This report is written by Tiger Research and analyzes the potential scenarios that may arise if Naver acquires Dunamu.

Key Points Summary

- The possibility of Naver acquiring Dunamu, the operator of Upbit, has emerged and attracted industry attention. This would be a deal on the scale of Google's acquisition of Coinbase.

- The synergies focus on three areas. Naver's 40 million users could simplify the registration process for Upbit. Stablecoins could enhance the payment efficiency of Naver Commerce. The IP of Naver Webtoon could create new blockchain revenue models.

- Both companies have denied the reports, but they have already begun collaborating in stablecoins and other areas. They view cryptocurrency as a core strategy. Integration is likely to occur.

1. Major Changes Coming to the Korean Crypto Market

On September 25, 2025, speculation arose that Dunamu, which operates South Korea's largest cryptocurrency exchange Upbit, might join the Naver Group. Dunamu would become a wholly-owned subsidiary of Naver Financial, Naver's financial subsidiary. This would create a vertical group structure.

Source: Tiger Research

The two companies had previously announced plans to collaborate in several areas, including stablecoin business. However, the news of Naver acquiring Dunamu, valued at 120 trillion won, shocked the industry. This deal is similar to Google's acquisition of the leading cryptocurrency exchange Coinbase.

Both companies officially denied these reports, stating that "there are no confirmed matters yet." However, the potential merger of these two giants is worth analyzing. We should examine what changes this scenario might bring and its ripple effects. This analysis will explore which business areas could generate synergies if the Naver-Dunamu deal is completed.

2. What Synergies Can Naver x Dunamu Generate?

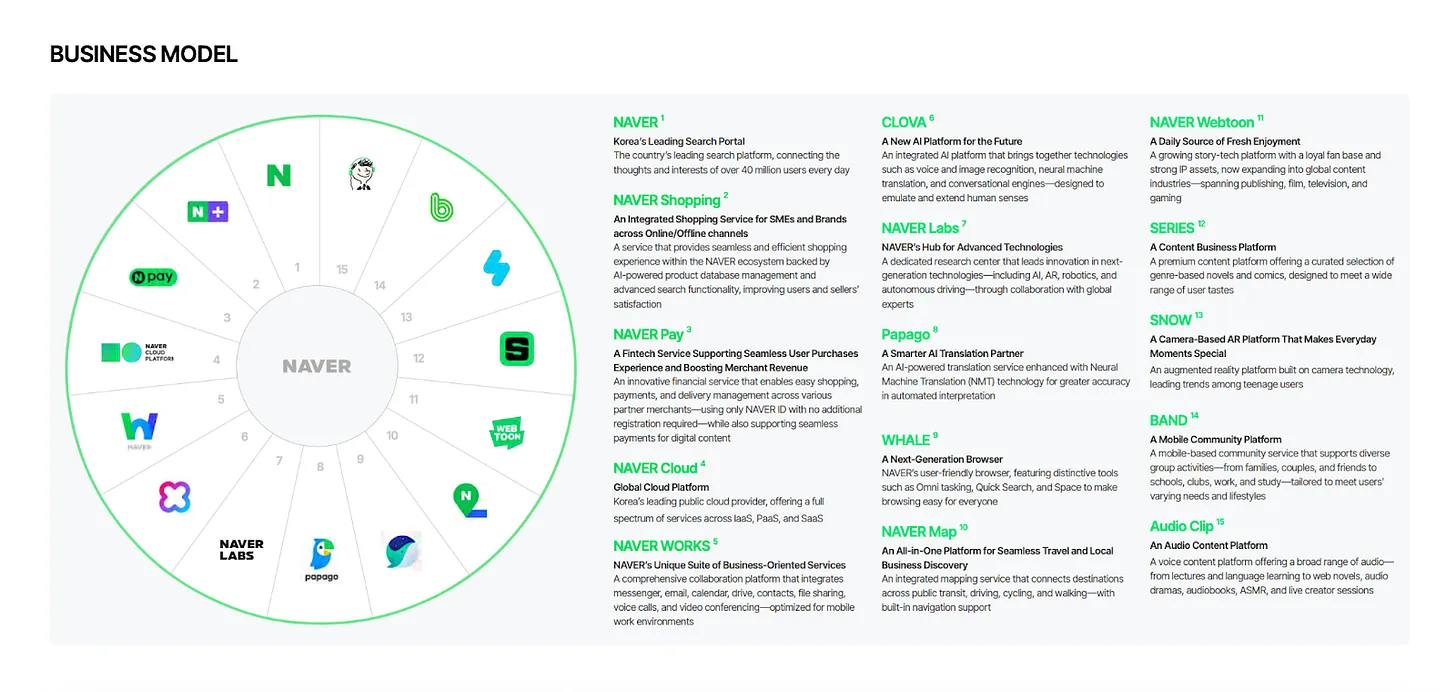

To understand the synergies between Naver and Dunamu, we first need to examine Naver's corporate characteristics. Naver is South Korea's leading large tech company. It started as a search engine and now operates across various industries. The company has established its own ecosystem, covering e-commerce (Naver Shopping), easy payments (Naver Pay), and content platforms (Naver Webtoon).

