Author: Frank, PANews

On October 2, a project named DoubleZero ignited a "flash battle" for listing in the crypto world. On this day, its mainnet test version officially launched, and its native token 2Z almost simultaneously landed on multiple global exchanges, including Binance, Bybit, and Upbit, at an unprecedented speed. The market's enthusiastic response was beyond imagination, with the 24-hour trading volume of the 2Z token once exceeding $1.4 billion, and its circulating market cap quickly climbing to over $2 billion, making it one of the top 100 crypto assets.

This wave of excitement did not come out of nowhere. Before and after the project launch, the Solana ecosystem endorsed it with unprecedented strength. Not only did its co-founder publicly express congratulations, but the network also attracted over 300 Solana validator nodes upon launch, capturing a significant portion of the network's staking share. More notably, it achieved breakthroughs in compliance: just days before the token launch, the U.S. Securities and Exchange Commission (SEC) issued a historic "No-Action Letter" to DoubleZero, confirming that the programmatic distribution of the 2Z token does not need to be registered as a security. This move was interpreted by the market as a "bright green light" from regulators, greatly alleviating compliance concerns for major exchanges. Even Coinbase, known for its strict compliance requirements, announced the launch of the 2Z perpetual contract on October 3.

How did an emerging infrastructure project manage to secure such top-tier resource allocation and market recognition right from its inception? What magic does the project named DoubleZero possess? PANews will delve into the team, technology, narrative, and potential dilemmas behind it.

A New Star in DePIN Emerging from the Solana Ecosystem

From its inception, DoubleZero has shown the potential of a star project.

First, it boasts a luxurious founding team composed of industry elites. The core leadership of DoubleZero can be seen as a continuation of the "Solana think tank." Its co-founder and CEO, Austin Federa, was the head of strategy and communications at the Solana Foundation and a key figure in the early rise of the Solana ecosystem; COO David McIntyre was the head of financial planning and analysis at the Solana Foundation; co-founder and CTO Andrew McConnell is also a co-founder of Malbec Labs; and chief economist Nihar Shah previously served as the head of data science at Mysten Labs and held key positions at Jump Crypto and Meta's Libra/Diem project.

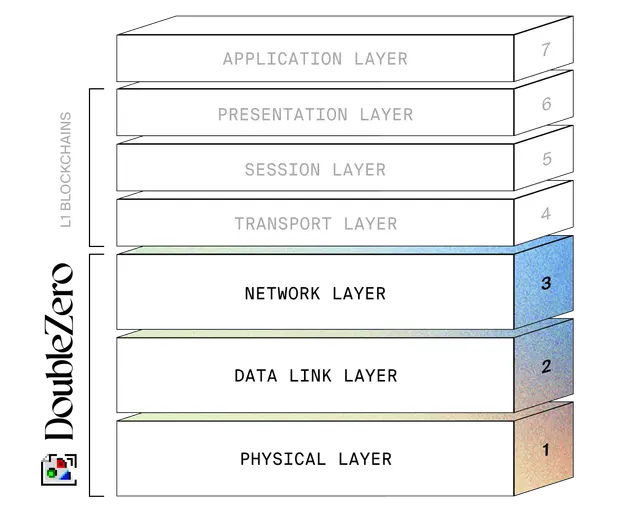

In addition to a strong team background, its narrative proposition is relatively unique. DoubleZero introduces and defines a new category of protocol—"N1" (Network 1). This positioning strategically distinguishes it from common L1 (consensus layer), L2 (scaling layer), or L3 (application layer) protocols. According to its design philosophy, N1 provides the network layer, L1 offers consensus on top of it, and L2 provides scaling.

In simple terms, N1 is designed to create a dedicated high-speed network for existing blockchain networks. This narrative cleverly avoids the fiercely competitive tracks and can essentially be classified within the DePIN domain. Its potential extends beyond the crypto field and may cover all areas that require distributed networks in the future, such as content delivery networks (CDN), large language models (LLM), and real-time gaming.

The dazzling team combined with a highly promising narrative structure has also attracted capital to DoubleZero. In March 2025, the project announced the completion of a $28 million token financing round, with a post-investment valuation reaching $400 million. This round was co-led by Multicoin Capital and Dragonfly Capital, with participation from well-known institutions such as Foundation Capital, Reciprocal Ventures, and Borderless Capital. Two co-founders of Solana, Anatoly Yakovenko and Raj Gokal, also participated as angel investors.

