This article attempts to compare and analyze the differences in the performance of new coin listings and derivative trading across the top ten mainstream exchanges from the dimensions of spot and contract trading through quantitative data comparison.

In the third quarter of 2025, after a phase of market recovery, new coin trends once again became the focus of speculation and hot money. Recently, a large number of projects have issued airdrops through TGE (Token Generation Event) and have concentrated on launching on exchanges, such as the Trump family-related token World Liberty Financial (WLFI), sparking widespread discussion in the market about whether "new coins are still worth participating in." In the current environment, there is a clear divide among investors on whether to continue the short-term mindset of "selling immediately after listing" for newly launched tokens or to adopt a more long-term strategy. In response to this controversy, this article aims to provide a more comprehensive observation framework for investors by comparing and analyzing the differences in the performance of new coin listings and derivative trading across the top ten mainstream exchanges from the dimensions of spot and contract trading.

First, we selected the top ten exchanges for data statistics: Binance, Upbit, OKX, Bybit, KuCoin, Gate, LBank, Bitget, MEXC, and HTX (formerly Huobi). We collected data on the new coin listings and performance on these platforms from early August to mid-September 2025. By comparing the listing pace of new coins, the price fluctuations over different periods after listing, and the changes in contract trading volume during the same period, we hope to evaluate:

Listing pace and new coin performance: Which exchanges have the most new coins and the highest frequency of listings? How do the price increases and retracements of new coins differ across platforms, and where is the "profit effect" concentrated?

Contract trading activity: Which exchanges have the fastest growth in derivative trading volume and market share? What are the differences in strategies across platforms regarding new coin-related contracts (such as whether to quickly list new coin contracts and the breadth of contract varieties)?

Spot-contract linkage: Does the number of new coin listings on the platform form a closed loop with the corresponding contract support? How do the spot market trends of new coins and contract trading influence each other?

Future trends: Against the backdrop of exchanges increasingly laying out their own chains (such as Binance's BNB chain and Bybit's Mantle), how will the "new coin-contract-on-chain ecosystem" interact and form a closed-loop effect?

Through the above analysis, we aim to clarify the differences in new coin strategies among major exchanges in the current market and the underlying reasons behind these differences.

Spot New Coin Listing Comparison

Overview of Listing Pace and Quantity

During the new coin boom around August 2025, different exchanges exhibited significant differentiation in the number and frequency of new coin listings. According to statistics, the number of new tokens listed on each platform over the past six weeks (approximately from early August to mid-September) is as follows:

Binance — The global leader, focusing on quality and compliance, with a relatively conservative approach to new coin listings. Since August, Binance has listed about 13-14 new coins, maintaining restraint and preferring to filter projects through mechanisms like Launchpad/Seed Tag before opening trading.

OKX — Preferring quality over quantity, with the fewest listings. OKX listed only about 6 new coins from August to mid-September. The platform continues its cautious approach, selecting only a few high-quality projects to maintain overall market order.

Bybit — Strictly screening projects, with a moderate but stable number of listings. Bybit has listed about 14 new coins over two months, averaging around 2 coins per week, continuing its steady output of one coin every 2-3 days in the first half of the year. Bybit prefers to list high-heat categories like Meme and new public chain ecosystems, accounting for about 70%.

Upbit — Based in the Korean market, selectively listing well-known coins. Upbit added about 18 trading pairs during the statistical period, mostly consisting of globally recognized or locally popular coins (such as WLD, API3, CYBER, which already had trading history on other platforms). Upbit rarely does project launches, resembling more of a "confirmation-style" listing.

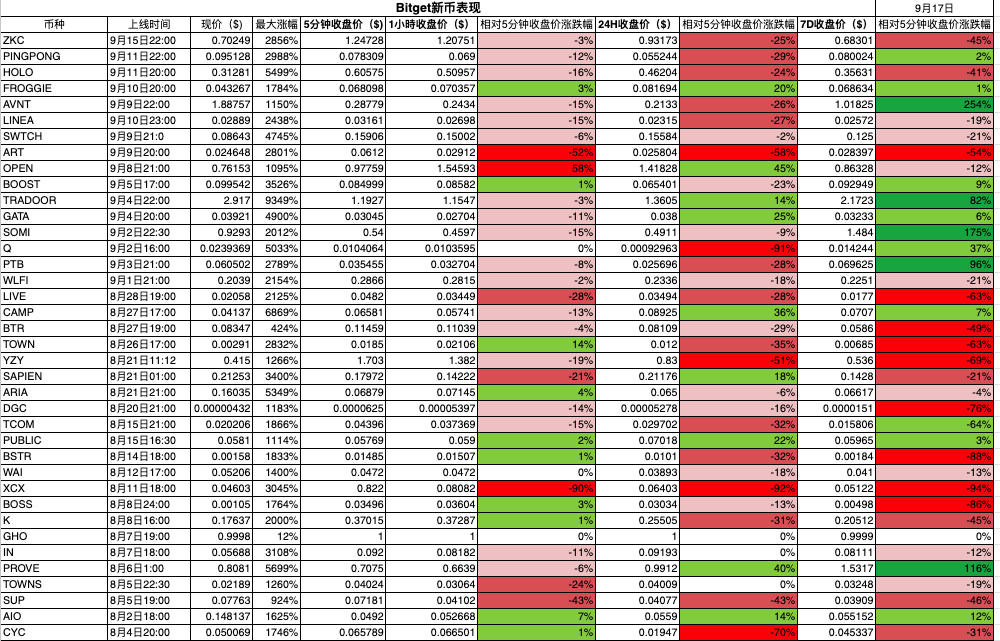

Bitget — Driven by both spot and contract trading, with a moderately high number of listings. Bitget is expected to have listed around 20-30 new coins during this period (exact data to be supplemented), with a frequency of about 4-5 new coins per week.

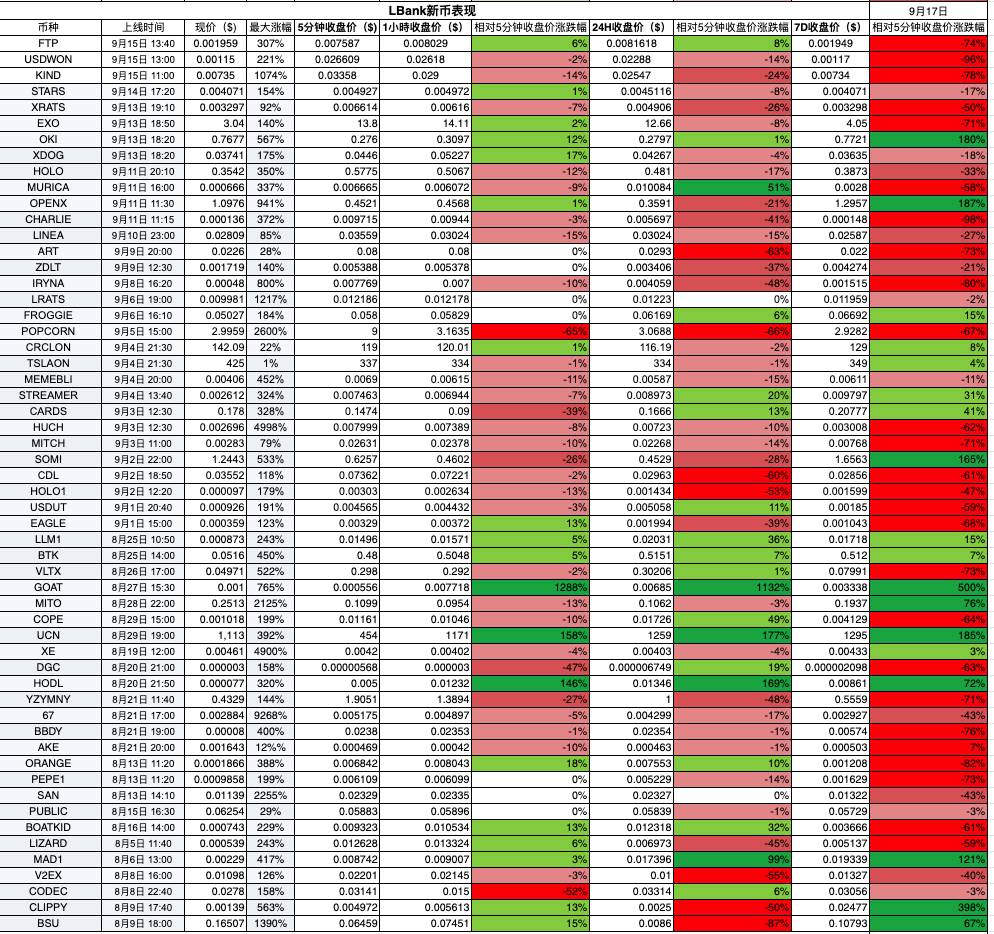

LBank — The highest quantity, listing new coins at a "machine-gun" frequency. According to incomplete statistics, LBank listed dozens or even hundreds of new coins during this period, continuing its aggressive pace of "2-3 new coins daily" from the first half of the year. This high-density listing provides many trial-and-error opportunities for the market, but the quality of projects varies significantly, with notable price differentiation within seven days (in previous samples from May to June, 90% of projects experienced significant price fluctuations within a week).