Source: Naver Integrated Report 2024

If Dunamu were merely a cryptocurrency exchange, the collaboration between the two companies would be limited. However, Dunamu recently launched GIWA Chain, a Layer 2 blockchain based on Optimism. This indicates that Dunamu is transforming from a pure exchange into a blockchain infrastructure company. Blockchain infrastructure can naturally integrate with various industries.

This is where Naver's vast business scope connects with Dunamu's infrastructure capabilities. This connection explains why their combination would attract attention.

Scenario 1: User Base Expansion

The most apparent synergy between the two companies is the expansion of the user base. Naver has approximately 40 million monthly active users (MAU). The company provides digital authentication infrastructure, including easy login services and mobile ID services (such as ID cards and driver's licenses) within its app.

Source: Upbit

Currently, the registration process for cryptocurrency exchanges is quite complex. Users must complete multiple steps: identity verification, taking ID photos, and linking bank accounts. These cumbersome procedures are the main barriers to acquiring new users. However, if Naver integrates with Upbit, the situation will change completely. Users can easily register and log in using their Naver ID. The company can also significantly simplify the KYC (Know Your Customer) process by leveraging Naver's mobile ID services.

These changes will directly impact Upbit's user expansion. Upbit currently has 10 million cumulative registered users. When Naver's 40 million user base is combined with a simplified registration process, potential users can join more easily. This presents a significant opportunity for Upbit to accelerate its user growth rate.

Scenario 2: Stablecoin Payment Revolution

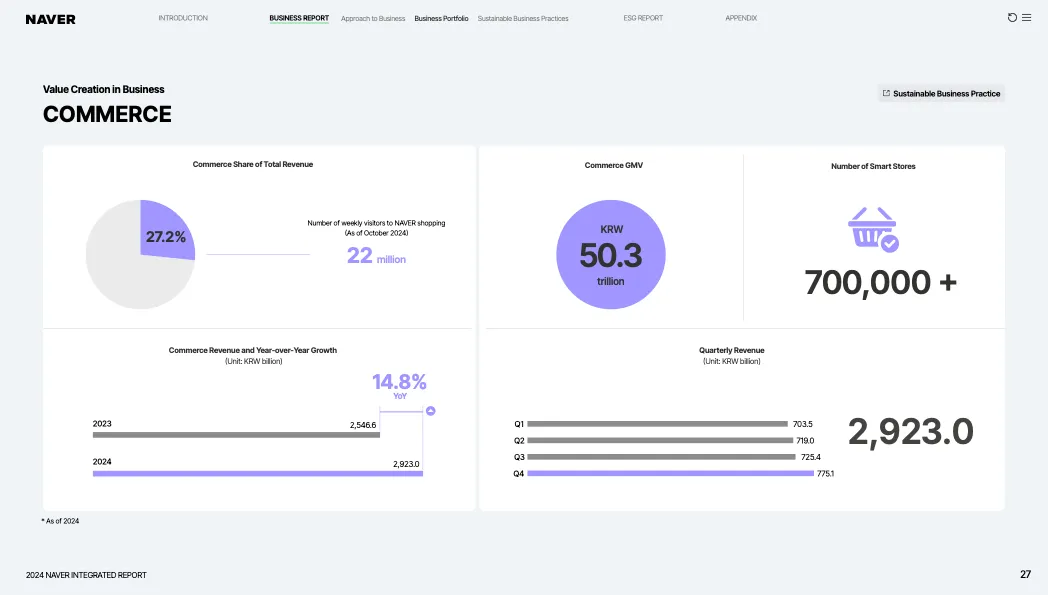

Source: Naver Integrated Report 2024

Source: Naver Integrated Report 2024

The next area to focus on is stablecoins. Naver has officially announced its intention to enter the stablecoin market. The company is likely to issue stablecoins around GIWA Chain. The key lies in Naver's vast payment ecosystem. Naver Pay has 30.68 million users (as of 2025). Naver Shopping's annual transaction volume reaches approximately 50.3 trillion won (as of 2024).

If stablecoins are introduced into this large-scale payment ecosystem, both companies can expect significant synergies. Naver can reduce existing credit card fees and improve profitability. The company can also greatly enhance the efficiency of the settlement process. Additionally, it is expected that 10 million cryptocurrency investors will flock to Naver Pay.

