Perp DEXs trading volume has surged, marking an unprecedented shift from CEX to DEX.

Author: Axel Bitblaze

Compiled by: Deep Tide TechFlow

The trading volume of perpetual contract decentralized exchanges (Perp DEXs) is currently experiencing an unprecedented surge. Tokens like $ASTER and $AVNT are showcasing the potential of this trend. If you missed the $HYPE airdrop, now is the best time to participate in tokenless DEXs. Here are 8 DEX airdrop projects I recommend getting involved with:

For years, centralized exchanges (CEXs) have dominated the crypto industry for several key reasons. Firstly, CEXs have better user interfaces and are more convenient to use. Secondly, CEXs offer deep liquidity and lower fees. This is why exchanges like Binance have grown from zero to a market cap of over $100 billion in just 6-7 years.

However, attention is now shifting towards decentralized exchanges (DEXs) for the following reasons:

CEXs mandate KYC (Know Your Customer), leading to data breach issues.

CEXs can freeze accounts without any wrongdoing from users.

DEX liquidity is approaching that of top CEXs.

DEXs offer a simpler user experience with low to no gas fees for transactions.

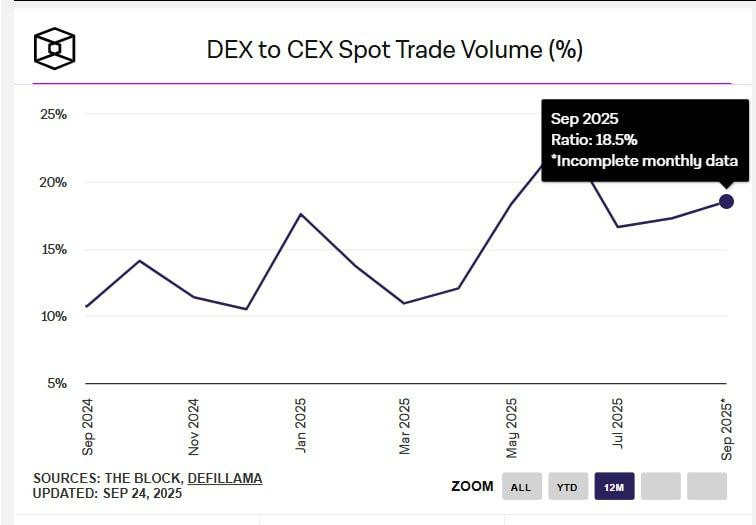

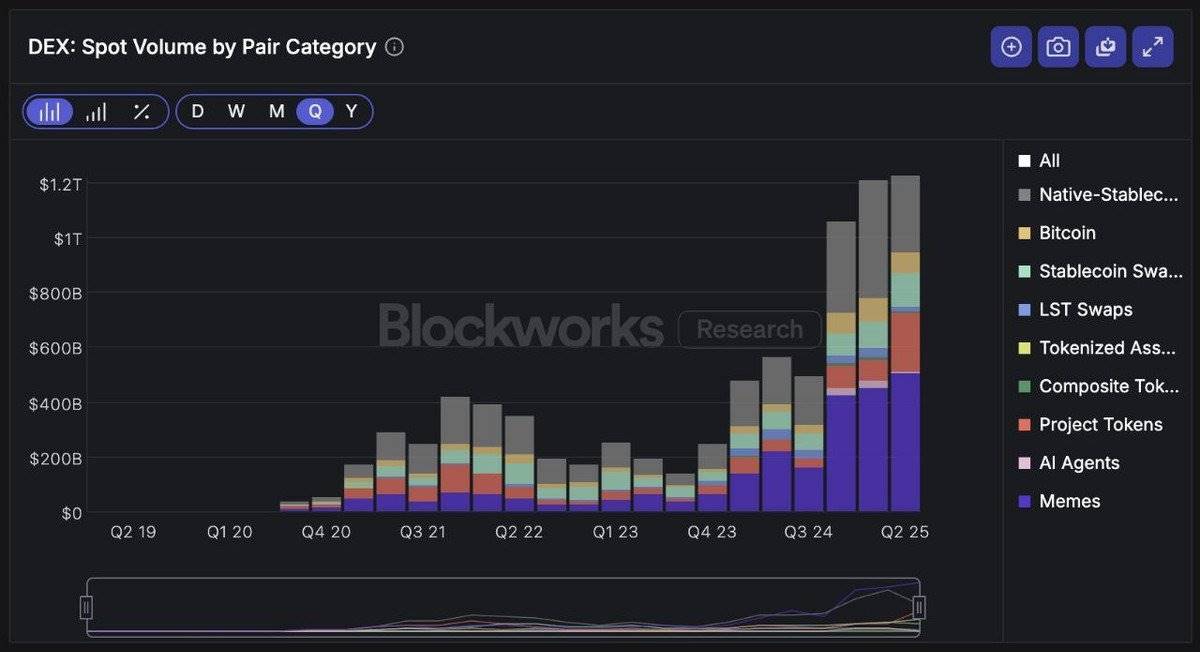

This has also contributed to the rapid growth of DEXs. In the first and second quarters of 2025, DEX trading volume exceeded $1 trillion. The spot trading volume ratio of DEXs to CEXs reached 20%, nearly double that of September 2025.

