Original Title: 《Loopscale: Order book lending on Solana》

Author: Castle Labs

_Translation: Luiza, ChainCatcher

_

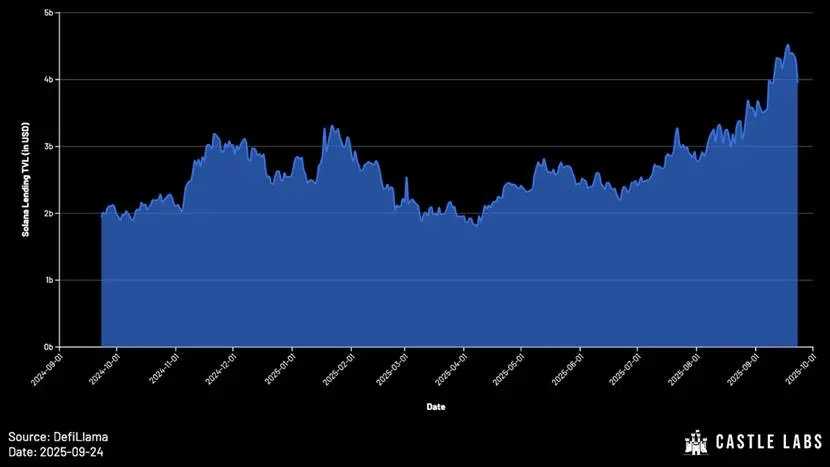

Although the total value locked (TVL) in Ethereum's DeFi is still far from its peak in 2021, Solana's TVL has seen significant growth and has now reached an all-time high.

The characteristics of the Solana ecosystem make it an ideal choice for lending protocols. Protocols like Solend are a testament to this—this protocol had nearly $1 billion in deposits as early as 2021. Despite the severe impact of the FTX collapse on the development of Solana's lending ecosystem in the following years, lending protocols on Solana have shown remarkable resilience and have sparked a new wave of growth.

In 2024, the TVL of lending protocols on the Solana chain was less than $1 billion, and this figure has now surpassed $4 billion. Among them, Kamino leads with over $3 billion in TVL, followed closely by Jupiter with $750 million in TVL.

This study will first analyze the limitations of the pool-based lending model and the rise of alternative models. It will then delve into Loopscale's value proposition, unique features, and the practical benefits it brings to users. Finally, it will look ahead to the future development trends of the lending market and pose several thought-provoking questions.

Evolution of Lending Models

Mainstream lending protocols (such as Aave and Compound) generally adopt a pool model: users inject liquidity into the pool for others to borrow. Interest rates are dynamically adjusted by algorithms based on the utilization rate (total borrowed / total deposited).

Early on, the design flexibility of such protocols was limited by the architecture of the Ethereum mainnet. While the pool model has advantages in the startup phase and ensuring liquidity for collateral assets, it has significant shortcomings:

- Liquidity fragmentation (the challenge of new asset listings): Each new asset requires a separate pool, which inevitably leads to fragmented liquidity. Users managing multiple positions also face increased complexity and need to invest more effort in active management.

- Rough risk pricing: The utilization curve is a "one-size-fits-all" pricing mechanism that is inefficient and may ultimately lead to terms that are either overly aggressive (high risk) or overly conservative (low yield). In fact, the interest rates in a pool often align with the highest-risk collateral assets in the pool.

