Crypto Market Extends Bull Run, Bitcoin ATH and ETF Flows Lead Way

The crypto market continued its upward momentum on Monday, climbing 1.75% over the past 24 hours and extending its weekly rise to nearly 9%. This rally was a result of increased institutional inflows and resurgent confidence in large-scale digital assets, specifically Bitcoin and Ethereum.

Crypto Market Extends Rally as Bitcoin and Ethereum Lead Gains

Spot Ethereum exchange-traded funds (ETFs) recorded 307 million net inflows, indicating the increased confidence of the investor in the asset, just as Grayscale launched additional staking-enabled ETFs, which further drove an enthusiasm in the market and contributed to the current demand in the market.

A recent study by VanEck underscored the shifting position of Bitcoin as a generational currency store of value and equated its increasing popularity to that of gold. This reinforced the message that institutional investors discovered Bitcoin to be a long-term inflation hedge and wealth-preservation instrument.

On the technical front, the global crypto markets capitalization broke above $4.28 trillion, setting a new all-time high. On October 6, 2025, Bitcoin rose to the highest price ever of 126,198.07, which indicated increased interest and increased purchases.

Ether is also showing a significant 4.09% increase during the past 24 hours and is trading at a high of above 4,700, continuing to follow a bullish trend. Other major cryptocurrencies mirrored this trend, contributing to the broader market’s positive performance.

Today in the Crypto Market

The European Union is preparing a major shake-up in its supervision of the crypto market , aiming to strengthen oversight and reduce fragmented regulation across member states. Verena Ross, chair of the European Securities and Markets Authority (ESMA), confirmed that the European Commission is drafting a proposal to expand ESMA’s authority over digital asset firms. The move aligns with the EU’s Markets in Crypto-Assets (MiCA) framework and could mark a step toward a unified financial market.

EU Moves Toward Centralized Crypto Oversight

At present, MiCA licenses are given to crypto-asset service providers by national regulators. This system has contributed to the imbalanced standards, with each country establishing its own supervisory system. Smaller states, such as Lithuania, Malta, and Luxembourg, have been pioneers in licensing companies like Robinhood Europe, Crypto.com, OKX, Coinbase, and Bitstamp.

Nevertheless, ESMA has also expressed worries relating to unbalanced practices, with problems being found in the Malta licensing process. Ross stressed that by centralizing the efforts of ESMA, the integrity of the markets would be improved, the inefficiencies would be eliminated, and the EU global competitiveness would be enhanced.

Record Crypto Fund Inflows Amid U.S. Shutdown Fears

In the meantime, the unprecedented inflows of global crypto currency investment products occurred in the past week. CoinShares has registered an inflow of 5.95 billion into cryptocurrency exchange-traded products (ETPs) the biggest inflow of funds into the funds ever.

Analysts have attributed the run-away to slow markets responses to the recent Federal Reserve rate cuts, poor employment statistics, and the market fears of a possible U.S. government shutdown. The rise in demand propelled the digital assets upwards as the traders found other safer means in case the political environment changed.

The GENIUS Act and the Changing Face of Banking

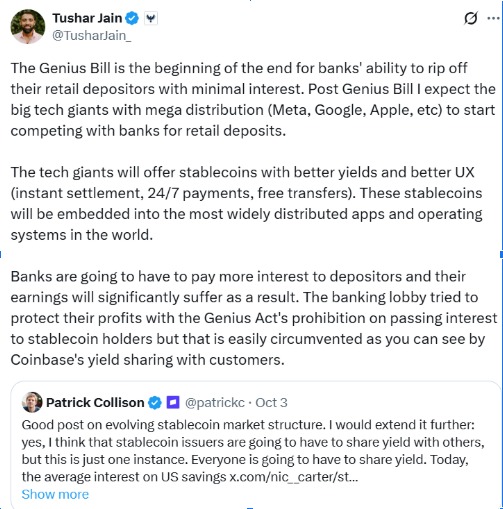

The co-founder of Multicoin Capital, Tushar Jain, said the new GENIUS Act had the potential to transform banking. He forecasted a tidal of deposits going off the customary banks to stablecoin-based items with increased yields.

Jain further opined that big tech firms such as Meta, Google, and Apple might become the next competitors to the banks by providing 24/7 and easy payment of stablecoins and higher returns. This, he argued, was the dawn of a new period of financial competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。