The entry of SunPerp signifies the beginning of a new cycle driven by collaboration, innovation, and imagination in the industry.

The development history of decentralized exchanges (DEX) is essentially a history of the evolution of the infrastructure of the cryptocurrency market.

The earliest DEXs were primarily in the embryonic stage of matching trades. Due to a lack of depth, complex interactions, and a limited user base, they could hardly compete with centralized exchanges. It wasn't until 2018, when Uniswap introduced automated market makers (AMM) to the cryptocurrency market, that DEXs truly became a track with independent vitality.

The significance of AMM lies in lowering the threshold for liquidity provision, allowing anyone to become a liquidity provider. However, the limitations of AMM are also evident: excessive slippage, low capital utilization, and an inability to meet the complex tool demands of professional traders. With the maturation of Ethereum Layer 2 technology and the establishment of cross-chain bridges and on-chain settlement systems, the infrastructure of DEXs has gradually entered a usable stage.

At the same time, changes in user demand are driving the expansion of DEX functionalities. The DeFi Summer of 2020 led to a surge in demand for leverage and derivatives among cryptocurrency users, with perpetual contracts gradually becoming a "battleground" in the DeFi world. This is because, in centralized exchanges, perpetual contracts have long been one of the most attractive categories, boasting a large trading volume and user stickiness. Consequently, the DEX track has transitioned from a "liquidity experiment" to a "derivatives stronghold," truly entering a fiercely competitive fast lane.

Early Explorations of Perp DEX: dYdX and GMX

The early attempts at Perp DEX can be traced back to dYdX in 2021. As one of the earliest on-chain derivatives projects, it adopted a hybrid model of "off-chain matching + on-chain settlement" to address performance bottlenecks using the StarkEx Layer 2 network. The success of dYdX lies in its first proof that "on-chain contracts are not impossible," but the limitations are also very clear: matching remains centralized, cross-chain operations are complex, and the user-friendliness for traders is limited.

Subsequently, in 2022, GMX provided another solution—offering depth through multi-asset AMM pools, allowing users to trade directly against the pools. GMX's advantages are its "foolproof" experience and transparency, enabling ordinary users to easily open and close contracts, while also allowing Perp DEX to truly enter a "decentralized" context. However, the AMM model cannot provide sufficient professional tools, and there are risks of capital pool losses (exposure to GLP risks) in extreme market conditions, limiting its potential for higher-level development.

During this stage, Perp DEX remained more in the realm of experimentation and exploration. The market recognized the value of "decentralized contracts," but there remains a significant gap with CEXs in terms of performance, depth, and professionalism.

High-Performance Public Chains and Full-Chain Order Books: The Rise of a New Generation of DEX

The turning point is 2023-2024.

