Institutional Adoption Grows as MicroStrategy Surpass Starbucks Milest

Is Bitcoin becoming the new gold for companies? MicroStrategy Surpass Starbucks in market value as Michael Saylor’s Strategy ($MSTR) just hit a new milestone with its $101.06 billion market cap, overtaking Starbucks’ ($SBUX) $98.57 billion capitalization.

This symbolic moment highlights the growing power of Bitcoin-treasuries in global markets. At the same time, institutional bitcoin-holdings have crossed 1 million coins, signaling a fundamental shift in how corporations view digital assets.

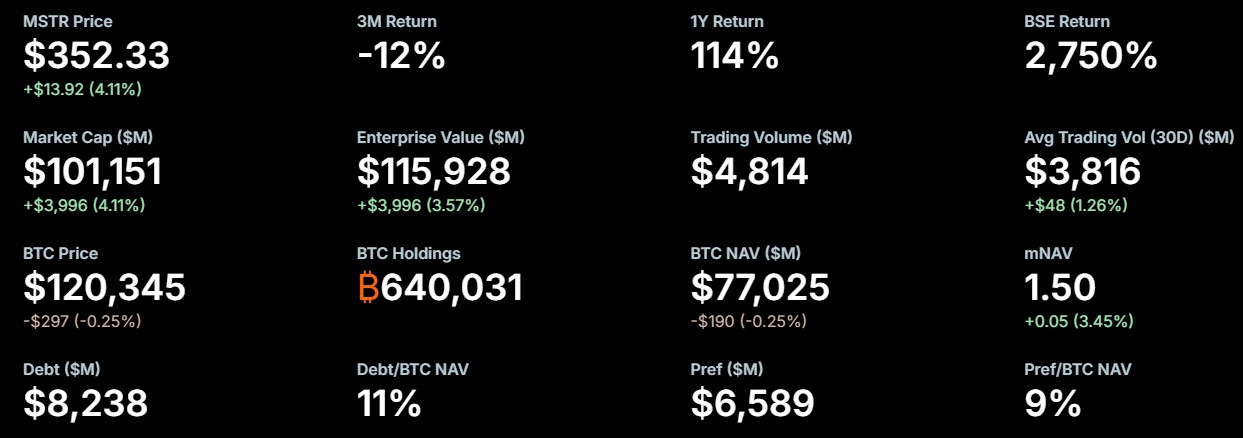

A Glance At Strategy’s Surging Accounts

Once a traditional software company, MicroStrategy has evolved into a Bitcoin treasury giant. With more ₿-coin than many countries, it has effectively become a publicly traded Bitcoin-proxy for institutional investors seeking exposure to the asset.

Source: MicroStrategy

Corporate Bitcoin Adoption Expands Rapidly

The firm’s bold acquisition has inspired a wave of companies to follow suit. In the past year, firms like Mara holdings, Metaplanet , Semler Scientific, and even GameStop have begun holding on their balance sheets.

Source: Bitbo

This wave of Bitcoin-digital asset treasury (DAT) strategies represents a diverse range of industries, from miners and tech firms to retail players and governments, all moving towards long term BTC accumulation.

Adoption Boosted by Asset’s Price Surge

Parallel to this mass adoption wave, Bitcoin’s market cap has soared past $2 trillion, briefly overtaking Alphabet. Earlier this year, Bitcoin surpassed Amazon, and in late 2024, it even exceeded Silver’s market cap, cementing its position among the world’s most valuable assets.

After facing a medium-term down the asset is currently trading above $120K again reaching its path to achieve new heights with a $72.73 billion 24-hour volume (8.36% up).

A Structural Shift in Corporate Finance

This is not just another crypto rally, it is a strategic transformation in corporate finance. As over 250 entities now hold bTC, the asset is shifting from speculative instrument to a mainstay of balance sheet strategy.

With more than 50,000 publicly traded companies globally, the current nearly 1 million BTC figure is just the beginning. Analysts expect that BTC will occupy a growing share of corporate reserve as firms look for alternatives to fiat currencies in an inflationary world.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。