Seven years is just the prologue; UEX is the real beginning. The story of Bitget is far from over.

In the crypto industry, many stories do not start with a highlight.

Tight cash flow, unanswered partnership requests, extreme market squeezes. When facing the strong of that time, newcomers often have to endure more effort and hardship.

Every choice made will amplify into results in the future. Some bid farewell passively, while others use failure as a calibrator, repeatedly correcting their course.

But fate always favors those who refuse to be mediocre and strive for a comeback.

The PUMP new listing event brought the handling of different platforms into the same frame, with various exchanges experiencing different degrees of issues, while this rising star secured the largest quota among all its peers, and its handling plan received the most praise.

The protagonist of the story is Bitget.

This year marks Bitget's first seven years, and in fact, Bitget's journey to today has not been easy; it once faced a situation where startup funds were nearly depleted.

How did this exchange complete its transformation from an industry supporting role to a leading role in seven years? What determination does the recently proposed UEX (Universal Exchange) represent? We will delve into Bitget's core transformations and initiatives, revealing the development context behind it.

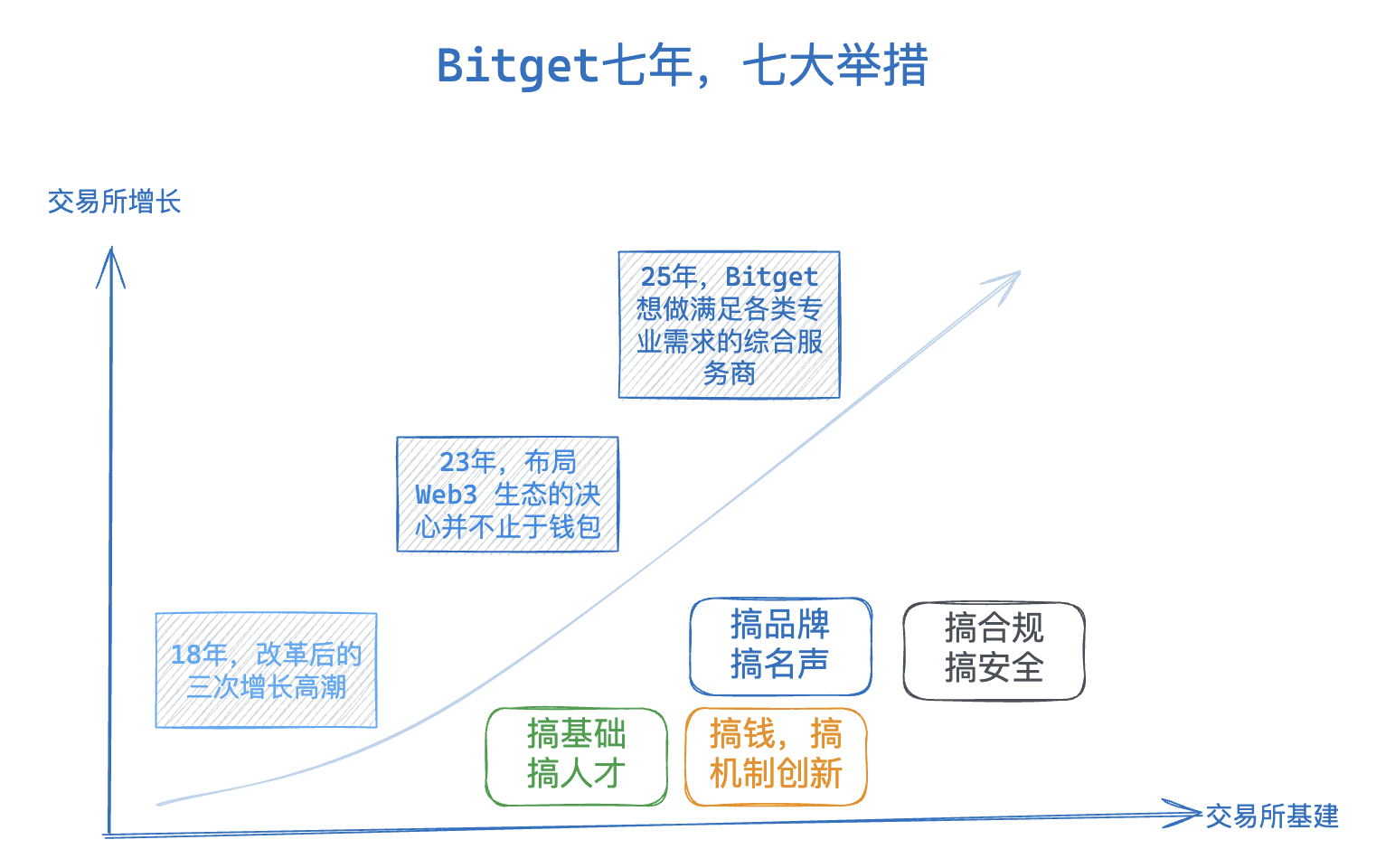

From 2018 to 2025, reform in the first seven years

1. A bold decision, the USDT opportunity, social trading, and growth finally began

In 2018, the crypto market was experiencing a winter. For the fledgling Bitget, this was undoubtedly the most brutal entrepreneurial test— a streamlined team of dozens had to maintain spot trading while also expanding into the futures market, yet found itself in difficult situations on both fronts.

In a dire situation where funds were nearly exhausted, Bitget made a decision that could be described as "a bold move": to suspend spot trading and concentrate all resources on the futures track. This seemingly risky choice laid a crucial foundation for its later rise.

The turning point came in July 2019. Through in-depth market research, the team keenly captured the urgent demand from users for positive contracts settled in USDT. Bitget quickly responded by launching an innovative positive contract product. This decision was spot on—on its first day, the trading volume exceeded $100 million, injecting strong momentum into the platform.

Innovation did not stop there. By the end of 2019, they targeted a brand new blue ocean market—social trading. In May 2020, the copy trading feature was officially launched, aiming to build a bridge between professional traders and novices. However, although the initial version attracted hundreds of traders, the complex user experience became a bottleneck for growth.

