Prediction markets can teach us how to think about future outcomes from a probabilistic perspective.

Written by: 1912212.eth, Foresight News

Fortune always favors the brave. Today's prediction markets can teach us how to think about future outcomes from a probabilistic perspective. Out of interest in research betting and the Polymarket airdrop, I have been active in prediction market trading in recent months.

Polymarket is a decentralized prediction market platform where users make predictions by purchasing "shares" that represent event outcomes, with share prices reflecting the market's expected probability of those outcomes. If the prediction is correct, profits will be earned. Conversely, if the outcome shows the prediction was wrong after the deadline, the invested funds will be lost. Traders can also choose to take profits by buying low and selling high before the deadline arrives.

Prediction markets are a wild west gold rush of speed, information asymmetry, information gathering and analysis, and execution. Every bet is a gamble on cognition and belief. There are many arbitrage opportunities, but there are also many pitfalls.

In June of this year, Paradigm partner Matt Huang remarked after leading the investment in Kalshi, "Prediction markets remind me of cryptocurrency ten years ago: an emerging asset class on the verge of reaching trillions of dollars." Just three months later, Polymarket and Kalshi were considering new rounds of financing at valuations of $9 billion and $5 billion, respectively, with Kalshi's valuation more than doubling from $2 billion a few months prior. The heat of prediction markets is evident.

I will omit the amounts of unrealized gains and losses and will review the gains and losses with actual cases of success and failure.

