Author: 0xBrooker

This week, BTC remains in a market fluctuation following interest rate cuts, with continued selling pressure and diminishing buying strength, leading to a price drop once again.

The main factors influencing BTC pricing include fluctuations in risk appetite caused by unclear interest rate cut paths, ongoing selling by long positions, a shift in buying strength from inflow to outflow, and the leverage cleansing in the contract market along with end-of-quarter fluctuations in the futures market.

The Nasdaq is also experiencing market fluctuations post-interest rate cuts, but BTC is affected by other factors, showing a notable weakness in both the duration and magnitude of its decline compared to the Nasdaq.

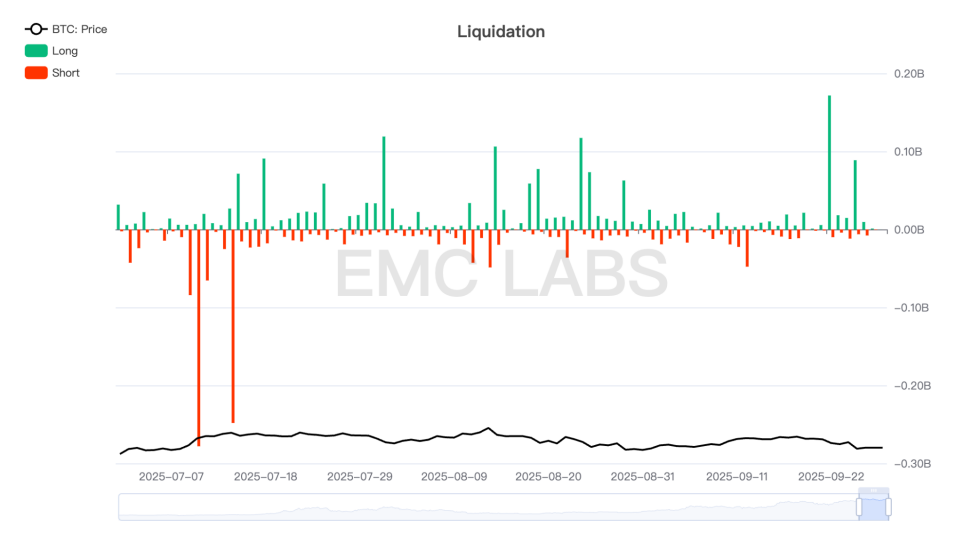

During a week of continuous adjustments, BTC once again fell below the key support level of $110,000 but recovered over the weekend, experiencing over $2 billion in liquidations throughout the week, with total open interest in the contract market dropping to $77.1 billion.

After the interest rate cuts, long positions have intensified their selling, becoming a significant force driving down pricing. Has BTC already peaked at $124,000 in this cycle? The market will provide an answer in Q4.

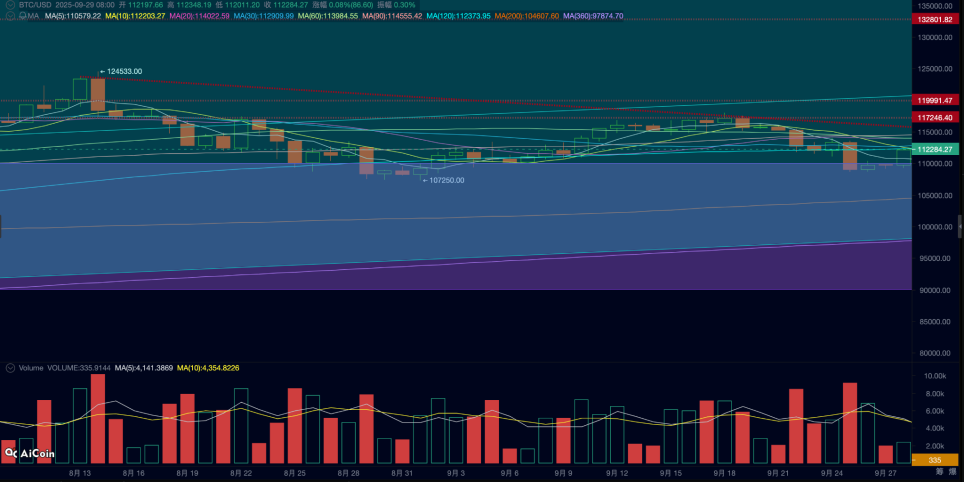

BTC Daily Chart

Policy, Macroeconomic Finance, and Economic Data

This week, important U.S. economic and employment data released included initial jobless claims for the week of September 20 and the August core PCE.