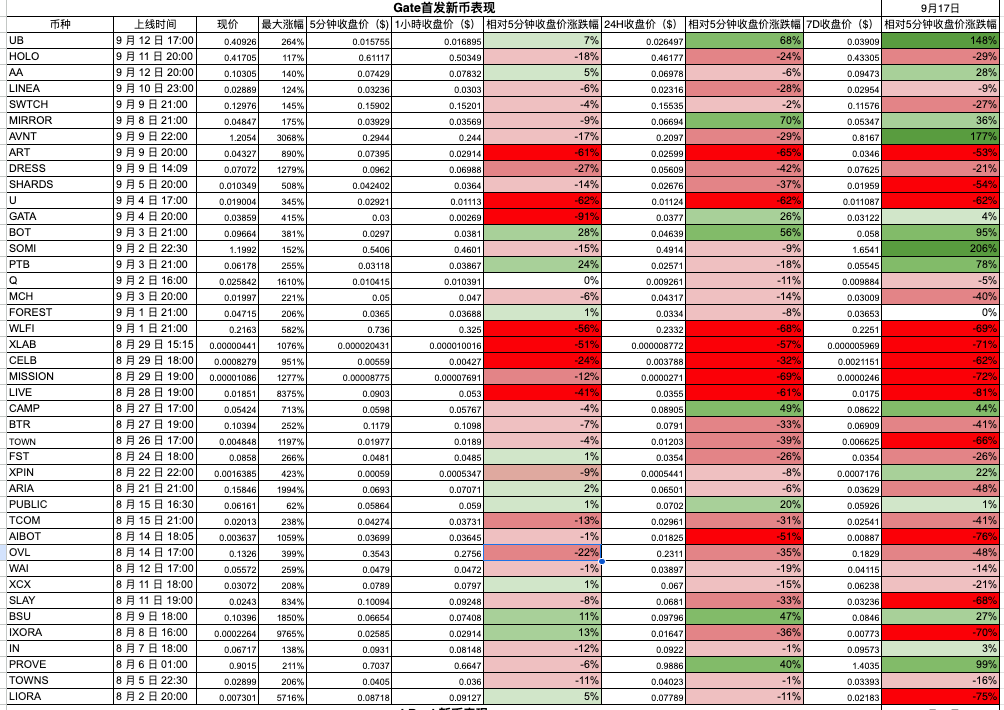

Gate — High-frequency listings, second only to LBank, with new coins listed daily. Since August, about 40 new coins have been listed on Gate, either simultaneously or as first listings, surpassing first-tier platforms expanding into the European and American markets during the same period. Gate generally maintains a "new coin daily" listing frequency, providing ample opportunities for short-term funds. However, due to the large number of projects and limited market depth, some tokens experienced significant volatility and deep retracements after listing.

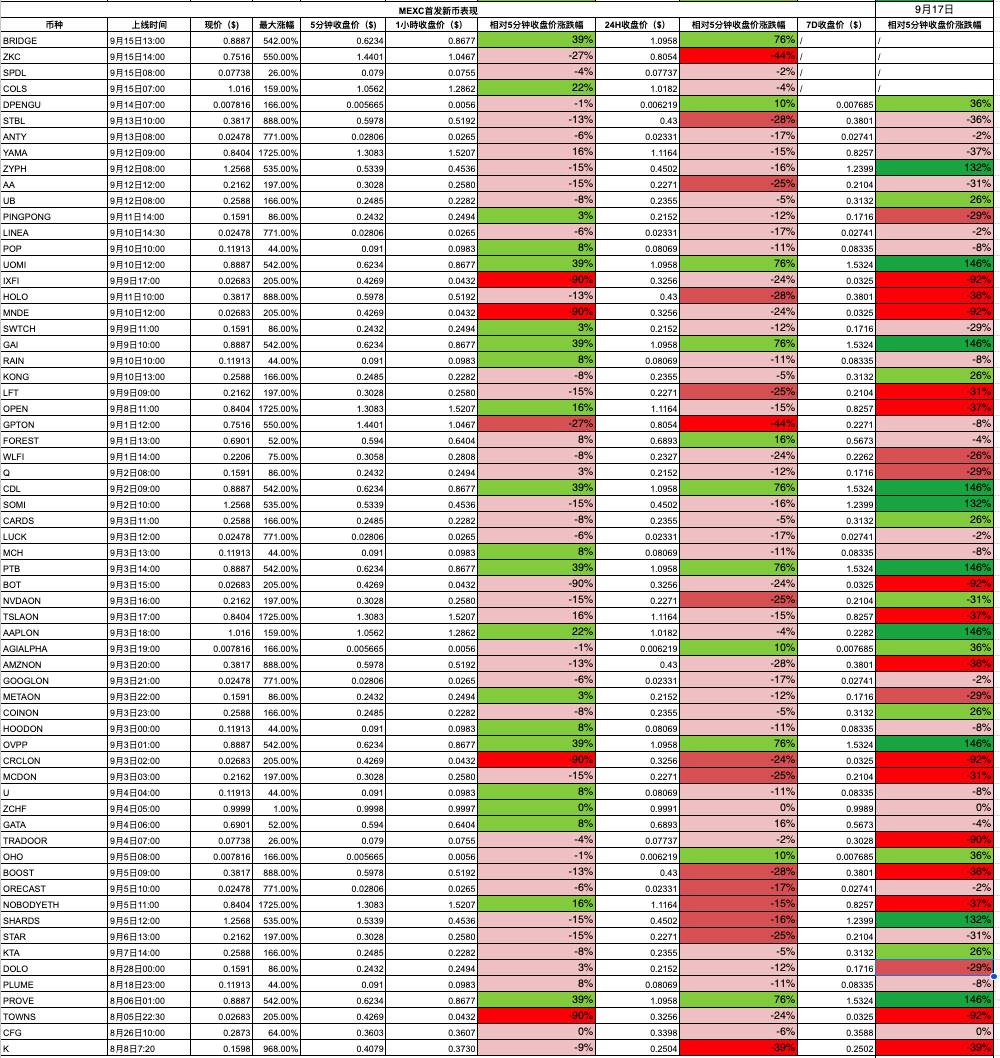

MEXC — Extremely fast listing pace, covering a wide variety of tokens. During the statistical period, MEXC listed over 60 new tokens, even surpassing Gate, ranking among the highest. MEXC is eager to be the first to list various small-cap hot topic tokens, almost ensuring "if there's a hot topic, it will be listed." This aggressive strategy provides explosive opportunities but also means that the quality of new coins varies, with severe polarization in short-term price trends.

KuCoin — Actively following market trends, with a significant increase in new coin listings. KuCoin has listed about 44 new coins in recent months, with new projects launching almost daily. Compared to its previously more restrained listing strategy, KuCoin has significantly accelerated its pace recently, covering popular public chain ecosystem coins, GameFi/Meme coins, etc. The high frequency of listings allows KuCoin users to keep up with market trends but also requires users to have the ability to quickly capture market movements.

HTX (Huobi) — Attempting to revive its listing business, with a moderate number of listings. HTX listed about 11 new coins in August, showing some improvement compared to the sluggish listing situation at the beginning of the year, but the overall number is still far less than high-frequency platforms like LBank and Gate. As an established exchange, HTX currently focuses more on compliance and quality in its listings, strategically leaning towards following mainstream trends rather than leading them.

In summary, the listing pace of new coins presents a "polarized" pattern: platforms like LBank, Gate, MEXC, and KuCoin capture market attention through high-frequency listings, willing to "cast a wide net" to create short-term opportunities; while Binance, OKX, and Upbit strictly control the number of listings to maintain ecological stability. Bitget and Bybit fall in between, maintaining a certain volume of listings while amplifying market participation through derivative tools. This difference reflects the varying development strategies of exchanges: some attract speculative traffic with a large number of new coins, while others build a solid reputation through carefully selected projects.