Market Rewards Research, AI-Assisted Search and Research

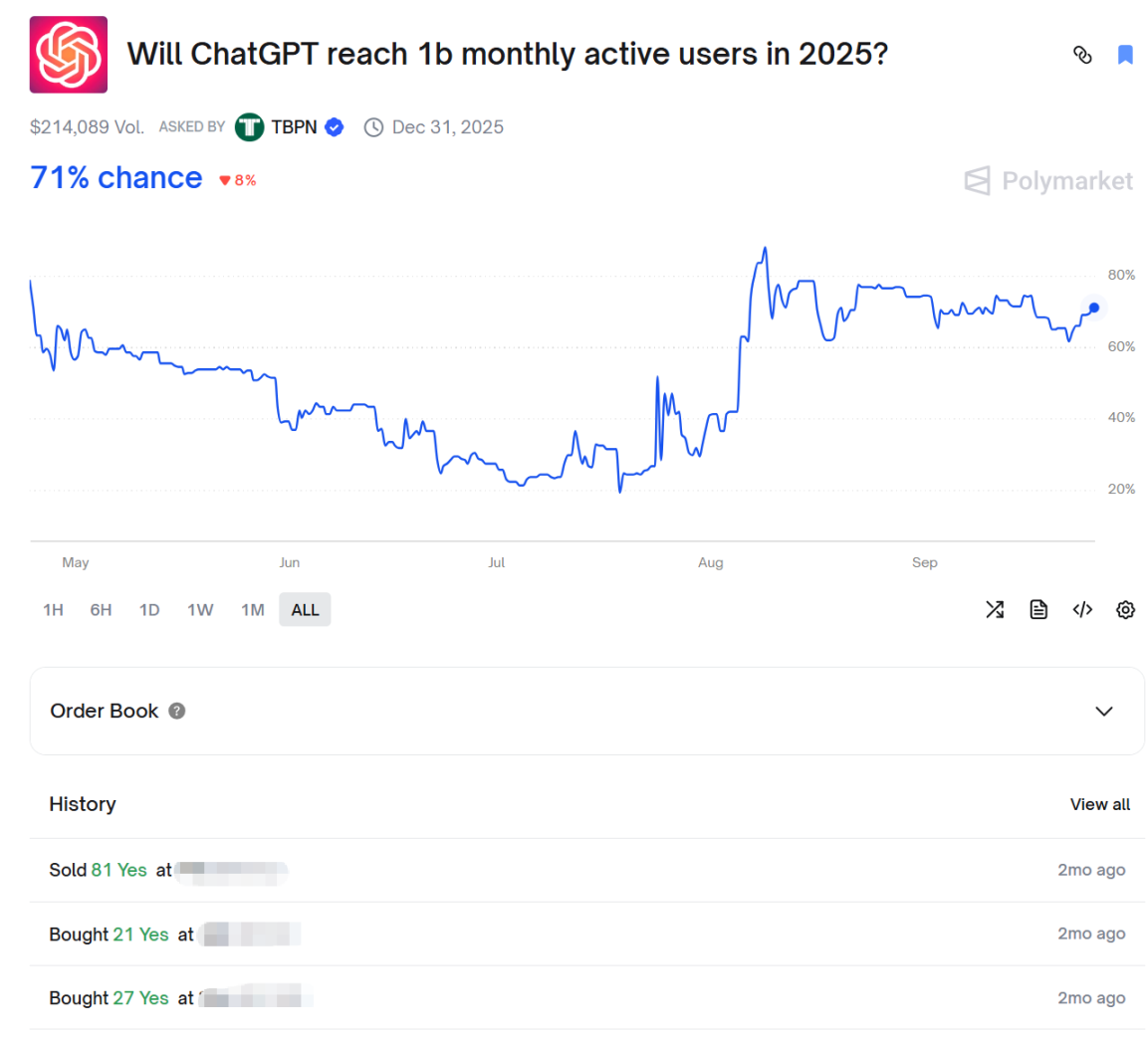

I personally focus on three or four familiar verticals on Polymarket, including Crypto, Technology, Trump, and Federal Reserve interest rate cuts, with some betting opportunities requiring daily scanning. For example, on July 29, I found a very interesting betting market in the technology channel: Will ChatGPT reach 1 billion monthly active users by 2025?

At that time, the probability was only 30%, and I was curious to break down why it was so low. The question can be split into two points: What has been OpenAI's monthly active user count this year? How far is it from 1 billion? The second point is what positive developments can be expected from OpenAI, such as major product announcements that could boost its monthly active users.

At that time, there was just over a week left until the anticipated release of ChatGPT5, and the market had high hopes, so the second point seemed to be no problem. Therefore, the key point is what the current monthly active user count is. At that time, neither ChatGPT nor Grok provided an accurate figure until I used Perplexity, which revealed a relatively reliable data point: OpenAI's monthly active users had reached 600 million as disclosed in court documents this year.

On July 31, while browsing and searching for information, I came across a report from Wall Street Journal citing The Information, which stated that OpenAI's annual revenue had reached $12 billion, with "weekly active users surpassing 700 million." Therefore, the first key point seemed to be no problem.

Thus, I chose to increase my position and took profits when the probability reached 81%.

It is worth noting that today, Grok4 and ChatGPT5 have become quite adept at collecting, processing, and analyzing information. For many uncertain questions, one can input specific queries to seek answers. However, AI can occasionally make mistakes, so cross-validation from multiple sources is necessary.

For example, using AI Q&A, the probability of experiencing earthquakes of magnitude 7 or higher globally each month is quite high, and indeed, this has been the case, with earthquakes of magnitude 7 or higher occurring every month for the past two months. On July 17, a 7.3 magnitude earthquake struck off the coast of the Alaska Peninsula, on July 30, a 7.9 magnitude earthquake occurred off the eastern coast of Kamchatka, on August 22, a 7.4 magnitude earthquake hit the Red Sea, and on September 13, a 7.1 magnitude earthquake occurred off the eastern coast of Kamchatka.

From observation, it often happens that when the probability falls below 60%, the odds become higher.

