Recently, I read a report from an American investment bank, summarizing in one sentence: we are not yet at the "bubble burst" stage, but market risks are accumulating.

Yesterday, Goldman Sachs also released a similar report on the outlook for U.S. investment strategies, introducing the current situation of the U.S. stock market from several dimensions.

First, it introduced some typical characteristics of bubbles, which we can compare against:

1️⃣ Asset prices are soaring: This is usually the most intuitive manifestation of a bubble.

2️⃣ Valuations are absurdly high: For example, the price-to-earnings (P/E) ratio far exceeds historical levels and is disconnected from fundamentals.

3️⃣ Systemic risk is increasing: Mainly due to a significant increase in leverage (borrowing to invest).

Based on the above points, Goldman Sachs listed reasons why we are not in a bubble now and compared it to the internet bubble of 2000:

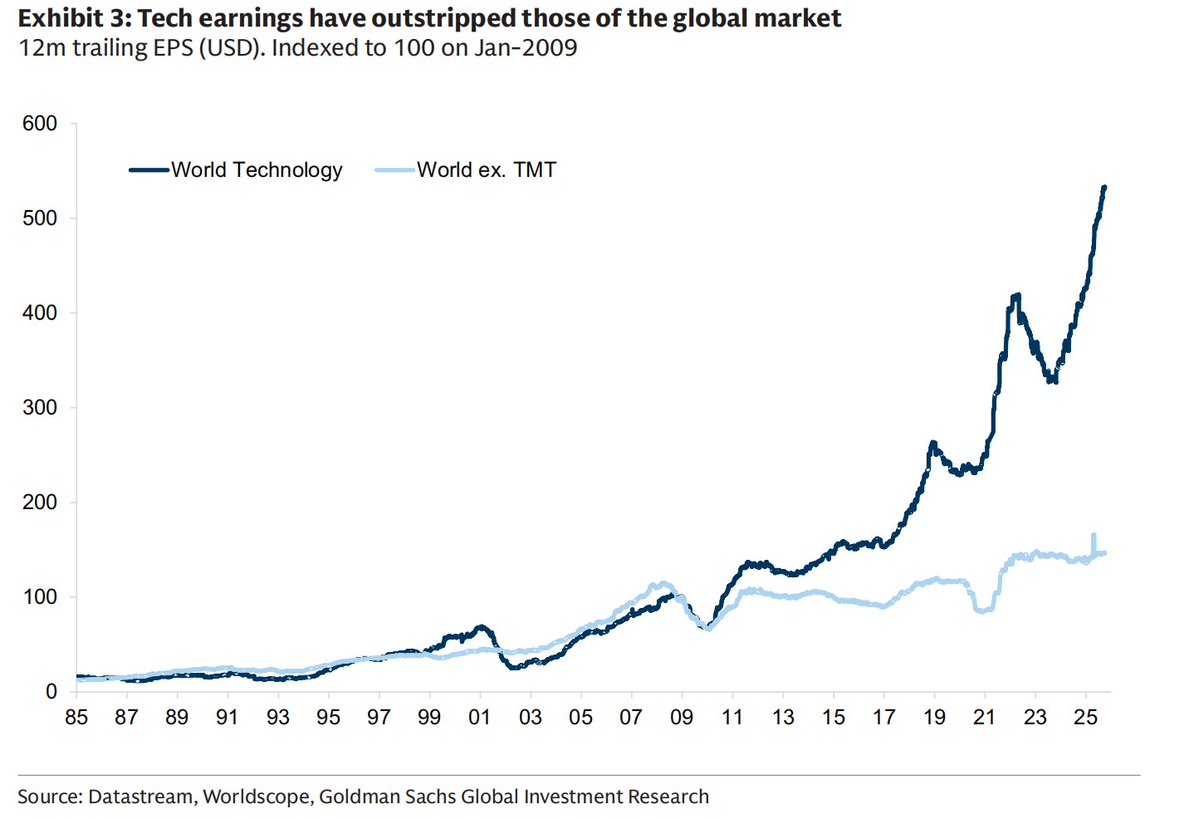

1️⃣ Profit growth vs. speculative trading: This is the most important point. In past bubbles, such as the internet bubble, many companies' stock prices rose based on "irrational" speculation about future growth. At that time, investors rushed into any new company associated with "the internet," hoping to find the next giant. But this time is different; as we often say, the "seven giants" of the U.S. stock market have seen their stock prices rise based on solid and strong profit growth. The profitability of these companies, especially the earnings per share (EPS) in the tech sector, is much higher than in other sectors. As shown in the chart below, the profit growth curve of tech companies is "leaps and bounds ahead."

2️⃣ Healthy company balance sheets: In past bubbles, many companies borrowed heavily to expand. But now, leading tech companies have very strong balance sheets. Although they are increasing capital expenditures for #AI, most of this money is funded by their own free cash flow rather than through heavy borrowing. This significantly reduces systemic risk (it seems the new trend is mutual capital investment).

