Author: @Web3Mario

Abstract: 20% to 40% stablecoin APR! No time to explain, seize the opportunity for stablecoin subsidies after the Plasma mainnet launch! This article will summarize the opportunities for stablecoin yields on the Plasma mainnet, participation tutorials, and precautions from the perspective of DeFi beginners.

Quick Overview of the Plasma Project Background

Just yesterday, on September 25, many friends may have seen the wealth effect of XPL on various consulting or social media platforms, which gave its issuer, Plasma, a great start for its TGE. If you missed the early rounds of XPL, don’t worry, because after the mainnet launch, Plasma has provided short-term high subsidies for various stablecoin yield scenarios. I believe these scenarios are low-risk, relatively simple to operate, and offer very objective returns, making them suitable opportunities for DeFi beginners. Therefore, I will quickly summarize some information and precautions that readers may find useful when participating.

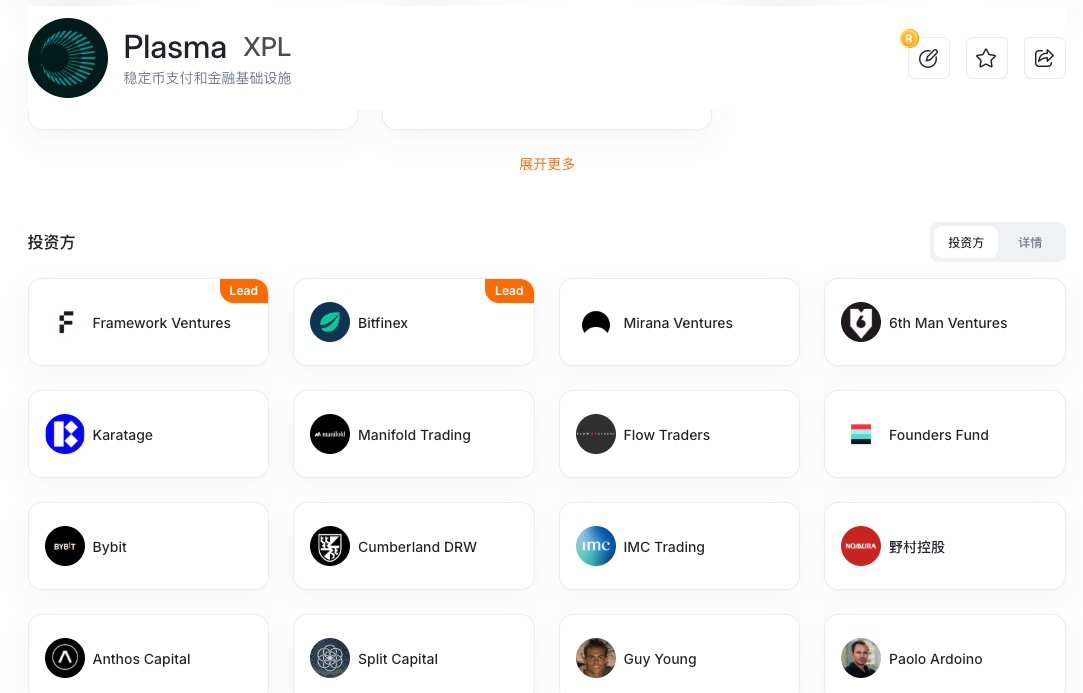

First, let’s quickly introduce the Plasma project. In summary, it is a Layer-1 blockchain with strong backing from investors, specifically designed for stablecoin payment systems, aiming to provide high-performance, low-cost, and nearly instant transfer experiences for dollar-pegged stablecoins (like USDT). Its core selling point is the "zero-fee USDT transfer" mechanism (meaning users do not need to pay additional gas fees when performing standard USDT transfer operations). It is also EVM compatible, allowing various mature EVM DeFi products to be quickly integrated.

Plasma (XPL) is backed by a strong lineup of investors, including Founders Fund, Framework Ventures, Bitfinex, and executives from the Tether team, providing both funding and strategic support. The project has completed approximately $3.5 million in seed funding and about $20 million in Series A funding since 2024, raising over $370 million during the public offering phase before the mainnet launch for stablecoin liquidity pools, ecological incentives, technology development, and security audits. This funding has laid a solid resource foundation for Plasma to build a zero-fee stablecoin transfer network and a broad DeFi ecosystem.