This indicates that DEXs are gradually replacing CEXs, and even some large exchanges are becoming aware of this shift. But which DEXs will dominate in the long term and are worth participating in their airdrops?

@Lighter_xyz

If you missed the $HYPE or $ASTER airdrop, this opportunity is perfect for you. Lighter allows zero-fee trading of perpetual contracts. As of now, Lighter's open interest exceeds $1 billion, with monthly perpetual contract trading volume exceeding $130 billion.

Why choose Lighter? First, the team confirmed in an AMA that the airdrop allocation ratio is 30%-50%. By the fourth quarter, only 11 million tokens will be distributed, meaning the token issuance will be completed within 2-3 months. Currently, each Lighter token is trading at over $50 in the over-the-counter (OTC) market, indicating its significant scale.

Additionally, Lighter is still in private testing and requires an invitation code to join. You can try clicking this link.

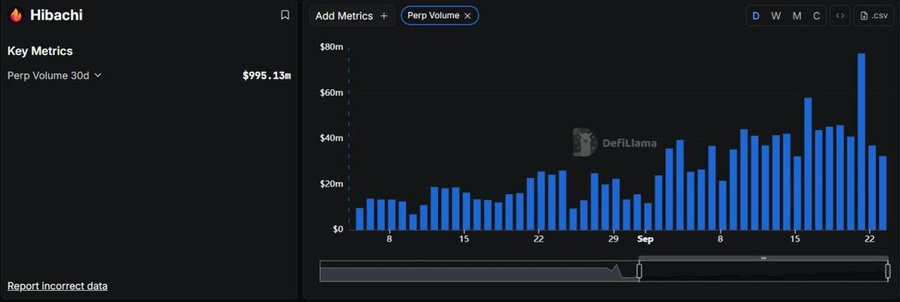

@hibachi_xyz

Fast and privacy-focused perpetual contract trading, secured by zk technology. It has raised $5 million from Dragonfly, Echo, and Electric Capital. Currently still in the early stages, points have been launched. The current daily perpetual contract trading volume is between $35 million and $40 million, indicating significant room for participation.

How to participate in the airdrop:

Visit: click here for the link

Register using your wallet

Deposit USDC and start trading

The pre-season will end on September 30, so hurry up.

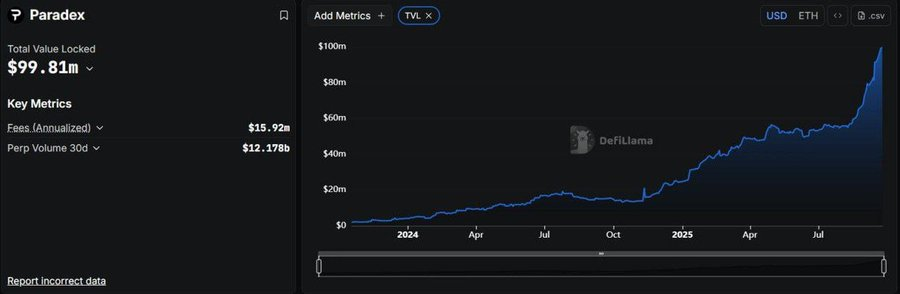

@tradeparadex

Zero-fee perpetual contract trading with deep liquidity and privacy protection, supported by Paradigm.

