Before the US stock market opens, the three major stock index futures are down, while most Chinese concept stocks are up. Bilibili is up about 5%, Xpeng Motors is up about 2%, and Alibaba is up about 1%. Spot gold has dropped more than 1.00% today, currently reported at $3795.27 per ounce.

Written by: Li Jia, Zhang Yaqi

Source: Wall Street Insights

On September 30, before the US stock market opens, due to the ongoing risk of a US government shutdown, investors remain cautious. The three major US stock index futures are collectively down, with the S&P 500 index futures down 0.2%, the Nasdaq 100 index futures down 0.3%, and the Dow futures down 0.2%. The dollar is under pressure, and gold prices have slightly retreated.

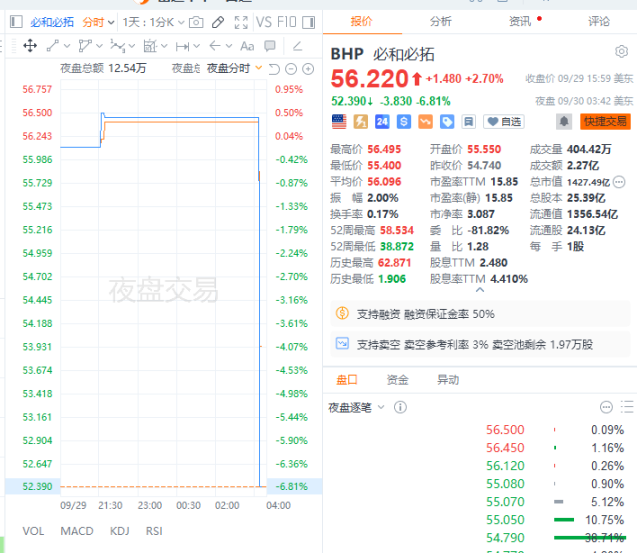

Most Chinese concept stocks are up, with Bilibili rising about 5%, Xpeng Motors up about 2%, and Alibaba up about 1%. BHP's US stock is down nearly 7% in after-hours trading.

Asian stock markets are mostly down, with the Nikkei 225 closing down 0.2%, the Seoul Composite Index down 0.2%, the Vietnam VN Index down 1%, the Singapore Straits Index up 0.4%, and the Malaysia Index up 0.4%.

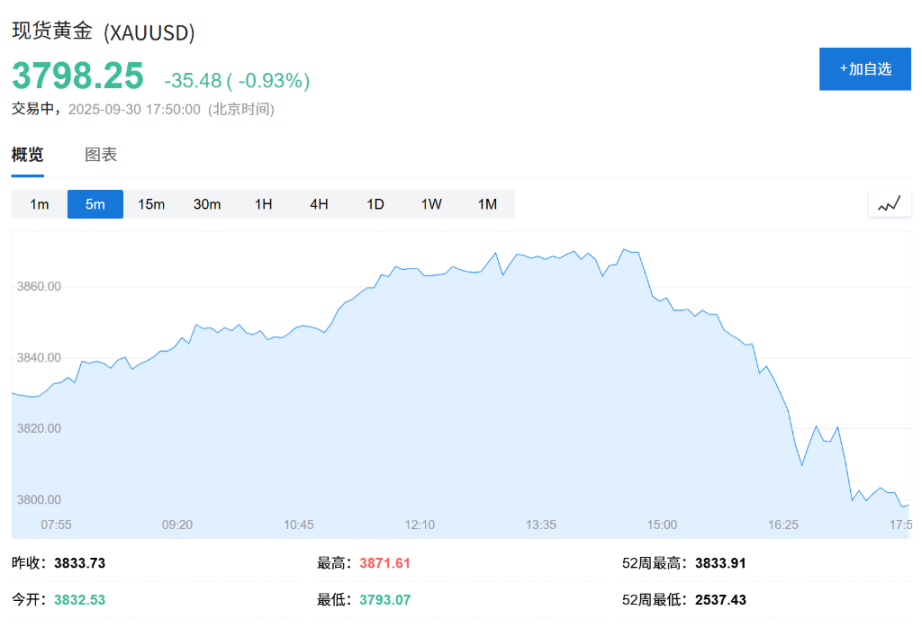

In terms of commodities, spot gold has dropped more than 1.00% today, currently reported at $3795.27 per ounce. Spot silver has fallen below $46 per ounce, down 2% today, iron ore is down 0.6%, copper is experiencing a high-level correction, and crude oil is down 2%.

The performance of core assets is as follows:

- The three major US stock index futures are collectively down, with the S&P 500 index futures down 0.2%, the Nasdaq 100 index futures down 0.3%, and the Dow futures down 0.2%.

- BHP's US stock is down nearly 7% in after-hours trading.

- Most Chinese concept stocks are up, with Bilibili rising about 5%, Xpeng Motors up about 2%, and Alibaba up about 1%.

- The Nikkei 225 index closed down 0.2%, at 44932.63 points.

- The Seoul Composite Index closed down 0.2%, at 3424.60 points.

- The dollar index fell 0.15% to 97.79.

- Spot gold has dropped more than 1.00% today, currently reported at $3795.27 per ounce.

- Spot silver has fallen below $46 per ounce, down 2% today.

- Spot palladium is down more than 3%, to $1213.75 per ounce.

- The dollar index fell 0.15% to 97.79.

- Brent crude oil has dropped 2.0% today, reported at $65.73 per barrel.

- WTI crude oil has dropped 2.0% today, reported at $61.72 per barrel.

The Nasdaq 100 index futures are down 0.3%. Due to the ongoing risk of a US government shutdown, investors remain cautious. Trump met with Democrats on Monday Eastern Time, but no progress has been made in reaching an agreement to avoid a government shutdown. Lawmakers must reach an agreement by 12:01 AM Wednesday, or it will lead to a partial government shutdown.

If the government shuts down, it will stop releasing economic data, leaving the Federal Reserve without key data to formulate its interest rate path.

BHP's US stock is down nearly 7% in after-hours trading.

Affected by the risk of a US government shutdown, the dollar is under pressure, and the dollar index has fallen 0.15% to 97.79.

Spot gold has dropped more than 1.00% today, currently reported at $3795.27 per ounce. This year, gold prices have surged 47%, likely to record the largest annual increase since 1979. This reflects not only market concerns about the US government shutdown but also the global trade tensions and the impact of the Federal Reserve's interest rate cuts.

Brent crude oil has dropped 2.0% today, reported at $65.73 per barrel.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。