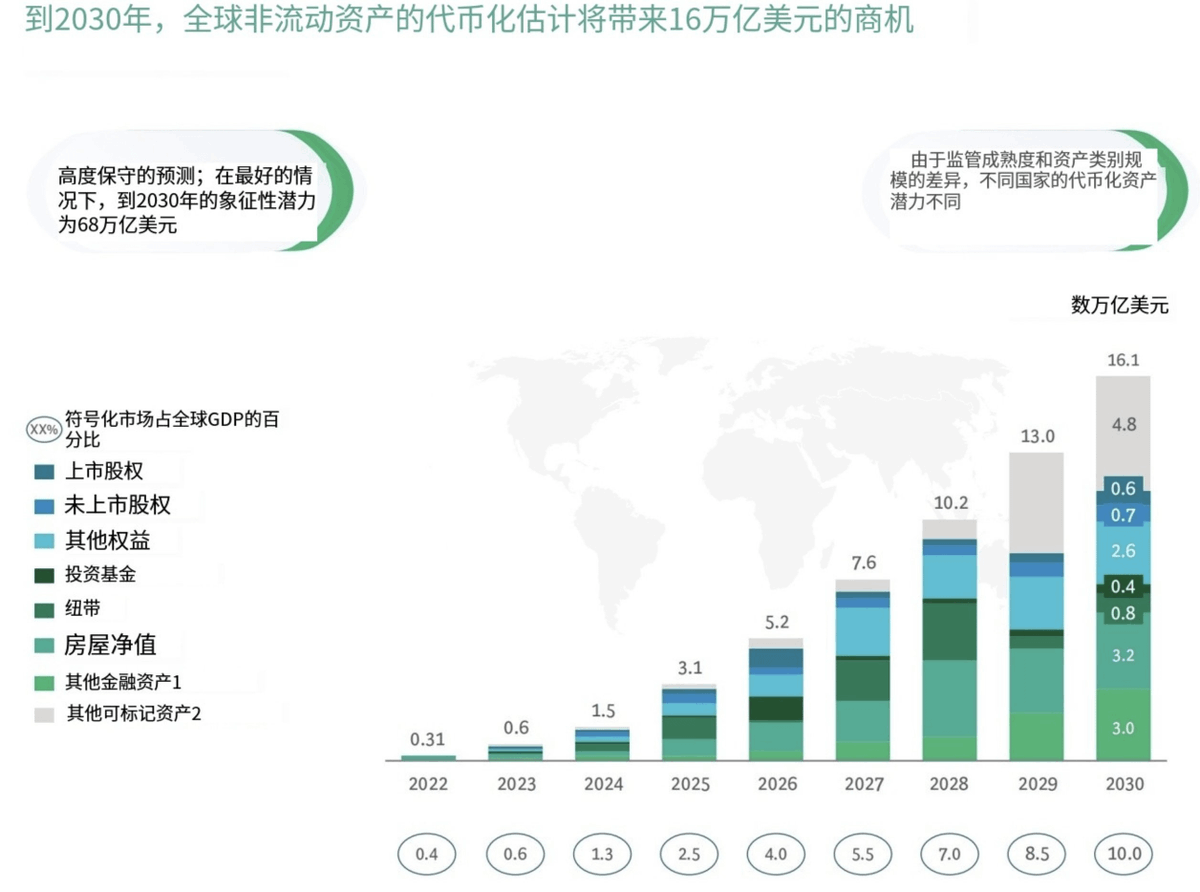

Larry Fink, the CEO of BlackRock, mentioned in an interview that #RWA and #AI are the biggest opportunities in the next decade. Especially after the implementation of the Genius stablecoin bill, the #RWA sector has received unprecedented attention, with related projects emerging rapidly. According to a report from Boston Consulting, #RWA is a massive market with a value of $16 trillion (as shown in Figure 1). Currently, the biggest pain points restricting the development of #RWA are compliance, privacy, and institutional adoption and compatibility. These pain points are precisely the core advantages of @CantonNetwork, which is working with Wall Street to build a "Global Financial Operating System" (Financial OS).

1️⃣ The #RWA public chain truly trusted by Wall Street

We often say that institutional adoption is the ultimate goal of #Web3. But to be honest, while public chains like ETH and Solana have thriving ecosystems, institutions are always hesitant to conduct real RWA financial transactions on them—too transparent, too chaotic, and too difficult to comply with.