Faced with this challenge, at the end of 2020, the management team conducted a "closed-door retreat" for product reconstruction in a remote restaurant. Adhering to the design philosophy of "simplicity is the ultimate sophistication," they drastically streamlined redundant features, simplifying complex operational processes. This revision broke through the bottleneck of user experience, bringing another wave of growth to the platform and establishing Bitget's leading position in the futures business.

Three years later, in 2021, Bitget restarted its spot trading business. Relying on its mature foundation, Bitget successfully made a comeback in the spot market, evolving from a single futures trading platform to a comprehensive leading exchange that now operates both spot and futures trading.

2. Acquisitions, investments, the next growth point: Web3 ecosystem

While most exchanges in the crypto world continue to compete in traditional business tracks, Bitget has already begun to plan a grander strategy—evolving from a single trading platform to a Web3 ecosystem builder.

A key step in this transformation was the strategic acquisition of BitKeep wallet.

In March 2023, Bitget announced the acquisition of a controlling stake in BitKeep for $30 million. Five months later, BitKeep was officially renamed Bitget Wallet, presenting a new vision of "faster trading, better assets," while maintaining the independence of the wallet and exchange from the start.

This acquisition was not merely a brand integration but a strategic layout for Bitget to build a comprehensive Web3 ecosystem. In May 2025, Bitget Wallet underwent another brand upgrade, introducing the slogan "Crypto for Everyone," and has gained a good reputation among users.

In terms of product matrix, Bitget Wallet has built a complete ecosystem around "trading, finance, payment, exploration" across four major scenarios:

Cross-chain trading functionality supporting over 20 public chains

Innovative GetGas feature to solve fuel fee issues for new users

Issuance of Bitget Wallet Visa card to bridge crypto and traditional financial payment channels

"Crypto for Everyone" is not just a simple slogan; its actions are not limited to the wallet. Bitget Onchain and GetAgent are two major products recently launched by Bitget to assist users in trading.

Bitget Onchain connects CEX and DEX, allowing users to directly use assets in their Bitget spot accounts for on-chain trading without manually crossing chains or switching wallets, significantly lowering the barrier for users to engage in on-chain trading. Additionally, in September this year, the Onchain platform announced support for all on-chain assets on ETH, BSC, Base, and SOL chains, expanding the trading boundaries of traditional financial assets, becoming the world's first exchange to support all assets as a UEX (Universal Exchange).

GetAgent is Bitget's first all-in-one cryptocurrency trading assistant. AI is the buzzword of the year, and various industries are exploring how to integrate with AI. For trading, Bitget's answer is: make trading as easy as chatting.