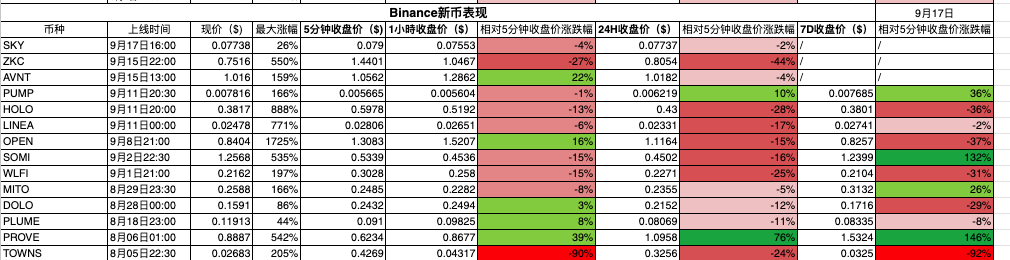

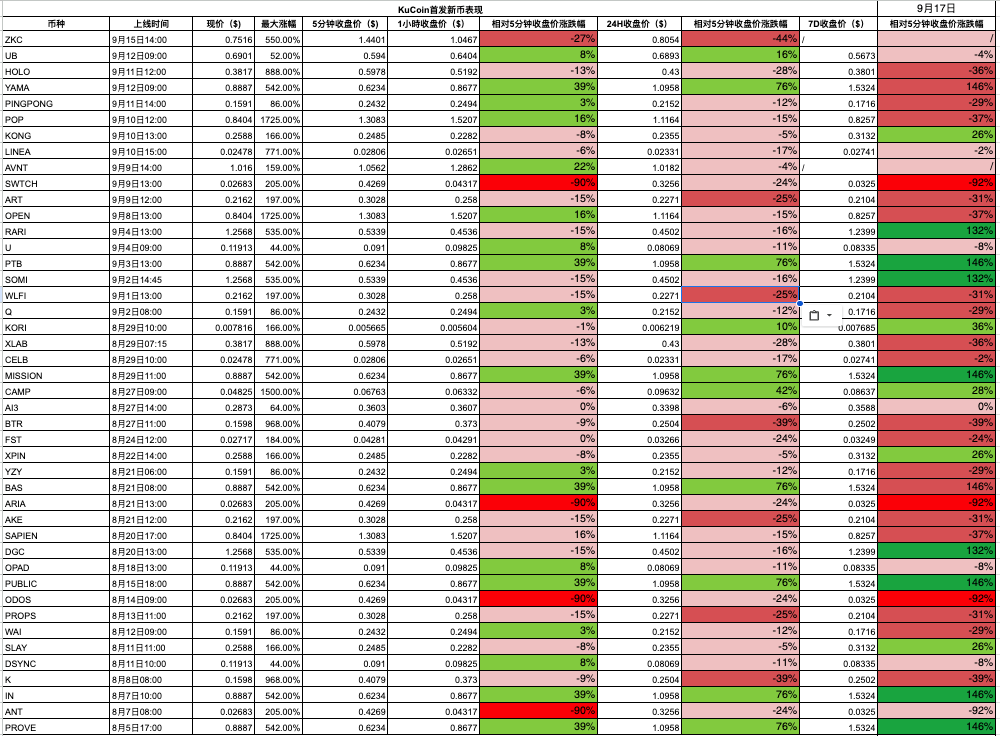

Overall Performance Comparison of New Coins

In addition to the number of listings, the price performance of new coins after listing is a core indicator for assessing the "listing effect" of each exchange. We conducted a horizontal comparison of the price fluctuations of new coins on each platform over different time periods (5 minutes, 1 hour, 24 hours, 7 days) to observe which exchanges have concentrated price increases for new coins and which platforms have a higher proportion of coins that break below their listing price.

According to the provided data statistics, the performance distribution of new coins on each exchange within the first week after listing is roughly as follows:

Binance: Overall stable, few increases, most retracements

As the leader, the new coins listed on Binance are mostly projects that attract market attention, with speculative trading being relatively rational. Weekly statistics show that about 36% of new coins on Binance increased in price, while 64% decreased, showing performance similar to KuCoin. Extreme retracements (over 50% drop) account for less than 10%, indicating that Binance's quality control on projects has reduced the probability of catastrophic failures.

Most coins experienced price fluctuations within +/-30% over the week, with volatility relatively contained.

WLFI peaked at nearly double its price on Binance before falling back, with a weekly drop of about 30%;

Linea, although it surged on the first day, quickly retraced, almost returning to its issuance price within a week (about a 2% drop).

Overall, there were not many miraculous wealth gains, nor were there significant cases of halving.

OKX: Controlled volatility, high concentration of profit effect

Due to the limited number of new coin listings, OKX has a small sample size. Out of 6 new coins, only 1 increased in price over the week, while the others all decreased, with one project experiencing a retracement of over 90%, dragging down the average return to negative.

In the 24-hour dimension, the price fluctuations of new coins on OKX on the first day were relatively mild, with the median close to flat;

The 7-day data reveals differentiation: a few high-quality projects still steadily increased over the week, such as RESOLV, which surged nearly 49% within 24 hours after its listing in May-June, but most projects retraced almost entirely within the week;

Overall, the volatility of new coins on OKX is lower than on other platforms, with few instances of wild surges or crashes, but the profit effect is highly concentrated: missing out on a few strong coins leaves little profit in other projects.

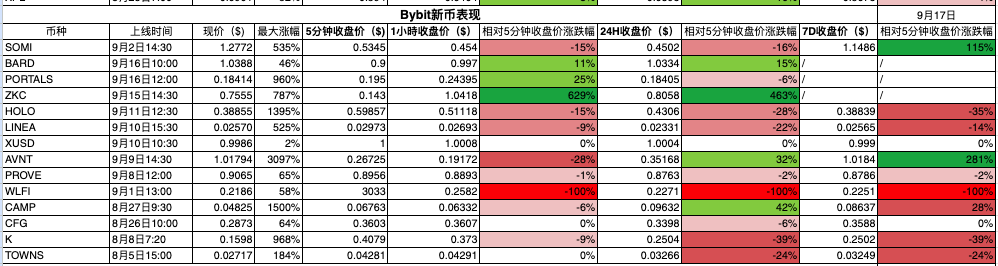

Bybit: "Stopwatch market" evident, profits and losses polarized

The performance of new coins on Bybit is characterized by significant volatility on the first day, followed by overall weakness. Statistics show that only about 27% of the coins listed on Bybit had prices higher than their initial listing price after 7 days, with nearly 30% of projects experiencing a drop of over 50% in their first week, and the overall downward trend exceeding 70%. Most tokens often peak within minutes of opening, followed by a stair-step decline in price. For example, Homecoin surged nearly 30% within 24 hours compared to its 5-minute price but failed to maintain the increase; similarly, BDXN started at 0.1404 USDT in the first 5 minutes, but a week later was only at 0.0441 USDT, plummeting by 68.6%.

However, Bybit occasionally has standout "dark horses": for instance, Avantis (AVNT) surged over 30 times on its first day, becoming one of the few samples that drove the average return to positive. Overall, however, the returns on new coins on Bybit heavily depend on a few star projects, with the vast majority of coins showing negative performance after 7 days, making it difficult for investors to achieve positive returns if they miss the initial surge.

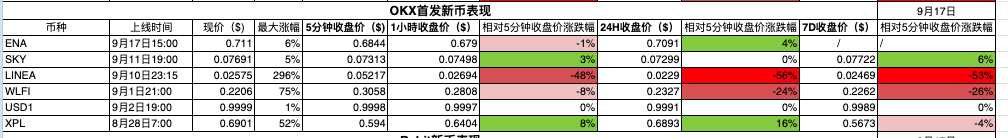

Upbit: More declines than increases, focusing on stability

Due to Upbit's tendency for "follow-up" listings, its new coins often miss the most frenzied phase in other markets, resulting in relatively subdued performance. Data indicates that only about 15% of new coins on Upbit increased in price over the week, with over 80% ultimately closing lower. Approximately 23% of the coins lost more than half their value within seven days, showing that some coins that were heavily speculated overseas faced corrections upon entering the Korean market. For instance, Worldcoin (WLD) surged on its listing day but fell over 20% within a week; Linea, on the other hand, was priced close to the market's reasonable value at launch, remaining roughly flat with a slight increase over the week. The average and median returns for new coins on Upbit were both negative (with a median drop of about -25%), indicating that most coins did not experience significant upward momentum on this platform. For risk-averse Korean investors, this performance, while lacking in surprises, remains relatively controllable.

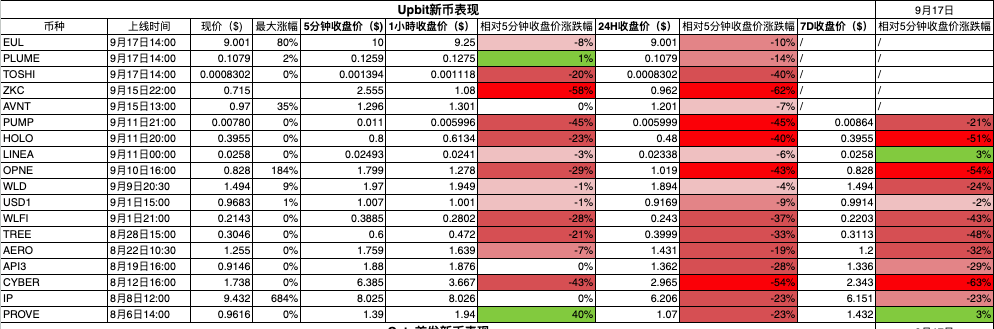

Bitget: Common Initial Retracements, Few Strong Performers Support the Average

The sample period includes 38 new coins.

The proportion of coins that increased in price over 7 days relative to their 5-minute price is about 34%, while 24% experienced a drop of 50% or more, indicating a significantly lower deep drop rate compared to LBank, but overall elasticity is also more limited.

The average price change over 7 days is approximately -6.7%, with a median of -19%; over 24 hours, the average is -16%, and the median is -20.5%, suggesting a common pattern of "initial surge—same-day retracement—weakness over the week."

The proportion of projects that doubled (≥+100%) over 7 days is 7.9%, with none reaching +300%.

Representative strong performers include AVNT (+254%), SOMI (+175%), and PROVE (+116%); however, significant retracements should not be underestimated, with examples like XCX (-94%), BSTR (-88%), and BOSS (-86%). Overall, Bitget's 24-hour median retracement is deeper, and the 7-day median negative values are more concentrated, resembling a distribution where "a few stars lift the average, while most assets weaken." For traders, if they miss the few strong coins, it becomes quite challenging to achieve positive returns afterward.

LBank: High-Frequency Listings = Higher Discovery Rate, Leading in "Dark Horse Density"

The sample period includes 56 new coins. LBank, relying on its "machine-gun" listing strategy and ample initial liquidity, achieves significant early price discovery efficiency:

The proportion of coins that increased in price over 7 days is about 34%, with 12.5% doubling (≥+100%) and 3.6% reaching +300%, indicating a leading density of dark horses among similar platforms.

The average return over 7 days is approximately +1.5%, while the average over 24 hours is about +16%, suggesting a considerable short-term profit-taking window on the first day.

Representative strong cases include GOAT (+500%), CLIPPY (+398%), and OPENX (+187%), reflecting the platform's ability to capture new themes and small-cap tracks. It is important to note that LBank's broad coverage also means a longer "long tail" in return distribution: the 7-day median is about -36.5%, with approximately 43% of coins experiencing a drop of 50% or more within a week. Therefore, a more trader-friendly approach is to view LBank as a "sample selection—first wave capture—disciplined profit-taking" engine for new coin discovery: using strict position control and risk management to amplify dark horse returns while mitigating long-tail retracements, thus transforming the platform's high hit rate into a strategy-level win rate.