Dunamu can also ensure substantial revenue opportunities. The company can collect blockchain fees generated on GIWA Chain. It can also secure transaction fees from stablecoin payment services. Stablecoins and cryptocurrencies have yet to become mainstream payment methods. Merchants need deposit and withdrawal channels when receiving stablecoins and converting them to cash. Exchange infrastructure is crucial throughout this process. Upbit is likely to play this role (as of 2025, the Financial Services Commission allows the sale of cryptocurrencies within licensed exchanges).

Naver Pay Connect, Source: Naver Pay

When Naver Pay and Upbit connect as one, they will gain a completely different competitive advantage. Considering Naver's recent launch of the offline payment terminal 'Naver Pay Connect', they can build an integrated ecosystem. This ecosystem will seamlessly connect all payments from online to offline through stablecoins. This will provide a significantly different competitive advantage compared to existing payment ecosystems.

Scenario 3: Content IP Innovation

Source: Naver Webtoon

Source: Naver Webtoon

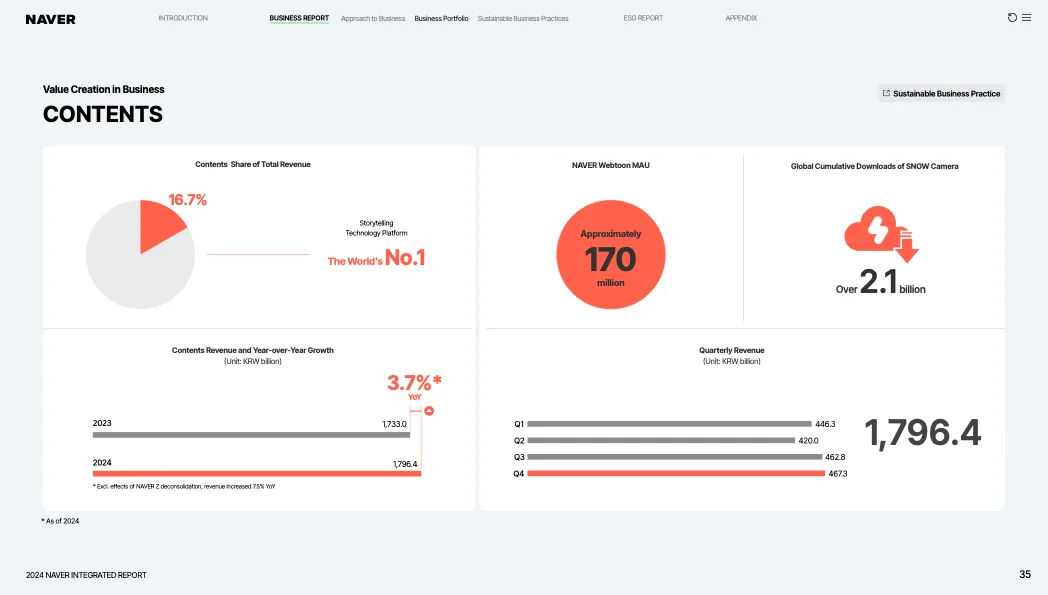

Finally, the potential integration of Naver's content ecosystem with blockchain deserves attention. Naver Webtoon has produced numerous popular webcomics, including "Tower of God," "Sweet Home," and "Vigilante." These works have been adapted into TV series and movies, gaining global fans. Naver Webtoon's revenue reached approximately $1.35 billion in 2024 and continues to grow.

Source: Naver Integrated Report 2024

Naver Webtoon essentially allows creators to own their IP, but the platform holds usage rights or exclusivity based on contract terms. If Dunamu's GIWA Chain integrates with this structure, it can enhance the transparency of IP utilization and innovate secondary creation and revenue distribution models. Additionally, new models become possible, such as token economies based on fan communities and on-chain IP assets.

Source: Naver Webtoon

Naver Webtoon has also recently expanded its collaborations with global IP companies like Disney and Marvel. Disney provides IP, while Naver Webtoon is responsible for platform development and operation. The new platform will consolidate Disney's vast comic IP collection. This means Naver Webtoon has laid the foundation for handling its own IP as well as top global IPs. It is expected that through this, the monetization methods in the content industry will leap forward in conjunction with blockchain.

3. Blockchain Expands Naver's Business Scope

Naver's platform ecosystem extends far beyond what we have covered here. There are various scenarios where blockchain technology can integrate with Naver's existing value chain to add new functionalities and value or expand into entirely different areas.