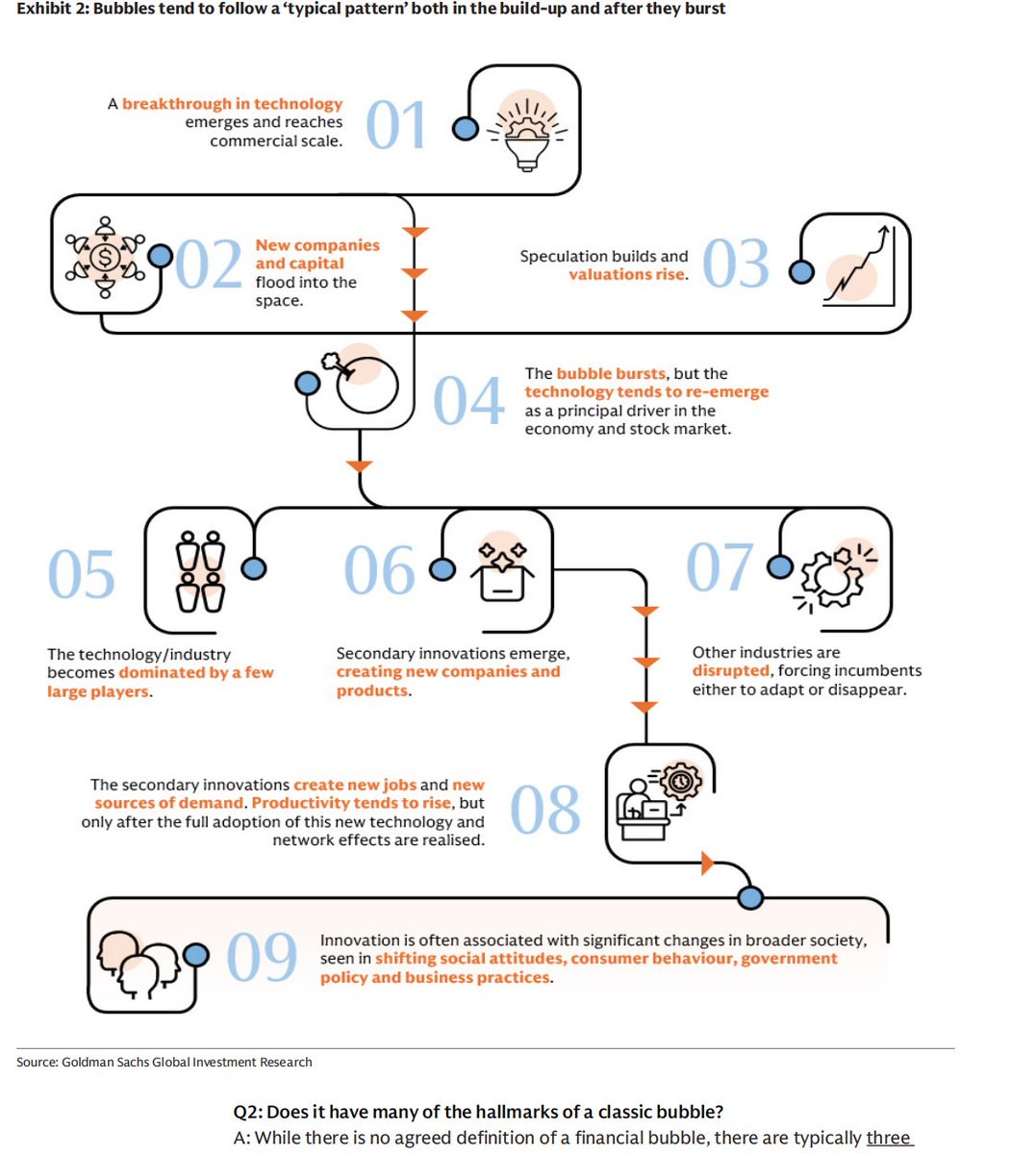

3️⃣ Market competition landscape: Historically, bubbles often formed when a large number of competitors emerged in a new field, with everyone rushing in. For example, during the internet bubble, countless ".com" companies emerged. In the current AI field, so far, it is mainly a few established giants that are leading (as shown in the chart below, you can see the path tree of bubble formation).

Finally, the entire report suddenly took a turn, first raising and then dampening expectations. Goldman Sachs believes that while we are not in a bubble now, there are some risks worth our attention:

1️⃣ Valuations are rising: Although we have not reached the extreme levels of historical bubbles, current valuations are indeed high. Especially in the U.S. market, the P/E ratio has exceeded the highest point of the past 20 years. This indicates that the market has high expectations for future growth, and if future profits do not meet expectations, it could trigger a significant correction.