Gate: Coexistence of Explosive Trends and Deep Drop Risks

Gate has the highest number of listings and the largest sample size. Statistics show that about 30% of new coins listed on Gate increased in price within 7 days relative to their initial price, but over 70% declined; among these, nearly 30% of coins experienced a halving (a drop of over 50%), representing the highest deep drop rate across platforms. This is related to Gate's relatively weak market depth, where price movements can be amplified by single-point capital.

However, Gate also contributed the most exaggerated price increase cases in the entire market: for example, Avantis (AVNT) surged over 30 times on its first day, creating a short-term myth, but then quickly fell back. Overall, Gate's new coins exhibit the highest volatility—while there are often astonishing price increases on the first day, most subsequently cannot escape significant drops.

MEXC: Right-Skewed Return Distribution, Prominent Peak Increases

As another high-frequency listing platform, MEXC's overall performance of new coins is somewhat similar to Gate: about 30% of projects increased in price a week after listing, while 70% declined. Approximately 10% experienced halving-level deep retracements. MEXC is characterized by frequent extreme price increase cases: the highest increase during the statistical period occurred with the IXORA project, which surged nearly 98 times relative to its issuance price, which is quite extraordinary. This indicates that MEXC attracts speculative funds with a high-risk appetite, willing to speculate on small coins; on the other hand, it also means that most projects quickly return to rationality after explosive speculation, with prices falling back or even breaking below their initial price. The average return for new coins on MEXC over 7 days is slightly positive (boosted by extreme values), but the median is negative, indicating that the actual performance of most coins is weak.

KuCoin: Overall Stable, Moderate Explosive Power

Approximately 36% of new coins listed on KuCoin increased in price over the week, while 64% declined, slightly better than platforms like Gate and MEXC. The proportion of projects experiencing over 50% retracement is less than 10%, indicating relatively few deep drops. On average, new coins on KuCoin show a slight positive return over 7 days (about +15%), with a median of about -8%, suggesting that a few large gainers pull the average up, while most coins experience slight declines. KuCoin rarely sees exaggerated cases of dozens of times increases, with peak increases generally in the range of 5-20 times, and the top gainers are often carefully selected hot projects (such as social finance and gaming). Overall, the performance of new coins on KuCoin falls into a "moderately bullish" distribution: there are no extreme wealth myths, nor are there frequent consecutive drops, providing investors with opportunities for stable returns if managed properly.

In a horizontal comparison, the overall return distribution of new coins within the first week after listing shows that high-frequency listing platforms like LBank, Gate, and MEXC exhibit a right-skewed distribution of "big ups and downs": a few coins create myths of dozens of times increases, but more projects quickly break below their initial prices, leading to significant polarization in investor profits and losses. In contrast, top exchanges like Binance and OKX, due to their strict listing selection, show more moderate and convergent performance for new coins: there are few instances of explosive increases, and significant drops are also rare, with the vast majority of coins experiencing price fluctuations within a controllable range. Bybit and Bitget exhibit characteristics of both types—having both star coins that surge dozens of times in a single day and a large number of ordinary coins that quietly decline, resulting in a "long tail" in their new coin return distribution, where extreme values raise the average while median returns are low or even negative, indicating that investors need to have the ability to select cases carefully when speculating on new coins on these platforms.

Analysis of New Coin Performance Distribution Characteristics

Combining the above data, we can further summarize the distribution characteristics of new coin performance across platforms:

Concentration of Increases: This refers to the extent to which profits are concentrated in a few new coins. Bybit and Bitget have the highest concentration of increases for new coins—one or two projects' significant gains contribute to most of the overall returns, while the majority of other coins have limited or even negative increases. OKX, due to its limited number of projects, also shows concentrated characteristics, where the rise or fall of a single coin significantly impacts the overall performance. In contrast, LBank and Gate have relatively "evenly distributed" increases; although there are cases with high absolute returns, the overall contribution of each coin is dispersed due to the large number of projects. Binance and KuCoin are in the middle: they do not have extreme concentration in one or two coins, nor are they completely average, with strong coins contributing to overall returns without dominating.

Red Market Ratio (the proportion of coins that increased on the first day or within the first week): This indicator reflects the "break-even rate" of new coins. Upbit has the lowest red market ratio, at less than 20%, indicating that most new coins in the Korean market did not end up increasing. OKX and Bybit also have low red market ratios, around 20-30%. Platforms like Gate, MEXC, Binance, and KuCoin have slightly higher red market probabilities, in the 30-40% range. Due to data limitations, LBank's precise judgment is not possible, but historical data suggests it may also be around 30%. This means that breaking below the initial price (declining in the first week) is the norm for most platforms, with red markets being the exception. Only by locking in profits promptly at the initial launch can investors ensure their gains.

Deep Retracement Ratio: We consider a drop of over 50% relative to the 5-minute closing price after 7 days as a "deep retracement" (halving). Gate has the highest rate of deep retracements among the samples, with about 31% of new coins experiencing deep retracements within a week. This confirms the liquidity risk associated with Gate's high-frequency listings, where waterfall declines occur frequently the next day. Upbit follows closely, with about 23% of new coins halving within the week, possibly due to overseas speculative coins facing corrections upon entering Korea. Bybit has about 9% of projects halving, while Binance and KuCoin are below 10%, MEXC around 10%, and LBank and Bitget are estimated to be in the 10-20% range. OKX is unclear but has at least experienced extreme cases. Overall, platforms like Gate and Upbit carry higher risks, with nearly a quarter of new coins rapidly halving; while Binance and KuCoin are relatively mild, with deep drop projects accounting for only about 10%.

Through the analysis of these dimensions, the performance of new coins across different exchanges has become quite clear: high-frequency listing platforms present both opportunities and risks, with overall return rates depending on the ability to capture a few explosive coins; while low-frequency selective platforms, although offering fewer opportunities for wealth, also exhibit lower average retracement rates, with return distributions more concentrated in the middle range. For ordinary investors, participating in new projects on high-frequency listing platforms requires more cautious profit-taking and stop-loss strategies, while engaging with popular listings on top platforms is relatively controllable in terms of risk, but high returns should not be overly expected.

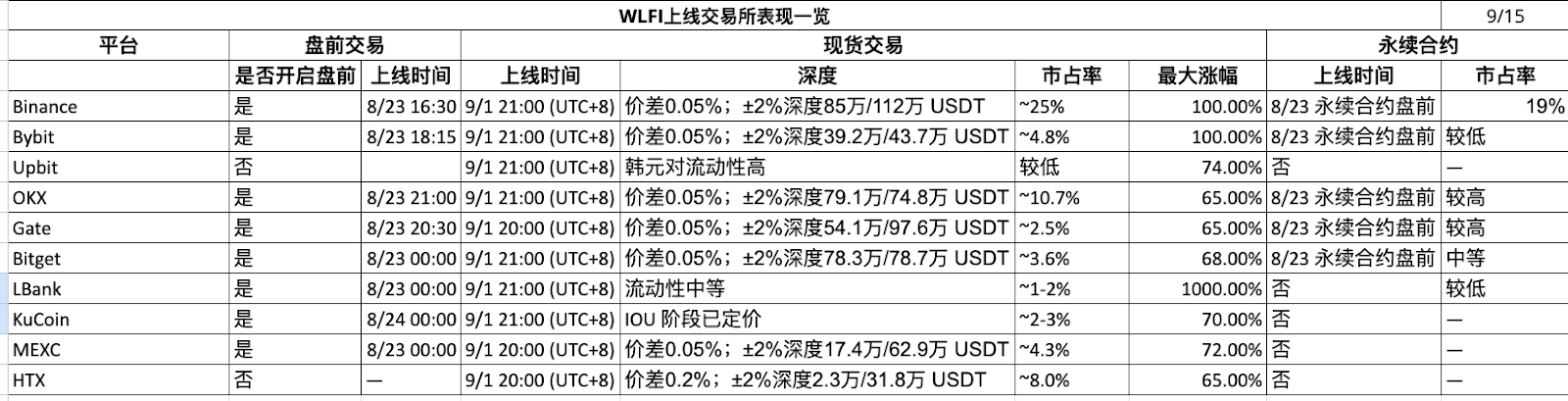

WLFI: Multi-Platform Performance of Trump Concept Coin

Project Overview: WLFI (World Liberty Financial)

WLFI has garnered significant attention due to its alleged support from former U.S. President Donald Trump's family, earning it the nickname "Trump Coin." Around September 1, multiple exchanges, including Binance, HTX, KuCoin, Bybit, and LBank, announced the listing of WLFI, creating a near-global synchronized launch. Binance even labeled it with the rare "Seed Tag" to indicate high risk. Bybit launched an exclusive "Token Splash" airdrop event, while LBank introduced a unique trading compensation program. Such a large-scale multi-platform simultaneous launch is rare in recent years, making WLFI an excellent sample for examining the user structure and marketing strategies of different exchanges.

First-Day Price Trajectory

The opening prices and subsequent fluctuations of WLFI across various platforms showed significant differences. Overall, the first day experienced a "high open and subsequent decline" trend—after a morning surge, the price quickly fell back, but the extent of the surge varied across exchanges:

On KuCoin, HTX, and Binance, WLFI opened at relatively low prices, with buying pressure pushing its price close to doubling, reaching a maximum increase of about 1.97 times (+97%). For example, within minutes of opening on Binance on September 1, WLFI rose from about 0.15 USDT to around 0.30 USDT, before encountering resistance and falling back. An hour later, the increase narrowed, and the 24-hour closing price had retraced to only 34% of the opening price, dropping over 30% below the issuance price after a week. KuCoin and HTX exhibited similar trends to Binance, with a near doubling surge that could not be maintained, closing roughly around the opening price level.

