Written by: Glednon, Techub News

Stablecoin giant Tether is brewing a major move that could change the market landscape.

On September 24, Bloomberg reported that Tether is raising $15 billion to $20 billion through a private placement at a valuation of up to $500 billion, sparking discussions within the industry. Subsequently, Tether CEO Paolo Ardoino further revealed key information on Twitter, stating that the company is evaluating financing from a group of high-end investors with the aim of enhancing its strategic scale in existing and new business lines, including stablecoins, distribution, artificial intelligence, commodity trading, energy, communications, and media. Currently, SoftBank and Ark Investment are in talks to participate in Tether's major financing round.

Expanding its business territory is clearly the core of Tether's strategic layout this time. Rewinding to September 17, Tether had just announced its return to the U.S. market, and CEO Paolo Ardoino had made it clear that Tether has no intention of emulating Circle's public listing. Given that the company made a profit of $13.7 billion last year, there is no need to raise funds; instead, it plans to focus on building new distribution channels and other investment businesses to drive the company's sustainable development.

As is well known, the competition in the stablecoin sector is unprecedentedly fierce today, especially in the U.S. market, where many traditional financial institutions are eager to launch their own stablecoins, aiming to carve out a share in this potentially lucrative market.

Against this backdrop, Tether plans to launch a compliant stablecoin, USAT, by the end of this year, attempting to re-enter the market. However, the reality may be more severe than it initially anticipated, as it faces significant resistance and challenges. Therefore, Tether's high-profile pursuit of massive capital injection not only demonstrates its ambition to change the stablecoin market landscape but also serves to create momentum for future business and market expansion. So, can USAT establish a foothold in this fierce market competition?

USAT: Tether's Compliant "Blade" to Break Through

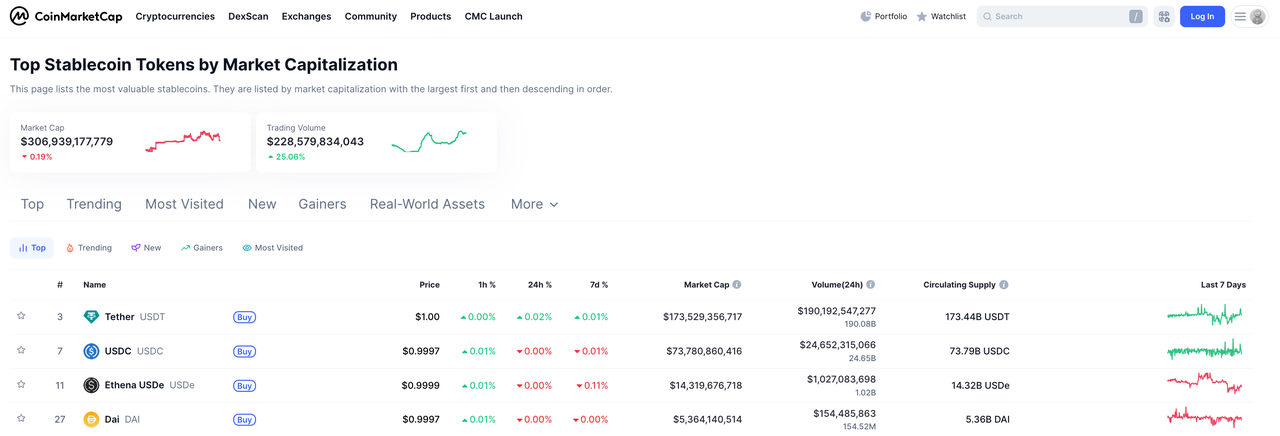

According to CoinMarketCap data, the total supply of stablecoins has surpassed $300 billion, reaching approximately $306.9 billion. Back in December last year, this figure had just crossed $200 billion, setting a historical high. Over the past nine months, the total supply of stablecoins has shown a stable growth trend, with an increase of over 53%.

This boom is attributed to the passage of the U.S. stablecoin regulatory legislation, the "GENIUS Act," and the overall enlightened policy environment. Currently, favorable regulatory proposals for stablecoins are continuously being strengthened and upgraded. On September 24, Caroline D. Pham, acting chair of the U.S. Commodity Futures Trading Commission (CFTC), announced a new initiative to allow stablecoins to be used as tokenized collateral in the U.S. derivatives market for the first time, and publicly solicited opinions on issues such as valuation, custody, settlement, and related rule amendments. This move undoubtedly opens up a new capital market demand for stablecoins.