The significance of introducing this is that we can understand that this is a project that is unlikely to encounter problems in the short term, making it relatively hot and providing good security for assets.

Opportunities, Tutorials, and Precautions for Subsidies During the Cold Start Phase of the Plasma Mainnet

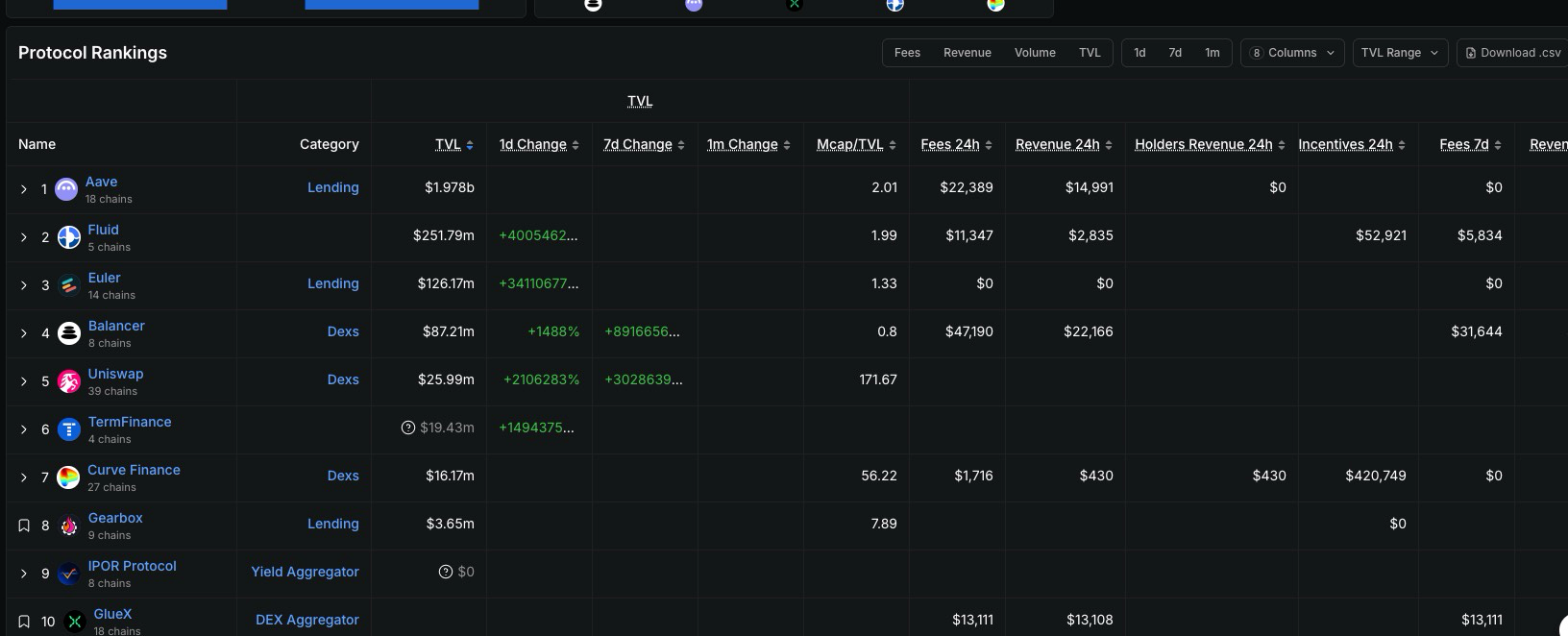

From a GTM strategy perspective, the Plasma project has adopted a high-profile approach. After achieving a good start for its token TGE, the Plasma official has provided short-term, high-return XPL token subsidies for stablecoin use cases in the ecological DeFi projects to maintain the project's momentum and quickly attract funds. On average, most stablecoin yield scenarios can maintain an APR between 20% and 40%. According to DeFillama, since the mainnet launch yesterday, the TVL has quickly reached $2.5 billion, and mainstream DeFi projects have gradually launched on Plasma. Moreover, the official subsidy scenarios of Plasma are all centered around these mainstream DeFi protocols, so everyone should temporarily avoid participating in new, native early projects to avoid unnecessary risks.