On OKX and MEXC, WLFI opened at a relatively high price without any significant surge, with the opening price becoming the highest price of the day (a "plunge" trend). This resulted in a maximum increase of only about +0.75 times (25% lower than the opening price)【30†First Column】—in other words, WLFI had no upward range on these two platforms, peaking at the opening and then steadily declining. The first-day closing price was over 20% lower than the opening price, and after a week, it still fell about 26%, showing weak performance【30†First Column】. This situation suggests that on platforms like OKX and MEXC, more aggressive buy orders may have pushed WLFI's opening price higher, leaving it unable to rise further afterward.

On Bybit, WLFI's first-day performance was particularly unique. Due to Bybit's simultaneous airdrop event, many users received WLFI tokens for free, leading to selling pressure. At the opening, WLFI's price was quickly driven to a high (high open), with a maximum increase of only 0.58 times, followed by a significant price drop【30†WLFI-Bybit】. Data suggests that WLFI's 5-minute closing price on Bybit was about 0.3033 USDT, which fell to 0.2582 after one hour, and closed at 0.2271 USDT after 24 hours, all below the opening price, with a further drop of about 30% after a week【30†WLFI-Bybit】. While Bybit's airdrop strategy increased trading volume, it also led to heavy selling pressure at the opening, resulting in relatively weak first-day performance.

In Upbit (Korean market), WLFI's first-day performance was also poor. Upbit users showed limited interest in this overseas political-themed coin, with the opening price directly becoming the peak (reportedly recording a "maximum increase" of 0%【30†WLFI-Upbit】). Subsequently, WLFI's price continued to decline, with a 24-hour drop of about 37%, and over 43% lower than the opening price after a week【30†WLFI-Upbit】. This indicates a lack of momentum for chasing prices in the Korean market—possibly due to regulatory environments or investor preferences, leading to a tendency to wait and see rather than engage in frenzied speculation. Additionally, when WLFI was listed on Upbit, the global price had already been inflated and then corrected on other platforms, resulting in a lack of independent market activity in the Korean won.

Liquidity and Trading Volume

The trading volume and liquidity distribution of WLFI at launch across platforms also reflect differences in user structure. As the largest exchange globally, Binance's WLFI/USDT trading pair had a significantly higher trading volume on the first day, with ample depth in buy and sell orders, allowing for a relatively stable price discovery. KuCoin, MEXC, and others, which attracted a large number of speculators, also saw high short-term trading activity, with extreme fluctuations in second-level candlesticks, but their depth was inferior to Binance, making them susceptible to large orders driving prices up or down. Bybit, due to the airdrop distribution, saw a surge of sell orders at the opening, creating significant pressure on buy orders, but it also attracted many bottom-fishing orders, maintaining high trading volume. In Upbit, while the trading volume in the Korean won was less than in the USD market, it still ranked among the top trading volumes of the day in Korea, indicating some level of interest. Overall, WLFI's liquidity was more concentrated in larger exchanges, with stronger price orderliness, while smaller exchanges were active but exhibited chaotic volatility.

Analysis of Marketing Strategies and User Structure Differences

The WLFI case illustrates how the differing strategies of exchanges in launching new coins significantly impacted price trends:

Binance, by labeling it with a "seed tag" and not engaging in additional promotions, attracted a more rational user base, resulting in relatively mild and orderly price movements. Its user structure is primarily composed of global professional investors who are cautious about politically themed coins, leading to a quick return to rationality for WLFI despite initial surges.

Bybit opted for an airdrop frenzy to stimulate trading volume, with its user base largely consisting of derivatives and airdrop enthusiasts. The influx of free tokens, combined with Bybit users' preference for short-term trading, caused WLFI's opening price to be artificially high with heavy selling pressure, resulting in a high open and low close. This indicates a high proportion of speculators in Bybit's user structure, with the platform's strategy reinforcing this short-term trading atmosphere.

Upbit users are primarily local retail investors in Korea, with a relatively conservative investment style and a lack of emotional attachment to non-Korean products. Despite WLFI's global popularity, Korean investors remained restrained, not driving up a frenzied market. This reflects regional market preferences: Korean users favor local concepts or globally mainstream coins, showing limited interest in U.S. political-themed coins. Additionally, Upbit lacks a futures market for short-selling arbitrage, meaning users can only trade spot, leading to a decline in the Korean won market after prices fell on other platforms without support.

LBank, to reduce initial pricing deviations and abnormal matching risks, often implements pre-launch price protection mechanisms and platform-level compensation plans when new coins are listed: setting protective thresholds for opening price ranges, order sizes, and matching anomalies, triggering fallback and compensation processes if activated. This combination helps suppress extreme slippage and enhances the predictability of early price discovery for sentiment-driven coins like WLFI, while also boosting retail participation confidence in the initial launch; correspondingly, the short-term "surge" potential is somewhat suppressed, resulting in a more controllable opening curve and a steadier participation experience.

Platforms like KuCoin, MEXC, and HTX gather a large number of international retail investors and speculative funds, showing high sensitivity to novel concepts. Particularly, KuCoin's community users excel at chasing short-term hot topics, willing to rush in and buy at low prices to drive up prices, which is why WLFI saw an initial surge of nearly 2 times on KuCoin. However, due to the quick in-and-out nature of these funds, once the price reaches a peak, they quickly sell off, leading to price retracement. The marketing strategies of these platforms generally involve broad outreach to cater to the market, lacking additional risk control measures, with new coin trends driven entirely by market sentiment, resulting in significant volatility.

Summary: Cross-Platform Insights on New Coin Launches

Through the WLFI case, we can summarize some general rules regarding the cross-platform performance of new coins:

User structure determines speculation intensity: Platforms that favor speculation (like LBank, MEXC, Gate) can easily produce exaggerated increases on sentiment-driven coins, but may also face heavier selling pressure on fundamentally driven coins. Conservative and rational user groups (like Upbit and some Binance users) tend to react mildly to thematic coins while showing some preference for value coins.

Synchronized launches narrow price gaps: When most exchanges launch a new coin simultaneously, the price discovery process is very brief, and arbitrage quickly eliminates price differences across platforms. In this case, the performance differences between exchanges reflect more in amplitude and details rather than trend-based price deviations.

Platform strategies influence short-term trends: The strategies employed by exchanges (airdrops, trading competitions, trading compensation, etc.) affect the supply and demand of new coins in the initial listing phase. For instance, airdrops increase selling pressure, trading competitions stimulate trading volume and amplify volatility, while trading compensation may reduce the popularity of blind chasing. All of these factors are reflected in the first-day candlestick chart.

Contract tools accelerate return to rationality: Platforms offering new coin futures/perpetual contracts often see spot prices return to rationality more quickly. The short-selling mechanism allows price bubbles to be punctured more rapidly. This is particularly evident after explosive surges in new coins—wherever short-selling is possible, the upward momentum is likely to peak sooner.

Regional markets have their own rhythms: Local exchanges (like Upbit) may exhibit unique response patterns from local investors even when listing global coins. Coins that have been speculated on in international markets may not necessarily perform well locally, and vice versa. This highlights the importance of considering the market environment in which an exchange operates when analyzing new coin trends.

In summary, the differences in new coin performance across exchanges are shaped by both investor composition and platform policies. The same new coin can encounter entirely different scenarios depending on where it is traded. For project teams, launching on multiple platforms has become a trend, but coordinating the launch timing and leveraging each platform's advantages is also a skill. For investors, understanding these differences can help in choosing the right timing and location for participation—where to buy and where to sell can significantly impact final returns. This is precisely the significance of conducting in-depth cross-platform comparisons.