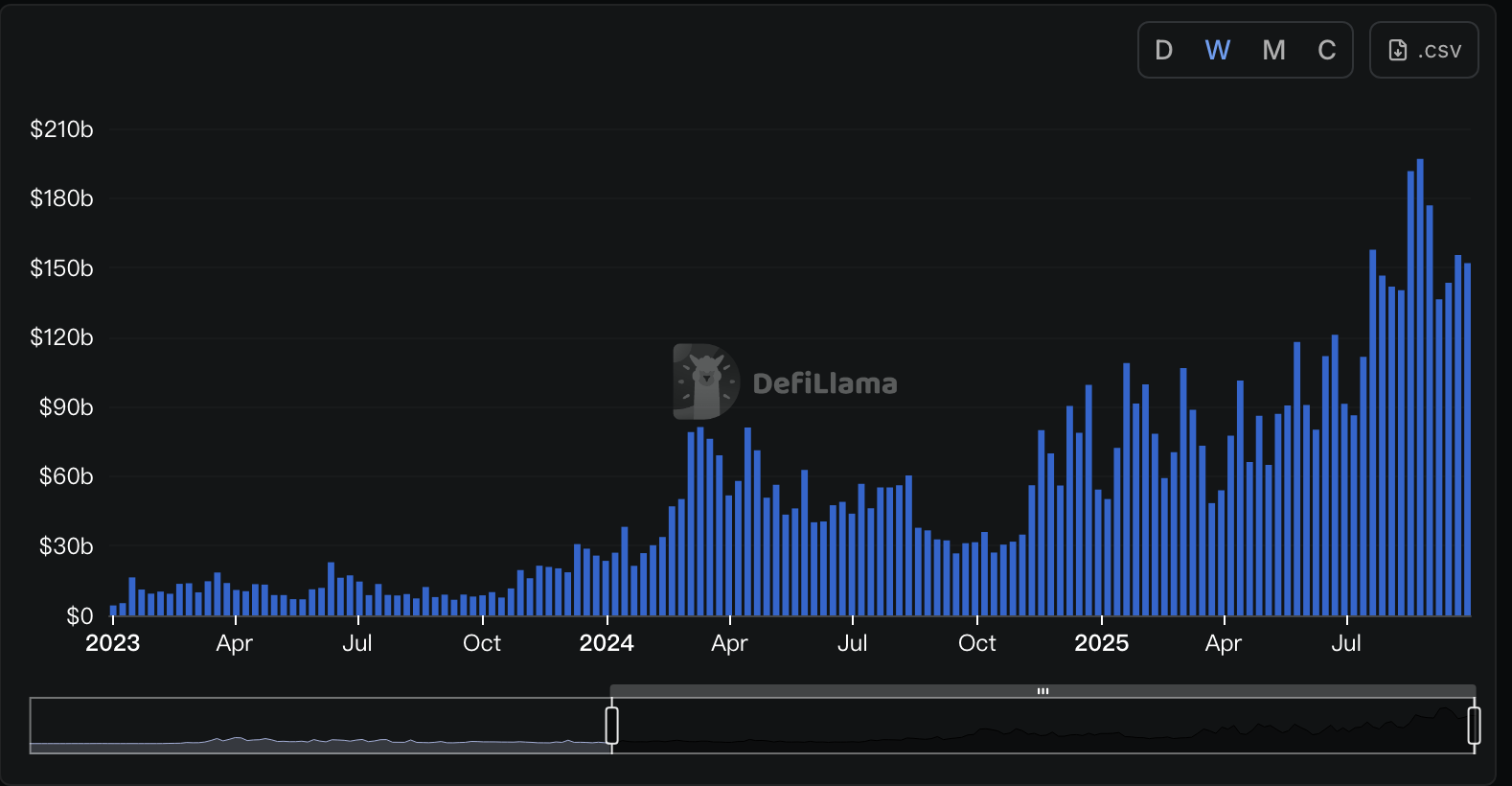

*According to DefiLlama data, the TVL of DEXs has shown a significant upward trend since the second half of 2023.

The new generation of projects is no longer satisfied with piecing together solutions on Ethereum or Layer 2, but instead builds high-performance infrastructure to support a fully on-chain matching experience with near-centralized performance. One of the leading projects, Hyperliquid, is considered the most representative case.

Hyperliquid is not only a Perp DEX but has also built a high-performance L1 blockchain, aiming to create a blockchain that supports all financial transactions and high-performance on-chain financial trading infrastructure. Its architecture is divided into two parts: HyperCore and HyperEVM. HyperCore is responsible for on-chain order book matching, while HyperEVM provides a compatible environment, effectively offering a complete on-chain open financial system where every order, trade, and settlement is transparent and has extremely low latency. This is why community users refer to it as "on-chain Binance."

Moreover, Hyperliquid relies on community and KOL diffusion to form a growth flywheel. In terms of valuation logic, it also attempts to interpret the value of DeFi protocols using traditional internet-style user growth and retention models.

In contrast, Aster leverages Binance's strong resource advantages, achieving a remarkable victory during the TGE phase and carving out a path more reliant on "platform support."

