Will Central Banks Adopt BTC as a Reserve Asset? Deutsche Bank Explain

Deutsche Bank analysts projected the potential adoption of Bitcoin and Gold by global central banks as their reserves by 2030. They based the prediction on the waning dominance of the US dollar and rising global tensions.

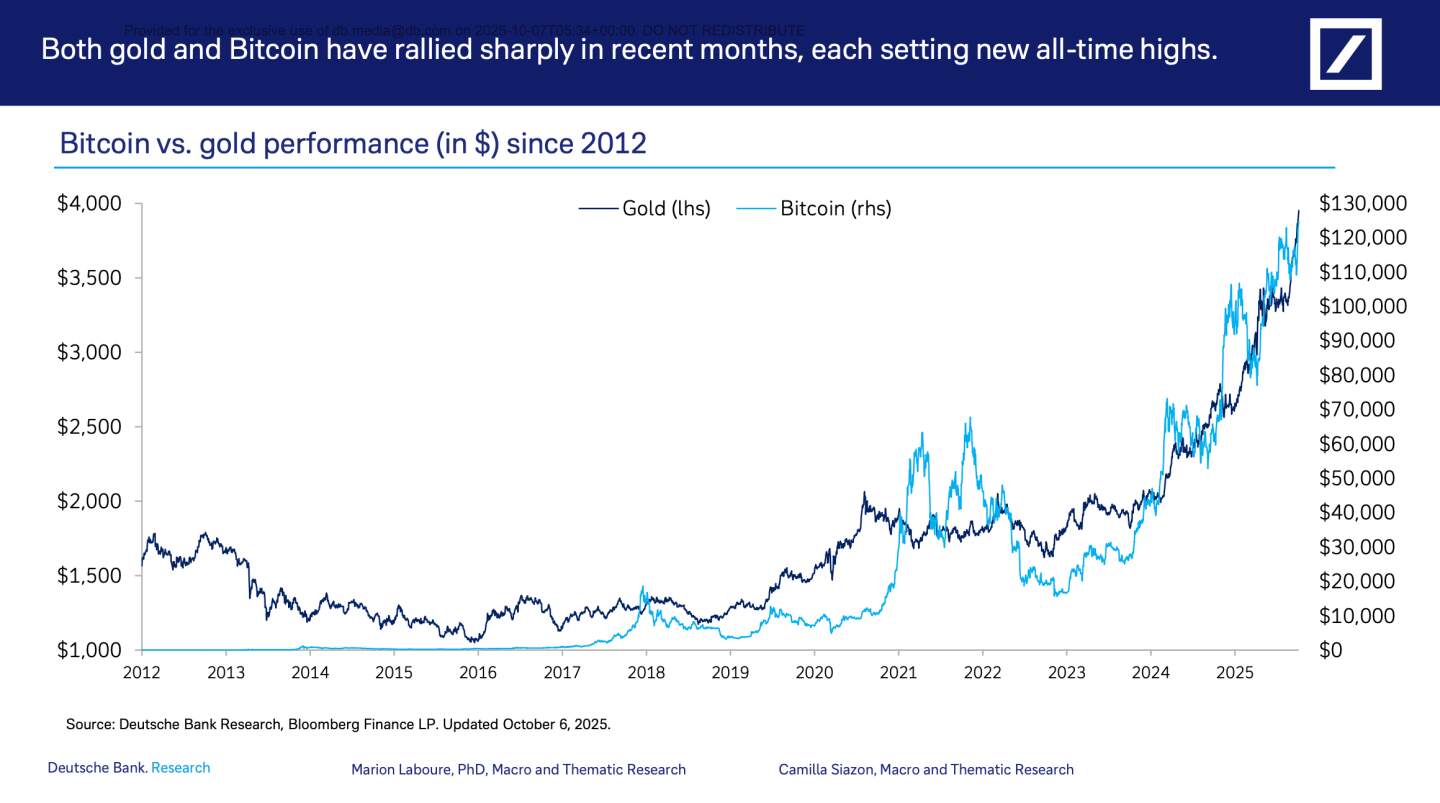

As Bitcoin's price surges past $125,000 and gold approaches $4,000 per ounce, this potential shift in central bank strategy highlights the growing recognition of digital assets as a stable store of value. Analysts believe Bitcoin is becoming increasingly similar to the metal, with its volatility at historic lows and rising institutional trust, making it an attractive asset for apex financial institutions looking to diversify their reserves.

Deutsche Foresees BTC Adoption

Recent reports state that Deutsche Bank has predicted Bitcoin’s potential entry into central bank reserves. By 2030, BTC and gold are poised to solidify their position as solid reserve assets, now becoming a strong rival to the dollar.

Despite lacking traditional backing, the crypto's appeal as a safe-haven asset is growing, driven by central banks' diversification efforts and companies building Bitcoin "treasuries.” The researchers told,

“A strategic Bitcoin allocation could emerge as a modern cornerstone of financial security, echoing gold’s role in the 20th century. Assessing volatility, liquidity, strategic value and trust, we find that both assets will likely feature on central bank balance sheets by 2030.”

The development occurs as both assets have gained popularity, as they have made outrageous price moves. BTC and XAU recently reached record levels, amid a US governmental shutdown, as investors seek safe havens amid escalating political discord.

BTC Trailing Gold

Analysts Marion Laboure and Camilla Siazon noted BTC is seemingly becoming more like gold in stability and trustworthiness; this stems from its price surge with historic low volatility, and it is an asset that will be considered an attractive potential holding for banks. They share key similarities, including scarcity, liquidity, and value retention when fiat currencies falter. Both assets operate independently of government control, with their value not tied to any specific economy.

With trust in traditional fiat currencies like the U.S. dollar waning, both crypto and the yellow metal are becoming increasingly appealing. As CoinGabbar recently reported, the US dollar is losing its value in contrast to the rise of cryptocurrencies, safe havens, and more.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。