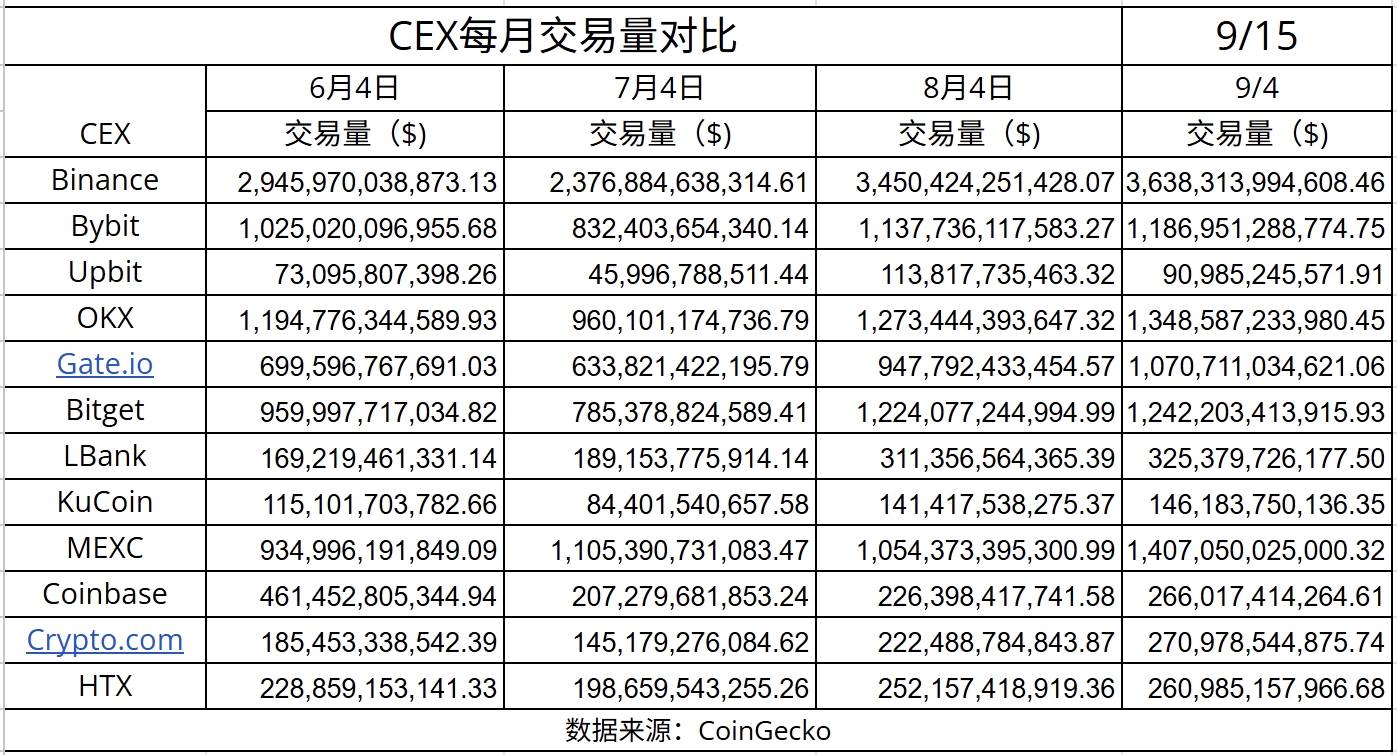

Contract Data Comparison

While the spot market for new coins is certainly eye-catching, the competition and changes in the contract market better reflect the strategic focus of exchanges. In August 2025, as the market warmed up, significant differentiation appeared in the derivative trading volumes of major exchanges. We utilized the indicators in the "Exchange Data Comparison" table to analyze the contract trading situation across the top ten platforms, gaining insights into changes in trading volume scale, growth trends, and coin coverage.

Total Trading Volume and Derivatives Proportion

First, let's look at the overall trading volume and the proportion of derivative trading. According to CoinGecko's statistics on 24-hour trading volume data from early September 2025, the comparison of spot and derivative trading across platforms is as follows (with the proportion of derivatives in parentheses):

Binance: Spot trading volume is approximately $735.6 billion, with USD derivatives around $2.90 trillion, totaling $3.64 trillion/24h, with derivatives accounting for about 80%. As the industry leader, Binance's futures trading volume is nearly four times that of spot trading.

Bybit: Spot trading volume is approximately $126.9 billion, with derivatives around $1.06 trillion, totaling $1.187 trillion, with derivatives accounting for about 89%. Bybit has positioned itself as a contract expert since its inception, with its contract volume nearly nine times that of spot trading.

OKX: Spot trading volume is approximately $114 billion, with derivatives around $1.234 trillion, totaling $1.348 trillion, with derivatives accounting for about 92%.

Gate: Spot trading volume is approximately $129.2 billion, with derivatives around $941.5 billion, totaling $1.0708 trillion, with derivatives accounting for about 88%.

Bitget: Spot trading volume is approximately $131.6 billion, with derivatives around $1.1106 trillion, totaling $1.2422 trillion, with derivatives accounting for about 89%.

MEXC: Spot trading volume is approximately $128.5 billion, with derivatives around $1.2785 trillion, totaling $1.4070 trillion, with derivatives accounting for about 90.8%.

LBank: Spot trading volume is approximately $108.4 billion, with derivatives around $21.69 billion, totaling $32.53 billion, with derivatives accounting for about 66.7%. LBank's proportion of derivatives is relatively low in the sample, at only about two-thirds.

HTX (Huobi): Spot trading volume is approximately $107.3 billion, with derivatives around $15.36 billion, totaling $26.09 billion, with derivatives accounting for about 58.8%. HTX has the lowest proportion of derivatives in this comparison, at less than 60%.

KuCoin: Spot trading volume is approximately $53.7 billion, with derivatives around $92.4 billion, totaling $146.2 billion, with derivatives accounting for only 63%. KuCoin's proportion of derivatives is significantly lower than the aforementioned platforms. This indicates that KuCoin users primarily engage in spot trading, with its contract business relatively lagging. Although KuCoin also offers perpetual contracts, the variety and depth may not match that of leading exchanges, and user engagement in derivatives needs improvement.

Upbit: Spot trading volume is approximately $9.1 billion, with no derivatives trading.

From the above comparison, it can be seen that, with a few exceptions (KuCoin, LBank, Upbit), most exchanges have a trading volume structure dominated by derivatives. Particularly, emerging or second-tier platforms like OKX, Bybit, Bitget, Gate, and MEXC have futures/perpetual trading volumes generally accounting for 85-90% or more, indicating that they have successfully driven platform growth through contract products. This is related to user preferences and platform strategies—young traders prefer high leverage and high volatility, and these platforms are eager to provide a rich variety of contract products to meet demand. In contrast, Binance, while having a massive spot base, still sees its derivatives volume nearly four times that of spot trading, accounting for 80%, indicating that even leading platforms rely on contributions from the derivatives market.

KuCoin, LBank, and HTX show a transitional state: their derivatives business still has a significant gap compared to spot trading, with a proportion around 60%. This may reflect that these exchanges either started their contract business later (like LBank, which only recently launched futures), or have a user structure with a higher proportion of conservative investors (like HTX, where traditional users are accustomed to spot trading), or lack competitiveness in contract products (like KuCoin, where the futures market depth and variety have not fully opened up). As the industry develops, these platforms with lower proportions may need to focus on expanding their derivatives market share to increase overall trading volume.

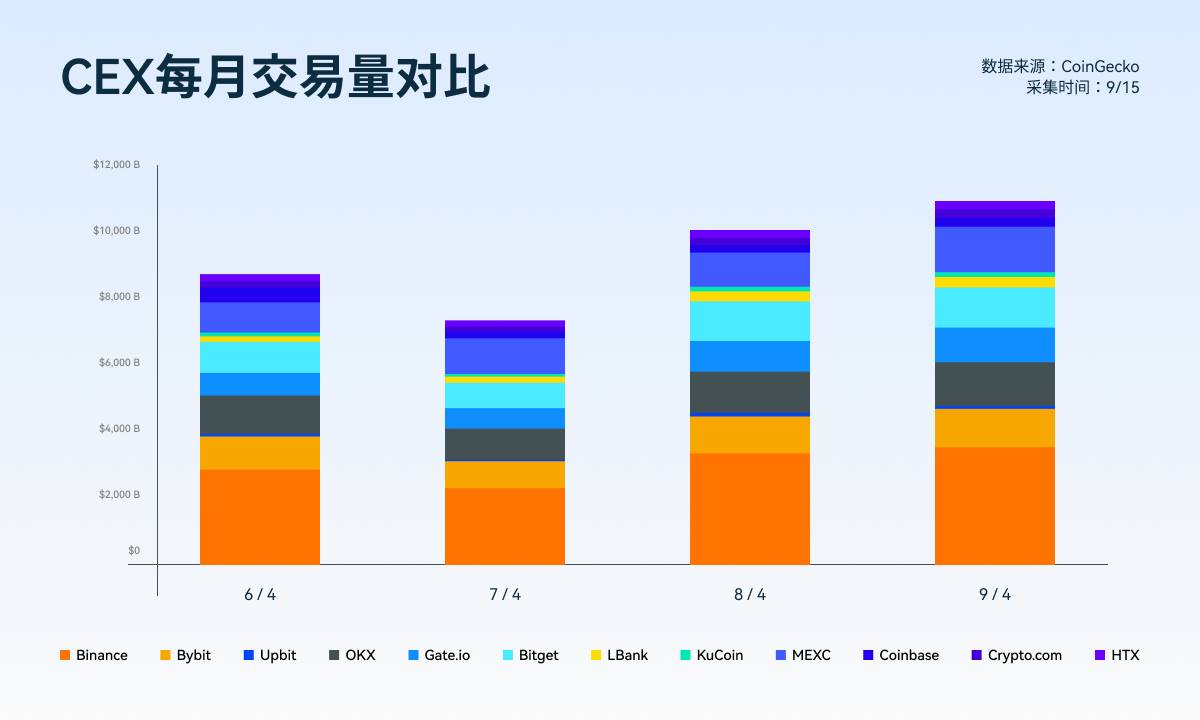

Trends in Contract Trading Volume and Market Share Changes

Observing trading volume trends, we compared data from early June 2025 and early September 2025, calculating the quarterly growth rate of total trading volume for each exchange. This can reflect which platform has experienced rapid growth in the recent quarter and which has stagnated:

LBank: The quarterly trading volume increased by as much as +92.3%, the fastest growth in the sample. Such astonishing growth suggests that LBank adopted aggressive strategies to expand its contract business in Q3, possibly attracting a surge in trading volume through the strong launch of popular coin contracts and contract incentive activities. Additionally, many small coins performed well in Q3, and LBank led in the number of new coin listings, which also boosted total trading volume.

Gate: The quarterly total volume increased by approximately +53.0%. As an established altcoin exchange, Gate reached a new level in trading volume in Q3, primarily driven by derivatives (with derivatives increasing by +62% month-over-month). This is related to Gate's timely launch of numerous new perpetual contracts for hot coins.

MEXC: The quarterly increase was approximately +50.5%. MEXC continued its rapid growth in Q3, solidifying its "dark horse" status. Notably, the significant increase in derivatives brought it close to OKX in terms of derivatives volume.

Bitget: The quarterly increase was approximately +29.4%. Bitget maintained a steady growth trend.

KuCoin: The quarterly increase was approximately +27.0%. KuCoin's total growth primarily came from an increase in spot trading (with many new coins launched in Q3 leading to a rise in spot trading). The derivatives business also showed progress, but the extent was moderate.

