Aster DeFi Fee Outpaces Uniswap & Circle in Fee Capture

Aster captured $14.33 million in fees in the past 24 hours, putting it second globally behind Tether and ahead of Circle and Uniswap. This jump shows how fast some new perp exchanges can earn revenue.

Aster DeFi Fee Hits $14.33M in 24 Hours

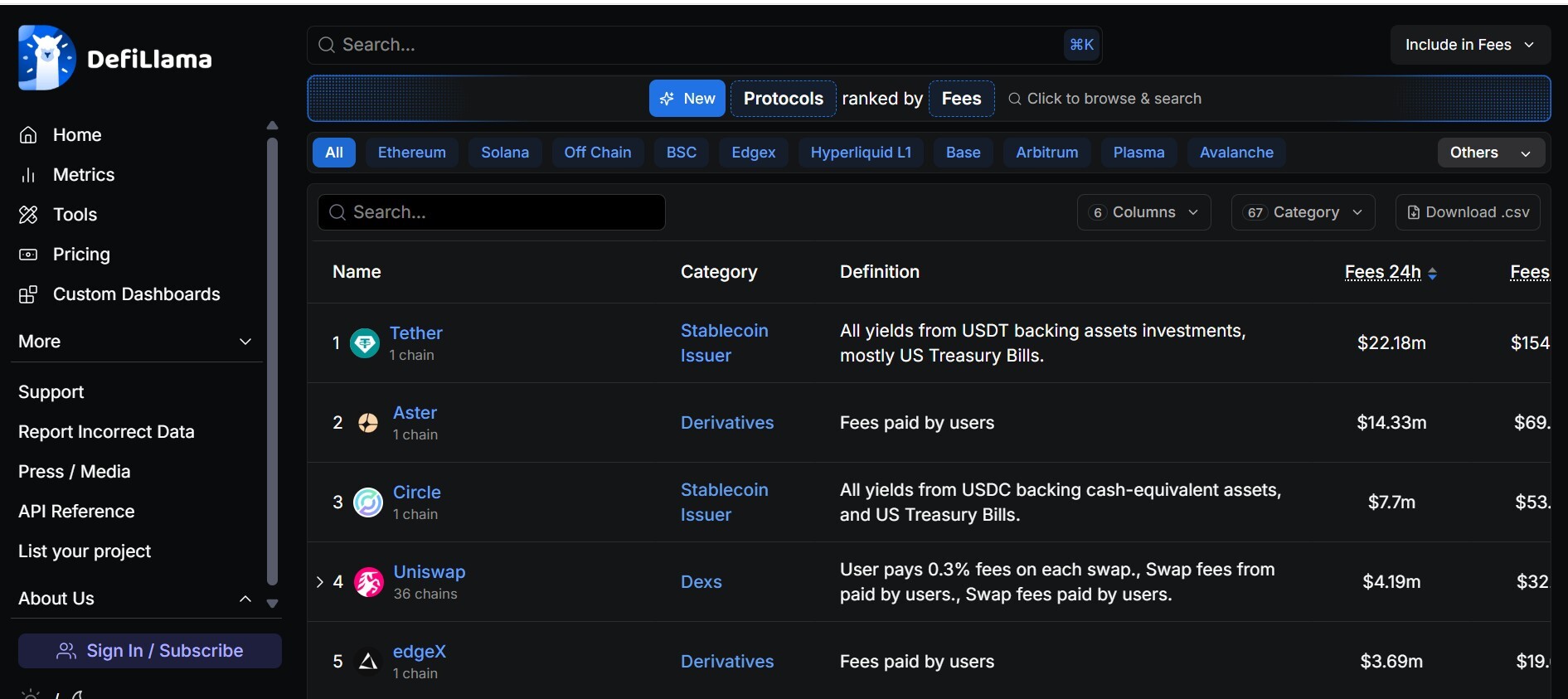

DeFi tracker DeFiLlama shows Aster collected about $14.33 million in fees over the last 24 hours. That feat put it in the No.2 spot for daily fee capture, behind Tether (about $22.18 million) and ahead of big names like Circle and Uniswap. The spike also means Aster’s fee take is nearly ten times the level seen at rivals such as Hyperliquid on the same day. These figures come from DeFiLlama’s fee leaderboard.