GetAgent simplifies the cryptocurrency trading process through artificial intelligence technology, integrating over 50 professional trading tools, providing various services such as market analysis, strategy formulation, smart money tracking, risk assessment, and trade execution. For instance, users can inquire about today's market conditions, specific details about a token, trending on-chain coins, and more.

Recently, as RWA gained popularity, Bitget also took the lead in collaborating with Ondo Finance to launch over 100 US stock tokens and US stock contracts.

**Crypto for Everyone, Bitget is providing users with an answer through wallets, on-chain, and *AI* in various ways.**

The recently proposed UEX (Universal Exchange) aims to break the "impossible triangle" of user experience, asset richness, and security in exchanges, integrating the advantages of CEX and DEX to create a unified platform for users.

Bitget CEO Gracy stated: UEX will integrate a unified ecosystem of multiple asset categories, including all mainstream tokens & innovative assets, seamless integration of traditional and crypto assets, true 24/7 operation, ultra-fast experience, and institutional-level risk control, among others.

While many have yet to realize that Nasdaq officially announced in March this year the launch of "24/5" trading services, Gracy firmly believes that the true future is not limited to "24/5," but rather "24/7"—a seamless, borderless, frictionless financial world.

UEX currently supports products such as US stocks and US stock contracts. In the future, it plans to gradually incorporate global quality assets such as stocks, ETFs, gold, and foreign exchange, allowing users to participate in global market trading seamlessly and conveniently. For more details, please refer to the CEO's seventh anniversary open letter.

3. Entering the institutional market, upgrading from "barbaric growth" to "professionalization"

While maintaining its advantages in retail business, **in 2025, Bitget began to comprehensively layout the institutional service market, shifting its business focus towards **ToB.

Better rates and experience. In the institutional service system, Bitget first launched the VIP upgraded "PRO" plan. Institutional users not only enjoy more favorable trading rates but also gain higher API call frequencies and an optimized trading environment, truly achieving a professional trading experience.

Capital security has always been the primary concern for institutional clients. To address this need, Bitget innovatively launched a professional fund custody service. Through a "1:1 delegation mapping" mechanism, institutional clients' funds are locked in a custody wallet, ensuring asset security while maintaining trading flexibility. This dual protection mechanism greatly enhances the trust of institutional clients.

Liquidity incentive program. In terms of liquidity management, Bitget has introduced a more competitive incentive program for market makers. By optimizing the fee structure and establishing a dynamic reward mechanism, the platform has attracted a large number of quality liquidity providers. Currently, the officially announced partners include:

Vataga Crypto, optimizing the execution speed and liquidity for high-frequency and professional trading, providing seamless access to Bitget's incentive mechanism for day traders.

DWF Labs, collaborating with Bitget to enhance the liquidity of USD1 in spot and derivatives.

Pulsar, providing liquidity support for spot and derivatives markets, enhancing Bitget's overall liquidity depth.

For exchanges, balancing C-end and B-end can showcase strong resilience during market fluctuations. Although B-end demand is relatively harder to meet or more targeted, taking this step is also a key move for Bitget to gradually evolve from a trading platform aimed at ordinary users to a comprehensive crypto service provider capable of meeting various professional needs.

Building the "infrastructure" of exchanges, the arms race of talent and compliance

4. Focusing on infrastructure and talent, Bitget is empowering the next generation

The core of corporate competition is talent competition, which is particularly prominent in the fields of AI and cryptocurrency. What makes Bitget capable of attracting talent?

**Is the year-end bonus the **core competitiveness?

Of course not. The year-end bonus is a manifestation of rewarding talents who create substantial value for the company. Multiple insiders have revealed that, at the internal management level, Bitget has always adhered to a pragmatic philosophy, implementing flat management and full empowerment.

Outstanding employees deserve corresponding permissions and incentives, while the company advocates for an efficient and direct communication culture, encouraging team members to confront issues and provide timely feedback, avoiding the efficiency losses caused by layers of reporting. This management approach allows the company to maintain agility and competitiveness in a rapidly changing market.

In terms of talent development strategy, Bitget has launched a global graduate program aimed at outstanding fresh graduates with a global perspective and innovative spirit. This program provides young talents with diverse career development opportunities in operations, product, marketing, risk control, and more, not only opening the door to the Web3 industry for them but also continuously injecting innovative vitality into the company.