Speed and Patience are Key, Pursue Vague Correctness

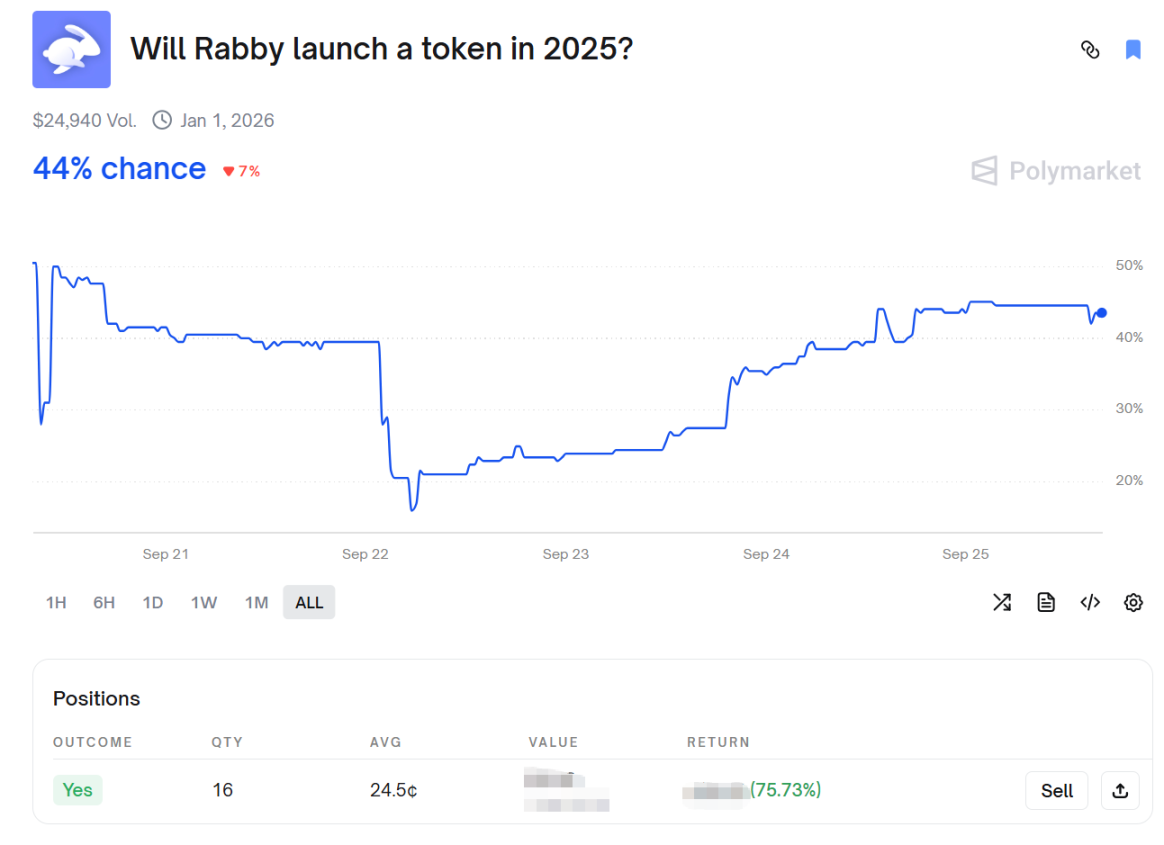

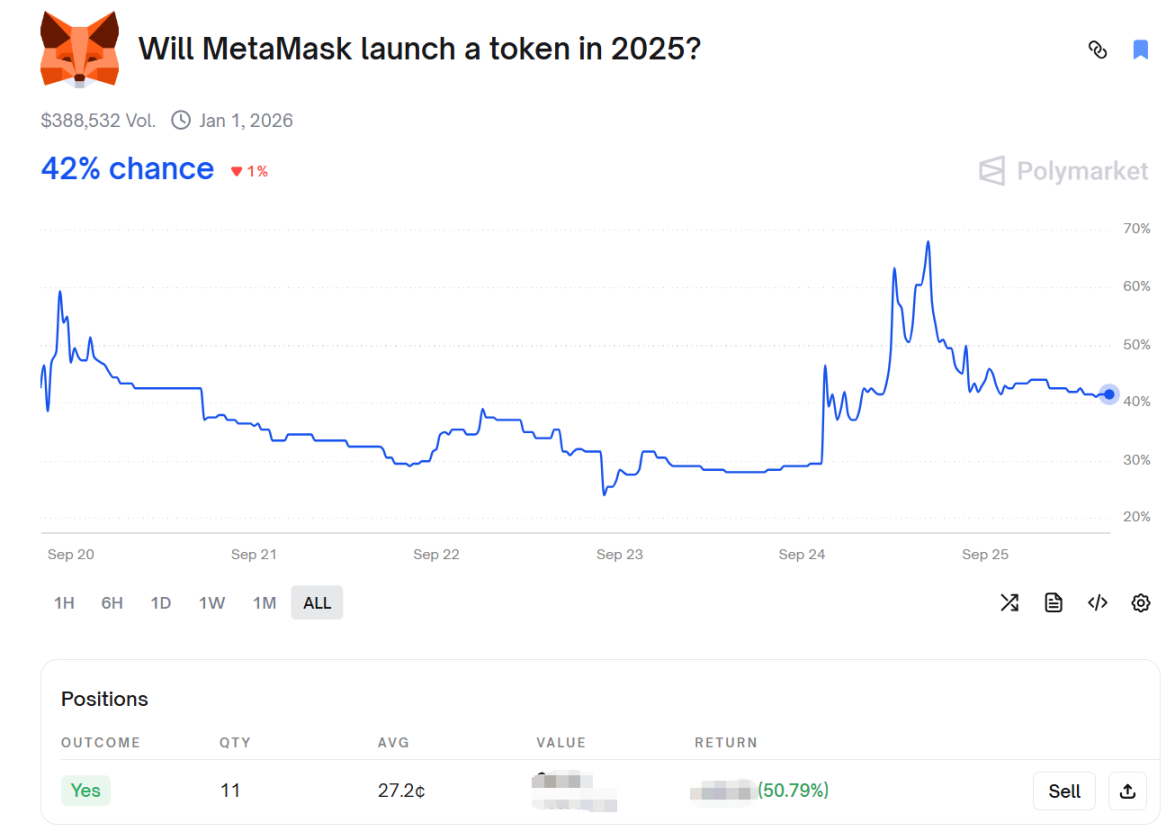

On September 23, while scanning the crypto prediction market on Polymarket, I stumbled upon predictions for the token release dates of Rabby and MetaMask.

Will these two wallets definitely release tokens this year? Aside from their founding teams, no one else can be 100% sure, but pursuing vague correctness is sufficient. Based on official tweets and some public news, it is not difficult to conclude that the probability of a token release this year is still quite high.

The decisive factor worth boldly participating in is a high win rate and favorable odds, with a loss resulting in zero and a win yielding returns of 3-4 times.

On September 24, the market bet on Rabby's token release probability surged to 44%.

The market bet on MetaMask's token release probability even soared to 68%.

However, in an uncertain market, for every profitable highlight moment, there are equally painful lessons learned.