Source : DeFiLama

How the DeFI Fee rose so fast

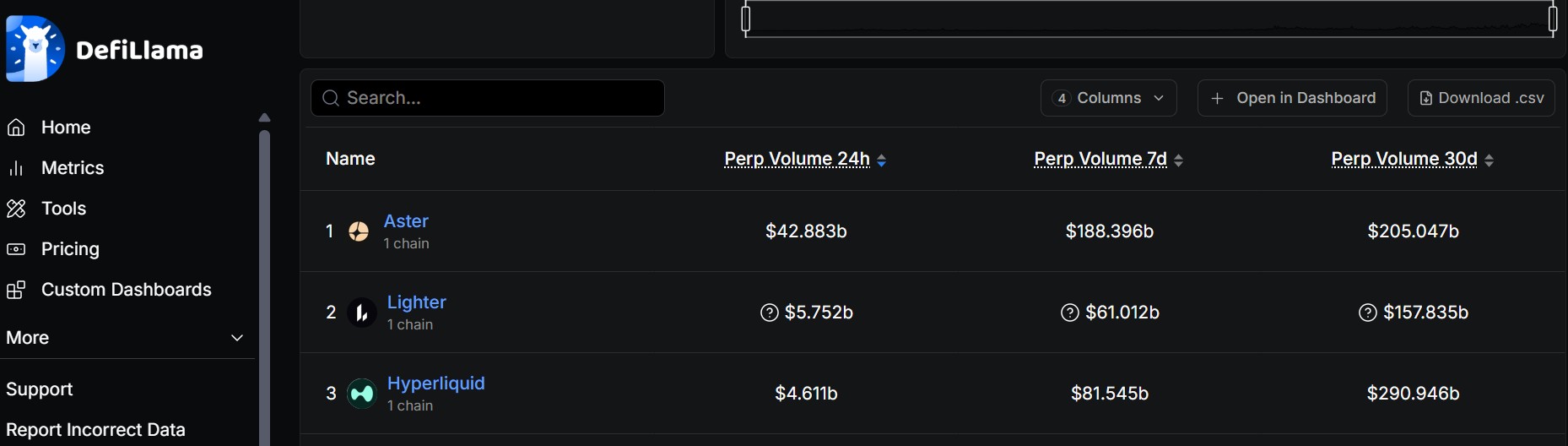

Aster’s jump ties to a few clear drivers: a big surge in perpetual (perp) trading volume, large single trades (whales), and active order books on the chains where the project operates.

Some coverage also points to its private order book design and recent user demand for faster perp trading as reasons for the spike. These factors together create a high-fee environment very quickly.

Drivers Behind the Rapid Growth

The Token has moved fast this month. Earlier reports showed token driving huge perp volumes and reaching big market caps in a short span. Analysts have compared Aster’s growth to other fast risers in DeFi and explored whether the surge is sustainable or a short-term event fueled by concentrated trading. Past articles also linked Aster’s rise to broader DeFi momentum and new product launches on BNB Chain and other networks.

Source : Website

Risks and What to Watch for Traders

Aster’s big day is newsworthy, but readers should watch for volatility. Heavy charge days can reverse if volume drops or if major traders move out. Also, data snapshots change quickly, fee rankings on DeFiLlama can shift hour to hour. Check on-chain metrics like perp volume, open interest, and TVL to see if the trend lasts.

