Hyperdrive Exploit Investigation Traces Sophisticated Attack

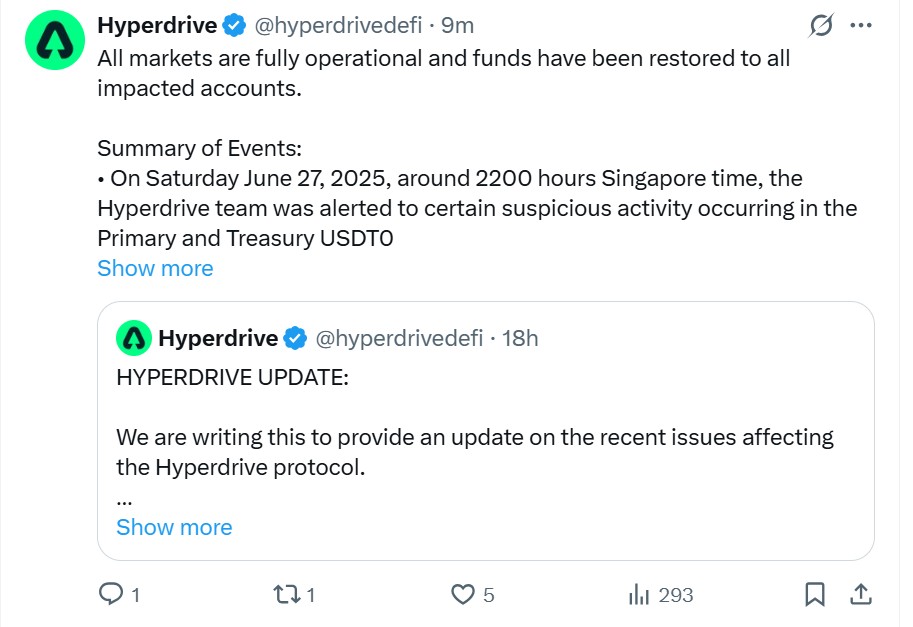

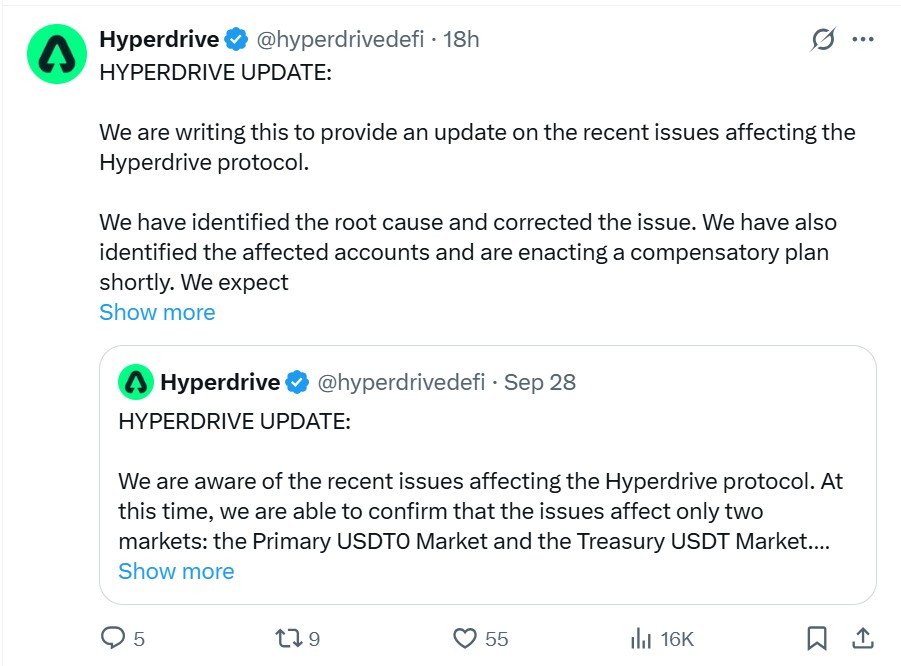

Hyperdrive confirmed a smart-contract attack that affected two markets. The team paused all markets, worked with auditors and forensics experts, patched the code and returned funds. Today, Hyperdrive says all markets are fully operational and impacted accounts have been made whole. The project made an announcement on its official X account; it also made a mistake in clarifying dates of exploitation.

Source : X

Hyperdrive Exploit Summary: ~$773K–$782K Drained from Two Treasury Accounts

A major attack drained roughly $773K–$782K from two accounts in its Treasury market. The team paused money markets, said it fixed the root cause, and promised a compensation plan. This comes after another big incident in the same ecosystem days earlier, raising questions about wider security.

Markets stayed suspended long enough for the team to remediate affected accounts. They said the attack was traced to an exploit that targeted collateralized positions.

Source : X

Who did it and why it matters

Investigators say the attacker is a known threat actor tied to other high-profile DeFi hacks . The attack appears sophisticated: it exploited operator permissions or router-level calls, letting the attacker move collateral from two positions and bridge funds across chains.

That cross-chain movement makes tracing harder and recovery slower. The Hyperdrive team worked with security firms and blockchain forensics to trace flows and remediate losses.

What Hyperdrive did next

Hyperdrive’s public posts confirm the root cause was fixed , that auditors reviewed the patch, and that affected users are now restored. The team will publish a full forensics report soon. They also encouraged anyone still facing issues to open a support ticket on Discord. Users were warned to ignore unsolicited DMs and not to send private keys or funds to anyone.

Ecosystem Risk: Back-to-Back Incidents Raise Red Flags

This is the second high-visibility security scare in the broader Hyperliquid ecosystem in recent weeks. Earlier incidents and high-volume odd flows raised community concern about architecture and permission design. The back-to-back troubles increase pressure on teams to tighten permissions, speed audits, and improve monitoring. Analysts say protocols must harden operator roles and limit what router contracts can call.

Watchlist: Are All Victims Fully Compensated and How Fast?

-

User funds & recovery: Will compensation fully reimburse victims? How fast?

-

Root cause details: Was it misconfigured permissions on router/operator settings? Early reports say yes.

-

Cross-chain risk: Attackers bridged funds tracing and recovery get harder across chains.

-

Ecosystem trust: Two incidents in days could push users away unless clear fixes and audits follow.

What users should do now

-

Check official Hyperdrive updates on X and the project’s Discord for support.

-

Don’t interact with old contract links until the team confirms full safety.

-

If you think you remain affected, open a support ticket and keep transaction IDs for evidence.

Final Thoughts

The Hyperdrive Exploit caused alarm, but Hyperdrive now says all markets are operational and impacted accounts have been restored. The incident highlights tradeoffs in fast-moving DeFi: rapid innovation but evolving security risk. Expect a full investigation report soon that should explain exactly how permissions were misused and what governance fixes the team will adopt.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。