Coinbase's financial report — — Summary of 2025, outlook for 2026, the revenue path of the exchange.

I just finished watching Coinbase's financial report for the fourth quarter of 2025. Although it is not good, it's not as bad as expected, because Coinbase's financial report basically represents the state of the industry.

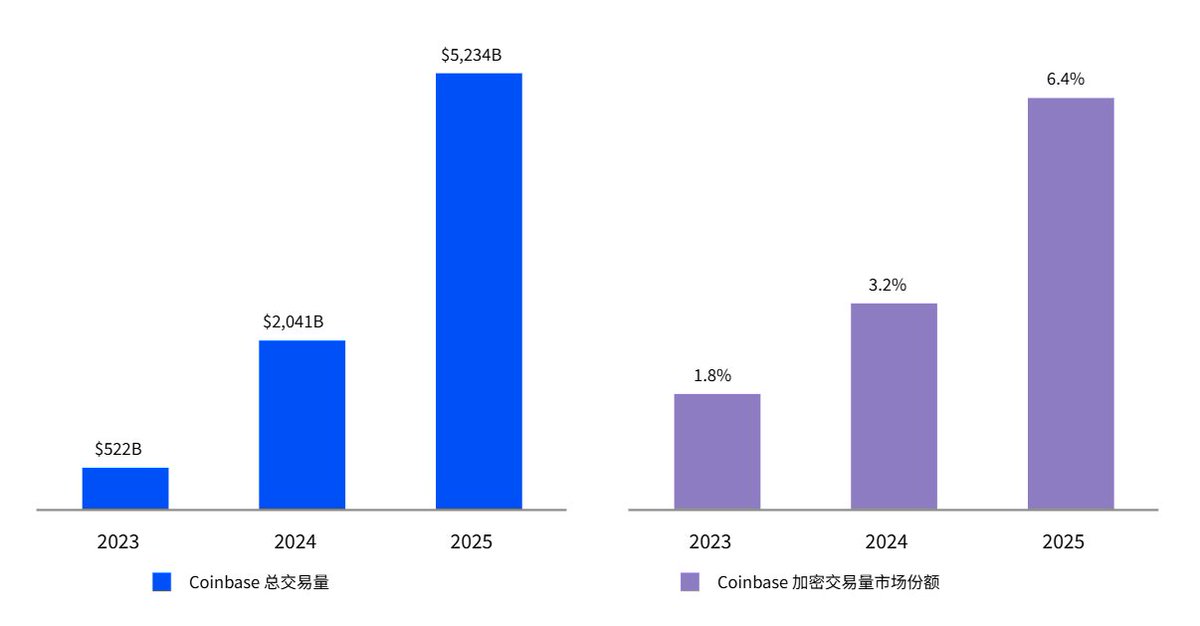

The total cryptocurrency trading volume for Coinbase in 2025 reached $52 trillion, an increase of 156%. This indicates that the overall cryptocurrency industry was on a positive trend in 2025. Of course, we also know that the first quarter was impacted by Trump's election, the second quarter rebounded after the end of the trade war, the third quarter had expectations for interest rate cuts from the Federal Reserve, and the market only started to decline in mid-October of the fourth quarter.

It can be said that apart from the market crash caused by Trump's antics in 2025, mainstream cryptocurrencies dominated by $BTC had a good year, so the increase in trading volume also reflects investors' growing interest in cryptocurrencies at that time.

Moreover, even though the cryptocurrency market was very sluggish in the fourth quarter of 2025, Coinbase's revenue still reached $7.2 billion, an increase of 9% year-on-year. To be honest, this figure exceeded my expectations. The fourth quarter of 2024 was considered a golden period for cryptocurrencies in this cycle, while the market in the same period of 2025 was extremely sluggish.

After reviewing the data, I found that the main reason Coinbase was able to be profitable was due to institutional trading and stablecoin earnings. In the fourth quarter, retail trading revenue decreased by 13%, but revenue from institutional trading increased by 37%. Additionally, in such a poor market, institutional trading provided the largest revenue in the last two years, likely through quantitative trading and market making, which also indicates that in a sluggish market, complex combined trading is expanding in scale.

