Author: Lawyer Shao Shiwei (Twitter: @lawyershao)

The "94 Notice" in 2017 and the "924 Notice" in 2021 have made it clear: Initial Coin Offerings (ICOs) are prohibited in the domestic market, and virtual currency trading is deemed illegal financial activity. Those in the industry are almost all aware of this.

However, in reality, a large number of Web3 studios are still active in the market, engaging in business related to virtual currencies and Web3. Lawyer Shao often receives similar inquiries in his daily work:

- "If we incentivize a large number of users to register accounts on an exchange and profit from referral commissions, will there be any risks?"

- "If I acquire a large number of user accounts and then help the project party create a liquidity pool (Liquidity Pool) on a DEX in exchange for service fees, will this cross the line?"

- "If I develop lower-level agents and users for the exchange in group chats on QQ, WeChat, or Telegram by publishing contract tutorials and receive referral commissions from the exchange, does this count as a violation?"

These questions have appeared frequently in legal consultations in recent years. I have previously written articles analyzing similar issues (e.g., "What Criminal Legal Risks Might Be Involved in Recruiting People to Trade Coins and Play Contracts?" and "Is the Business of Big Influencers in the Crypto Circle Taking Commissions Legal?").

Today, I will focus on dissecting a typical scenario: "Studios creating liquidity for project parties using a large number of accounts and receiving compensation"—is there any legal risk involved?

Meme Coin Issuance and False Liquidity: A Common "Harvesting" Script for Domestic Projects

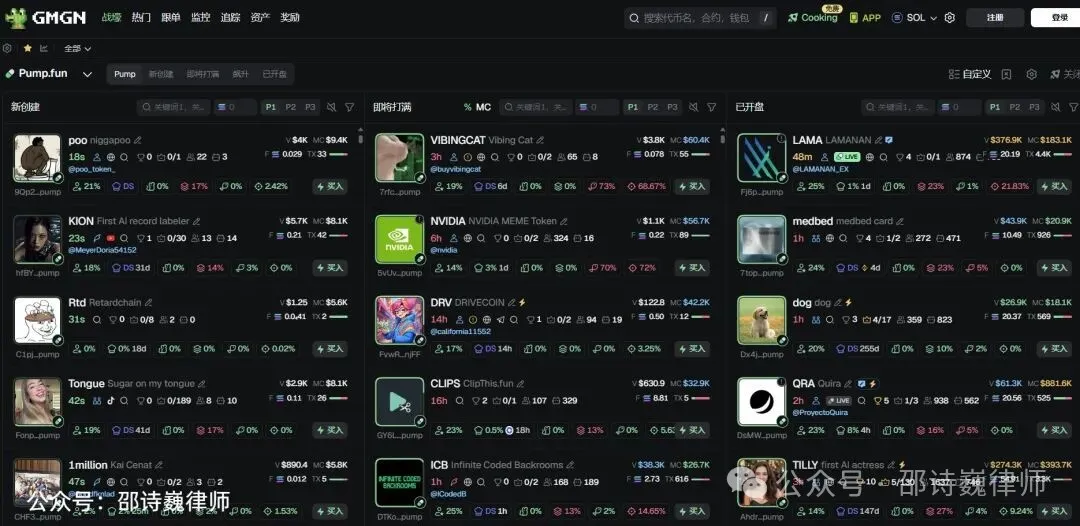

When you open GMGN (a one-stop platform focused on on-chain meme coin trading and analysis), you will find that meme coins are iterating almost in seconds. Are there issuers of these tokens from China? Certainly, and the number is astonishing.

In the crypto market, not all project parties aim for long-term operation. For some teams, the logic resembles a "script": first create hype, then fabricate an illusion, and finally cash out quickly. This situation indeed exists in the crypto world. Project parties collaborate with studios or market makers to artificially create liquidity, creating a false appearance of market prosperity, which is commonly referred to in the industry as "false liquidity" or "wash trading."

The common process for project parties to issue tokens and "harvest" investors:

- The first step is token issuance and packaging. Using token issuance tools like Four.meme and Pump.fun, project parties can generate a token with almost zero barriers and create a seemingly standardized process through "pre-sale + automatic launch." At this stage, common actions include setting "locked liquidity" and "destroying LP," misleading the outside world into believing that liquidity is safe and reliable.

- The second step is generating popularity and liquidity. Project parties need to make the token appear to have "inherent hype" from the moment of its birth. A common practice is to have bots trade back and forth on DEXs to create trading curves while simultaneously spreading screenshots of "pre-sale sold out" and "active trading" in the community.

- The third step is market promotion and emotional cultivation. As prices are pushed up, both inside and outside the community begin to promote, "This coin has multiplied dozens of times." External funds enter the market driven by FOMO (fear of missing out), becoming real buyers.

- The final step is for the project party to cash out. There are usually two methods: one is to sell off reserved chips in batches at high prices; the other is to directly remove LP and withdraw mainstream coins (BNB, USDT) from the pool. Regardless of the method, the result is often a sudden price drop, leaving real buy orders from retail investors.

From the outside, this entire process resembles a carefully designed performance: the stage is set, the audience is drawn in, while the project party secretly decides the script's ending.

Perfect Cooperation Between Web3 Studios and Project Parties

In this type of process, project parties do not act alone. Behind the scenes, there is often cooperation from Web3 studios, providing account resources, bulk user acquisition, DEX liquidity pool construction, automated trading volume generation, and hot topic promotion services, making the entire script more executable.

First, during the pre-sale stage. Studios usually acquire a large number of registered user accounts through paid purchases, allowing them to quickly fill quotas when the pre-sale starts, creating an atmosphere of "sold out in seconds." Meanwhile, hired promoters will simultaneously push screenshots and messages in Telegram and WeChat groups, misleading the outside world into thinking the project has garnered significant attention.