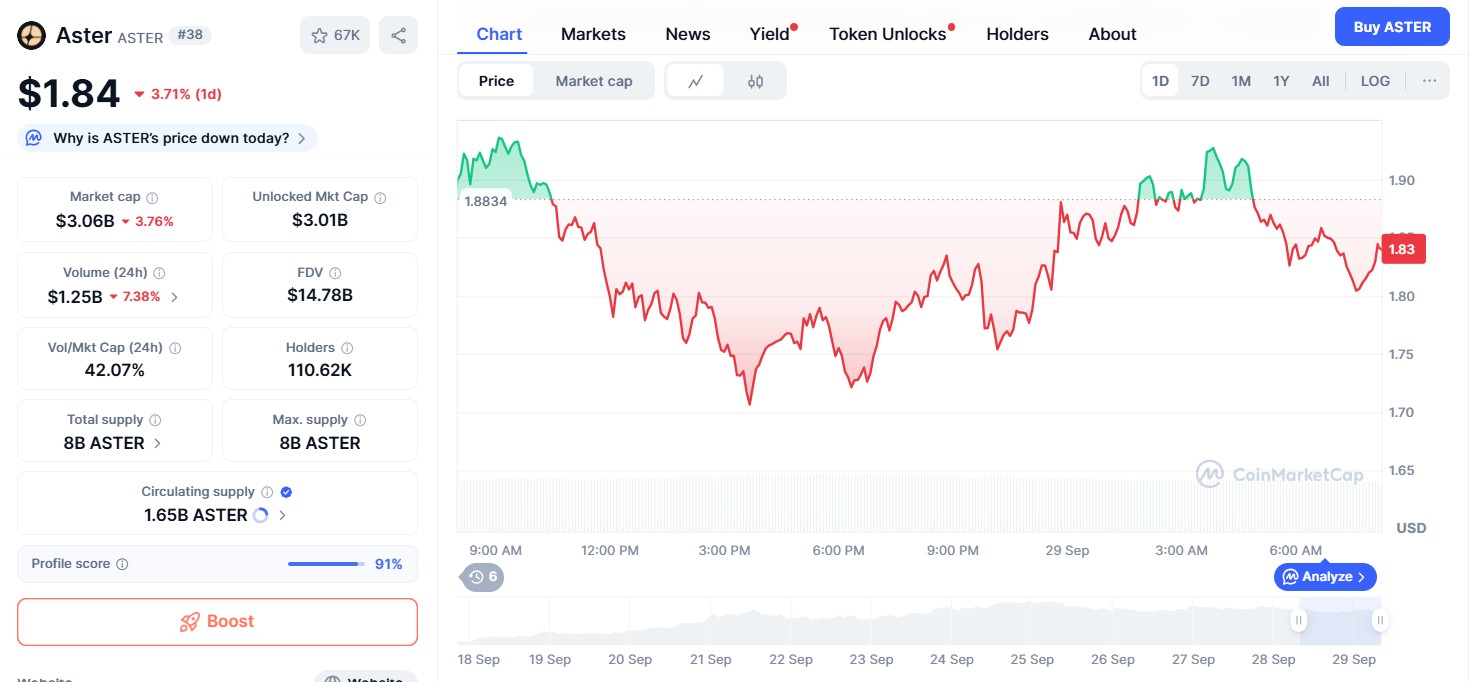

Price Movements After the Fee Surge

The coin is trading near $1.84 facing a downfall of 3.71% in the past 24hrs. The major dip is due to the hyperliquid’s Hyperdrive exploit. However this is not directly linked to the coin but fear created among traders about DEX security.

The token remains up 30.59% over 7 days and 2,059% over 30 days. Short-term traders likely locked gains after the token’s tremendous growth which turned investors profit taking, also a big reason for the downfall.

Source : Coinmarketcap

Fees are how many protocols show real usage and income. When a protocol suddenly captures large fees, it means big trading volume and real money moving through the system. For traders and investors, high fees can mean strong demand and liquidity.

What Traders and Investors Can Learn from Aster

For the wider DeFi world, a fast-growing charges leader can change where liquidity flows and how market share shifts among perp DEXs. Several crypto news outlets reported the same trend and noted Aster’s rapid rise in daily revenue.

Aster DeFi fee is important because it proves demand. But whether its price stays higher depends on how much of that price cash actually becomes sustained token buybacks, staking rewards, or long-term holder incentives and on token supply dynamics like unlocks.

Watch price trends, on-chain buyback activity, and vesting unlocks closely; those will tell you whether today’s revenue becomes a lasting price driver or just a one-day headline.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。