Upbit: The quarterly increase was approximately +24.5% (only spot). Upbit benefited from the overall market warming in Q3 and the return of Korean capital, naturally seeing a nearly one-quarter increase in trading volume. This growth rate is similar to that of Binance, indicating that Upbit essentially followed the overall market without extraordinary performance.

Binance: The quarterly increase was approximately +23.5%. As the exchange with the largest base, Binance's 23% month-over-month growth is also considerable. This is mainly attributed to the recovery of market trading sentiment in Q3, with major coins and some small coins seeing increased volume on Binance. Binance itself did not make significant strategic adjustments, even reducing some high-risk products under U.S. regulatory pressure, so its growth essentially represents the average level of the market. In terms of market share, Binance saw a slight decline (due to higher growth rates at mid-sized exchanges), but it still firmly holds the leading position.

Bybit: The quarterly increase was approximately +15.8%. Bybit's growth was relatively lagging, below the industry average. This may be due to several reasons: first, exchanges like Binance have captured some of its users (for example, some users have flowed to Binance after certain regions imposed bans); second, Bybit's Q3 promotional activities were generally moderate, with many new coins launched but limited contribution to trading volume; third, its derivatives market share has been eroded by emerging platforms like Bitget and MEXC. The 15.8% growth may bring Bybit closer to or even surpassed by Bitget in rankings, with a slight decline in market share. This serves as a warning for what was once the second-largest derivatives platform, indicating that Bybit needs to refocus on product and marketing efforts to regain rapid growth.

HTX: The quarterly increase was approximately +14.0%. HTX also experienced modest growth. Under internal and external pressures, the Huobi user base has struggled to expand significantly, with trading volume increases primarily coming from the slight uptick in existing user activity as market conditions improved. The 14% growth rate further marginalizes HTX in the rankings, with market share continuing to decline.

OKX: The quarterly increase was only about +12.9%. OKX experienced the slowest growth, nearly stagnating. This surprised many, as OKX has not been absent in expanding overseas and launching new products recently. However, the data indicates that its trading volume increase is far below that of its competitors. This may be due to OKX's high base, making it difficult to find incremental growth; or it may indicate a slowdown in user growth, especially missing opportunities in new hotspots for altcoins and derivatives.

The above trends indicate that the biggest winners in Q3 in terms of market share are mid-sized platforms like LBank, Gate, MEXC, and Bitget, which expanded at rates exceeding 50% and even approaching doubling, capturing a larger share of the trading volume pie; while traditional large exchanges like Binance, OKX, Huobi, and Bybit lagged in growth, with their market share relatively eroded. It can be inferred that the underlying reason for this is that Q3's hotspots were primarily concentrated in small coin speculation and derivatives—areas where second- and third-tier platforms excel. In contrast, large exchanges, due to compliance and strategic limitations, have not been able to delve deeply into many high-risk, high-reward areas, resulting in limited growth. In the long term, whether this change in market share is stable will depend on the performance of each exchange when a bull market fully kicks off, but at least in a volatile market, smaller and more agile platforms have demonstrated stronger pulling power.

Differences in Trading Volume Structure and Coin Coverage

In addition to the proportion of spot/contract trading volume, the internal structure of contracts can also be compared: for example, the proportion of perpetual contracts versus fixed-term contracts, the proportion of mainstream coins versus altcoins in contracts, and the number of contract targets. These aspects reflect the focus and depth of contract trading at exchanges.

From the perspective of perpetual vs. delivery contracts, almost all mentioned platforms primarily focus on perpetual contracts, which account for the vast majority of trading volume. Delivery contracts (fixed-term contracts) are only offered by a few full-category exchanges like Binance and OKX, and they are gradually becoming marginalized compared to perpetual contracts. Therefore, we can focus on the comparison of perpetual contracts.

Mainstream coins vs. altcoins: The contract volume on leading exchanges like Binance and OKX is still highly concentrated on mainstream coins such as BTC and ETH. For example, the trading volume of BTC/USDT and ETH/USDT perpetual contracts on Binance may exceed 50%. In contrast, while there are many altcoin contracts, their individual trading volumes are limited. Platforms like MEXC and Gate attract users who are interested in trading altcoins, resulting in their contract trading being more dispersed across a large number of altcoin targets. For instance, a newly launched perpetual contract on MEXC can see trading volumes exceeding $100 million in a day, while it may not even be listed on Binance. On Gate, perpetual contracts for low market cap coins like PEPE have at times ranked among the top in trading volume across the platform. This reflects that leading platforms succeed through "depth in large coins," while second-tier platforms succeed through "breadth in small coins."

Number of contract targets: Binance currently offers around 150 USDT-based perpetual contracts and several dozen coin-based contracts. OKX provides about 200 contracts, including many DeFi and popular projects. Bybit also has over 150 contract targets. In contrast, MEXC claims to offer more than 250 perpetual contracts, almost covering all the altcoins it lists. Gate has around 200 contracts. KuCoin has relatively fewer contracts, with just over 100. LBank has a very limited variety of contracts, possibly only a few dozen mainstream coins and some popular altcoins. Upbit has no contracts. The differences in variety indicate that MEXC and Gate are willing to increase the number of altcoin contracts to attract users, while Binance is cautious about altcoin contracts, controlling their quantity. Bitget and Bybit are in the middle, offering a considerable number of new coin contracts but with selectivity (for example, Bitget may choose some coins based on popularity for contracts, but not necessarily list everything like MEXC).

Trading tools and features: Besides quantity, there are also differences in the detailed features of contract trading. For instance, in terms of leverage, Binance and OKX offer up to 125x leverage on mainstream coins, while altcoins generally have a cap of 20-50x. MEXC sometimes offers high leverage on altcoins to attract gamblers. Additionally, in terms of liquidity provision, Binance and others have large market-making teams to ensure depth and minimize slippage; some smaller platforms may have thin depth on certain contracts, making them susceptible to liquidation. Other differences include funding rates and the strength of insurance funds. Overall, leading platforms exhibit better professionalism and stability in the contract market, while emerging platforms win through aggressiveness and flexibility, albeit potentially sacrificing some stability.

Hotspot tracking: Strategically, some exchanges are keen on chasing market hotspots. For example, MEXC and Gate will quickly launch perpetual contracts when new coins become popular, allowing users to trade in both directions. For instance, during the hype around the Friend.tech concept this year, related coins like BLUR had futures trading on these platforms, attracting significant volumes. Bitget and Bybit also chase hotspots but are somewhat more cautious, usually ensuring that a spot listing is available and has basic liquidity before launching contracts. Another group of exchanges focuses on mainstream coins and does not casually list obscure contracts. A typical example is Coinbase (which only offers BTC and ETH futures and is not within our discussion scope), and OKX (which also does not recklessly list extremely low market cap futures). Binance is positioned between the two: selectively participating in hotspots, such as launching perpetual contracts for PEPE when it was extremely popular, but generally not listing most altcoins.

The results of these differences are that user stickiness in contract trading varies across exchanges. Users who enjoy trading small coins are often active on Gate, MEXC, Bitget, etc., as they go where new varieties are available; meanwhile, funds trading large mainstream coin contracts prefer Binance, OKX, etc., due to their reliable depth and low slippage. In the short to medium term, when small coin markets are hot, the contract volumes on mid-sized platforms surge; when the market returns to rationality, and large funds focus on BTC, the positions of leading platforms become prominent again. These two models are not entirely opposed; many exchanges attempt to "grasp both sides"—promoting both small coin contracts and maintaining large coin markets. For example, Bitget and Bybit follow this strategy, offering a large number of altcoin perpetual contracts while competing with Binance on major coin depth. This versatile approach requires resource and technical investment, as well as market positioning. Currently, Binance is still recognized as the king of all-category contracts, but other platforms are differentiating themselves to gain ground in specific areas.

Summary of New Coins and Contract Performance Comparison

Through the comprehensive comparison of spot new coins and contract trading above, we can draw several key conclusions:

(1) The platform with the strongest explosive power for new coins: If we evaluate "explosive power," platforms like LBank, Gate, and MEXC exhibit the strongest short-term explosive power for new coins—provided that investors can pick the right "rocket." However, it is important to emphasize that the high returns on these platforms come with high failure rates and deep drawdowns, with volatility far exceeding that of leading exchanges.

(2) The platform with the best overall performance for new coins: From the perspective of obtaining relatively stable returns across most projects, Binance and KuCoin show better overall performance for new coins. Binance has a lower failure rate for new coins than average, with few instances of significant losses, making it less likely for investors to hit a landmine; KuCoin has about one-third of its projects showing gains within a week, with average and median returns ranking among the best in the sample (average +15%, median only -8%). Although OKX lists fewer coins, the few new coins it does list have not experienced exaggerated deep declines, showing relatively stable performance. Upbit, primarily following mainstream coins, does not see large increases but maintains controllable risk. Overall, from a perspective of stable profitability, Binance and KuCoin are slightly better, followed by Bitget/Bybit (as their averages are pulled up by extreme values, with lower medians), while Gate/MEXC face the most challenges (with polarized profits and losses). Of course, the term "overall best" here is based on a risk control standpoint; aggressive investors may place more emphasis on the "explosive power ranking" mentioned earlier.

(3) The platform with the fastest increase in contract transaction share: In terms of quarterly growth, LBank, MEXC, and Gate are the three platforms with the fastest increase in contract transaction share and scale. LBank's contract volume doubled quarter-over-quarter, with the derivatives share rising from about 55% to nearly 67%, indicating its success in converting a large number of spot users into contract trading users. MEXC and Gate already had high derivatives shares, which increased by about 5 percentage points each, solidifying their advantageous position in high-leverage trading. Bitget and KuCoin also increased by about 4 percentage points each, further highlighting the growing importance of the derivatives sector. In contrast, OKX and Bybit's derivatives shares remained basically flat, while Binance saw a slight increase but with little change (due to its large base). HTX showed almost no change, still hovering around 60%. Overall, mid-sized platforms generally saw a faster increase in contract share, as these platforms clearly leaned towards driving growth through contracts in Q3; leading platforms, due to their base and positioning, saw little change in share but their absolute volumes also increased. It can be anticipated that with the rise of these emerging players, the landscape of the contract market will become more diverse, no longer dominated by a few leading exchanges.