With its combination of "airdrop—pump—wealth effect," Aster not only quickly accumulated users and exposure but also successfully siphoned off a significant amount of liquidity from competitors like Hyperliquid. In terms of product, Aster adopts a multi-chain entry strategy, offering both professional models (order book) and simplified models (similar to AMM). It also introduces features like "hidden orders" to optimize the execution safety of large orders. In just a short time, it vividly illustrates the most genuine logic of the cryptocurrency market—when faced with traffic and capital, all technical advantages and disadvantages must take a back seat.

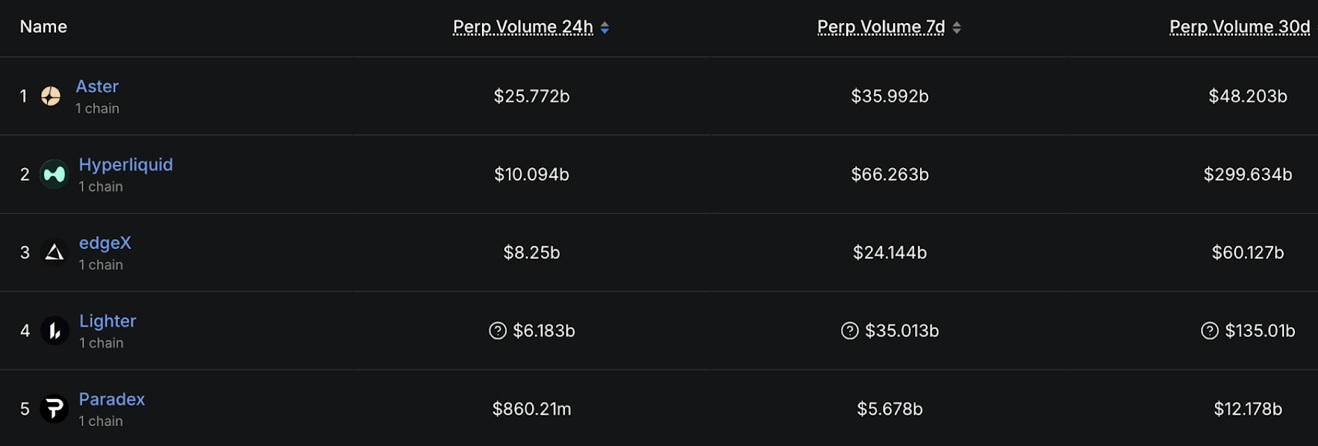

*According to DefiLlama data, as of September 24, at 24:00, Aster's perpetual contract trading volume in the past 24 hours reached $25.772 billion, surpassing Hyperliquid's $10.094 billion, more than 2.5 times its size.

If Aster demonstrates the leverage effect of capital and traffic, then Lighter represents another exploratory path. It attempts to differentiate itself at the trading mechanism level, allowing LLP (liquidity pool, similar to Hyperliquid's HLP) positions to be used as margin, emphasizing zero-knowledge proofs, which enhance transparency and fairness while maintaining high performance.

In terms of market performance, edgeX's results are undoubtedly more impactful. In September 2025, it set a record for Perp DEX revenue with a total income of $49.47 million, with a revenue of $20.46 million in the past 30 days, a year-on-year increase of 147%. In terms of mobile experience, edgeX stands out. Its v2.9 mobile application integrates the Privy MPC wallet and offers a CEX-level experience, significantly lowering the DeFi threshold and gaining favor in the Asian market.

Clearly, the characteristic of this stage is the approach of CEX-like experiences.

Traders find that the on-chain contract experience is becoming smooth, even approaching professional quantitative levels. As performance bottlenecks ease, liquidity begins to concentrate, and the narrative of Perp DEX gradually sheds its "experimental" positioning, becoming a track that genuinely hopes to carve out a piece of the CEX pie.