Currently, Bitget has developed into an international enterprise with over 2,000 employees. Through this complete talent system, Bitget is building a global team rich in innovation and adaptability, laying a solid foundation for the company's long-term development.

5. Making money, innovating mechanisms, BGB is no longer just a single platform token

In this particularly challenging market cycle for assets outside of Bitcoin, Bitget's platform token BGB has shown remarkable resilience. As of now, BGB has increased by 372% over the year, becoming one of the few quality assets that have outperformed Bitcoin. Behind this achievement is Bitget's carefully designed deflationary mechanism and complete ecological layout.

In December 2024, Bitget released a new version of the BGB white paper, launching an unprecedented buyback and burn plan.

The platform promises to destroy BGB tokens worth over $5 billion, accounting for about 40% of the total supply. In the first round of destruction, Bitget permanently destroyed 800 million BGB held by the core team in one go, reducing the circulating supply to 1.2 billion, achieving 100% full circulation and completely eliminating any possibility of reserved tokens or subsequent releases.

Entering 2025, Bitget innovatively introduced a "dual-track destruction" mechanism.

On one hand, it calculates the Gas fees generated by users based on actual on-chain activities within the Bitget Wallet ecosystem, using this as the basis for destruction;

On the other hand, it sets a fixed proportion for destruction quotas, constructing a self-driven supply-demand adjustment mechanism. This mechanism has already achieved significant results in the first quarter of 2025, completing the destruction of 30,006,905 BGB, accounting for about 2.5% of the total supply, far exceeding the industry average.

At the beginning of September, BGB was upgraded to a Morph public chain token, permanently destroying 220 million $BGB, worth $1.09 billion!

