$AXB @aixbet_ai's new investment on Virtuals has just started, and currently, the participation in terms of funds and number of people is still relatively low.

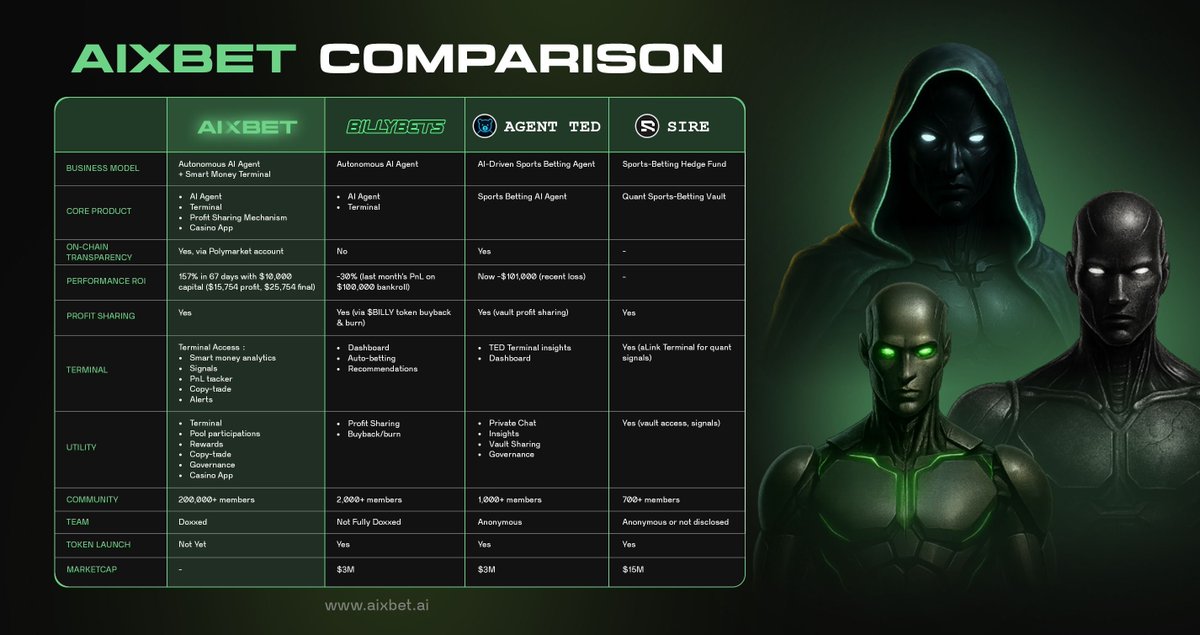

As a project launched in June this year, the core logic of AIxBET is quite clear: an AI-driven prediction platform.

From a mechanism perspective, AIxBET resembles a "smart money following betting system":

- Tracking and analyzing the smart money addresses in the prediction market

- Studying their behavioral patterns (how they bet, when they exit, profit and loss situations)

- Converting data into AI signals and taking action

The core assumption of this logic is that there is information asymmetry in the prediction market, allowing a few smart money players to continuously profit.

However, this brings up the first deep issue—sustainability of information arbitrage.

If there truly exists a smart money pattern that can be identified and replicated by AI, then:

- This pattern will become ineffective due to large-scale replication

- Real smart money will adjust strategies to avoid being tracked

- Market efficiency will gradually improve, and arbitrage opportunities will shrink

This is the fundamental paradox faced by all strategies that follow smart money.

The second issue is data verification.

AIxBET claims:

- 3 funds pools running for 67 days

- Initial capital of $30,000

- Final value of $77,262

- Total investment return rate of +157%

However, this data cannot be independently verified at all. I attempted to experience their terminal, which is currently in a closed state.

From the perspective of token economics, the design of $AXB does show some thought:

- Total supply of 1 billion, TGE circulation of 500 million (50%)

- Team tokens unlock 1 year after TGE, with a 6-month linear release

- Profit-sharing pool adopts a ve mechanism, with higher multiples for longer lock-up times (up to 3.25x)

This design avoids early selling pressure and incentivizes long-term holding.

There is also a team credibility issue. Several core team members have blank social media accounts with very few followers.

Successful DeFi project founders, such as Michael Egorov of Curve and Hayden Adams of Uniswap, have long public records of building. Their credibility is built on years of technical contributions and community interactions.

In summary, AIxBET is facing not a technical problem, but challenges in business logic and credibility. Participating at this stage feels more like betting on the market hype of the "AI + prediction market" narrative.

The way to break through is quite simple: more information disclosure + more proactive building + more available products and services launched.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。