The Crossroads of a Structural Bull Market: AI Capital Expenditure, Dollar Liquidity, and Market Rebalancing

Author: arndxt

Translated by: Tim, PANews

The prospects for a macroeconomic re-acceleration are limited, with its sustainability relying on the support of asset-rich households and AI-driven capital expenditure. For investors, the key to this cycle is not broad-based Beta returns:

- Focus on semiconductors and AI infrastructure as long-term growth drivers.

- Remain cautious on broad indices; the concentration of the tech giants masks market vulnerabilities.

- Pay attention to the dollar's movements: its direction may determine whether the current cycle continues or ends.

Similar to the 1998-2000 cycle, the market's fundamentals may still be solid, but volatility will be more pronounced, and asset selection will be the key factor distinguishing active winners from those merely riding the market wave.

1. Dual-Track Economy

The market is the economy. As long as the stock market is at or near historical highs, recession rhetoric is hard to form.

We are undoubtedly in a dual-track economic model:

The top 10% of income earners contribute over 60% of consumer spending. Their wealth, accumulated through leverage in stocks and real estate, keeps consumption levels high.

At the same time, inflation severely erodes the wealth of middle- and low-income households. This widening gap is the reason for the coexistence of economic "re-acceleration" and a weak labor market, along with an affordability crisis.

2. Federal Reserve Policy as Narrative Risk

Policy fluctuations will become the norm, as the Federal Reserve faces the dual challenge of inflationary appearances and the political cycle. This creates a window for opportunistic positioning but may also trigger sharp downward shocks during expectation resets.

The Federal Reserve is in a dilemma:

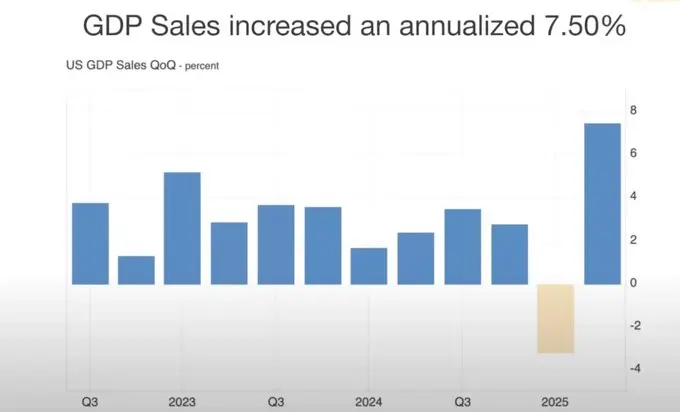

- Strong GDP data and resilient consumer spending justify a slower pace of rate cuts.

- The market is overly expanded, and delaying rate cuts could trigger "growth panic."

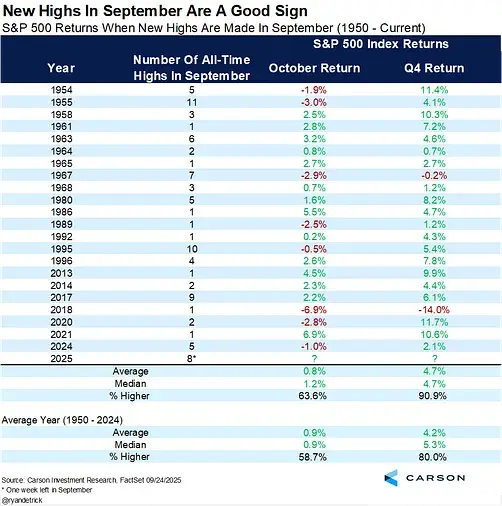

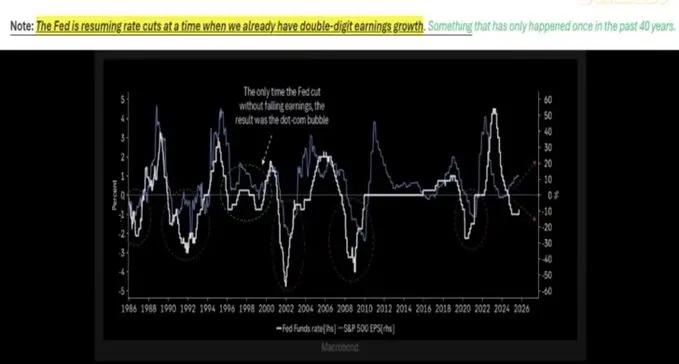

Historically, cutting rates during strong earnings (last seen in 1998) often extends bull market cycles. However, the current cycle has become distorted: inflation remains stubborn, the "Big Seven" in U.S. stocks dominate profits, while the other 493 constituents of the S&P 500 show weak performance.