"Unexpected" Teaches Me a Lesson

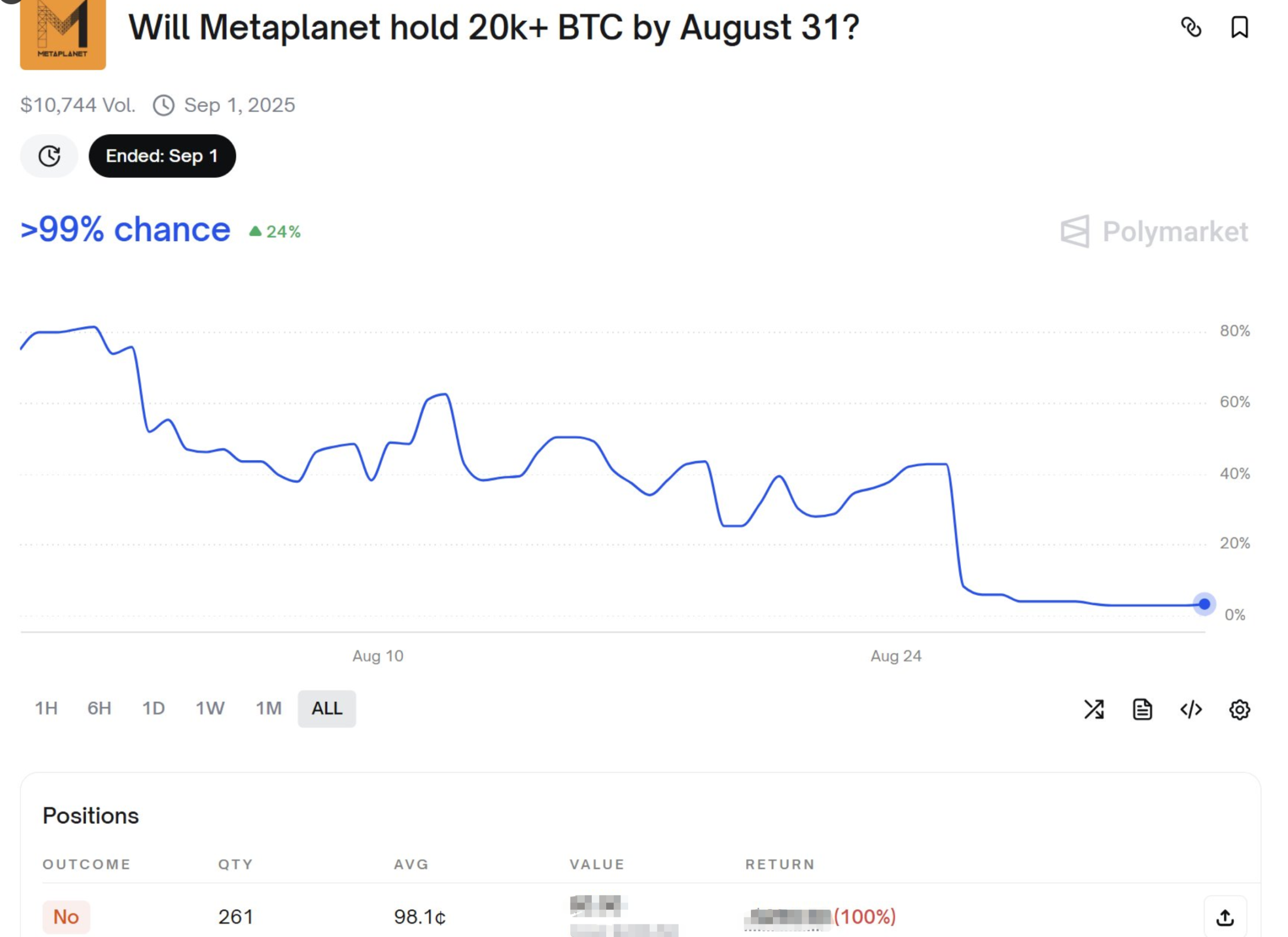

The probabilities on Polymarket are merely the market's views backed by money; even if the probability is high, it does not necessarily mean that it will happen.

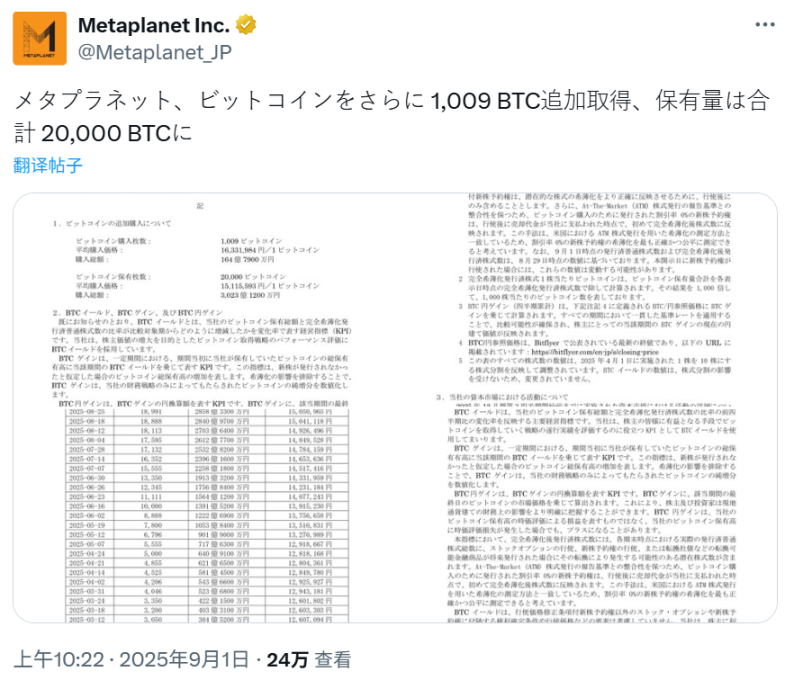

On the evening of August 30, I noticed a bet: Would the Japanese listed company Metaplanet hold 20,000 BTC by August 31 at 11:59 PM ET? At that time, the market's probability for NO had surged to 98%. It is worth noting that on August 25, they announced an increase of 103 BTC, bringing their total holdings to 18,991 BTC, still over 1,000 BTC short of 20,000.

The settlement time for this bet, converted to Beijing time, was September 1 at 11:59 AM. Just when I thought I could stabilize my arbitrage, an unexpected event occurred.

On September 1 at 10:22 AM, with just over 90 minutes left until the prediction market settlement, their official Twitter account announced an increase in BTC holdings, exactly reaching 20,000 BTC. At this point, my entire principal was lost.

