FOMC Minutes Report: What It Signals for the Next Crypto Rally

Could the latest FOMC minutes report set the tone for the next crypto rally—or signal a cautious phase ahead? The Federal Reserve’s policy stance, revealed through its meeting minutes, is once again at the center of both Wall Street and Web3 attention.

Key Highlights from the FOMC Minutes Report

The FOMC minutes report , released three weeks after the last discussion, provides deeper insight into the Federal Reserve’s monetary thinking:

-

Most officials believe it would likely be appropriate to ease policy further in 2025 , indicating that rate cuts are not off the table.

-

A few members said they could have supported keeping rates on hold in September , raising eyebrows about internal divisions.

-

Some officials noted that current policy may not be as restrictive as previously thought, leaving room for more flexibility ahead.

These statements came just weeks after Fed Chair Jerome Powell cut rates by 25 bps in September, lowering the federal funds rate to 4.00%–4.25% . But the meeting reveal some disagreement over that decision—hinting that Powell may have been under political pressure.

No October Rate Cut? Trump’s Shadow Looms Large

Speculation is growing that the October 2025 FOMC meeting may see no further rate cut. Several board members hinted that the September cut may have been influenced by pressure from President Donald Trump , echoing his past confrontations with regulatory heads like Gary Gensler.

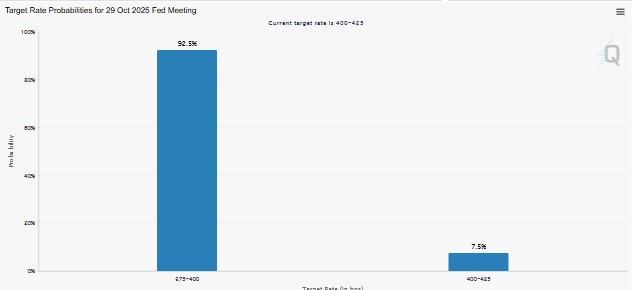

Powell’s caution on inflation and the minutes’ tone suggest that the October 29 meeting could maintain current rates. Market probabilities reflect this:

Source: FedWatch

Source: FedWatch

-

50 bps cut probability: 92.5%

-

25 bps cut probability: 7.5%

For now, the Fed seems to be walking a tightrope between easing to support growth and holding steady to fight inflation.

Crypto Market Reaction Remains Subdued

Interestingly, the crypto market’s reaction to the FOMC minutes report was muted. The global crypto market cap rose slightly by 0.56% to $4.17 trillion , showing resilience despite the policy ambiguity.

Bitcoin (BTC) hovered around $122,151.44 , up 0.25% intraday , with a $2.43T market cap and $62.07B in 24-hour trading volume. Solana (SOL) surged 3.21% , trading at $227.41 , supported by a $124.21B market cap and $7.02B in volume.

This measured response suggests traders had largely priced in the Fed’s stance and are waiting for more concrete signals from the next meeting.

What’s Next for the Crypto Market?

The upcoming FOMC meeting , combined with developments around the U.S. government shutdown and potential reopening, could be the next catalysts for a stronger move. If the Fed sticks to its easing path, liquidity could boost risk assets—including crypto.

Furthermore, Powell’s speech today is a big event everyone is waiting for. Maybe he speaks on the upcoming rate cuts or something good for the landscape.

However, if political dynamics overshadow monetary policy, volatility could rise, especially in Bitcoin and macro-sensitive altcoins like Solana and Ethereum.

Conclusion

The FOMC minutes report confirms a cautious but divided Fed, with political pressure whispers adding intrigue. While it haven’t reacted dramatically yet, the real test will come at the October 29 meeting . Traders should keep a close eye on Fed language, political narratives, and macro triggers to navigate the weeks ahead.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。