Author: Deng Tong, Golden Finance

On September 25, 2025, the Beta version of the Plasma mainnet, a Layer 1 stablecoin payment project supported by Bitfinex, was launched, integrating over 100 DeFi protocols including Aave, Ethena, Fluid, and Euler.

Plasma has created a myth where investors can seize an airdrop worth $8,390 for just $0.1. What does the future hold for Plasma?

1. Seizing an $8,390 XPL Airdrop for $0.1

On Thursday, the stablecoin blockchain Plasma launched its mainnet test version, and its native token XPL was also released.

Every participant in the Plasma pre-stored ICO plan received XPL worth $8,390—even if they did not actually purchase tokens through the ICO. This news caused countless people to slap their thighs in disbelief.

Plasma stated that within three hours of the mainnet test version launch, half of the ICO participants had claimed their tokens. Plasma allocated a total of 25 million tokens to all pre-stored users, which will be distributed equally among all depositors, meaning that whether one deposits $1 or $10,000, the additional rewards received will be the same.

The initial supply of Plasma tokens is 10 billion, of which 18% (1.8 billion) is currently in circulation. In Plasma's XPL tokenomics, 10% of the token supply was allocated to the public sale in July, which was ultimately oversubscribed by over $300 million. The team also reserved 40% of the token supply for ecosystem development, with 8% unlocked at launch and the remaining 25% distributed to the team and investors over a multi-year vesting period. A portion of the circulating XPL belongs to U.S. investors, who, due to regulatory factors, will not receive their XPL until July 28, 2026, meaning the actual trading XPL tokens will be less than 1.8 billion.

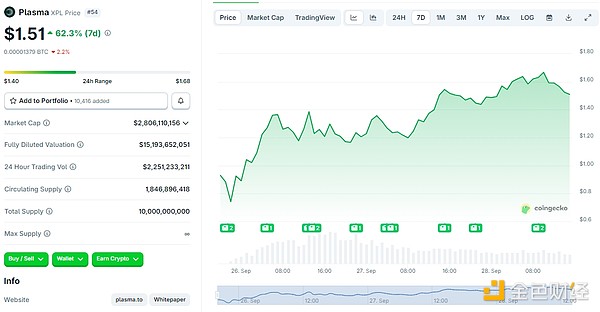

Since the XPL was listed on mainstream exchanges on September 25, its price trend has remained relatively stable, peaking above $1.6 and currently trading at $1.51.

Upon its launch, XPL was favored by whales. According to on-chain analyst @ai_9684xtpa, a mysterious whale that heavily invested in 24.29 million XPL transferred the tokens to address 0x57d…02dd1 at 10:30 PM last night, and then moved them to the Plasma mainnet via the Hyperliquid cross-chain bridge. The receiving address has not yet transferred or sold the tokens, which are valued at $39.6 million.

2. The Development Prospects of Plasma

1. Plasma May Be a Long-Tail Way to Access Tether

Some industry insiders believe that, relative to its adoption rate, Plasma's valuation may still be too high. Delphi Digital analyst @simononchain pointed out that although Plasma has not yet been truly adopted, the market often focuses on significant opportunities like stablecoins. "The market may see Plasma as a long-tail way to access Tether, which is rapidly becoming one of the most valuable companies in the world."

Plasma is a stablecoin-specific Layer 1 blockchain supported by Tether. Tether's sibling company Bitfinex participated in the investment in Plasma, and Tether CEO Paolo Ardoino also personally participated in Plasma's financing. Currently, Tether is still in a rapid growth phase. Tether CEO Paolo Ardoino has noted that USDT is growing rapidly worldwide. In the first half of 2025, the number of on-chain transfers of USDT increased by 120% compared to the entire year of 2024, with 66% coming from West Asia, the Middle East, and Africa.

Due to the special relationship between Plasma and Tether, investing in Plasma is also equivalent to indirectly investing in Tether. As Tether continues to grow stronger, investors will also have confidence in Plasma.

2. The Competitive Landscape Facing Plasma

Plasma has an ambitious mission: to change the way global funds flow. As early as February this year, Plasma raised $24 million to develop a new blockchain for Tether's USDT. However, Plasma currently faces competition from multiple rivals.

First, Ethereum still holds the throne in terms of stablecoin liquidity, with strong competitors like Tron and Solana.

Second, stablecoin chains are rising, and competition is becoming increasingly fierce. On August 12, Circle announced the launch of Arc—a Layer 1 blockchain designed specifically for stablecoin financial scenarios; on August 11, fintech giant Stripe partnered with crypto venture capital firm Paradigm to develop a high-performance, payment-focused Layer 1 blockchain called "Tempo"; there is also the native asset issuance chain Noble built on the Cosmos SDK; even Google recently announced the Google Cloud Universal Ledger (GCUL)—focused on providing digital payments and tokenization for financial institutions…

Therefore, Plasma's competitors include not only established public chains in the crypto industry but also emerging stablecoin chains and giants from traditional industries.

3. The Future of Plasma

Now, Plasma has launched its mainnet and native XPL token, introducing zero-fee USDT transfers through a custom consensus called PlasmaBFT, along with over 100 DeFi integrations. Within 24 hours of its launch, Plasma absorbed over $4 billion in cryptocurrency, ranking eighth in blockchain DeFi deposit value, mainly due to users in Plasma's lending vault and partner DeFi protocols being able to earn the network's native token XPL. This morning, Plasma announced that the stablecoin supply on the Plasma chain had surpassed $7 billion within two days.

Due to its speed and zero-fee advantages, exchanges, financial companies, and banks can use Plasma as a settlement layer for large transfers. Banks or corporate consortiums can also run private overlay layers on Plasma to settle large interbank transfers with Bitcoin-backed finality. For corporate treasuries, transferring $50 million between subsidiaries may only take a few seconds, rather than the days required by traditional SWIFT.

In addition to launching the mainnet to facilitate settlements, Plasma will also introduce a new banking product—Plasma One.

On September 22, Plasma announced the launch of Plasma One—the first new type of bank for native stablecoins. The target customers for this release are users in emerging markets with high demand for dollar usage, providing features such as stablecoin-supported bank cards, fee-free USDT transfers, and quick onboarding.

Plasma One has the following features: earn while you spend: pay directly from the user's stablecoin balance while earning over 10% returns; real rewards: earn up to 4% cash back when using the physical or virtual card from PlasmaOne; borderless coverage: use the card in over 150 countries and 150 million merchants; zero-fee USDT transfers: send digital dollars instantly and for free to individuals and businesses through the app; quick registration: register, complete the onboarding process, and receive a virtual spending card in minutes (rather than days).

Plasma One will fully integrate the entire Plasma ecosystem into one application, incorporating the DeFi ecosystem, exchange integrations, and payment partners, providing pricing and liquidity, as well as a consistent user experience.

Conclusion

The popularity of the Plasma project was evident as early as June this year: on June 9, Plasma's public token sale completed a subscription of $500 million within minutes. The first participating wallets exceeded 1,100, with an average deposit amount of about $35,000. On June 12, Plasma announced the opening of a $500 million deposit cap, raising the total cap to $1 billion…

Plasma CEO Paul Faecks pointed out: "The dollar is a product that most people in the world crave. Stablecoins provide a basic, permissionless way to hold and transfer dollars anywhere…"

Now, Plasma has shaken the industry with the XPL airdrop and gained the favor of numerous investors with its connection to Tether and its strong competitive identity in reshaping the stablecoin chain landscape. No one can predict what exciting paths Plasma will carve out in disrupting traditional financial payments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。