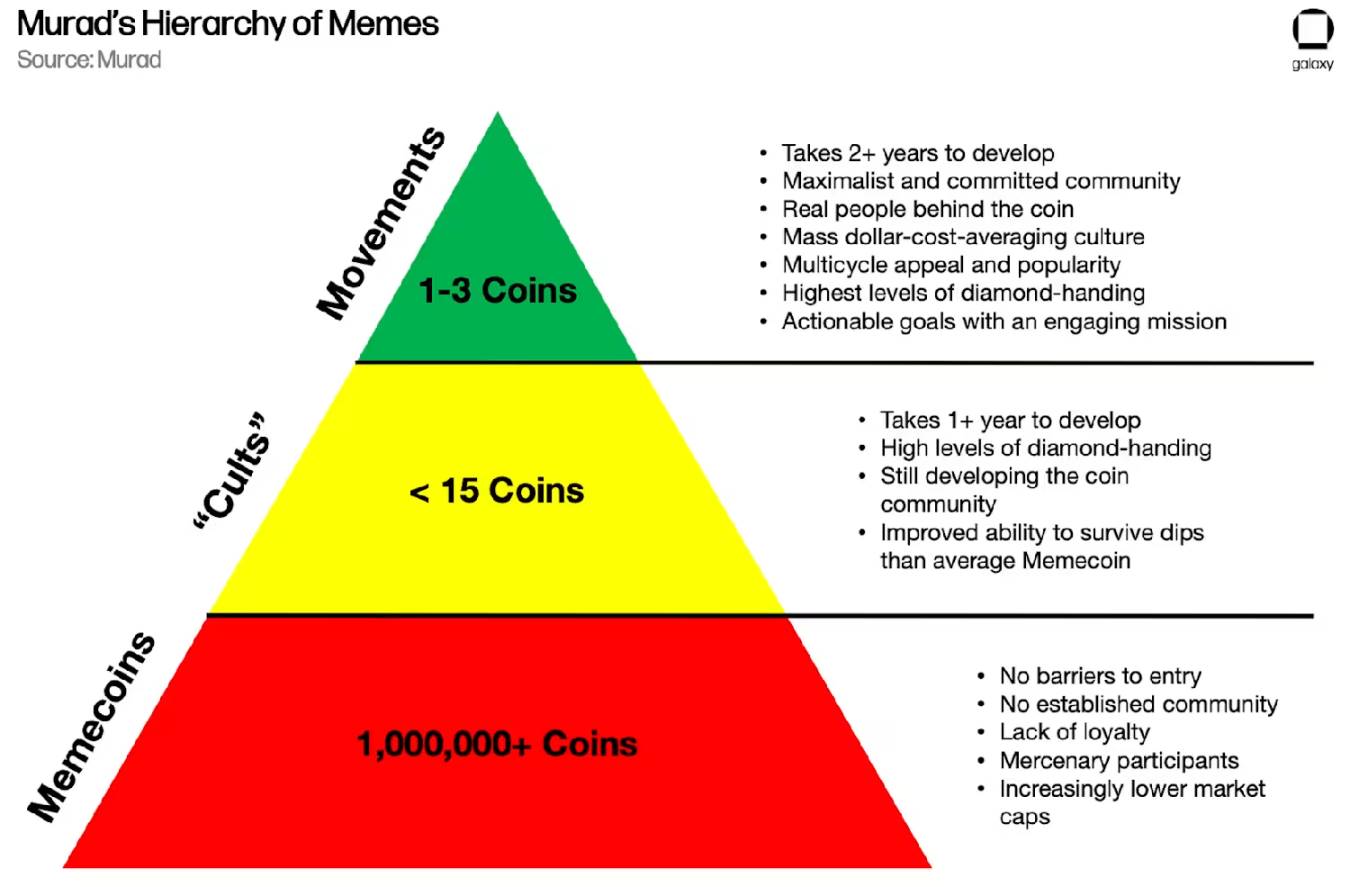

As noted by prominent blogger Murad, the meme coin ecosystem exhibits a "pyramid structure of attention and sustainability":

Base of the pyramid: millions of "one-time tokens," essentially PvP gambling chips, with lifecycles measured in minutes or hours, dominated by bots and high-frequency traders.

Middle of the pyramid: dozens of "fervent community tokens" (such as TROLL, MOODENG), which have highly engaged communities and can last for months or even years.

Top of the pyramid: a very small number of "cultural symbols that transcend trading" (or "quasi-religious assets") that can persist across multiple crypto cycles, such as Dogecoin (DOGE), PEPE coin, SPX6900, and possibly MOG coin.

Murad's Meme Coin Hierarchy Model

Each crypto cycle sees the emergence of several "breakout tokens" that attract outside capital and help legitimize the entire field. Such events reshape the meme coin ecosystem stack: a surge of copycat tokens, skyrocketing fees, ultimately giving rise to new "power law winners." Celebrity and politically related tokens (like TRUMP) will continue to exist in a form of "cyclical explosions," characterized by high volatility and strong media dissemination effects.

For most participants, the "expected value (EV)" of daily meme coin trading remains negative, with the real advantage held by "ecosystem distributors" — "owning the casino" is far more profitable than "being addicted to gambling in the casino." For example, the Axiom team, with fewer than 10 people, has accumulated revenues exceeding $200 million. For institutional investors, more prudent investment targets are "meme coin infrastructure" and a few "fervent community assets that persist across cycles," rather than the vast number of newly issued tokens.

However, meme coins also play a broader role in the evolution of the digital asset market: many users first encounter blockchain by purchasing meme coins on decentralized exchanges (DEX); subsequently, they gradually explore cross-chain assets, stablecoin exchanges, and even experience lending protocols. Meme coins lower the "psychological friction" for users entering the crypto space by transforming "speculation" into a socialized, low-barrier activity.

Additionally, meme coins have become "stress testing tools" for blockchain infrastructure — few other application scenarios can exert extreme pressure on blockchain performance like "meme coin mania." For instance, during the issuance of the TRUMP token, the trading platform Jupiter recorded over 42 million failed transactions in a single weekend.

In summary, the meme coin space is a "flywheel system supported by infrastructure, integrating user acquisition and cultural speculation." In the future, this field will continue to be filled with noise and rapid iteration, while a few platforms will achieve sustained growth through ecological advantages.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。