OpenEden is an infrastructure aimed at connecting traditional finance and DeFi.

Written by: Stacy Muur

Compiled by: AididiaoJP, Foresight News

OpenEden is positioning itself as the gold standard for regulated RWA tokenization, linking institutional-grade finance with DeFi's native composability.

With a total locked value exceeding $517 million, it has received a Moody's "A" rating, a Standard & Poor's "AA+" rating, and has established partnerships with BNY Mellon and Binance. It has addressed the regulatory-innovation paradox that most RWA projects have failed to solve.

Some brief background on the RWA market:

The total market size for tokenized RWA is projected to reach $1.2 trillion by 2025 (up from $300 billion in 2024).

The compound annual growth rate is expected to be 80-100% by 2025.

The market size potential exceeds $2 trillion by the end of 2025.

Tokenized government bonds: $150 billion market size (up from $1 billion in 2023).

Thus, OpenEden's potential market includes:

Government bonds: $26 trillion global market.

Stablecoins: Over $17 billion market seeking yield.

Total locked value in DeFi: Over $100 billion seeking RWA exposure.

Institutional RWA demand: Rapidly growing.

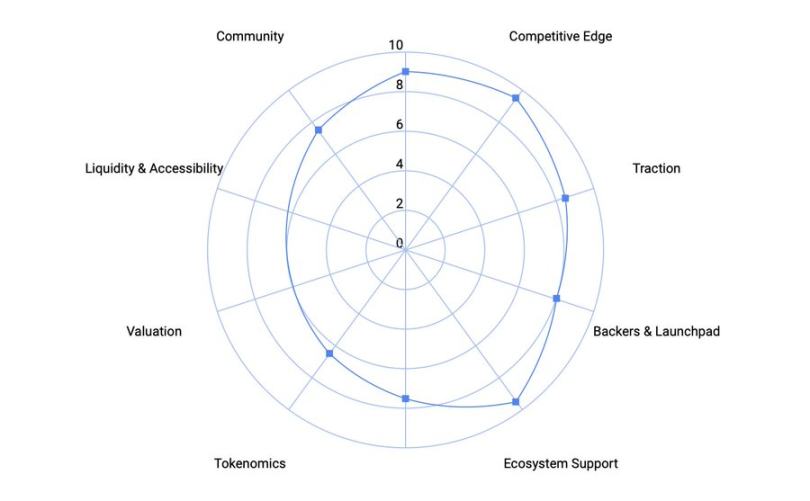

This analysis of OpenEden's investment potential uses the Muur score, which is my personal framework for evaluating protocols based on impact-weighted parameters.

Part One: Product Assessment

Product Status Score: 9/10

Stage: Mainnet launched in 2022, with multiple functional products (TBILL, USDO, cUSDO).

Metrics: Total locked value across products exceeds $517 million, with verified integrations in the DeFi space.

Maturity: Zero major security incidents in three years, audited infrastructure, stable yield delivery.

Why 9/10? OpenEden is already operating at scale with strong adoption rates. While it has not yet reached the billion-dollar dominance of Ondo, its proven mainnet appeal justifies a near-top score.

Competitive Advantage Score: 9.5/10

Unique Innovation: The first tokenized government bond fund to receive a Moody's "A" rating and a Standard & Poor's "AA+" rating.

Triad Paradox Resolution: Regulation + Yield + DeFi Composability, which is typically impossible to achieve, but OpenEden has accomplished all three.

Moat: Institutional custody and investment management (BNY Mellon), regulatory first-mover advantage, and multi-chain layout.

Why 9.5/10? Clear first-mover advantage in the regulated RWA space, with deep TradFi relationships and robust DeFi integrations. Rapid followers are unlikely to replicate quickly.

Market Attractiveness Score: 8.5/10

Total Locked Value: TBILL ($260 million) and USDO ($257 million) total $517 million.

Growth: TBILL year-on-year growth of +135%; USDO has surged to new highs.

Adoption: Binance and Ceffu accept cUSDO as off-exchange collateral; Pendle vault has attracted demand for ultra-high annual yields.

Multi-chain Operation: Ethereum, Ripple, Polygon, etc.

Why 8.5/10? Explosive growth, institutional adoption, and sustained usage. While total locked value has not yet ranked first compared to Ondo, the momentum is strong.

Supporter Score: 8/10

Supporters: YZi Labs, along with strategic support from BNY Mellon and Binance.

Why 8/10? Institutional-level partnerships, but top crypto-native VCs (like Paradigm/a16z) have not been disclosed. YZi Labs has been heavily investing recently, but not all investments have yielded good retail returns.

Ecosystem Support Score: 9.5/10

DeFi Integrations: Pendle, Curve, Morpho, Euler, Balancer, Spectra.

TradFi Partners: BNY Mellon (custody and investment management), Moody's and S&P (ratings), Binance (collateral acceptance).

Yield: Running products and vaults are generating returns.

Why 9.5/10? Few RWA projects can demonstrate such deep collaboration between TradFi and DeFi.