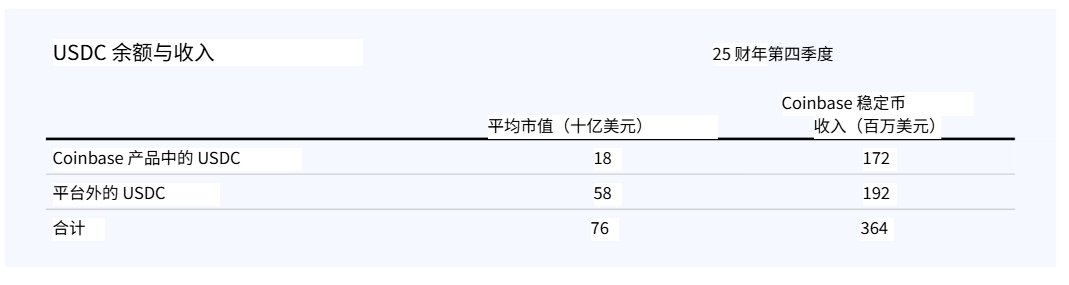

Furthermore, stablecoin earnings for Coinbase increased by 3% quarter-on-quarter, mainly from interest on reserves for USDC. The more USDC stored in Coinbase, the more reserve income it can generate. Coinbase's explanation is very straightforward: the increase in stablecoin revenue mainly comes from the growth in USDC scale, but this was partially offset by a decline in the effective reserve interest rate after the interest rate cuts in October and December.

This is also the issue we have been talking about regarding Circle. When interest rates are lowered, the income along this industrial chain tends to decline, and without new growth points, $CRCL will face a very awkward situation.

By looking at operating expenses, we can roughly understand where Coinbase's main development direction lies. The largest expenditure is on development costs, mainly due to the full-quarter impact of the acquisitions of Deribit and Echo. Surprisingly, the second largest expenditure is general and administrative expenses, which increased by 8% quarter-on-quarter. This growth was mainly driven by amortization related to trading, legal activities, and policy-related expenditures. This includes political donations.

Interestingly, the main source of losses was investment, with a net loss of $667 million in the fourth quarter, mainly due to Coinbase's own cryptocurrency asset investment portfolio generating losses of $718 million, along with a strategic investment (including investments in CRCL) that recorded a loss of $395 million.

Looking ahead to 2026, I believe the most valuable aspect of Coinbase's financial report is that it showcases how the industry is expected to evolve over the next year through its "revenue structure." This financial report may not hold significant meaning for retail and institutional investors, but it is essential for peer exchanges to study.

In terms of trading, there may be a structural differentiation in 2026 where retail investors might not return immediately, but institutions will continue to treat the market as an arbitrage space and risk control site. A typical signal has already emerged in the fourth quarter of 2025, where institutional spot trading volume decreased quarter-on-quarter, but institutional trading revenue increased by 37%.

This indicates that what is truly expanding in a weak market is not emotional capital, but rather the scale of complex trading such as quantitative trading, market making, and cross-market hedging. As long as volatility remains, products remain rich, and regulations do not tighten suddenly, exchanges will have stronger bargaining power on the institutional side because institutions require not just an exchange, but a complete infrastructure that seamlessly integrates spot, futures, lending, custody, and clearing.

Therefore, we see Coinbase focusing its funds on two directions: one is derivatives, and the other is the compliant "Everything Exchange." Development expenses increased by 16% quarter-on-quarter, while general and administrative expenses increased by 8%, primarily due to legal and policy-related expenditures. When combined, this funding represents Coinbase's bet for 2026, not on a bull market, but on the expansion of licenses and product boundaries, bringing derivatives, stocks, prediction markets, and payment sectors into compliance and capturing the largest increment in the next cycle.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。