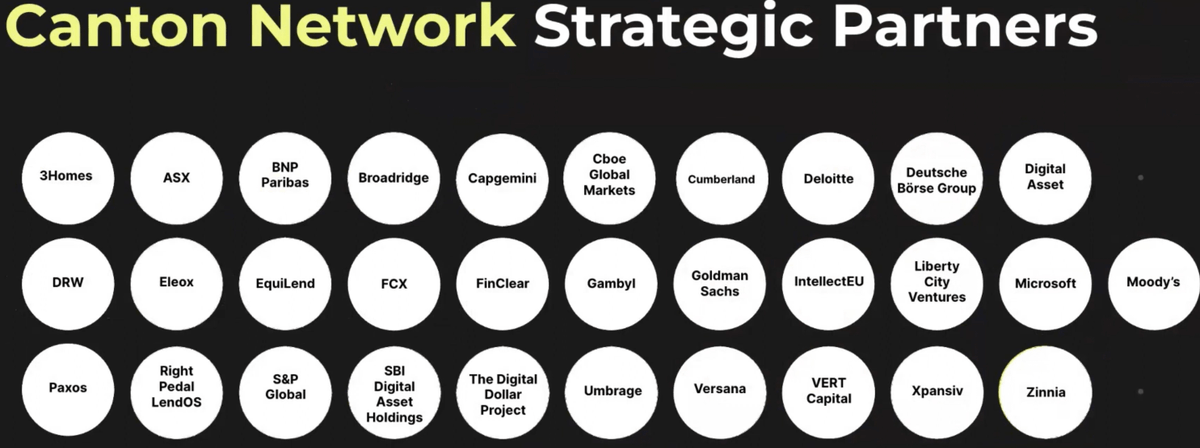

Canton has changed this situation. It is a financial network built with the participation of institutions such as Goldman Sachs, BNP Paribas, HSBC, BNY Mellon, DTCC, Tradeweb, Bank of America, Citadel, and Hong Kong Stock Exchange (Synapse). They are not "advisors," but actual participants running transactions on-chain. This level and scale are rare in the #RWA sector!

💰 Currently, there are:

• Over $6 trillion in RWA (real-world assets) on-chain

• Processing $4 trillion in transaction volume monthly

• Including $10 billion in U.S. Treasury repurchase transactions daily

These numbers are not "testnet" hype; they represent real financial business happening on-chain. This is why I call #Canton the "Financial Operating System of Wall Street on-chain."

2️⃣ Dual-driven by capital and technology

In 2025, #Canton just completed a round of strategic financing of $135 million, led by DRW Venture Capital and Tradeweb Markets.

DRW is no small player; it is one of the largest traditional trading firms globally, founded by legendary trader Don Wilson, who has even worked with Eric Trump. Headquartered in Chicago, its business spans traditional finance and crypto assets, with a strong presence in global financial centers.

Other investors include: BNP Paribas, Circle Ventures, Citadel Securities, DTCC, Virtu Financial, Paxos, etc.

This level of financing can be understood as not just raising money but as forming alliances—indicating that almost all core nodes of the global mainstream financial market have joined the #Canton ecosystem.