At this critical juncture, Tether, as the leader in the stablecoin market, has chosen not to modify the existing USDT for compliance with U.S. legal requirements but instead decided to launch an entirely new stablecoin.

On September 12, Tether officially announced the launch of the U.S. dollar-backed stablecoin USAT, regulated by the U.S., and appointed former White House Crypto Council Executive Director Bo Hines as CEO of USAT. As one of the key figures in promoting the passage of the "GENIUS Act," the implementation of the new regulatory framework for stablecoins relies on Bo Hines's support. Based on this, USAT is expected to benefit from the strong political resource support brought by Hines, creating favorable conditions for its compliant operation and development in the U.S. market.

From official documents, it is known that USAT's design will fully comply with the "GENIUS Act," providing digital alternatives to cash and traditional payment methods for businesses and institutions. The biggest difference from USDT is that USAT's asset reserve composition is completely transparent, with 100% of reserves in cash and short-term U.S. Treasury bonds, while about 16% of USDT's reserve assets are in Bitcoin, gold, secured loans, and corporate bonds (these assets have been explicitly excluded from compliant reserve assets by the "GENIUS Act") and still reflect transparency through "quarterly proof reports" rather than comprehensive audits.

In terms of technical support, USAT also uses Tether's real-world asset tokenization platform Hadron technology, and is issued by Anchorage Digital, a cryptocurrency bank holding a banking license. In this regard, analysts such as Nikolaos Panigirtzoglou, Managing Director at JPMorgan, pointed out in a report that this move may help Tether establish institutional trust, reduce reliance on third-party banks, thereby lowering operational costs, and also avoid the risks faced by Circle during the collapse of Silicon Valley Bank in 2023. Additionally, by directly managing USAT's reserves, Tether hopes to retain more earnings and further improve profit margins.

For reserve custody, USAT has designated Cantor Fitzgerald, a financial services company, as the designated reserve custodian and primary dealer. The association between Cantor Fitzgerald and Tether can be traced back to multiple business collaborations and capital ties, and the company has long been a major custodian of Tether's assets, holding most of the U.S. Treasury bonds in Tether's reserve assets. Notably, the company's founder, Howard Lutnick, is the current U.S. Secretary of Commerce. This political relationship undoubtedly provides Tether with a significant institutional trust advantage in expanding its presence in the U.S. market.

However, there are differing opinions in the market regarding USAT. Many believe that USAT is merely a product of Tether's compromise with U.S. regulatory policies and does not fully achieve compliance for Tether. In reality, this may be Tether's carefully planned win-win strategy. On one hand, Tether is unwilling to give up the significant advantages of USDT's easy access and low fees to meet the needs and risk preferences of a broader user base in other markets; on the other hand, it wants to secure a place in the U.S. compliant stablecoin market, even aiming to seize a market stronghold.

It is important to note that Tether's ambitions are no longer concealed. Previously, Bo Hines publicly stated that Tether is returning to the U.S. market with the goal of becoming the dominant stablecoin issuer in the country, replicating its success overseas.

But will Circle and other stablecoin issuers easily allow Tether to dominate the U.S. stablecoin market?

The "Zero-Sum Game" of the Stablecoin Market

Although the "GENIUS Act" has promoted steady development in the stablecoin market, the current situation indicates that the expansion trend of stablecoins and even the entire cryptocurrency market has not seen significant improvement. This may suggest that a broader "retail" group has not yet entered the market on a large scale. As JPMorgan analysts pointed out, competition in the stablecoin sector is becoming increasingly fierce, and in the absence of significant expansion in the cryptocurrency market, this competition among issuers like Tether and Circle may ultimately evolve into a "zero-sum game," where parties are merely competing for market share rather than collectively expanding the market pie.

In this battle for stablecoins, Circle is undoubtedly Tether's strongest competitor.

From the data, in the past nine months, the growth rate of USDC stablecoin supply has significantly outpaced that of USDT. As of the time of writing, the total supply of USDT and USDC stands at $173.6 billion and $73.8 billion, respectively, compared to $142.9 billion and $42.3 billion on December 28, 2024, representing increases of approximately 22% and 74%, respectively.