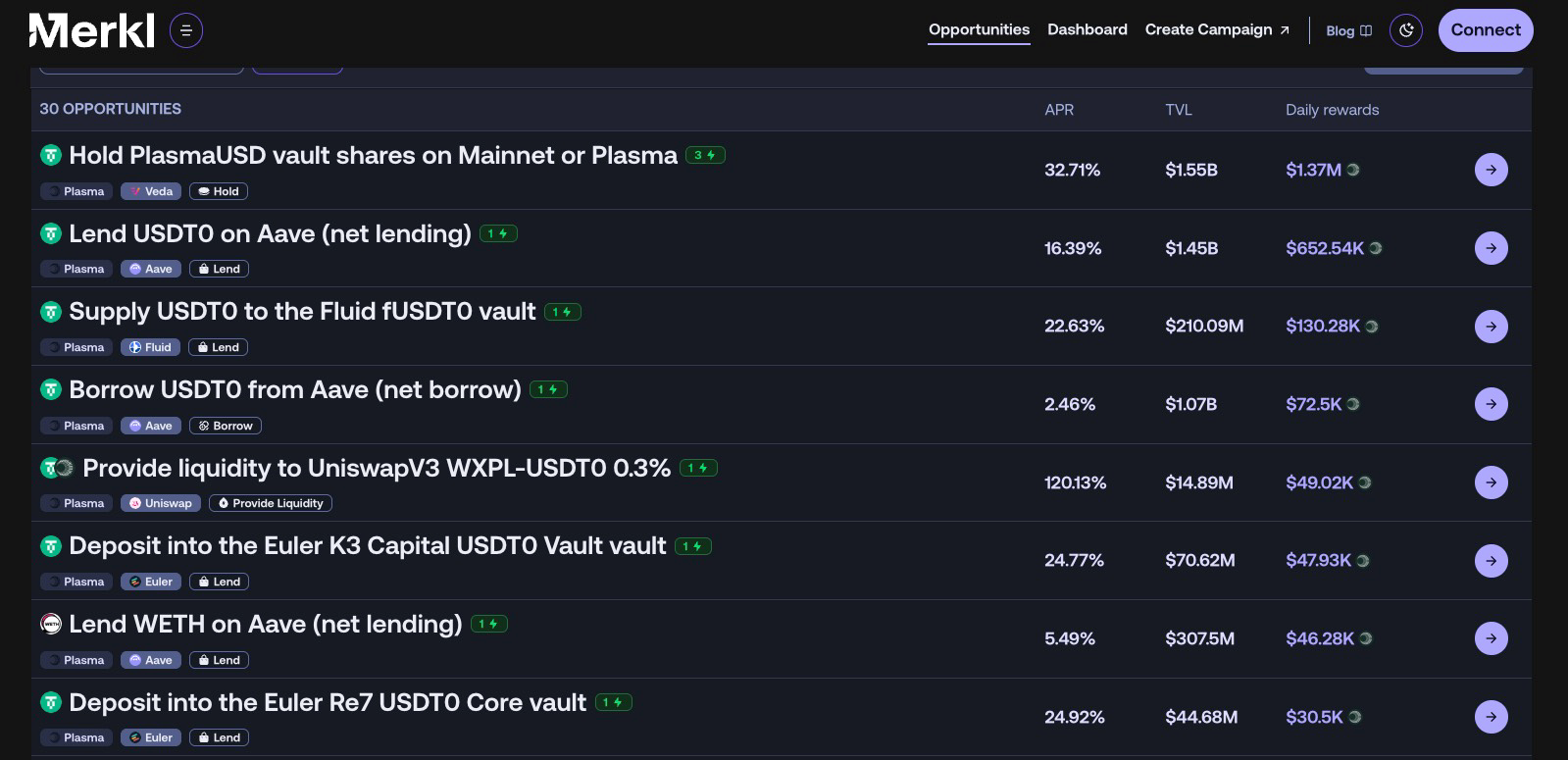

First, let’s introduce how to discover these investment opportunities. The first key link is the dedicated section for Plasma on the Merkl platform. Merkl is a multi-chain Web3 incentive distribution platform that has allocated over $200 million in liquidity and points rewards for 200+ protocols, supporting various schemes such as liquidity mining, lending incentives, and airdrops, helping projects efficiently attract and retain users, so security is not an issue. Plasma has chosen to distribute rewards through the Merkl platform, and you can find all subsidized scenarios at this link:

It is worth noting that Merkl uses a Merkle Root distribution model for incentives in some scenarios, which means that while rewards accumulate in real-time, they are not immediately claimable. Users may need to actively claim rewards after a certain period. If you are looking for compounding opportunities, please do not overlook this detail.