(4) The closed-loop effect of new coin quantity and contract support: From our analysis, we can see that some exchanges have formed a closed-loop ecosystem of "new coin spot + corresponding contracts," while others have not fully integrated. Typical examples include Bitget, LBank, Gate, and MEXC, which rank high in the number of new coin listings and also provide contract trading for almost every hot coin. This linkage between spot and contracts forms a closed loop, benefiting users by allowing them to complete both spot buying and leveraged trading of new coins on the same platform without needing to switch, naturally increasing trading stickiness and volume. For example, a user on LBank sees a new coin X performing well and can first build a position in the spot market, then immediately open a contract to leverage long, and after making a profit, close the position in the spot market—all within LBank. For exchanges, new coins bring spot traffic, and contracts further amplify trading volume, with both complementing each other. In contrast, platforms like Binance and OKX have not formed such closed loops as quickly: they list coins infrequently or slowly, and many new coins are not available for contracts without first being listed in the spot market (or they wait for the coin price to stabilize before considering launching contracts). This forces some users to go to other platforms to trade altcoin contracts. Binance has also attempted to synchronize contract launches with projects like Launchpad (such as futures after the ARB airdrop), but overall, the pace has been relatively conservative. KuCoin and HTX have listed some new coins but have not timely provided corresponding contracts, leading users who want to leverage to turn to other platforms, resulting in capital outflow. Overall, those platforms that have achieved the linkage of new coin listings and contracts have reaped significant benefits in Q3, with both trading volume and user retention benefiting; while platforms that have not achieved a closed loop have missed out on some trading volume potential.

(5) User returns and platform strategy alignment: Through comparisons of different platforms, we also find that the return prospects for investors on different exchanges align with the strategic positioning of those platforms: high-risk, high-return platforms (like LBank, MEXC, etc.) may offer huge short-term returns on new coins, but these are generally unsustainable, suitable for players skilled in short-term trading and quick entries and exits; while stable platforms (like Binance, OKX, etc.) may have fewer opportunities for new coins but offer relatively stable returns, suitable for investors who prefer lower volatility. Similarly, in contract trading, aggressive platforms provide more altcoin contracts and higher leverage, meaning profits can multiply many times, but losses can also lead to liquidation overnight; stable platforms primarily promote mainstream coin contracts, with market fluctuations being relatively controllable. This risk-return matching reflects that the ecology of each exchange has formed a certain "character": users will make choices based on their own risk preferences, and over time, these choices reinforce the strategic direction of the platform. For example, those willing to gamble on new coins flock to LBank/Gate, which in turn encourages these platforms to list various new coins, creating a cycle. For investors, when trading new coins or contracts, they should also fully consider the attributes of the platform, viewing it as part of their investment portfolio: making quick profits on one platform while doing stable allocations on another to achieve a balance of returns and risks.

Extension: The Trend of Ecological Linkage in Exchanges' Self-Built Chains

In addition to discussing new coins and contracts, we also need to pay attention to a broader trend: the self-built public chains or layer two network ecosystems of exchanges, and their potential linkage with new coins and contract businesses. Currently, many leading exchanges are laying out their own blockchains, such as Binance's BNB Chain, the Mantle network promoted by Bybit, and the Base network launched by Coinbase (which is also an Ethereum layer two). Additionally, although not developed by exchanges, emerging Layer 2 solutions like ZKSync are worth considering due to their partnerships with multiple exchanges (for example, the Bitget wallet integrates the ZKSync ecosystem). By comparing these strategies, we can explore how the future linkage closed loop of "new coins - contracts - on-chain ecology" may form.

Current overview of exchange chain strategies:

Binance: Early on, Binance launched its independent blockchain, BNB Chain (formerly BSC), which once thrived; in 2023, it launched opBNB as an Ethereum-compatible layer two, aiming to enhance performance and attract developers. Binance's strategy is to build its own on-chain kingdom, especially leveraging the Binance Alpha points system to attract retail investors while allowing projects to list an unlimited number of tokens, forming a unique tripartite win-win model of "retail support data - Binance Alpha acting as a bridge - projects being infinitely enriched." Additionally, by utilizing stronger capital and the DATs model to reshape new capital, it aims to drive up the value of BNB and on-chain trading volume, subsequently listing corresponding project tokens on centralized exchanges to form a closed loop.

Bybit/Mantle: Bybit uses Mantle as an extension of its own ecosystem: on one hand, it allows Bybit users to participate in Mantle chain projects (such as providing Launchpad, staking, and airdrop rewards for Mantle ecosystem projects); on the other hand, it quickly lists outstanding new project tokens from Mantle on Bybit's spot and contract markets. This way, Bybit users can enjoy on-chain benefits (like early mining airdrops) while conveniently trading and cashing out on the exchange, creating a synergy between on-chain and off-chain activities. The more prosperous Mantle becomes, the more Bybit benefits.

OKX: OKX has maximized market exposure through strong price surges and a combination of X Layer promotions. Currently, both of its token assets have performed well in the market, marking a significant turnaround, though the sustainability of this heat remains to be seen; time will tell.

Coinbase/Base: Coinbase has attracted a large number of users to its wallet and services through Base. Although Base has not yet launched a token, the prosperity of on-chain projects will ultimately flow back to the Coinbase exchange. Coinbase has already tasted success with Base, prompting other exchanges to follow suit. Recently, there may be a trend for Base to issue tokens, further igniting this network.

Future Closed Loop Outlook

The linkage of "new coins - contracts - on-chain ecology" can be imagined in the following scenario: an exchange incubates a new project A on its own chain -> Project A issues tokens to attract a community on-chain, with prices discovered through on-chain DEX -> The exchange notices the popularity of project A and lists its tokens for trading on the centralized platform, also launching contract trading for project A -> The centralized exchange brings massive liquidity and higher prices to project A, attracting more people to participate in A's ecological applications on-chain (like Yield Farming) -> Project A's ecosystem flourishes, on-chain transaction fees rise, and the value of the chain's native tokens (like BNB, MNT, etc.) increases, further benefiting the exchange financially. Additionally, the exchange may offer special treatment to projects issued on its chain, such as a green channel for direct token listings, more trading pairs, and higher leverage for contracts, encouraging projects to choose its chain. This will create a situation where the strong get stronger: projects within the exchange's ecosystem are more likely to succeed, and successful projects further enrich the ecosystem, prompting other projects to join the chain ecosystem due to this demonstrative effect.

For users, this closed-loop linkage means more opportunities and greater convenience. In the past, users had to go through multiple steps to chase a new project, participating in IDOs/airdrops, then trading on DEXs, and finally waiting for centralized exchanges to list them, which was quite cumbersome. In the future, if exchanges connect on-chain and off-chain, users can directly participate in early on-chain projects on the exchange platform (for example, Launchpad directly connecting to its on-chain issuance), and once the project tokens are credited, they can trade them on the exchange. When users want to engage with on-chain applications, the exchange will provide cross-chain bridges for direct access. This one-stop experience will significantly lower the participation threshold, attracting mainstream capital into the previously complex on-chain world.

Of course, achieving this closed loop also presents challenges: project quality control, regulatory risks, and technical stability, among others. If exchanges relax their review of on-chain projects for the sake of ecological prosperity, fraudulent projects may emerge, harming the exchange's reputation. If a large number of tokens on self-built chains are traded exclusively on the exchange, regulators may worry about price manipulation and benefit transfer, leading to increased scrutiny. Furthermore, both on-chain protocol security and exchange system security require dual guarantees; otherwise, a problem in one link could jeopardize the whole system (for example, if the chain is hacked, the exchange's token could plummet). Therefore, exchanges need to find a balance between openness and security.

From the current progress, Binance and Coinbase have already taken solid steps toward this closed loop: Binance has successfully achieved multiple asset increases through the combination of Binance Alpha + USD1, with the potential implication of "contracts first, then spot" becoming a market trend indicator; it is foreseeable that going on-chain will no longer be just a marketing gimmick but will become an indispensable part of CEX operations, with "new coins - contracts - on-chain" truly merging into one: exchanges will be both trading venues and blockchain network operators, as well as investors in new projects. A more closed-loop cryptocurrency economic system may emerge.

The cryptocurrency trading industry in 2025 is undergoing profound changes from multiple dimensions. The launch of new coins is reaching a peak, competition in derivatives is intensifying, and exchanges are increasingly crossing into blockchain territory. In this era, investors face more opportunities as well as challenges. This article aims to help readers clarify the strengths and weaknesses of different platforms through an in-depth analysis of new coin and contract data from the top ten exchanges. Before chasing the next hundredfold coin or opening a high-leverage contract, choosing an exchange that aligns with one's strategy and risk preferences is undoubtedly the foundation for success. At the same time, we should also recognize that centralized exchanges and on-chain ecosystems are accelerating their integration, and future investment opportunities will no longer be limited to isolated platforms but will exist within the synergistic effects of on-chain and off-chain interactions. The closed loop of "new coins - contracts - on-chain ecology," once formed, will give rise to new growth poles and wealth effects, redefining the rules of the cryptocurrency market. Let us watch the evolution of this trend, continuously learn and adjust in practice, and seize the opportunities presented by the times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。