This gap indicates that USDC, leveraging its regulatory compliance advantages, revenue-sharing models with platforms like Coinbase, and the scale effects formed on chains like Ethereum, is rapidly expanding its business scale and accelerating its pursuit of USDT. It is not difficult to see that Tether's launch of USAT is both a strategic move to expand its business territory and a necessary step to fill regulatory gaps and consolidate its market position.

If Tether abandons the U.S. market, Circle is likely to leverage its dominant position in the U.S. market to further expand into other markets, gradually eating away at Tether's market share.

On the technical front, Circle is building a dedicated stablecoin blockchain called Arc, aimed at maintaining USDC's core position in the entire cryptocurrency ecosystem by optimizing speed, security, and interoperability. Looking at Circle's layout, it has already become the preferred stablecoin for U.S. institutions, with deep liquidity and a solid liquidity foundation, and has established partnerships with numerous exchanges and financial institutions. For example, Circle is actively exploring the use of USDC for merchant payments on blockchains like Solana and collaborating with payment giants like Visa.

With these advantages, Circle has built a solid moat, making it difficult for even USDT to easily replace its position in the U.S. market.

In fact, USAT faces competition from more than just USDC. The U.S. stablecoin market has undergone tremendous changes, and the stablecoin sector is showing a more diversified differentiation trend.

Once, USDT or USDC served as the primary trading medium for investors purchasing cryptocurrencies like Bitcoin, with over 80% of stablecoin inflows being used to buy crypto assets. However, this core logic has fundamentally changed.

DeFi researcher Ignas pointed out that the application scenarios for stablecoins have significantly expanded, extending to "lending, payments, yield generation, asset management, and airdrop arbitrage," with some funds no longer flowing into the Bitcoin or Ethereum spot markets, but still injecting vitality into the entire cryptocurrency system. This is specifically reflected in the increased trading volume of Layer 1 (L1) and Layer 2 (L2) networks, enhanced liquidity in decentralized exchanges (DEX), revenue growth in lending markets like Fluid and Aave, and deepening of the entire ecosystem's currency market.

At the same time, in the native cryptocurrency space, platforms such as decentralized exchanges are also joining the stablecoin battlefield. A typical example is the recently concluded Hyperliquid stablecoin USDH competition. Competitors such as Paxos, Frax, Agora, and Ethena Labs have proposed plans centered around "how to maximize user benefits," all intending to cede 95% or even 100% of their profits in pursuit of issuance rights. This shows that occupying distribution channels and seizing market share has become the top priority for issuers.

The launch of the stablecoin USDH by Hyperliquid is partly aimed at reducing dependence on USDC. Similarly, other DeFi protocols may follow Hyperliquid's lead and launch their own stablecoins to capture market share from USDT. A more recent example is the launch of mUSD on MetaMask, which integrates through the wallet ecosystem to attract users to shift from USDT/USDC to more convenient on-chain payment scenarios. The implementation of this ecological closed-loop strategy will undoubtedly weaken the usage rate of stablecoins like USDT in specific scenarios (such as DeFi trading).

In addition, traditional financial giants have also recognized the enormous potential of the stablecoin market and are actively positioning themselves. Companies like Robinhood, Revolut, and the Society for Worldwide Interbank Financial Telecommunication (SWIFT) are developing their own stablecoins, attempting to gain an edge in this market. In summary, the competition in the stablecoin sector has shown an unstoppable trend of intensification.

What Advantages Does Tether Have?

In the face of multiple competitors, Tether still possesses significant advantages. Although it faces regulatory restrictions in countries and regions such as the U.S. and the EU, it maintains an absolute dominant position with over 56% market share due to its strong market foundation. In comparison, USDC currently holds about 24% of the global stablecoin market.