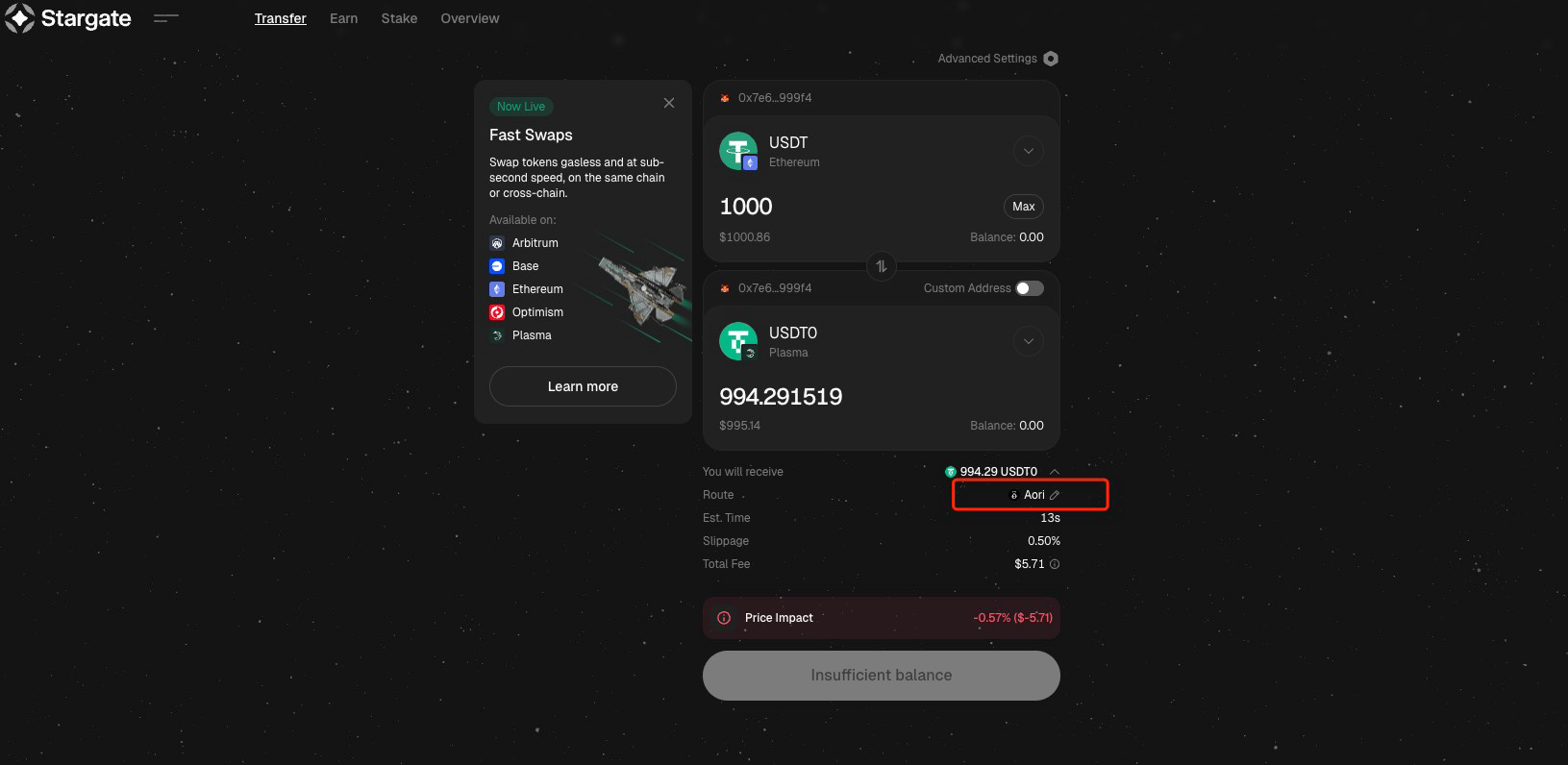

Next, let’s discuss how to transfer funds to the Plasma mainnet. The cross-chain protocol specified on the official website is stargate.finance. Users can click on the top navigation bar of the official website to access it.

