$ETH potential to pump is capped by its failure to be accepted as SoV.

To buy and hold $ETH now you need to believe in its ability to become a store of value asset.

Yes, $ETH can run to 10k with no fundamental change, but the current narrative of tokenization and RWAs is not enough to push it much higher without the SoV premium.

This narrative can even backfire as new chains ALREADY compete for RWAs and stablecoin adoption with better features like privacy, speed, and low fees.

Yet none of them have the potential to be SoV the way $ETH does. Alt L1s will not be neutral or decentralized like Ethereum.

Some already treat $ETH as SoV, mostly hardcore DeFi users who use it as yield-bearing collateral.

But $ETH needs to push into BTC territory to be accepted by passive institutional and retail holders as well.

It has potential because $ETH :

- has native yield and

- smart contract utility for usage within DeFi.

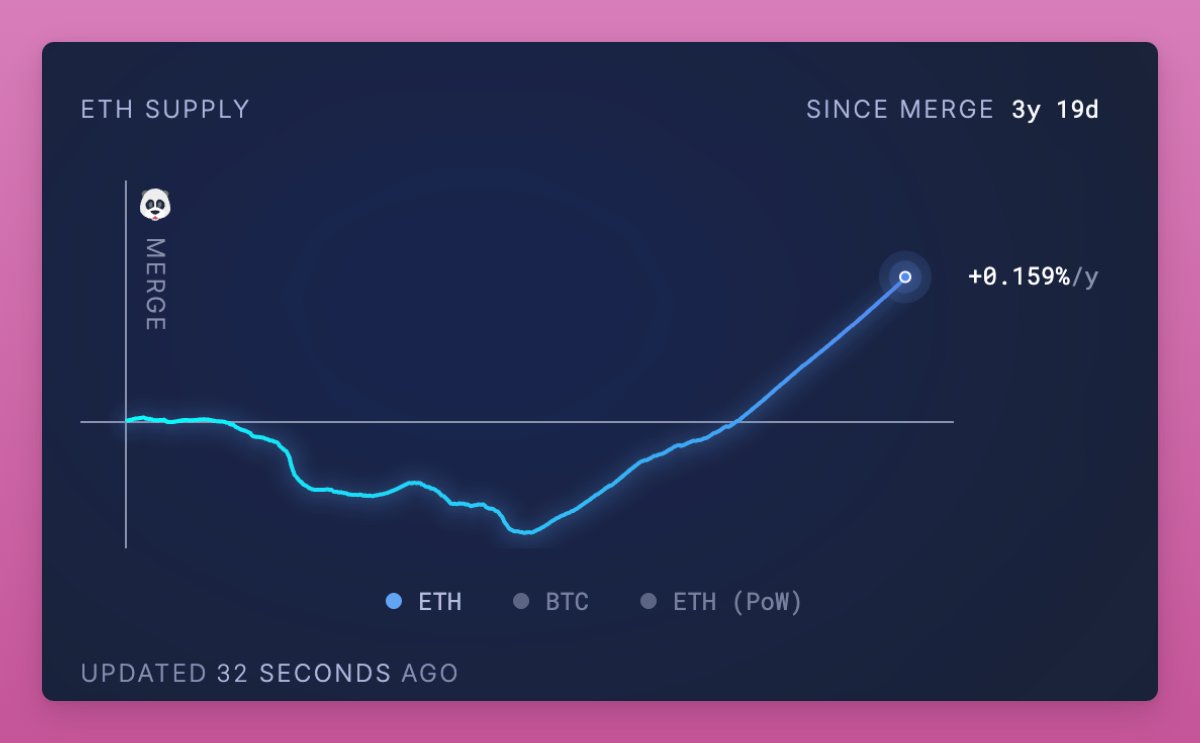

I believe the missing piece is deflationary supply.

If Ethereum can burn more $ETH than it issues, then $ETH becomes the superior SoV to BTC, which has long term security issues from shrinking miner subsidies and weak fee revenue.

The Ultrasound Money 1.0 narrative is dormant.

But not dead.

So if you buy and hold $ETH now, you should believe that Ethereum will find a way to tax the L2s and adoption will grow enough to burn supply.

As Ray Dalio said on BTC, money must be both a medium of exchange and a storehold of wealth. The latter is more important.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。