US PCE Inflation Data Today 6 PM Amid Fed Rate Cuts and Trump Tariffs

The markets are anticipating the U.S. Personal Consumption Expenditures report due to be released today, September 26, 2025.

The PCE Inflation data will play a very important role in influencing the future expectations of the next interest rate decision by the Federal Reserve .

PCE Data Report Release Date, Sept 26, 2025

The PCE report is to be released today by the Bureau of Economic Analysis. This is the most preferred inflation indicator by the Federal Reserve, and it is commonly followed by investors, economists, and policymakers.

It records the consumer expenditure trends and gives an idea of whether the price pressures are abating or remaining sticky.

Source: US Core PCE Data today

The report is released at a time when the U.S. economy has demonstrated remarkable strength despite the continuing trade tariffs.

Recent statistics indicated a higher growth in GDP in the second quarter, declining jobless claims, and a steep increase of 20% in new home sales. This makes decision-making of the Fed difficult because robust growth diminishes the need to cut the rates aggressively.

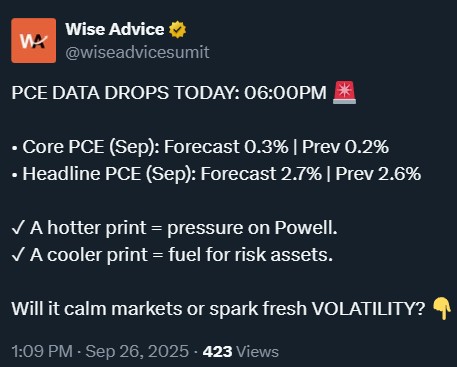

PCE Inflation Forecast Today

Forecasters believe that headline PCE data will have risen at an average rate of 2.7% in August, slightly higher than 2.6% in July. Core PCE is expected to stay unchanged at 2.9% without food and energy.

Although this prediction indicates that inflation has not increased at a very high rate, it remains higher than the Fed's target of 2%.

Economists assume that Trump tariffs are driving up the prices of imports, which is keeping headline inflation sticky, despite some categories of prices, such as rent, cooling.

Other analysts, such as Goldman Sac, have forecast that the inflation will rise to 3.2% in December and then drop in 2026.

Expectation of the Fed to decrease the rate in October and December 2025.

Markets are looking forward to the October 29, 2025, Federal Open Market Committee (FOMC) meeting. The CME FedWatch tool shows that the Fed will cut the rate by 25 basis points to a level of 3.75-4.00 with a probability of 91.9%.

Source: PCE forecast

The probability of further reduction in December to 3.50-3.75 is also 78.8% which indicates the possibility of a cut of 50-75 basis points in case growth slows or inflation subsides faster.

The possibility of no rate cut is minimal at 1.2%. Going further ahead, the meeting in December might lead to another decrease if the rates decrease and the situation in the labor market becomes softer.

Impact on Markets

The current release is very sensitive in the stock market. An unexpected temperature rise would quash the expectations of reduced borrowing rates and push equities down.

On the other hand, the milder inflation would probably raise investor morale, which would improve the stocks and also the bond markets.

The movement of the metals has been mixed before the release. Platinum increased by 0.9% to 1,541.85 per ounce, and silver dropped by 0.7% to 44.87 per ounce. The prices of copper were mostly stable, as the investors were cautious in the run-up to

Trump New Tariffs and Pressures

The tariffs are still a major cause of the existing inflationary pressures. President Donald Trump has remained an advocate of high-rate cuts, demanding the Fed cut rates to 2%. He has further revived his attack on Fed Chair Jerome Powell , who has resisted political pressure and concentrated on data.

As tariffs are increasing the cost of imports, the position of Trump highlights the political tug of war over monetary policy, which introduces a further element of uncertainty to the future action of the Fed.

Conclusion

The current PCE report is not merely economic data, but a turning point in Federal Reserve policy. As the tariffs increase the cost and the markets need relief, the Fed has one of the most difficult decisions to make.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。