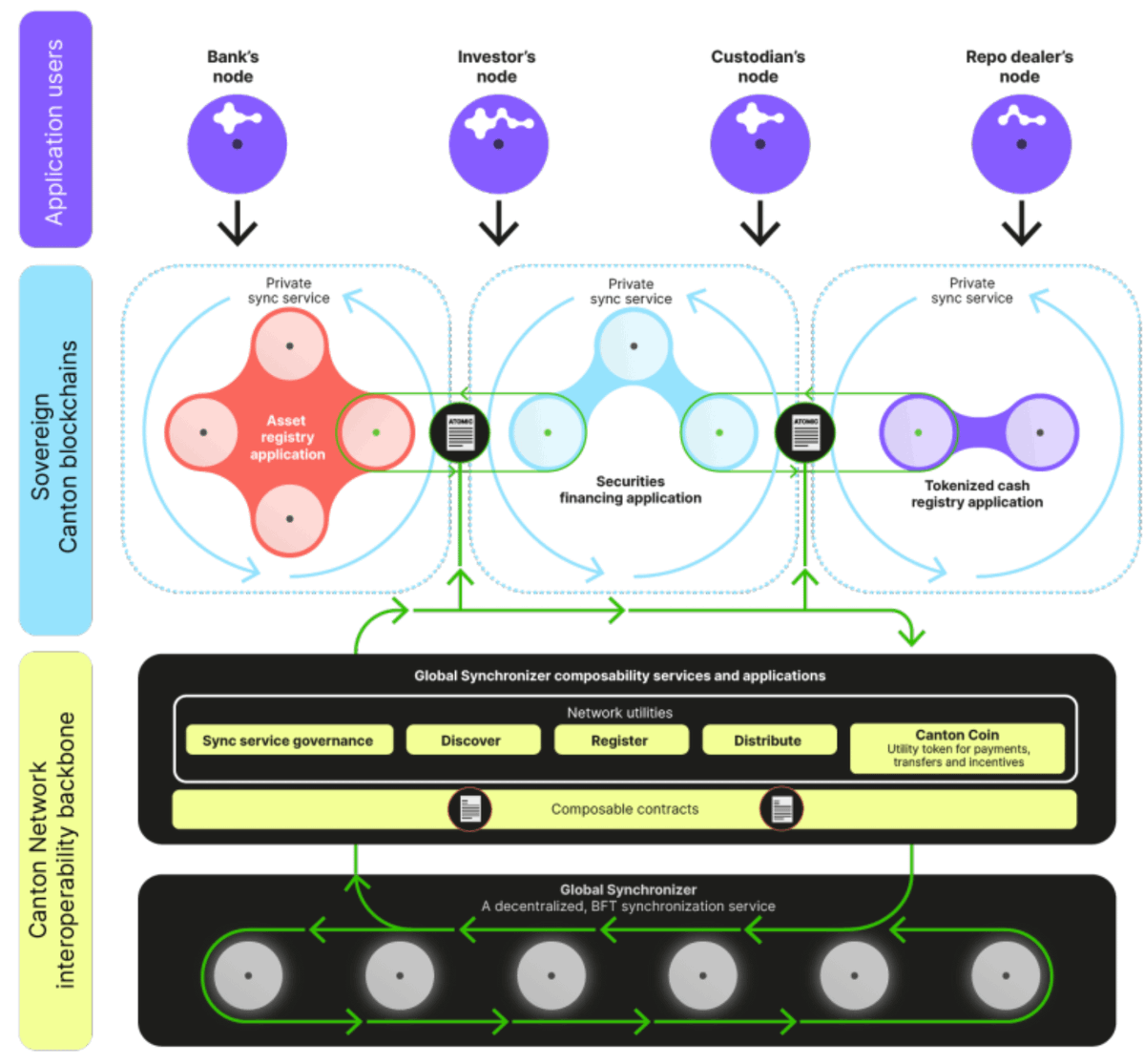

Technologically, #Canton employs a two-tier consensus mechanism; Global Synchronizer for cross-timezone instant settlement; and infinite horizontal scalability (network of networks architecture) among other core technologies. This allows it to support throughput at the level of NASDAQ or SWIFT while maintaining privacy and compliance.

3️⃣ The only "privacy public chain" that can be trusted by regulators

Why do institutions dare to use it? The answer is simple: #Canton solves the "last mile" of "privacy and compliance." On public blockchains, all transactions are publicly transparent, but this is a disaster for banks, funds, and brokerages.

Canton's technical architecture has considered this issue from the design stage—through Daml smart contracts + Canton protocol, it achieves "who should see, who can see," truly realizing a solution that balances compliance and privacy:

• Every transaction's data is end-to-end encrypted

• Unauthorized nodes cannot access it

• It can even set "sub-transaction privacy" at the smart contract level

• Fully compliant with GDPR, SEC, EU, and Asian regulatory frameworks

We have searched for information, and #Canton should be the only blockchain infrastructure currently accepted by the SEC, EU, and Asian regulatory bodies simultaneously, and the only solution that allows institutions to "safely operate on-chain."

4️⃣ Beyond "tokenization," achieving on-chain Financial OS

We find that many people discussing #RWA in the market are still at the stage of "issuing a token to represent an asset." But what #Canton is doing is entirely different. It is not just "tokenizing assets," but moving the entire financial operation process on-chain.

On #Canton, assets can not only be issued but also settled, cleared, financed, repossessed, mortgaged, exchanged, and settled across time zones.

Here are a few examples that have already been implemented👇

• The world's first weekend financing (August 2025): U.S. Treasury ↔ stablecoin on-chain swap

• Euroclear experiment: Using gold bars and European bonds as collateral for 24/7 liquidity

• DTCC real test: Completing margin delivery, clearing, and default handling using a digital twin of U.S. Treasury bonds

From this, it can be seen that it is no longer the "imagined #DeFi," but has surpassed the traditional #RWA category, moving beyond the traditional thinking of "one coin, one asset, one tokenization," and is a real-world tested on-chain financial infrastructure, truly achieving the ultimate goal of on-chain Financial OS!

In my view, what #Canton is doing is akin to when Microsoft installed an operating system on personal computers, providing a blockchain operating system for global finance, the "Windows moment" of on-chain finance. For the past 30 years, global finance has operated in isolation through SWIFT, clearinghouses, and custodians; in the next 30 years, #Canton may connect them all together, forming a global real-time synchronized, regulator-visible, privacy-secure financial network. This is not a "crypto project," but an industrial revolution of on-chain financial systems. If ETH represents the idealism of open finance, then #Canton represents the on-chain realization of real RWA finance, worthy of close attention and observation🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。