Not Understanding When to Take Profits Leads to Losses

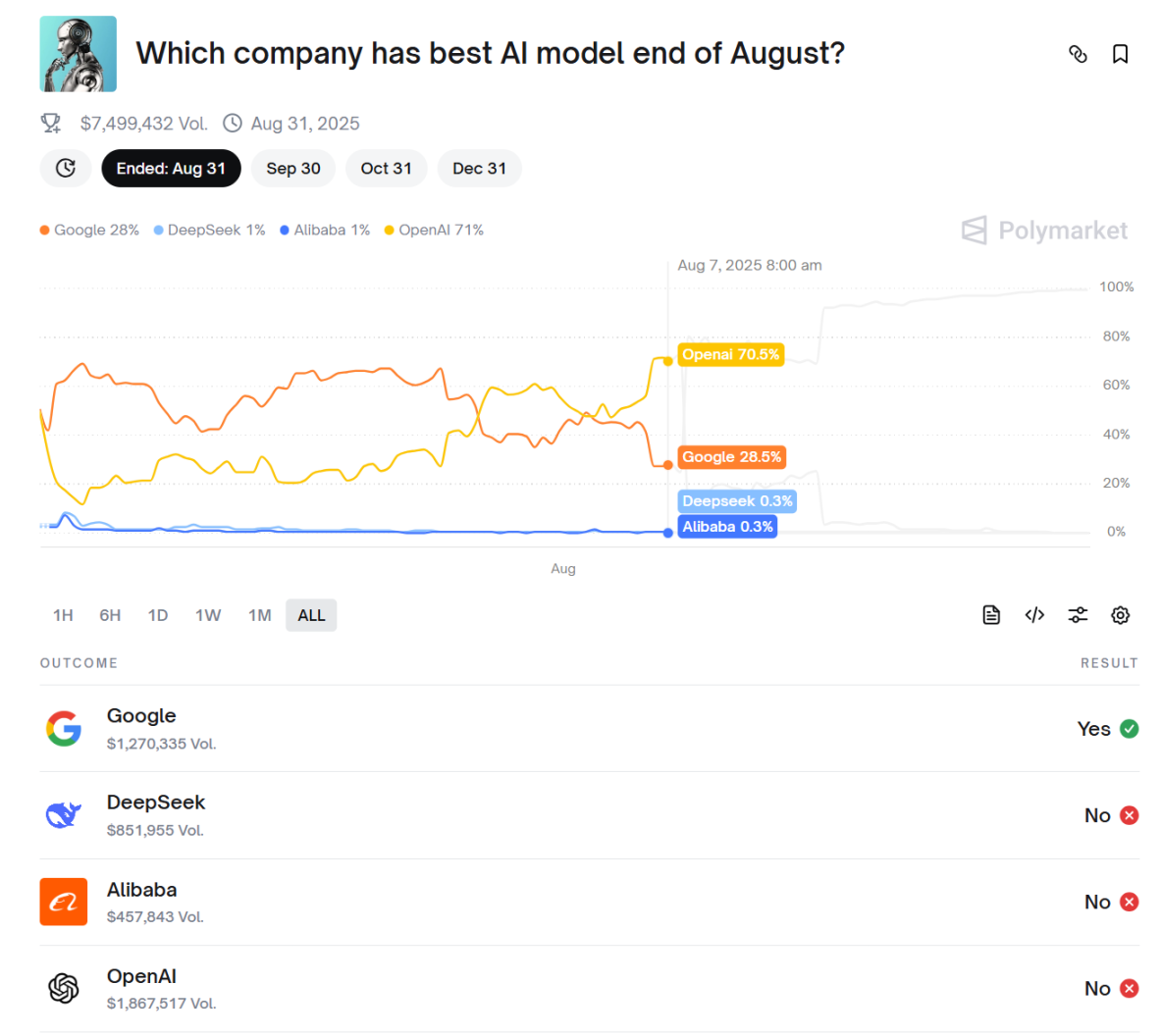

At the beginning of August, I discovered a bet regarding "the best AI model before September 1." At that time, Google was leading, while OpenAI was far behind. I realized that with the launch of ChatGPT5, OpenAI would definitely have a chance.

So, I placed a significant bet on OpenAI winning. As the release date approached, OpenAI's win probability rose above 70%, and I was enjoying substantial unrealized gains. However, the market sentiment suddenly shifted, and most of the market was dissatisfied with OpenAI's minor functional improvements. Although I noticed this sentiment, I dismissed it, thinking it was just a passing trend. As a result, I was soon severely punished by the market, and OpenAI's win probability plummeted, quickly erasing all my unrealized gains.

After the release of important products and features, the market's feedback can significantly influence the probability trends. If one does not take this seriously and fails to take profits in a timely manner, it can easily lead to a complete loss of previous gains.

Additionally, for some prediction markets with expiration dates several months away, taking profits in a timely manner can also reduce opportunity costs.

Be Mindful of Market Order Liquidity

For convenience and speed, I often choose to place market orders directly when betting on Polymarket. However, in some prediction markets with low trading volumes and insufficient order liquidity, clicking buy can immediately result in a floating loss of 5-10%, or even more exaggerated losses of 20%.

Generally speaking, when the trading volume of a prediction market exceeds several hundred thousand dollars, the liquidity of the order book performs well. However, in certain options, if the betting amount is small or the trading volume itself is low, it is necessary to click on the option to observe the order book before trading to avoid immediate losses upon buying.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。