For example, Poshmark, the largest second-hand trading platform in North America acquired by Naver in 2023, can utilize the programmable payment features of stablecoins to implement an escrow system. Naver's search advertising business can improve transparency through blockchain-based settlements. The live streaming service Chzzk can attempt to convert audience engagement into token rewards.

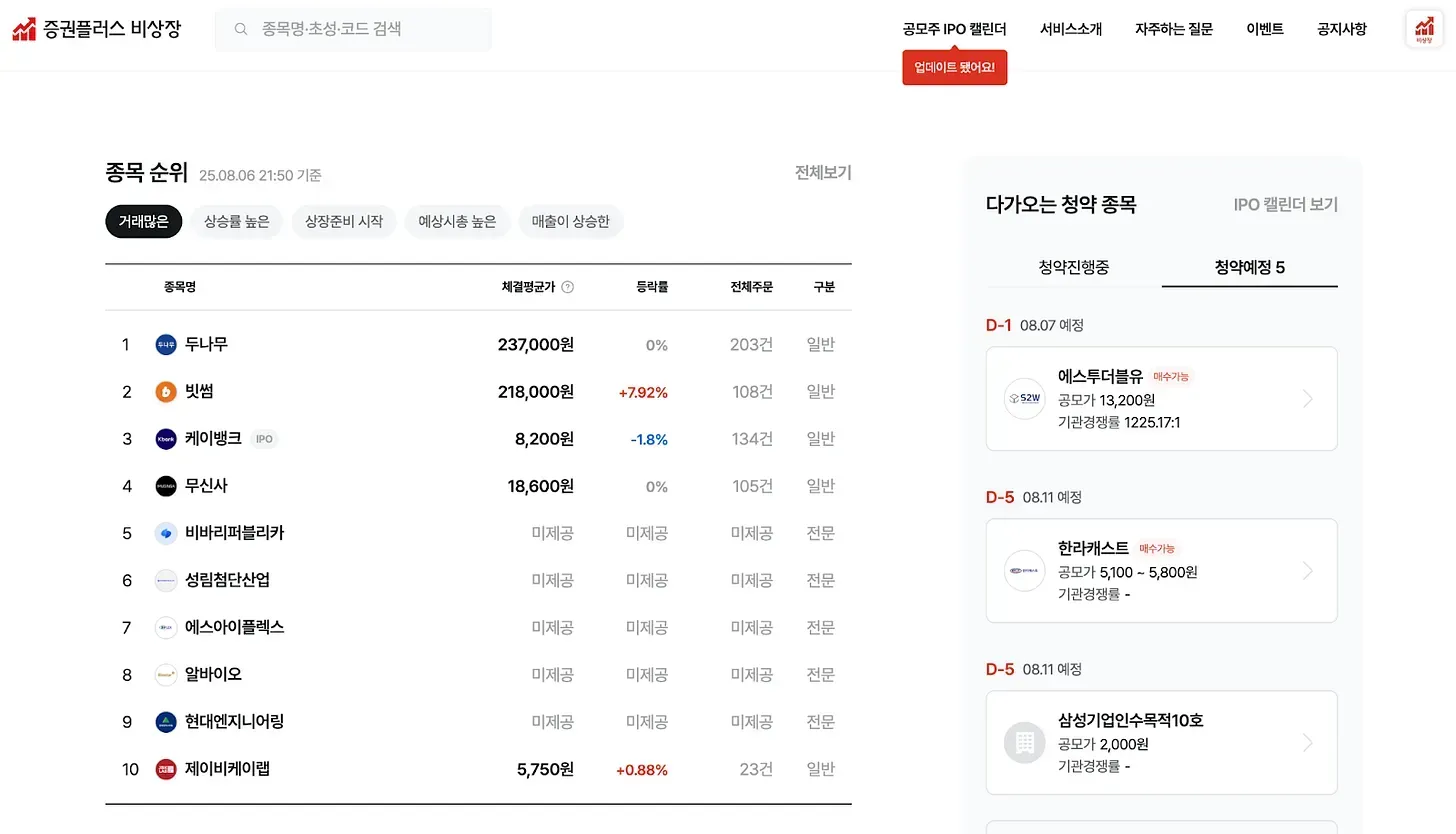

Source: Securities Plus Unlisted

A particularly noteworthy point is that Naver Pay has acquired the unlisted stock trading platform "Securities Plus Unlisted." Combined with Dunamu's GIWA Chain, this opens up realistic scenarios for significantly improving liquidity and accessibility through the tokenization of unlisted stocks.

Naver and Dunamu have drawn clear lines in terms of subsidiary integration, but they have already begun collaborating in multiple areas. Importantly, both companies now view the crypto industry as a strategic core pillar and have started to engage comprehensively. The industry is closely watching how their combination will materialize and what new blockchain services will emerge in the process.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。