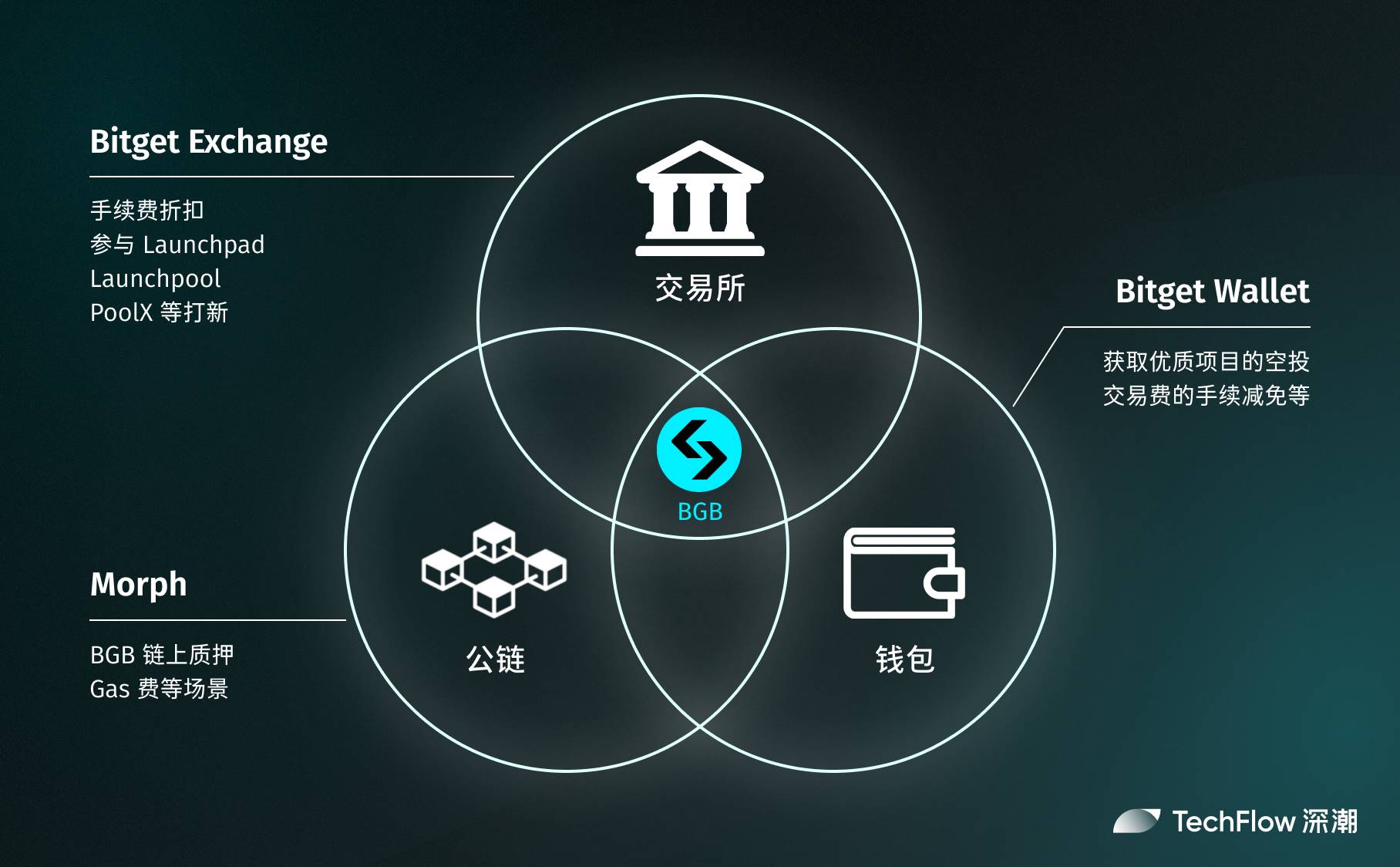

At this point, BGB has become the core token that integrates exchange, wallet, and public chain.

At the centralized exchange level, BGB not only serves as a medium for paying trading fees but also as an important credential for users to participate in platform governance and obtain various rights and interests. Users can enjoy trading fee discounts by holding BGB and participate in innovative projects such as Launchpad, Launchpool, and PoolX.

In terms of wallets, BGB is integrated through Bitget Wallet, allowing users holding BGB on-chain to have opportunities to receive airdrops from quality projects and enjoy reductions in trading fees.

At the public chain level, users can stake BGB on the Morph chain to participate in ecological construction, provide liquidity in decentralized trading, or use it as collateral for DeFi lending protocols. After becoming a Morph public chain token, it has directly increased its consumption scenarios.

6. Building the brand, enhancing reputation, investing in sponsorship and charity

When mentioning Bitget, people often think of its iconic blue bidirectional arrows and the image of global football superstar Messi, which is a testament to Bitget's continuous efforts in brand building.

In terms of visual identity, Bitget adopted a "subtraction" strategy in July 2023, simplifying and upgrading its brand logo. The new logo centers around a minimalist bidirectional arrow, symbolizing Bitget's mission to connect traditional finance with digital assets.

In terms of brand endorsement, Bitget signed legendary star Messi in 2022, and this strategic choice yielded significant returns after Messi led the Argentina team to win the World Cup, greatly enhancing the brand's global influence.

Subsequently, Bitget continued to expand its influence in global markets, adhering to a diversified sports marketing strategy, becoming the official cryptocurrency partner of La Liga in East Asia, Southeast Asia, and Latin America. At the same time, it became the official partner of the world's top motorcycle road racing event, MotoGP.

In terms of charity, Bitget has reached a three-year public welfare cooperation with UNICEF, utilizing innovative educational models and blockchain technology to empower young women and educators in developing countries.

To deepen its global layout, Bitget is actively establishing regional operation centers in Asia and Latin America and plans to enter the European and African markets. The platform's "Bitget Wallet Champion" global community influencer program aims to cultivate "crypto evangelists" to promote the popularization of Web3 applications. Notably, Bitget has joined the UNICEF Game Changers Coalition, supporting blockchain skills training programs in eight countries, demonstrating the platform's commitment to promoting inclusive finance.

7. Focusing on compliance, ensuring security, aggressively obtaining licenses

In the digital asset industry, security is always the paramount consideration.

Since launching the proof of reserves mechanism in December 2022, Bitget has maintained regular monthly updates, ensuring that the user asset reserve ratio is no less than 1:1. As of September 2025, the platform's total reserve ratio has climbed to 186%, demonstrating strong asset reserve strength.