SunPerp's "Latecomer Strategy"

Amid the excitement generated by Hyperliquid and Aster, the Perp DEX track is entering a stage of intense competition. From underlying technology to user experience, from asset coverage to ecological integration, each protocol is seeking differentiated breakthrough paths.

However, in this battle, "latecomer" does not mean passive; rather, it resembles a well-considered strategic choice. The emergence of SunPerp coincides with a critical juncture of technological maturity, ecological completeness, and market demand, entering with a global perspective to rapidly amplify its strategic advantages.

The ecological closed loop, or the power of resource integration, makes SunPerp not an isolated tool but a hub of the cryptocurrency ecosystem. The TRON public chain provides underlying performance and cross-chain capabilities, while JustLend DAO, Sun.io, and others undertake liquidity and settlement functions. The multi-dimensional resource collaboration allows SunPerp to have a complete closed loop from product experience to ecological governance, forming a self-driven mechanism for platform growth.

*Data shows that on the 10th day of the public test, SunPerp users have exceeded 7,000, with a cumulative trading volume of over 19.5 million USDT, demonstrating strong market appeal and growth potential.

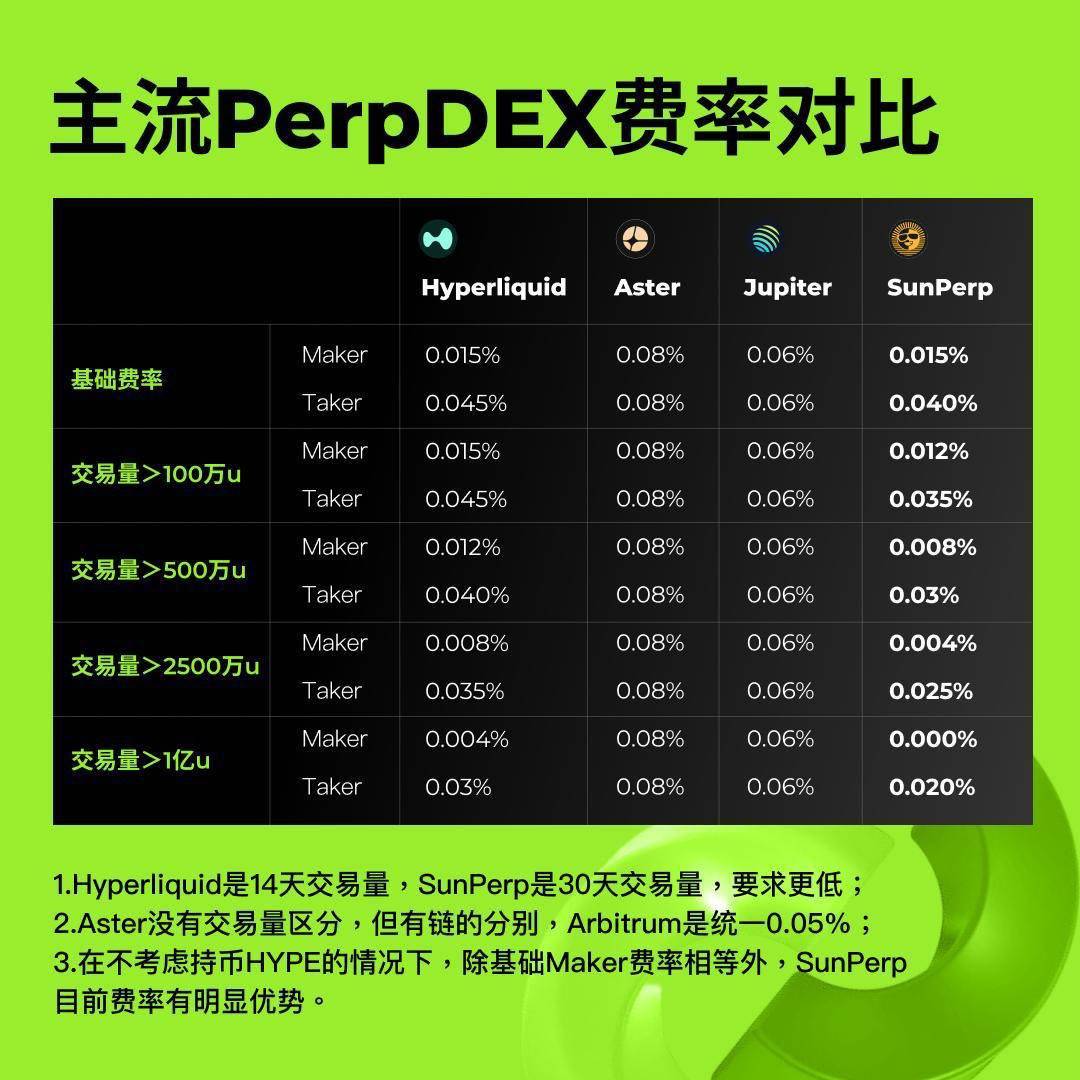

With extreme cost advantages and innovative incentives: the lowest trading fees in the network, "deposit to receive real gold," and full gas fee refunds, this combination directly addresses the core pain points of high-frequency traders, elevating both capital efficiency and yield experience to industry-leading levels. Additionally, SunPerp will implement innovative incentive mechanisms such as trading mining, staking mining, points, and leaderboards to closely bind growth with user retention.

*Aside from the basic Maker fee rate, SunPerp's current rates are significantly lower than those of other mainstream Perp DEXs like Hyperliquid and Aster.

It appears that in the crowded Perp DEX track, SunPerp resembles a participant equipped with "resource plugins," which will determine its starting speed and growth potential far exceeding that of its competitors.