- Link: https://stargate.finance/bridge?dstChain=plasma&dstToken=0xB8CE59FC3717ada4C02eaDF9682A9e934F625ebb

There are four points to note during the cross-chain process:

- Plasma uses an EVM-ecosystem-compatible private key system, so your EVM address can be reused in the Plasma ecosystem.

- The current Plasma mainnet requires XPL to pay transaction gas fees, so you need to pre-load some XPL into the operating address. It is recommended to purchase 5 to 10 XPL from a CEX and withdraw it to that address.

- The main subsidized stablecoin asset in the Plasma ecosystem is USDT0, which is a cross-chain stablecoin based on the Omnichain Fungible Token (OFT) standard launched by Tether, pegged 1:1 to USDT. Therefore, you only need to prepare USDT.

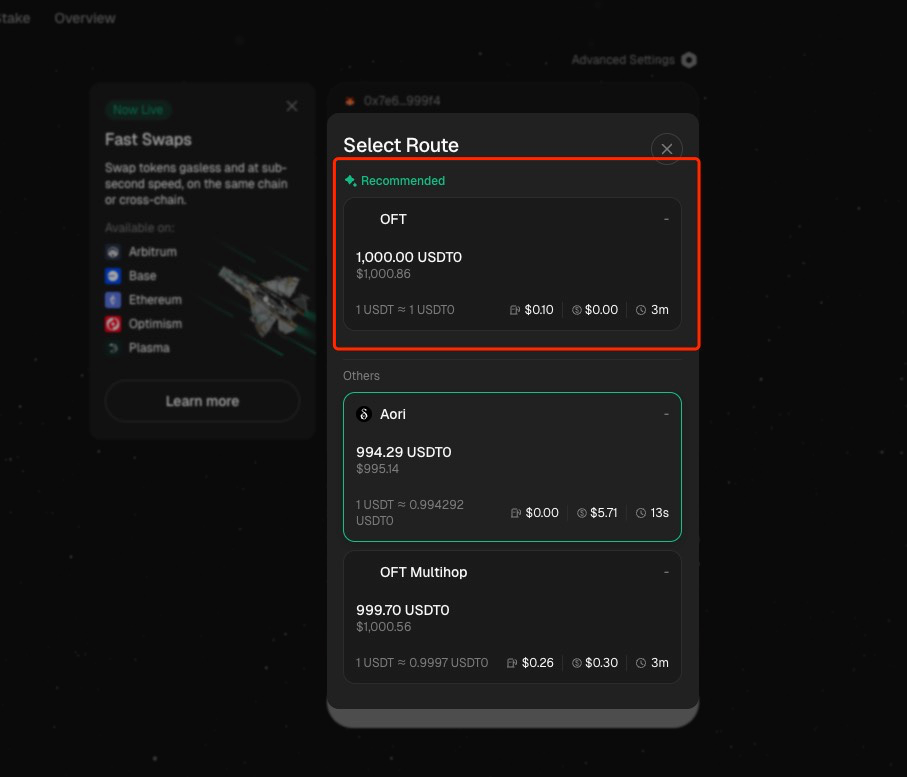

- Stargate supports cross-chain transactions, so your cross-chain request may not necessarily go through LayerZero; it may also be routed through other trading paths. The default protocol seems to be Aori, which has significant slippage and fees. Be aware that if you do not actively choose to use the OFT protocol for cross-chain (which is free), you will incur considerable fees, so pay attention to this!