Token Economics Assessment

Valuation Score: Not Applicable (Pre-TGE)

Fully diluted valuation has not been disclosed, score postponed until TGE.

Token Economics (35% Score: 6.5/10)

Unknowns: Allocation ratios, vesting periods, unlock schedules.

Positives: Community activities (Bills events) and token incentives (OpenSeason) indicate a fair launch dynamic; institutional conservatism may ensure fairness.

Why 6.5/10? Limited data on pre-TGE token economics; a cautious mid-low score is given until disclosure.

Utility (30%) Score: 7.5/10

Expected Utility: Governance, fee sharing from TBILL/USDO, staking, ecosystem incentives.

Advantages: Real revenue capture based on fees.

Weaknesses: Regulatory constraints may limit the breadth of utility.

Liquidity and Accessibility (10%) Not Applicable (Pre-TGE)

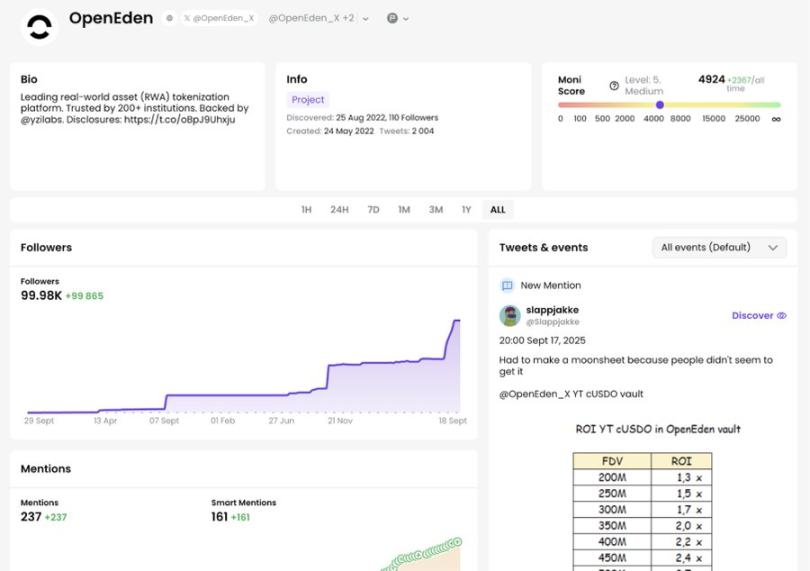

Community and Market Sentiment

Score: 7.5/10

Strong performance among institutional and DeFi-native users; weaker in retail or viral appeal. Activities like OpenSeason are enhancing engagement before TGE.

Market Background

Narrative Heat: RWA is one of the hottest narratives for 2025. (Final Score +0.5)

Market Sentiment: The market is in the "greed" zone, and altcoin season has arrived. (Final Score +0.5)

Competition: Intense competition for retail user mindshare, especially in the RWA category. (Final Score -0.5)

Adjustment: Overall +0.5

OpenEden's Final Score: 8.27

Product: 8.85/10

Token Economics (Pre-TGE): 6.96/10

Community: 7.5/10

Market Adjustment: +0.5

Risk Assessment

Bullish Scenario (55% Probability):

The RWA market experiences sustained exponential growth, and OpenEden captures significant market share.

Regulatory advantages evolve into insurmountable competitive moats.

Institutional adoption accelerates through strategic partnerships with BNY Mellon and Binance.

EDEN token appreciates due to increased fee revenue.

Base Case (20% Probability):

Adoption remains limited to specific institutional verticals.

Moderate growth observed, but token appreciation is constrained.

Regulatory barriers hinder innovation.

Bearish Scenario (25% Probability):

Traditional financial institutions develop competitive solutions.

Regulatory changes favor larger, existing entities.

Value generated from DeFi integrations falls short of expectations.

Competition arises from market participants with more abundant or aggressive funding.

Key Risks to Monitor:

Regulatory changes affecting RWA tokenization.

Competition from traditional finance (e.g., BlackRock, JPMorgan entering the market).

Risks associated with integration with DeFi protocols.

Current interest rate environment affecting government bond yields.

Specific Danger Signals:

Total locked value concentrated among a few large depositors.

Regulatory compliance costs negatively impacting profitability.

Token utility limited due to regulatory constraints.

Competition from protocol tokens offering better yields.

Conclusion

OpenEden is positioned for the institutional-grade future of RWA tokenization, providing a fully regulated platform that deeply integrates DeFi and is supported by partnerships with traditional financial entities.

The investment thesis for OpenEden is strong due to:

Proven product-market fit: evidenced by over $517 million in total locked value.

Regulatory moat: a significant barrier to entry for competitors that is nearly impossible to replicate.

Institutional partnerships: providing sustainable competitive advantages.

DeFi composability: enabling yield optimization and broader adoption.

OpenEden is not a speculative project but an infrastructure investment aimed at connecting traditional finance and DeFi. The upcoming EDEN TGE offers an early opportunity to engage with a foundational protocol that could become a cornerstone in the multi-trillion dollar RWA market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。