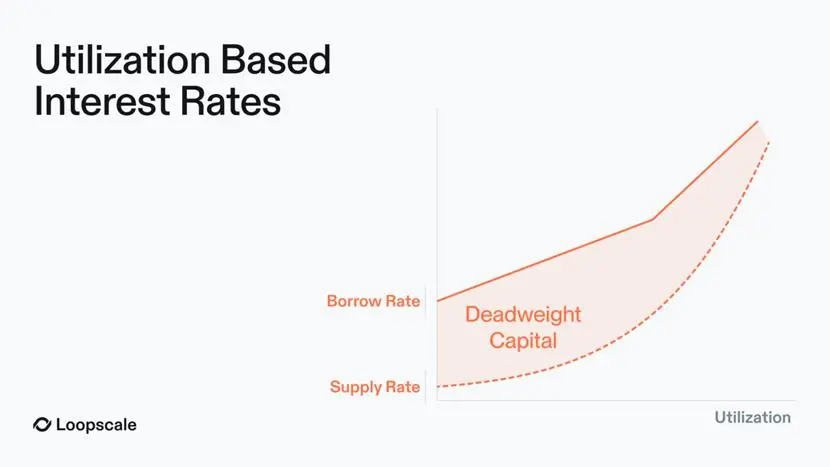

- Low capital utilization efficiency: In a pool lending market, only the borrowed funds generate interest, but the interest income must be distributed among all depositors. This means that lenders actually receive less interest than what borrowers pay, creating "deadweight capital." Additionally, idle funds waiting to be borrowed in the pool also participate in interest distribution, further widening the aforementioned interest gap.

To alleviate these issues, protocols like Euler, Kamino (V2), and Morpho (V1) have introduced curated vaults, where professional managers allocate funds and set interest rates.

This pragmatic improvement allows for a transformation without the need for a complete overhaul of the lending protocol's tech stack, while also addressing some of the problems of the pool model. In the curated vault model, the vault is managed by selected "curators" who possess professional research and risk control capabilities, responsible for fund allocation, market selection, interest rate setting, and loan structure design. The advantages this model brings to users include:

- Users can choose different vault managers, with each vault designed for specific risk preferences, allowing users to avoid exposure to the risks of all assets supported by the pool.

- Position management is more convenient: managers can quickly allocate assets to new markets, thus more efficiently guiding liquidity towards new assets and facilitating the launch of new asset pools.

However, curated vaults also have drawbacks:

Trust and alignment of interests issues: The vaults are operated by third-party managers, requiring users to trust them, and the alignment of interests between managers and users cannot be fully guaranteed.

Manager competition and rising costs for borrowers: Managers are responsible for setting risk parameters, formulating strategies, and adjusting liquidity to pursue higher yields. During the liquidity adjustment process, competition among different strategies of managers can adversely affect borrowers—since managers have the incentive to maintain high capital utilization rates to provide lenders with attractive annual percentage yields (APY), this can drive up borrowing rates and increase costs for borrowers.

Curated vaults also fail to resolve the inherent flaws of the pool model:

- Inefficient interest rates leading to "value loss" still harm the capital efficiency of the lending market;

- The cost of launching new markets remains high;

- Liquidity is still fragmented across multiple independent markets;

- Interest rate volatility is high, making it difficult to meet the needs of institutional users;

- Insufficient flexibility, as supporting new assets or credit products requires governance votes and the creation of new independent pools.

Although curated vaults optimize risk management by splitting liquidity, they essentially remain a variant of the pool model. As the variety of supported assets and risk combinations continues to grow, the number of curated vaults is increasing, and their logic is approaching that of an order book model—where each lending quote represents an "independent market" with specific terms, achieving extreme granularity.

Why is the Order Book Model Rising Now?

The concept of order book lending has long been recognized, but in the past, it was often impractical to deploy due to high transaction costs and technical limitations of networks like Ethereum, which also had significant shortcomings in scalability and capital efficiency.

The rise of alternative public chains like Solana has changed this situation—its low transaction costs and high throughput characteristics have finally made it possible to build scalable and efficient order book-based lending markets.

The pool model once supported the scaled development of lending protocols, but the order book model provides the much-needed flexibility for the market, especially suitable for institutional users and diverse asset types, such as interest-bearing RWA tokens (like OnRe's ONyc), AMM LP positions, JLP/MLP tokens, and LSTs (with a TVL exceeding $7 billion), allowing users to have complete control over risk allocation.

Loopscale: An Order Book Lending Protocol on Solana

Loopscale is an order book-based lending protocol on the Solana chain, currently boasting over $100 million in deposit liquidity and an active loan volume of $40 million.