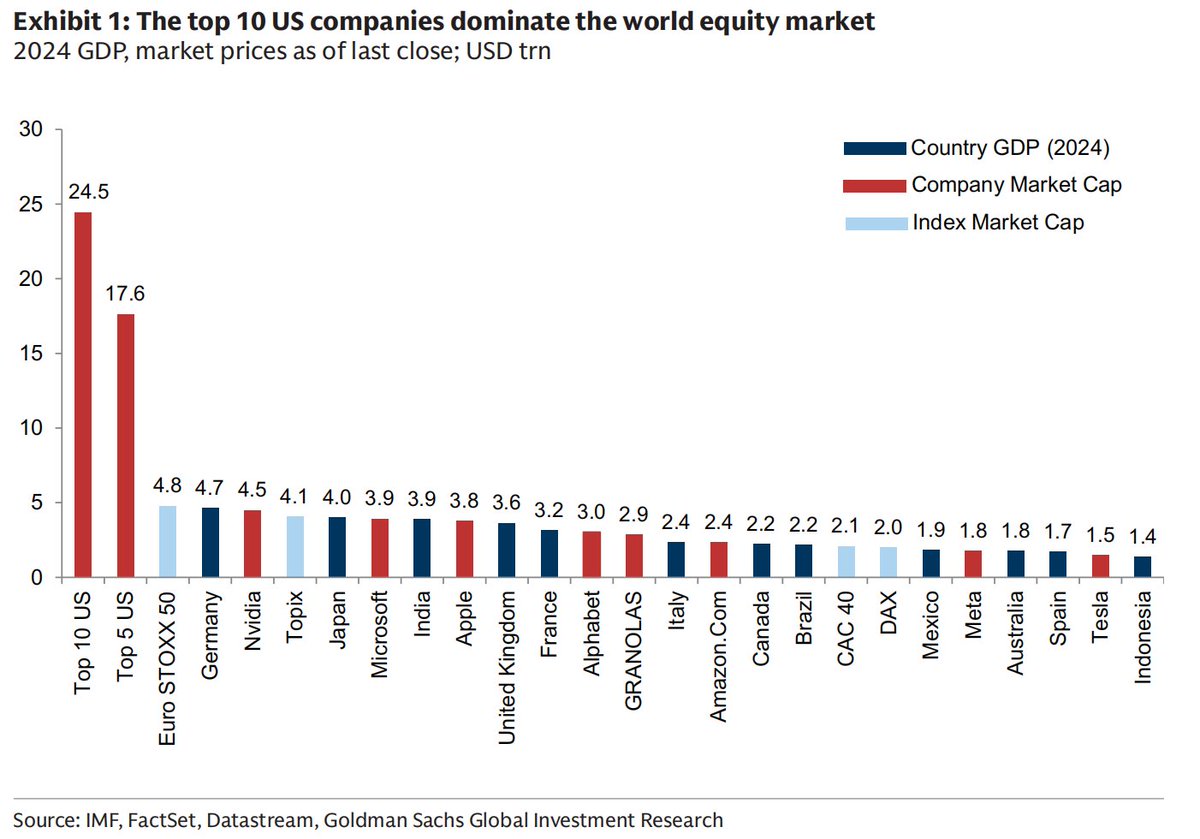

2️⃣ Market concentration is too high (as shown in the chart): Currently, in the U.S. stock market, especially in the global market, a few leading tech companies hold too much weight. The top 10 tech stocks in the U.S. (including Nvidia, Microsoft, etc.) account for nearly 25% of the global stock market value, totaling $25 trillion, which exceeds the combined GDP of the Eurozone, the UK, Japan, and other economies. The performance of these companies has a decisive impact on the entire market index. Although there have been many periods of high market concentration in history, and not all ended with a bubble burst, this extreme concentration itself is a risk; if these companies encounter problems, the entire market will be affected.

3️⃣ Surge in capital expenditures: These tech giants are significantly increasing capital expenditures to compete in #AI. The report includes a chart showing (since only four images can be included, please message me to join the U.S. stock group for a free report) that starting in 2023, these companies' capital expenditures are expected to double in the coming years. Although currently mainly funded by their own resources, excessive investment may lead to a decline in future capital returns, similar to past bubbles in railroads, canals, and telecommunications, ultimately resulting in overcapacity.

Therefore, Goldman Sachs' current investment advice is: the era of blindly buying U.S. stocks and making money is over. As a U.S. stock investor, my current strategy is:

1️⃣ Don't panic, but stay vigilant: I don't think we should sell all tech stocks because their profit foundation remains solid. However, I also won't blindly chase high prices.

2️⃣ Diversify investments: The report repeatedly emphasizes the importance of diversification. I won't put all my eggs in a few tech giants' baskets. I am starting to pay attention to some traditional industries, such as energy, resource stocks, and utilities. The development of #AI requires huge power and infrastructure support, which will bring new growth opportunities to these industries.

3️⃣ Focus on "new stars": Within the tech sector, future growth may expand from the current leading companies to those "new star" companies that can develop new products and services using #AI infrastructure. For example, in the storage industry, companies like Micron Technology and Western Digital, especially with the release of Sora2, will see an increasing demand for storage!

Although historically, Goldman Sachs' reports have often served as contrarian indicators, several of their reports this year seem to have turned this situation around, especially with their bold overestimation and analysis of gold, which has indeed resonated with people, now bullish up to $4,900. So this report can be considered relatively objective; switching investment sector strategies is the way to ensure success! 🧐

Finally, if you are trading U.S. stocks and cannot register with Futu Securities or Tiger Brokers, I recommend using the RWA tokenized platform #Mystonks to invest in the U.S. stock market: http://mystonks.org/?code=Vu2v44

Message me to join our U.S. stock research group for free, and receive free investment bank research reports and passwords! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。