Building "Infrastructure" for Blockchain Infrastructure

The technical core of DoubleZero is its innovative "dual-ring" architecture, consisting of an outer ring (Ingress/Egress Ring) and an inner ring (Data Flow Ring).

In layman's terms, DoubleZero's narrative primarily aims to build a highway outside the current chaotic public internet. This highway serves L1, L2, and other blockchain networks, achieving low latency and minimal congestion. The design of the outer ring can be understood as a smart security check system, akin to a toll booth on a highway. Through this design, all data entering the core network undergoes "cleaning" and "preprocessing."

The inner ring can be understood as the road of this highway. The clean traffic, "cleaned" by the outer ring, is directed into the inner ring, which consists of a physical network backbone made up of dedicated fiber links provided by independent contributors worldwide. In short, DoubleZero's technical principle is to construct a dedicated, smart security-checked "information highway" for distributed systems through the combination of "hardware and software" and the "separation of inner and outer rings," addressing the current network bottlenecks that limit blockchain performance from a physical level.

Potential in Compliance, Narrative, and Implementation

Overall, the project potential of DoubleZero is reflected in the following aspects:

Narrative Potential: Besides the original "N1" concept, the biggest feature of this narrative is that it not only escapes the "public chain competition" red sea but also cleverly turns all public chains into potential customers. Additionally, as the underlying layer of distributed systems, its narrative potential may expand into hotter and more promising fields like AI in the future.

Technical Implementation: Unlike many projects that remain at the white paper stage, DoubleZero has already achieved real physical infrastructure operation. As of October 3, the number of its official public internet nodes has exceeded 1,300, with over 330 participating Solana network validators.

Resource Capability: In fact, the grand launch of DoubleZero's token 2Z demonstrates the project's ability to integrate industry resources. On October 3, the token was launched almost simultaneously on all major global exchanges, including Binance, Kraken, and Upbit. Furthermore, the strong endorsement from Solana's official backing and the active participation of the validator system provided robust support for DoubleZero to generate significant market response without conducting an airdrop.

Compliance Capability: The mature compliance capability demonstrated by DoubleZero is also a rare advantage among new crypto projects. Before its launch, it received a "No-Action Letter" from the SEC, which stated: "If the 2Z token is programmatically distributed as described, the SEC will not recommend enforcement action, and the 2Z token does not need to be registered as a security." Additionally, PANews noted that DoubleZero's token 2Z achieved a record for being the first token sale open to U.S. accredited investors on CoinList since 2019. Its compliance capability may also serve as a "pass" for exchanges like Coinbase and Upbit, which have higher compliance requirements, to quickly launch the project.

Too Far from the C-end, Can Market Heat Be Sustained?

Even with the aforementioned potential advantages, the price performance of DoubleZero's token on its first day of listing did not show sustained growth. Besides the lack of upward momentum due to high valuation, the absence of any community airdrop has drawn complaints from the community, reflecting the reality that DoubleZero is too close to institutions and too far from the community.

First, from the characteristics of the project itself, although it is a DePIN-type project, its high entry threshold requires participants to possess specialized network facilities such as dedicated fiber optics and data center rooms. This directly excludes ordinary players. Additionally, the narrative is too vertical; compared to L1 and L2 public chains that can spawn numerous application-layer projects to drive the ecosystem, DoubleZero's main benefit may primarily come from connecting more public chain facilities. Overall, the characteristics of DoubleZero itself dictate that it is closer to the B-end and further from the C-end.

Moreover, in terms of operational thinking, DoubleZero does not place enough emphasis on the C-end. On one hand, the project has not proposed a plan for testnet users to participate in an airdrop. Even the token presale on CoinList was targeted at institutional users at the validator level. Although it launched a "HODLer airdrop" in collaboration with Binance, this model has not been a strong topic in the market and is not a genuine thank-you to its community users.

As a result, discussions within the community about DoubleZero are not particularly enthusiastic. After reaching a high of $1.28, its token price quickly fell back to around $0.51, with a maximum drawdown of nearly 60%.

Overall, the launch of DoubleZero is undoubtedly a stunning debut. From the perspective of project development, it proposes a new development approach and narrative structure. This has certain enlightening implications for the future development of the crypto market. If the project itself develops as expected, it may also become a new giant in the DePIN track. However, from the perspective of the crypto market, the project's operational thinking and product characteristics dictate that it is far from C-end users, and the most direct way for users to participate is to speculate on the value of its token. Clearly, this is its main flaw, and the future value may still depend on whether its B-end business can continue to expand.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。