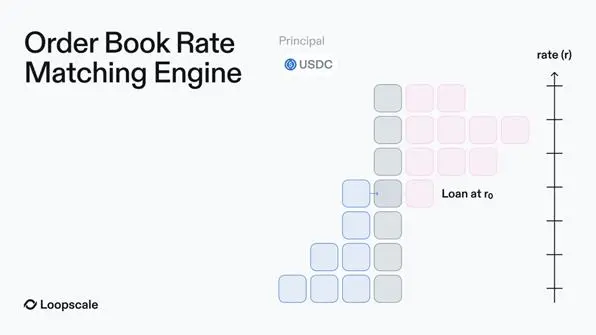

Unlike traditional pool-based lending platforms, Loopscale's core innovation lies in allowing lenders to create customized orders, setting their own loan structures and risk parameters. These quotes are "listed" on the order book based on interest rates and other terms, with Loopscale's matching engine completing the lending matches.

Core Advantages of Loopscale's Order Book Model

① Automated Vaults:

For users looking to further simplify operations, Loopscale achieves process automation through its own "curated vaults." The liquidity injected into the vault can be used across all markets approved by the manager, with each vault equipped with a risk manager responsible for setting unique risk preferences and strategies.

This design creates a differentiated strategy system that can meet the risk needs of different users: for example, some users may be willing to take on reinsurance-related risks through the USDC OnRe vault (via ONyc tokens); while more risk-averse users can choose to deposit funds into the USDC Genesis vault—this vault will conduct robust liquidity distribution across Loopscale's various markets.

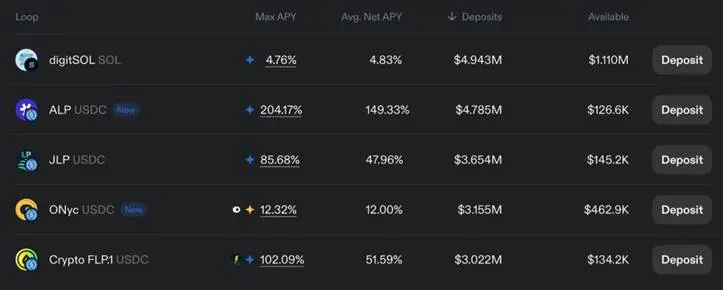

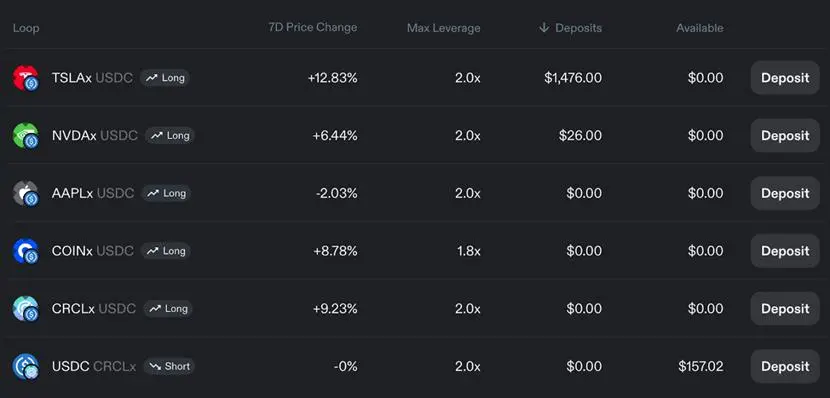

② One-Click Leveraged Cycling:

In addition to traditional lending, Loopscale also supports a "fund cycling" feature. Through this feature, users can leverage interest-bearing assets (including JLP, ALP, digitSOL, ONyc, etc.), with the specific principle as follows:

The core logic of fund cycling is: after depositing collateral assets, borrow the same asset as the collateral, allowing both the initial position and the borrowed tokens to generate returns. The leverage multiple available to users depends on the market's loan-to-value ratio (LTV).