Finally, let’s introduce some stablecoin-based, no-risk investment scenarios that I believe are very suitable for DeFi beginners to participate in:

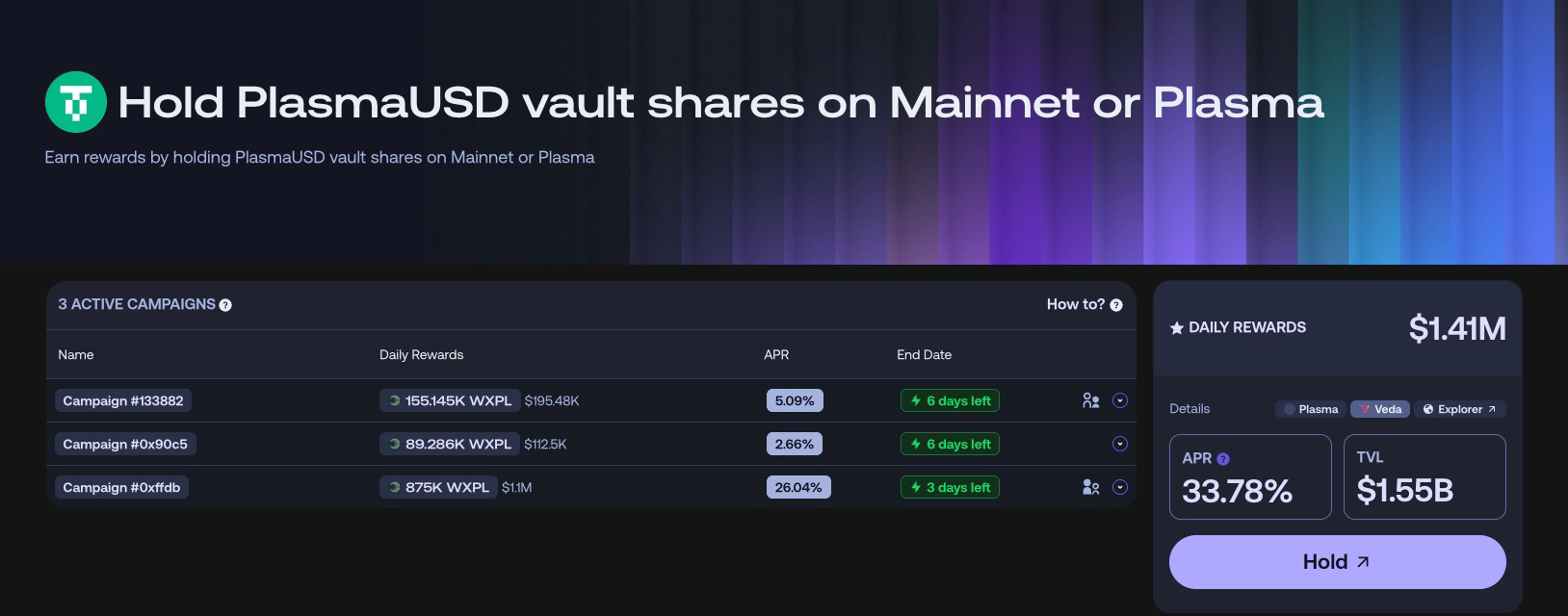

- Official Plasma ecosystem stablecoin Lending Vault: This is an official stablecoin vault where users can stake USDT0 to earn subsidized returns. The funds provided will be automatically staked into the AAVE USDT0 pool by the Vault. Currently, the total TVL of this pool has reached $1,604.64 million, with an instantaneous yield rate of 33.78%.

There are two points to note:

- The current yield rate of this pool can only be maintained for 3 days, but after 3 days, Campaign #0xffdb will end, and the subsequent yield rate will depend on how much funding the project team continues to allocate to this pool.

- The redemption of this pool has a 48-hour cooling-off period, and the principal can only be withdrawn after the cooling-off period ends.

Key links are as follows:

- Reward details: https://app.merkl.xyz/opportunities/plasma/ERC20_CROSS_CHAIN/0xd1074E0AE85610dDBA0147e29eBe0D8E5873a000

