How Will James Wynn’s ASTER Move Impact Token Price?

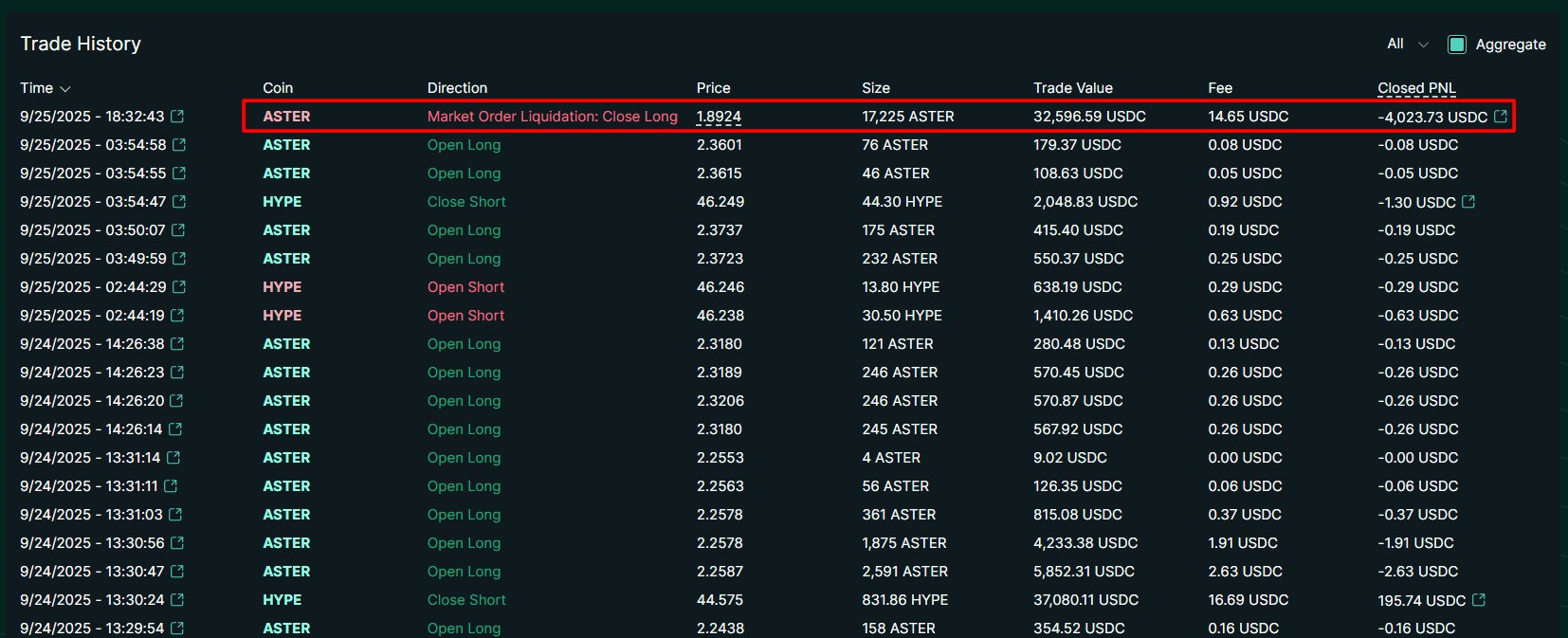

High-profile crypto trader James Wynn has made a striking return to the high-risk trading scene, opening a 3x leveraged long position on the ASTER token. This move comes on the heels of the recent liquidation of his position on the same token, which resulted in a loss of $4,023.73. This daring action has generated interest from crypto traders and enthusiasts, highlighting the richness of trading in leveraged fashion in uncertain markets, but it also poses questions about the accountability of the effect of the action on the price.

3x Leveraged Position

In particular, James Wynn trades with high leverage, and his long position on ASTER indicates a belief that ASTER will move up. Wynn opened a new leveraged bet on the altcoin on HyperLiquid, presumably inspired by increasingly promising on-chain statistics or possible growth in the ecosystem. In a recent post, Onchain Lens noted , “After being liquidated on ASTER, James Wynn is back and has opened a 3x leverage long position on ASTER .”

Significantly, this move follows the loss of $4,023 for the trader by liquidating his 3x long trade on the token. A previous X post of Onchain Lens read, “Trading against James is always a "Wynn..." Just In: James got liquidated on his… long position, losing $4,023.73.”

His decision has significant implications for the crypto’s price. This move showcases Wynn's confidence in $ASTER's upward potential, possibly driven by favorable on-chain metrics or emerging ecosystem developments. The increased demand for the altcoin could push its price up. However, the use of high leverage amplifies potential gains and losses, making his bet susceptible to significant price swings.

Altcoin Price Surges

Since its launch last week, the crypto has been experiencing notable price gains, despite volatility. Today, the altcoin is trading at $2.00, up 8.5% in a day. Over the last seven days, the crypto has been up by about 70%. Taking its trajectory from its debut, it has seen a massive gain of 2278%.

Despite this hike, traders are less enthusiastic about the token. This declining sentiment is evident in the token’s decreasing trading volume, currently at $1.71 billion, down by 30%. This shows that the community is less optimistic about the cryptocurrency’s potential uptrend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。