The latest audit report shows that Bitget maintains sufficient levels in all major asset reserves. The platform holds 30,753.11 bitcoins, while user assets amount to only 9,395.3 bitcoins, resulting in a reserve ratio of 327%. In terms of stablecoins, the USDT reserve reaches 1.945 billion, covering user holdings of 1.93 billion, with a coverage rate of 101%; the USDC reserve also maintains a healthy level, with the platform holding 143 million while user assets total 114 million, achieving a reserve ratio of 125%. Ethereum assets are even more prominent, with the platform holding 308,082.22 ethers, while the total user accounts amount to 139,140.23 ethers, corresponding to a reserve ratio of 221%.

To further enhance the security of user assets, Bitget has established a $300 million protection fund, which has now reached $700 million, creating a dual asset protection system. This fund aims to provide users with additional security guarantees to effectively respond to extreme market fluctuations or sudden risk events.

In terms of compliance construction, Bitget is also continuing its efforts.

In April 2025, Chief Legal Officer Hon Ng reiterated the platform's global compliance commitment through an open letter. Against the backdrop of global compliance, Bitget has currently obtained over eight regulatory licenses in countries such as Australia, the UK, Italy, Poland, Lithuania, the Czech Republic, and El Salvador, and is continuously advancing compliance processes in more jurisdictions.

From an obscure futures exchange to a global leading digital asset platform, Bitget has achieved breakthrough after breakthrough in just seven years.