More importantly, it finds a balance between CeFi and DeFi, merging on-chain transparency, asset efficiency, and mature risk control to form a sustainable, closed-loop trading ecosystem. This combination of ecological integration, core experience refinement, and strategic foresight makes SunPerp not just a newly launched DEX, but also a core financial engine within the TRON ecosystem that carries long-term growth and market breakthrough potential.

The Second Half of Perp DEX: Ecology, Users, and Long-Term Growth

At this stage, mere technical flashiness or low fees are no longer the only winning formula; there is a greater emphasis on ecological integration capabilities, user experience optimization, and capital efficiency enhancement.

The entry of SunPerp undoubtedly brings new considerations for the second half of Perp DEX. The key to its success lies in resource integration and innovation based on that foundation. Moving forward, SunPerp is expected to achieve long-term growth and market breakthroughs through the following dimensions:

- Ecological Expansion: Further integrate TRON and external on-chain resources to form deep collaboration in cross-chain liquidity and application scenarios, upgrading from a single trading tool to an ecological hub.

- User Deepening: Expand the user base from high-frequency traders to professional institutions and ordinary users, enhancing user stickiness through multi-layered products, smart strategies, and data tools.

- Innovation-Driven: Continuously optimize cost structures and yield mechanisms, exploring more innovative plays such as composite derivatives, on-chain leverage, and risk hedging tools to enhance capital efficiency and platform competitiveness.

- Governance and Sustainability: Utilize DAO governance and community co-construction mechanisms to achieve transparency in platform decision-making and user participation, creating a long-term sustainable ecological closed loop.

In the future, whether SunPerp can truly grow into the "financial engine" of the TRON ecosystem, or even move towards a global cross-chain infrastructure, remains to be seen. However, it is certain that the second half of Perp DEX is no longer merely a competition of trading functionalities, but a competition for ecological niches: those who can tell a compelling long-term narrative, integrate upstream and downstream resources, and shape user perceptions will seize the initiative in the new landscape. The entry of SunPerp not only adds a new player but may also herald the beginning of a new cycle driven by collaboration, innovation, and imagination in the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。