Blockratize Filing Hints at Polymarket POLY Token Launch: Users Excite

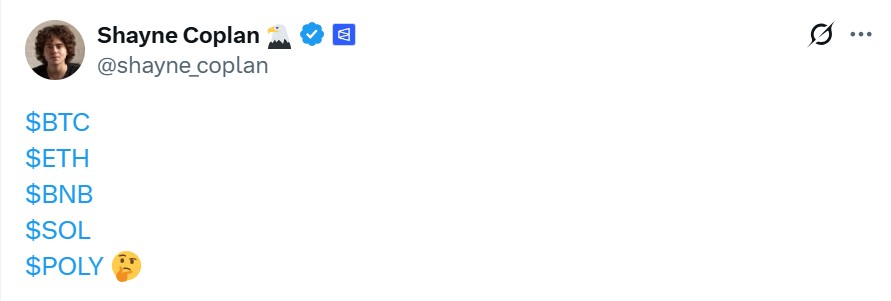

Shayne Coplan drops a hint for Polymarket POLY token in a semi-cryptic X post, days after ICE pledged a major strategic investment — traders and investors are watching closely.

Polymarket Founder Drops a Hint — Is POLY Coming?

Shayne Coplan’s short, semi-cryptic message on X set off fresh talk about a platform coin. The hint suggested the team is thinking about a native asset that could grow fast in market size. The post pushed community chat and on-chain watchers to scan recent company filings for clues.

Source : X

Shayne Coplan Joins Billionaire Club — What It Means for POLY

Bloomberg named CEO Shayne Coplan a self-made billionaire . The milestone raises attention on Polymarket’s future—especially after Blockratize’s disclosed “other warrants,” and nearly $19 billion in trading volume. Investors say this heightens chances of a POLY token and regulatory scrutiny too.

Big Outside Bet : Intercontinental Exchange invests $2 billion in Polymarket

This chatter arrived as Intercontinental Exchange (ICE), owner of the NYSE, publicly agreed to invest up to $2 billion in Polymarket. The deal values the business near the high single-digit billions and makes ICE a distributor of event data to institutions. The investment and distribution tie could smooth routes for regulation, product partnerships, and token distribution if the prediction company chooses to issue one.

Where the Platform Stands Today: Volume, Users, Regulation

Since launching in 2020, the prediction service has seen heavy use — nearly $19 billion in total trading volume is regularly cited by industry trackers. That scale gives any future digital asset a wide base of potential holders and utility use cases, like fee discounts, staking rewards, or governance voting. The platform also faced regulatory challenges in the past, so any coin plan will likely be shaped by legal advice and compliance needs.

What a Native Asset Could Do

A native coin could unlock governance rights, let the community vote on rules, and reward activity. It might also be used to pay fees, boost liquidity, or fund market-making. Yet tokens also bring new duties: tax rules, securities review, and disclosure requirements. Observers say Polymarket’s team will likely design careful token economics to balance growth and regulatory safety.

Market Reaction and Next Steps

Social feeds and chat rooms reacted fast. Some long-time users hope for a generous airdrop ; investors watch valuation and allocation terms closely. Analysts expect Polymarket to formalize plans only after legal sign-off and partner alignment — and ICE’s backing could speed that timeline. For now, the hint, the warrants mention, and the ICE deal are the strongest signals available.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。