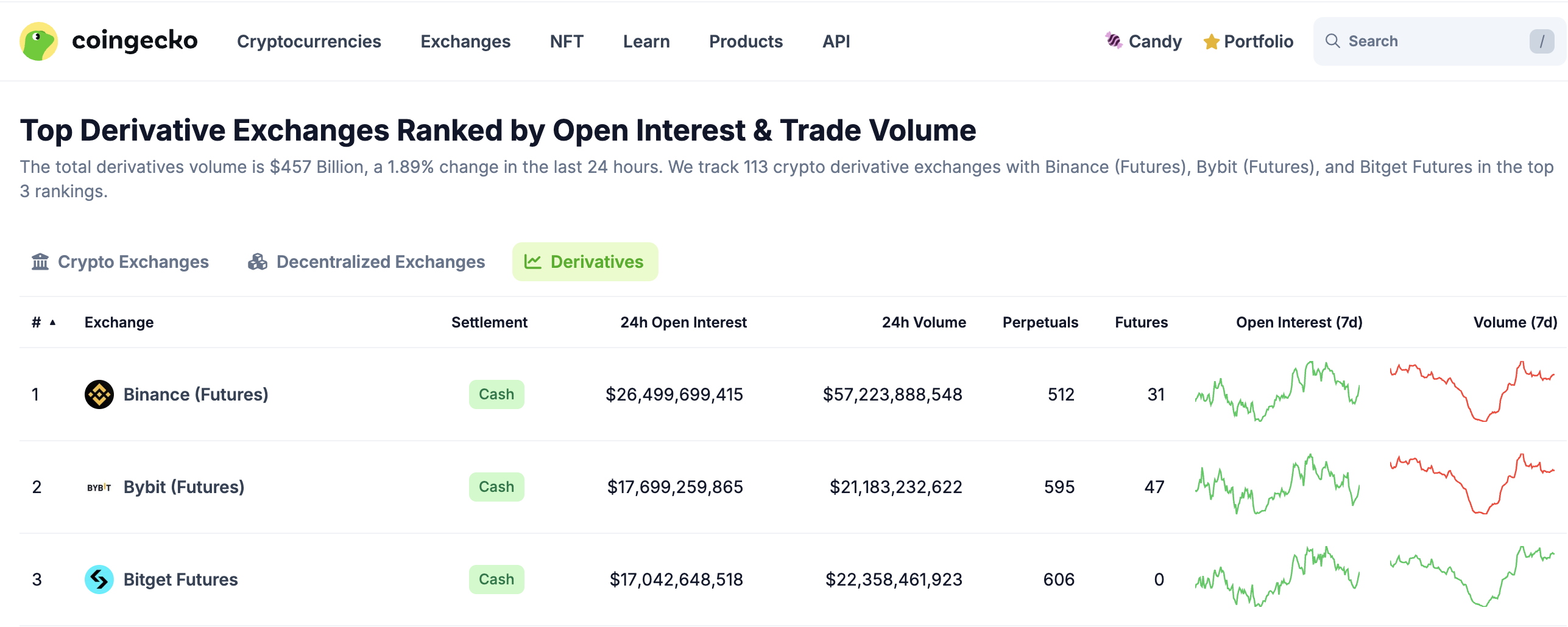

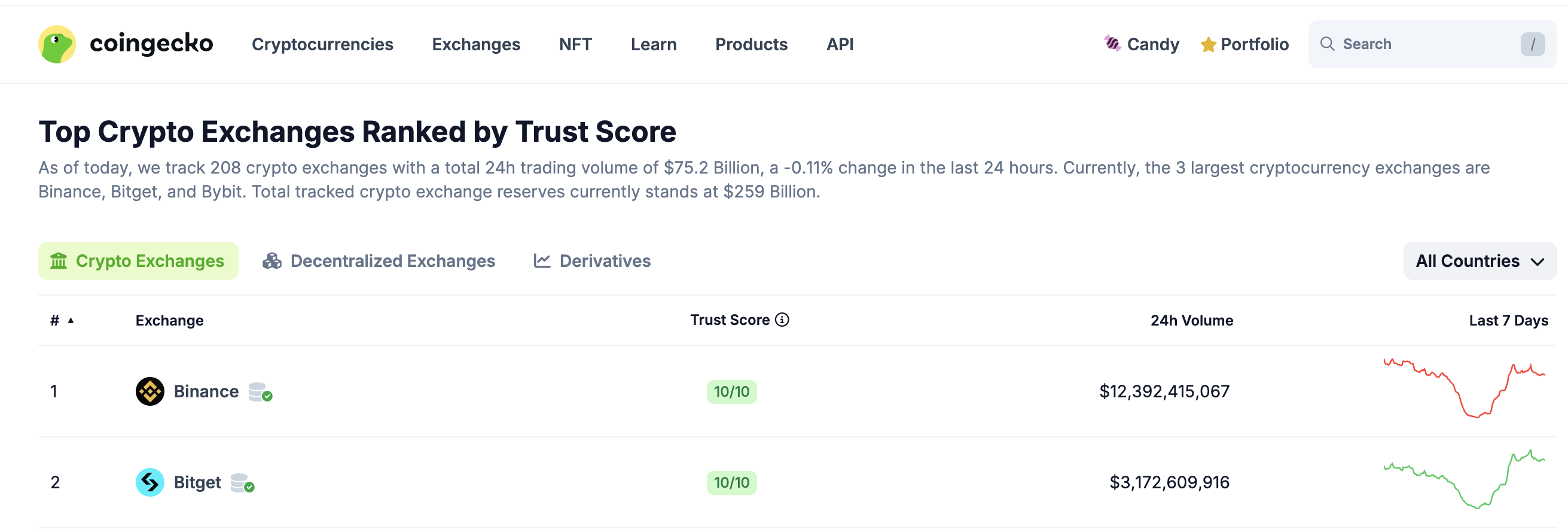

In Bitget's recently released August 2025 transparency report, the platform disclosed the latest dynamics and key progress in its core business areas. According to data from The Block and Coinglass, Bitget ranks among the top three global CEXs in terms of open interest in Bitcoin (BTC) and Ethereum (ETH). The open interest in Bitcoin has surpassed $10 billion, while Ethereum remains in the $5–7 billion range, rising to $6 billion by the end of August.

Additionally, CoinDesk's published "Market Data Depth Report" pointed out that Bitget leads the market in ETH and SOL liquidity. From November 2023 to June 2025, Bitget's derivatives trading volume has reached $11.5 trillion. In 2025, the platform's average monthly trading volume reached $750 billion, with nearly 90% coming from derivatives business.

As of July 2, 2025, Coingecko data shows that Bitget ranks third and second globally in contract and spot trading volume, respectively.

In its seven-year journey, Bitget has completed the leap from the industry’s periphery to the global stage. But the real story is just beginning.

UEX (Universal Exchange) is Bitget's declaration for the future. It is not a simple assembly of functions but a disruption: breaking the boundaries between centralized and decentralized, allowing users to seamlessly switch trading scenarios on a single platform and freely control their assets.

If the past seven years were Bitget's "barbaric growth," then UEX will be the starting point of its "new civilization." It carries the ambition to reshape the exchange landscape and ignites the spark for the crypto industry to evolve to a higher stage.

Seven years is just the prologue; UEX is the real beginning. The story of Bitget is far from over.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。