On Thursday, the initial jobless claims for the week of September 20 were reported at 218,000, lower than the expected 235,000 and the previous value of 232,000, while the number of continuing claims remained above the critical level of 1.9 million at 1.93 million. This indicates that employment pressure remains significant, but the situation has not worsened beyond expectations. This supports the maintenance of interest rate cut expectations. U.S. stocks closed higher that day.

On Friday, the August core PCE data was released, showing a month-on-month increase of 0.2%, in line with expectations, and a year-on-year rate of 2.9%, also meeting expectations, but personal spending increased by 0.6%, slightly exceeding the expected 0.5%. This indicates that inflationary pressures are within expectations, but concerns remain.

Last week, Powell stated that the Federal Reserve emphasizes monitoring the deterioration of the job market, but this does not mean completely ignoring inflation data. This has left the market in a precarious state after pricing in three interest rate cuts totaling 75 basis points earlier in the year. Therefore, before the release of key data this week, traders chose to take profits, pushing the market down, which only stabilized and slightly rebounded after the expected data was released on Thursday and Friday.

After a week of fluctuations, the market slightly adjusted its interest rate cut expectations, with the dollar index rebounding significantly by 0.53% after consecutive declines, putting pressure on stock and cryptocurrency valuations. The 2-year U.S. Treasury yield rebounded by 1.65%, and the 10-year yield rebounded by 1.21%, dampening the optimism of "rate cuts = liquidity easing," which exerted some pressure on the stock market and long-duration assets.

By the weekend, FedWatch indicated that the market still supports two rate cuts totaling 50 basis points before the end of the year, but the probability has slightly decreased compared to last week. Both U.S. stocks and BTC experienced declines before the release of key data in the past week, stabilizing and slightly rebounding afterward, but still showing a slight decline over the week.

Cryptocurrency Market

BTC fell in sync with the Nasdaq this week, but its decline of 2.68% far exceeded the Nasdaq's 0.65%.

Technically, BTC has broken below the 120-day moving average this week, briefly returning to the "Trump bottom" (the $90,000 to $110,000 range) that it has hovered around for 10 months, indicating a potential weakening in mid-term prices.

ETH broke below the upward channel since April, briefly falling below the important support level of $4,000.

The weakness in BTC is the result of multiple factors at play.

First is the decline in risk appetite due to lowered interest rate cut expectations. This is ultimately reflected in the shift of funds in the BTC Spot ETF channel from inflow to outflow, with DATs companies facing financing constraints leading to reduced buying strength.

Secondly, there is the "curse" of cyclical laws. Historically, BTC peaks often occur around "525 ± 7" days after halving, corresponding to the 21st of this month. We note that long positions strictly adhering to cyclical laws have continued to sell, and even after this week's price breakdown, they have not stopped. This undoubtedly accelerated the price decline.

Finally, there is the leverage cleansing in the contract market. Around mid-September, before and after the interest rate cuts, BTC and ETH contract open interest approached historical highs. This week, the price breakdown cleared out tens of billions in open positions, with liquidations exceeding $2 billion.

BTC Perpetual Contract Liquidation Statistics

The current Crypto market has undergone significant changes, with different factors pointing to both supporting and opposing peak judgments.

Institutions and U.S. stock funds have become the main buyers, while funds from the crypto circle are retreating. However, long positions acting according to cyclical laws still hold a large amount of BTC, and their impact on the cycle should not be underestimated. Over 95% of BTC is already in circulation, and the impact of halving on its price has become minimal. Another factor that cannot be ignored is that the Federal Reserve is indeed pushing for interest rate cuts, which is beneficial for high-risk assets in the long term.

We tend to respect the forces at play and observe changes while controlling our positions.

Long positions trading according to "cyclical laws" are methodically selling off, becoming the largest shorts, and their performance in the remaining time of this month and around the next interest rate cut in October will be very important.

At the same time, close attention should be paid to economic and employment data that influence interest rate cut expectations, as well as whether funds from ETFs and DATs companies can recover inflows in a timely manner.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, in an upward continuation phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。