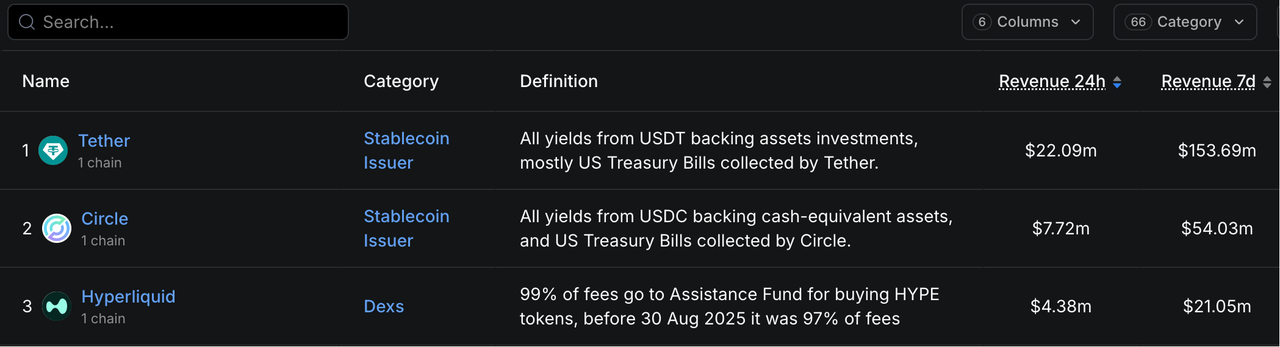

Moreover, Tether's profitability is remarkable, with a net profit of $4.9 billion in the second quarter of 2025. Tether CEO Paolo Ardoino even tweeted that Tether's profit margin is as high as 99%.

According to DeFiLlama data, as of the time of writing, Tether's 24-hour earnings reached $22.09 million, ranking first in the cryptocurrency market. Although Circle ranks second, its 24-hour earnings are only $7.72 million, showing a significant gap compared to Tether.

Additionally, Tether has a unique and powerful advantage: its global distribution network.

Ardoino stated that Tether's core advantage lies in the distribution network established over the past 11 years, covering hundreds of thousands of physical distribution points, akin to a vast and intricate commercial web. Unlike most competitors, Tether does not need to rent distribution channels. Furthermore, Tether has invested $5 billion in the U.S., including a $775 million investment in Rumble Inc. Therefore, although USDT is not compliant in the U.S., Tether has already established a solid financial infrastructure in the country.

Next, Tether plans to implement its dual-track strategy.

Regarding USDT, Ardoino mentioned in an interview that USDT primarily focuses on serving emerging markets, covering regions such as Latin America, Africa, and Southeast Asia, helping local users bypass inefficient financial infrastructures, and functioning more like an international stablecoin. USAT, on the other hand, is designed specifically for the U.S. market, aiming to optimize user experience to perfectly fit the mature and complex financial system in the U.S. Through this dual approach, Tether can meet the needs of global retail investors for trading flexibility while also addressing institutional users' compliance requirements, achieving breakthroughs at different market levels.

However, in this process, Tether is bound to face many challenges, including the need to invest substantial funds to build a new liquidity system, ensure the stable operation of USAT, and enhance its acceptance in the market, as well as changes in regulatory policies and rising compliance costs. After Tether's return to the U.S. market, the first task will be to address stricter audits and reserve proofs to establish sufficient trust and gain recognition from the market and regulatory agencies.

If USAT can successfully operate under U.S. regulation, its valuation will break through $500 billion, achieving a significant leap and attracting a broader range of institutional funds, potentially reshaping the U.S. stablecoin landscape.

It is worth mentioning that USDT is also facing compliance challenges in the EU market, as it does not meet the requirements of the EU's Markets in Crypto-Assets Regulation (MiCA). Currently, several platforms, including Coinbase and Bitstamp, have delisted USDT trading pairs in the EU region. This means that once USAT successfully achieves compliance in the U.S., it will reverse Tether's existing regulatory disadvantages, making it unsurprising for it to subsequently expand into the EU market, potentially further seizing USDC's market share in Europe.

In this regard, Ardoino has also expressed high confidence in Tether during interviews. He stated that although Tether is no longer a startup, its development stage is only "0.25," far from reaching its peak. He claimed that the company's future growth potential is "unlimited," with plenty of room for innovation and development.

Of course, the stablecoin market may not be entirely a "zero-sum game" focused solely on market share competition, as pointed out in a JPMorgan report. Citibank's latest report has raised its baseline forecast for stablecoin issuance to $19 trillion by 2030, emphasizing that in a bullish scenario, this figure could reach $40 trillion. The report also highlights that if the circulation speed of stablecoins approaches that of fiat currencies, the annual transaction volume could reach $100 trillion to $200 trillion.

As the enticing "big cake" of the stablecoin market continues to expand, its prospects are becoming increasingly broad, and it is highly likely that a dual-strong competition or a multi-strong coexistence pattern will emerge in this field. In such a situation, it is difficult to assert that Tether can stand alone at the top of the industry.

However, at present, in the face of Tether's ambitious and aggressive expansion, what measures will Circle take to fend off Tether's attack and consolidate its position in the U.S. market?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。