- Participation link: https://app.plasma.to/

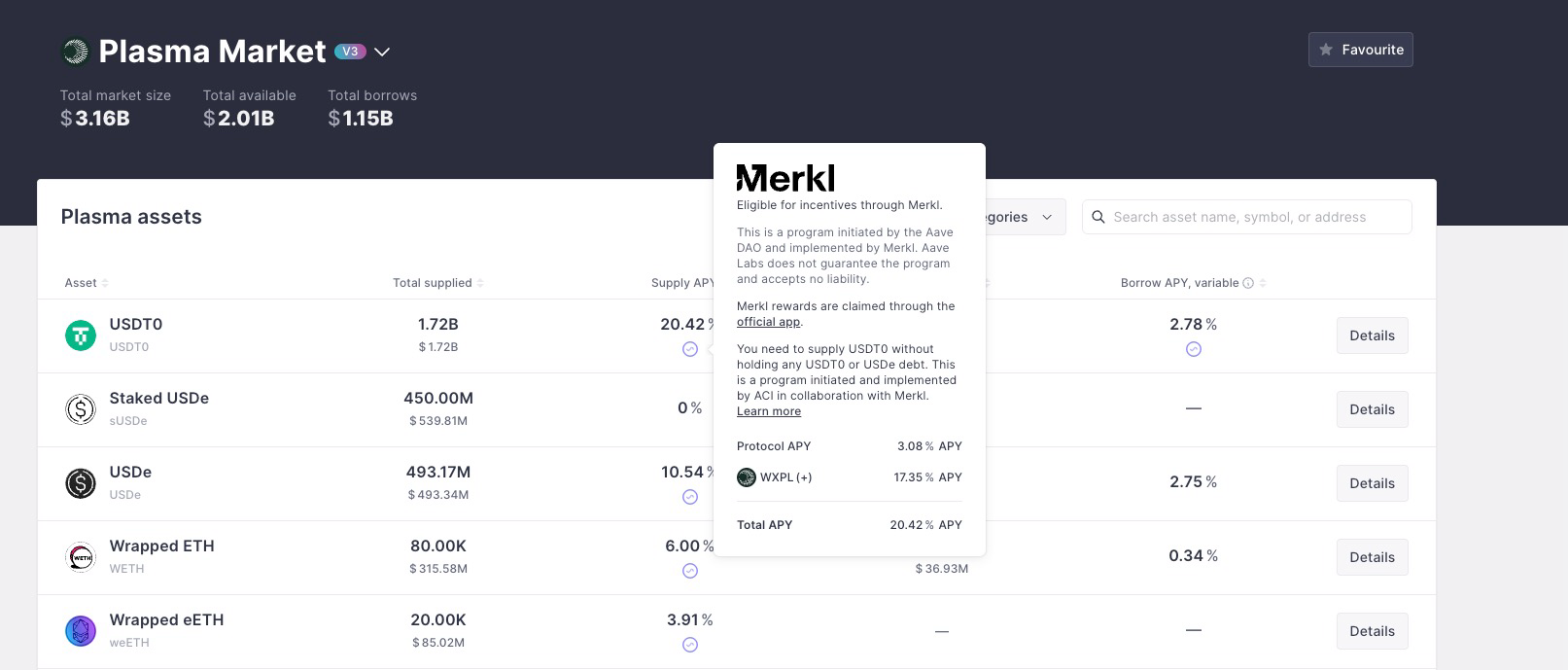

- Providing funds to the USDT0 pool in AAVE: The second good opportunity is to directly provide funds to the AAVE USDT0 pool, which will yield 20.42%, with 3.08% coming from borrower interest payments and the remaining 17.35% from the official XPL token subsidy.

Points to note:

- The remaining duration of this subsidy is 6 days, and after it expires, the yield rate will depend on the official allocation.

- Since the funds from the official Lending Vault are also fully injected into this pool, and the official Lending Vault has a cooling-off period, in subsequent reward settings, if the official wants to retain the Lending Vault, the yield rate they allocate must be higher than that of directly depositing funds into AAVE to subsidize the time cost of user funds.

- The subsidy portion only calculates the net value of the funds provided by the user, meaning that if you have borrowed funds, this portion will be deducted from the principal calculation, so circular lending is meaningless in this scenario.

Key links:

- Reward details: https://app.merkl.xyz/opportunities/plasma/MULTILOG_DUTCH/0xc5a8eda89cc8ef1de7c861be9bcf3ffdbd250627

- Participation link: https://app.aave.com/markets/

- Providing USDT0 in the specified Vaults in Fluid or Euler: From a TVL perspective, Fluid and Euler should belong to the second tier of lending protocols, and compared to AAVE, they have designed more complex functions, so they are slightly weaker in terms of security, but they have also stood the test of time. In these two scenarios, Plasma has also allocated rewards, and the current yield rates can reach 23.76% and 27.20%.

After the early subsidy phase, I will continue to track suitable investment scenarios on the Plasma chain for DeFi beginners, so stay tuned!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。