Taking liquid-staked tokens (LST) as an example, the traditional fund cycling process is as follows:

- Deposit wstETH (wrapped staked ETH);

- Borrow ETH;

- Exchange ETH for wstETH;

- Borrow ETH again to obtain higher wstETH yields.

It is important to note that the fund cycling operation only yields actual returns when the yield of the LST exceeds the annualized borrowing rate.

On Loopscale, this process is simplified to a "one-click operation," allowing users to avoid manually completing multiple steps.

Through the fund cycling feature, users can maximize the APR of interest-bearing tokens;

Additionally, leveraged fund cycling also allows users to engage in directional leveraged trading on assets like stocks.

③ Solutions to the Deficiencies of the Pool Model

(1) Liquidity Aggregation

The order book model can address the liquidity fragmentation issue in pool markets. Loopscale further resolves the liquidity dispersion of the pool model and the difficulty of reusing funds in early order book models by creating "virtual markets." Lenders only need to perform a single operation to simultaneously place orders across multiple markets, without being limited to a single market or managing multiple positions.

(2) Efficient Pricing

Each market on Loopscale is modular, with independent types of collateral assets, lending rates, and terms. This means that lenders can set interest rates for specific collateral assets and principal amounts, no longer constrained by capital utilization rates. Ultimately, the interest rates for each asset are dynamically adjusted based on market supply and demand in the order book (which may be influenced by factors such as asset volatility).

This design also achieves the following goals: minimizing "deadweight capital"; ensuring that borrowing rates perfectly match deposit rates (in the pool model, "interest income must be distributed among all depositors, leading to lenders receiving less than borrowers' costs," whereas on Loopscale, interest is only paid on funds that are actually utilized, achieving precise interest rate matching);

In particular, it supports fixed-rate, fixed-term loans to meet the needs of institutional users—who typically are unwilling to accept interest rates that fluctuate based on utilization in the pool model.

(3) Optimizing Capital Utilization

Loopscale reduces idle funds waiting for matches in the order book through an "optimized yield" mechanism. Its operational logic is simple and direct: Loopscale directs this portion of idle liquidity to the MarginFi platform, ensuring that lenders can still "earn competitive yields" before order matching is completed.

(4) Expanding Asset Support

The Loopscale team can easily integrate with other protocols and fully leverage Solana's asset composability to support assets that are difficult to obtain liquidity for in pool markets.

④ Practical Benefits for Users

The aforementioned features provide tangible benefits for users: they can fully control loan terms, collateral assets, and the markets they participate in, achieving refined management; as competition in the lending market intensifies at the interest rate level, the Loopscale model offers advantages over pricing methods based on pool utilization rates—by directly matching orders, interest rates can be precisely aligned, saving costs for borrowers and increasing returns for lenders.

Future Outlook and Conclusion

Loopscale combines the flexibility of the order book with modular markets to directly address the inefficiencies of the pool model, providing users with customized rates, optimized collateral pricing, and risk management tools.

As DeFi expands into institutional capital and RWA, the order book model will become an important infrastructure for scaling on-chain lending. Loopscale has already supported various RWAs and exotic assets, continuously expanding its partnerships. New markets require only an oracle and initial liquidity (which can be provided by vaults or individual lenders), significantly lowering the entry barrier.

Currently, the Solana ecosystem is benefiting from the widespread adoption of new token prototypes, including LSTs worth billions of dollars, liquid-staked derivatives (LRTs), staked SOL (which accounts for 60% of the total SOL supply), liquidity positions, RWA assets, and more. In this context, lowering the entry barrier for new assets as collateral is key to enhancing market efficiency. The feasibility of the order book lending model has been widely recognized in the market—protocols like Morpho have already introduced similar designs in their V2 versions.

Although Loopscale faced a hacking incident in April 2025 (shortly after its launch), the team demonstrated strong resilience, recovering all funds. It is important to note that handling complex collateral carries inherent risks, and thorough risk assessment and management are necessary from both operational and user interface perspectives. If these challenges can be properly addressed, Loopscale is expected to achieve architectural optimization through Solana's tech stack and successfully advance the platform's scaling development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。