This is one of the highest funding amounts received by projects in the Crypto field in recent years.

Written by: 1912212.eth, Foresight News

Recently, a massive funding round has caused a stir in the entire Crypto circle, as Polymarket confirmed that the parent company of the New York Stock Exchange, Intercontinental Exchange (ICE), will make a strategic investment of $2 billion, resulting in a post-investment valuation of $9 billion. This is one of the highest funding amounts received by projects in the crypto field in recent years, and its nearly $10 billion valuation also brings the potential and popularity of prediction markets to the forefront.

Intercontinental Exchange (ICE): The Fourth Largest Exchange Group in the World

Intercontinental Exchange (ICE) is a leading global provider of financial infrastructure and data services, serving as the parent company of the New York Stock Exchange (NYSE). Founded in May 2000 by Jeffrey C. Sprecher in Atlanta, USA, ICE initially focused on electronic trading of energy derivatives. In 2007, it acquired the New York Board of Trade (NYBOT), expanding into agricultural and metal futures.

In 2013, ICE acquired NYSE Euronext for $8.2 billion, gaining ownership of the New York Stock Exchange and expanding its business into equities and options trading, becoming the first exchange group in the world to simultaneously control both commodity and equity trading.

ICE has a very extensive global business layout, operating 14 exchanges worldwide, including ICE Futures Europe (London), ICE Futures U.S. (New York), and ICE Futures Singapore (Singapore), covering commodity markets such as energy, agricultural products, and metals. It also engages in diversified trading through the NYSE and Liffe exchange, involving stocks, stock index futures, and more. Additionally, it provides clearing, data services, and mortgage services.

As of now, ICE has a market capitalization of over $50 billion, ranking as the fourth largest exchange group in the world.

Polymarket Returns to the U.S.

According to Decrypt, the prediction market Polymarket is set to reopen to U.S. users, nearly four years after it was effectively banned by the U.S. Commodity Futures Trading Commission (CFTC).

Polymarket previously acquired the CFTC-licensed trading platform QCX LLC for $112 million and has begun self-certifying event contracts, including those related to sports events and election markets.

The crypto market has become an important component of the global financial market. ICE's investment in Polymarket is a significant move for ICE to enter the crypto prediction market.

ICE can bring its experience and resources from traditional financial markets into the crypto market, promoting the deep integration of prediction markets and crypto technology, thereby opening up new business areas and revenue sources.

Over a Million Traders, Total Trading Volume Exceeds $18.9 Billion

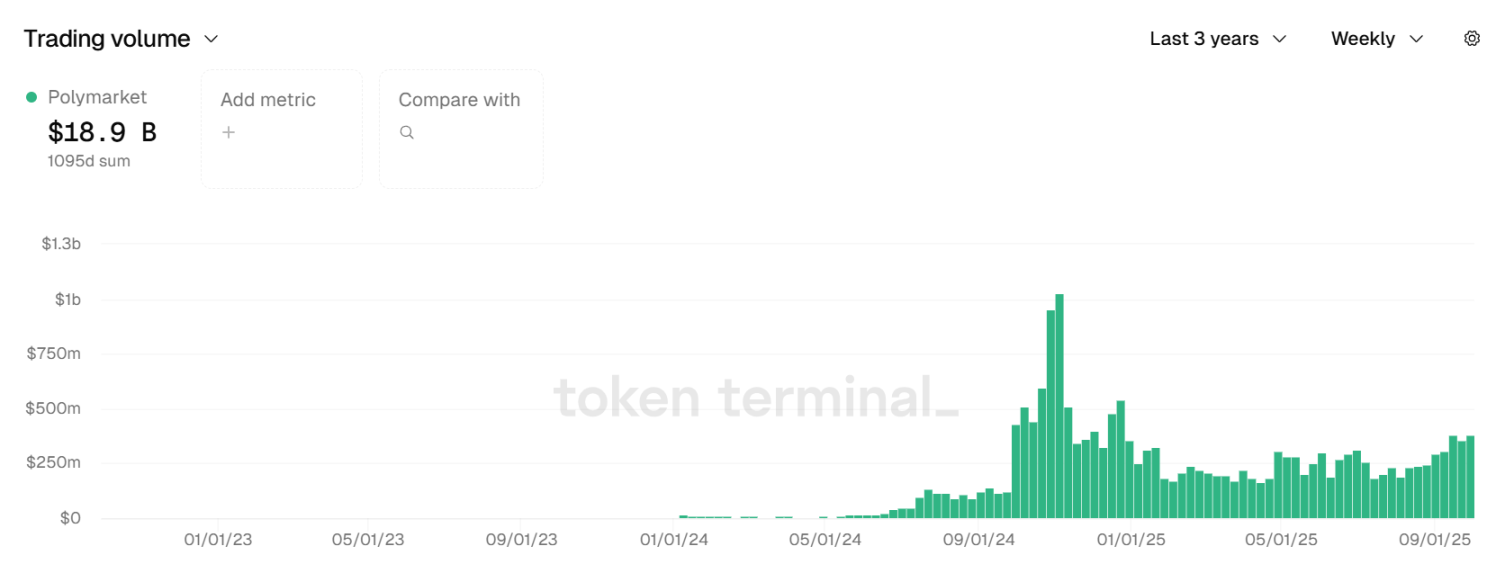

Since making headlines during last year's U.S. presidential election, Polymarket has seen a significant surge in both funding and user numbers. Although the hype has somewhat decreased since then, its trading volume remains at a good level.