Second, in the construction and packaging of liquidity pools. Project parties need to complete liquidity injection on DEXs, while studios provide technical support: helping to configure the initial pool size and using "locking tools" or "destroying LP" operations to create a sense of security. These actions can easily be packaged as symbols of a "fair launch" to enhance external trust.

Third, in creating trading activity during the trading phase. Many studios are equipped with automated scripts that can perform high-frequency trading on DEXs, creating the appearance of trading prosperity. At critical price points, studios may also briefly support the price to prevent it from crashing too early. Additionally, they will push trading curves and transaction screenshots to the community to further hype the atmosphere.

Finally, in terms of promotion and marketing, studios and project parties form a division of labor: project parties are responsible for storytelling, while studios execute specific user acquisition, traffic diversion, viral marketing, and hot topic creation.

From an external perspective, these Web3 studios are not merely "technical outsourcing." They resemble the "execution team" of the entire performance, helping project parties package the launch of a new coin as a "highly popular, actively traded" market event.

Legal Risks for Owners and Employees of Web3 Studios

If the project party is the director of this performance, then Web3 studios are often the behind-the-scenes execution team. In fact, compared to Web3 project parties, the legal risks for Web3 studios are often higher. The reason is simple: most token-issuing project parties may not be based domestically. So, what criminal legal risks might be involved for relevant personnel within Web3 studios? Below, I detail the potential criminal risks of fraud, illegal fundraising, illegal operation, aiding information network crimes, and money laundering that Web3 studios may face.

Fraud risk. When a studio knowingly assists a project party with deceptive intentions by creating false appearances to help raise funds or attract buyers, it may be considered an accomplice. Typical scenarios include:

Knowing that the project party will not genuinely lock liquidity, yet assisting in the promotion of "fake destruction" or "fake locking";

Knowing that the project party plans to withdraw liquidity at a high point, yet helping to create trading activity in the early stages, inducing real investors to enter.

In some cases, this type of risk is not merely theoretical but has concrete criminal cases. For example, the widely publicized case of "a post-00s college student issuing a 'dog coin' and being sentenced to 4 years and 6 months for withdrawing liquidity" reveals this logic: the project raises prices in a short period, attracts buyers, and then withdraws the liquidity pool on a DEX. Judicial authorities often consider "whether there is premeditated deception, whether there is a withdrawal of liquidity, and whether users are induced to participate" as key factors in defining fraud in similar cases.

In this model, if a Web3 studio deeply participates in actions such as "early volume generation," "creating false appearances," or "supporting the price," even if they are not direct beneficiaries, they may still be held accountable for objectively committing acts of fraud or aiding in such actions.

Illegal fundraising risk. For Web3 studios, their actions may include helping project parties "inflate quotas" during the project pre-sale stage, creating a "sold out" atmosphere. According to regulatory documents, any fundraising from unspecified members of the public, whether through token subscriptions, rebate promises, or "liquidity locking," without approval from financial regulatory authorities, may touch upon the crime of illegally absorbing public deposits.

So, if the studio only uses the large number of accounts it purchased and is actually using its own funds or funds provided by the Web3 project party, does that mean it does not involve this risk? The answer is not absolute. Because even if the studio buys tokens using a large number of accounts to increase liquidity, its purpose is still to attract a large number of unspecified users to invest funds and purchase project tokens.

Illegal operation risk. In the context of domestic regulation, virtual currency trading and related matching and market-making are defined as illegal financial activities. If a studio builds liquidity pools for project parties, manipulates trading pairs, or provides volume generation services, it essentially participates in unlicensed financial business. For studio owners, this risk directly corresponds to criminal liability for "organizing and operating"; while employees who directly execute related operations may also be deemed as "joint participants."

Risk of aiding information network crime. Many studios possess a large number of real-name or virtual accounts for "user acquisition," "bulk registration," and "proxy trading." If such behavior is deemed to provide conditions for illegal activities such as fraud or money laundering, it may touch upon the crime of aiding information network crimes. In some cases, even employees who merely provide technical interfaces or account resources may fall under the scope of accountability.

Money laundering risk. When studios help project parties convert tokens into USDT and then exchange them for RMB, or assist in cross-border fund transfers, if the funds are linked to illegal gains, they may fall under the purview of money laundering offenses.

Additionally, from the perspective of principal and accomplice, the owners of Web3 studios often face direct responsibility for "organizing and planning," while employees, although operating at the execution level, may also be considered accomplices if they repeatedly operate despite knowing the project poses risks. In other words, in such gray businesses, being "just an employee" does not serve as a natural excuse for exemption from liability.

Conclusion: Legal Risks in the Gray Area

From the project party's script to the studio's collaboration, and finally to the real buy orders from retail investors, this industrial chain is repeatedly played out in the crypto world. However, its existence does not imply safety.

Although there are currently no explicit legal provisions regarding "liquidity services" or "volume trading," judicial authorities' understanding of virtual currency-related cases is continuously deepening. With the maturation of on-chain data analysis methods, the flow of funds and trading behaviors are gradually falling within the scope of traceable and quantifiable ranges.

For Web3 studios, this means a reality: in the past, due to insufficient understanding of such business activities by judicial authorities, if retail investors reported cases for rights protection, the response might have been that the risks of virtual currency investment losses are inherent. However, in the future, such activities are likely to be viewed as components of illegal activities such as "aiding fraud," "illegal operation," and "aiding information network crimes." The owner, as the organizer, bears direct responsibility, while employees who operate despite knowing the project has deceptive intentions may be regarded as accomplices.

In other words, the survival space for such gray businesses is gradually being compressed. This article serves as a risk reminder.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。