3. Asset Selection in a Nominal Growth Environment

Allocate scarce physical assets (gold, key commodities, real estate in supply-constrained areas) and productivity platforms (AI infrastructure, semiconductors), while avoiding excessive concentration in the influencer stock sector driven by internet popularity.

The future is leaning more towards a structural bull market rather than a broad-based rally.

Semiconductors remain the foundation of AI infrastructure, and capital expenditure continues to drive growth.

Gold and physical assets are steadily re-establishing their status as hedges against currency depreciation.

Cryptocurrencies are facing dual pressures from leveraged liquidations and treasury backlog, but their structure remains closely linked to the liquidity cycle that drives gold.

4. Housing Market and Consumption Dynamics

If both the housing and stock markets weaken, the psychological "wealth effect" on consumption will collapse.

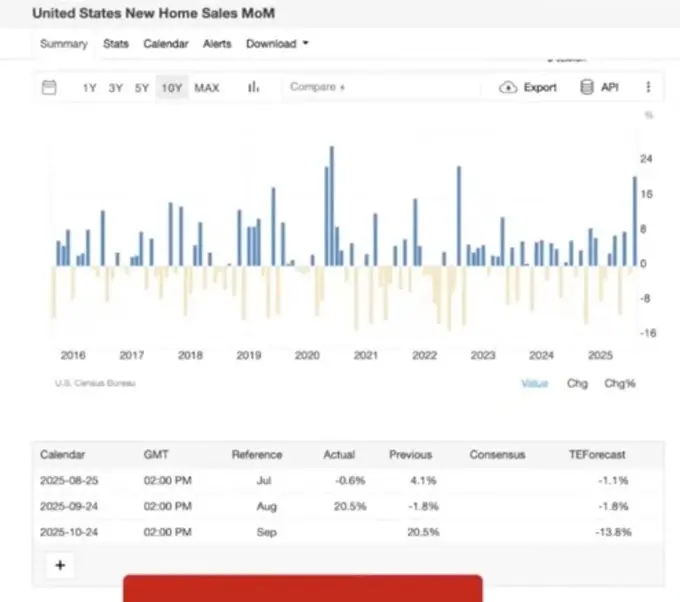

The real estate market experiences a short-term rebound (a dead cat bounce) when interest rates are lowered, but structural challenges remain:

- Supply-demand imbalances due to demographic pressures.

- A surge in cases of lost foreclosure rights due to the end of student loan and Federal Housing Administration repayment pause policies.

- Regional economic divergence (the Baby Boomer generation's asset buffer coexists with pressures on younger families).

5. Dollar Liquidity

The dollar is a hidden fulcrum; in a weak global economy, a stronger dollar may first crush the more vulnerable markets rather than the U.S.

An underestimated risk is the contraction of dollar supply.

Tariffs will reduce trade deficits, thereby limiting the global dollar flow back to U.S. assets.

The fiscal deficit remains high, but with fewer external buyers of U.S. treasuries, liquidity mismatch issues have emerged.

CFTC positioning data shows that dollar short positions have reached historical levels, indicating a potential for dollar short squeezes, which could impact risk assets.

6. Political Economy and Market Psychology

We are at the end stage of a financialization cycle:

- Economic policies are designed to "keep things running" before political key points (elections, midterms, etc.).

- Structural inequality (rent increases outpacing wages, wealth concentrated among older generations) is generating populist pressures, prompting policy changes across various fields from education to housing.

- The market itself has dual characteristics: the concentration of the seven major weighted stocks supports valuations while also sowing the seeds of vulnerability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。