Author: Turner Wright

Translated by: Jordan, PANews

The U.S. government shutdown continues into its second week. As of October 7, Republican and Democratic lawmakers in Congress have yet to reach an agreement to restore normal operations, which means that important financial regulatory agencies, including the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), are still unable to function smoothly.

In fact, due to the interruption of government funding, the SEC began shutting down its operations last Wednesday, with most staff receiving instructions to ensure job security and prepare for a potential operational pause that could last several days. The agency will operate with extremely limited personnel under certain conditions, and its ability to review cryptocurrency ETFs will be restricted. The SEC stated: "Before the U.S. government shutdown, employees should take various actions to conclude their respective business work unless there are special circumstances, but they need to protect their workstations and materials and prepare to resume business quickly after the U.S. government reopens."

What Can the SEC and CFTC Do for Cryptocurrency During the Government Shutdown?

Aside from deploying limited personnel and handling emergency cases or cases involving property threats, the SEC will no longer participate in ongoing litigation, meaning that any enforcement actions against cryptocurrency companies may effectively be paused until the government shutdown ends.

The SEC is also unable to review any registration applications, participate in non-emergency rulemaking, oversee self-regulatory organizations, or provide non-emergency assistance to foreign regulators. Although the SEC's electronic filing system will continue to accept submissions, pending applications for cryptocurrency-linked exchange-traded funds (ETFs) may be stalled. Industry insiders estimate that several Solana ETFs currently awaiting approval by mid-October may be delayed.

The situation is similar for the CFTC, which currently has only one commissioner serving as acting chair, and its operations are also limited with few personnel. Before the U.S. government resumes normal operations, it is unlikely that the Senate will consider legislation to establish a digital asset market structure, and Trump will not nominate a successor for the CFTC chair. Reports indicate that the White House withdrew Brian Quintenz's nomination for CFTC chair last week due to opposition from Gemini co-founders Cameron and Tyler Winklevoss (both of whom are Trump donors and supporters).

Przemysław Kral, CEO of cryptocurrency exchange Zondacrypto, analyzed: "The U.S. government shutdown may disrupt the SEC and CFTC, thereby harming the cryptocurrency industry, as these two agencies are crucial to the global digital asset market. Although the direct impact seems limited, the decline in their operational capacity may hinder innovation and reduce investor confidence, especially in regions where cryptocurrency regulation is already lagging."

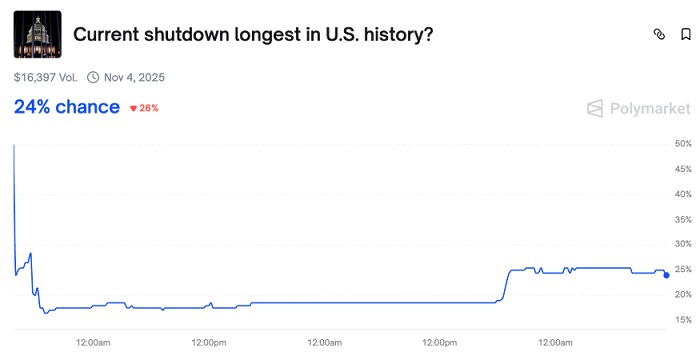

On the Kalshi website, a bet on the duration of the government shutdown shows a 69% probability that the shutdown will last more than 15 days, with a 41% probability that it will exceed 25 days. On the Polymarket platform, most cryptocurrency users predict that this U.S. government shutdown will become the longest in U.S. history, with about a 72% probability that it will not end until after October 15.

The good news is that the SEC has clearly stated in its operational plan that as soon as the U.S. government shutdown ends, employees must return to work on the next normal working day.

Government Shutdown Stimulates "Devaluation Trades," Bitcoin Hits All-Time High

As investor concerns about the uncertainty of the U.S. government shutdown grow, a "devaluation trade" aimed at hedging against the depreciation of the dollar is becoming one of the most popular investment themes this year, driving Bitcoin prices higher. In the early hours of October 7, Beijing time, Bitcoin's price surpassed $126,000, setting a new all-time high, exceeding the previous record of $125,689.

This "devaluation trade" strategy has gained favor among retail investors ahead of the 2024 U.S. presidential election. Analysts believe that whether this government shutdown is brief or lasts for several weeks, the structural factors behind it provide room for further increases in this trade in the future. Additionally, the decline in real interest rates and the Federal Reserve's resumption of rate cuts amid persistently high inflation have added extra catalysts for this round of Bitcoin's rise, as investors flock to decentralized assets for hedging.

Geoff Kendrick, head of global digital asset research at Standard Chartered Bank, analyzed that Bitcoin's performance during this U.S. government shutdown is markedly different from the shutdown that occurred from December 2018 to January 2019. During the last government shutdown under Trump, Bitcoin was in a different position and performed poorly. However, this year, Bitcoin has formed a trading correlation with U.S. government risk, which is best reflected in its relationship with the term premium of U.S. Treasuries.

Various data from prediction markets like Kalshi and Polymarket show that many users predict the U.S. government shutdown will be lengthy but will not reach historical highs. Trump set a record for the longest U.S. government shutdown at 35 days during his first term due to his push for building the U.S.-Mexico border wall.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。