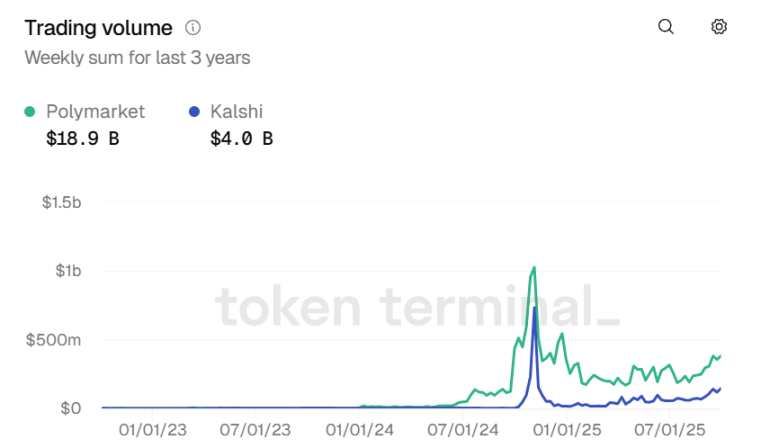

According to the latest data from tokentermina, its total trading volume has risen to $18.9 billion, significantly ahead of another competitor, Kalshi.

Its Total Value Locked (TVL) has risen to $169.2 million, with the trading volume over the past 30 days reaching $1.5 billion, an increase of 42.2%.

Its monthly active user count has also seen a significant increase. Currently, the number of active users has reached 263,800, with a monthly growth rate of 26.8%.

The latest data from Polymarketanalytics shows that there are a total of 1,349,740 traders and 46,995 prediction markets. While Polymarket leads significantly in total trading volume, it lags behind Kalshi in total markets and total open positions.

Rumors of Token Issuance

As early as after the 2024 U.S. presidential election, Polymarket hinted on its official website that there may be a token airdrop in the future to attract continued funding.

According to the SEC EDGAR database, Polymarket's operating entity, Blockratize Inc., submitted a Form D filing on August 1, 2025, which mentioned other warrants or rights terms. Such statements are often seen as signals for future token issuance.

Due to the unclear legal status of tokens in the U.S., companies typically cannot directly mention token issuance plans in SEC filings, so they use terms like "warrants" to reserve the right for investors to obtain tokens in the future. This has become a common practice in the crypto industry when conducting traditional equity financing.

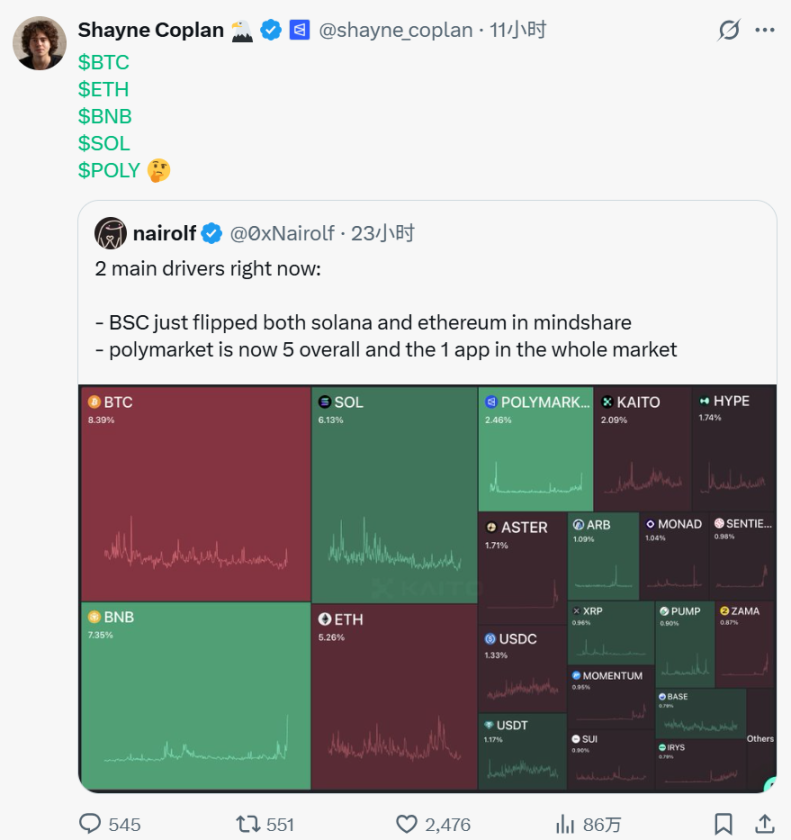

On October 8, Polymarket founder Shayne Coplan hinted at the token symbol POLY by placing it after BTC, ETH, BNB, and SOL in a retweet, suggesting that the name of Polymarket's token may be POLY. However, the timing of the token issuance remains unknown.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。