The total locked value (TVL) currently stands at $100 million, with monthly perpetual contract trading volume at $12.1 billion and annual revenue reaching $20 million.

Supporting 15+ chains, there are currently only 6,000 monthly active users (still significant room for participation).

How to participate in the airdrop:

Visit link and register using your wallet

Deposit supported assets and start trading

Provide liquidity in your favorite trading pairs

Deposit into the treasury to earn APR and XP

Currently still in the early stages, so don’t miss out.

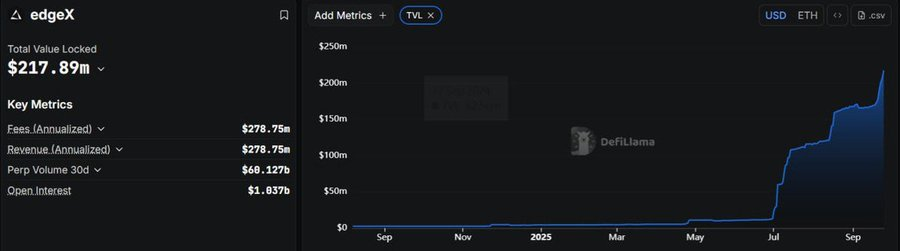

@edgeX_exchange

High-performance, order book-based perpetual contract DEX. Open interest exceeds $1 billion, with monthly perpetual contract trading volume reaching $60 billion and annual revenue of $278 million. Its points program has been launched.

How to participate in the airdrop:

Visit: click here for the link and register using your wallet

Deposit funds and start perpetual contract trading

Deposit into the protocol treasury to earn over 30% annual yield and points.

This exchange has consistently ranked among the top five perpetual contract exchanges, so don’t miss out.

@extendedapp

A perpetual contract DEX built by the former Revolut team. The locked value exceeds $52 million, with monthly perpetual contract trading volume at $5 billion. Supported by Cyber Funds, it has raised $6.5 million. Extended's first quarter points program has been launched, distributing 1.2 million points to users weekly.

How to participate in the airdrop:

Visit: click here for the link and connect your wallet

Deposit funds, start trading, deposit into the treasury, and earn points.

Extended's current trading volume is nearly 70% of Avantis' monthly perpetual contract trading volume.

If launched at Avantis' 70% fully diluted valuation (FDV), each point is expected to be valued at $7-9.

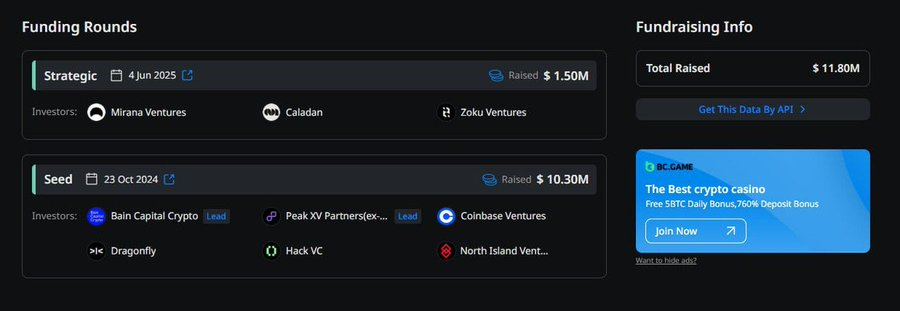

@variational_io

A perpetual contract DEX based on Arbitrum. Still in private testing and requires an invitation code to join. Supported by Coinbase Ventures, it has raised $11.8 million.

How to participate in the airdrop:

Visit: click here for the link and connect your wallet

Deposit funds from Arbitrum and start trading

The user base is very low, making it relatively easy to earn points.

@Aster_DEX

A week ago, no one was talking about $ASTER.

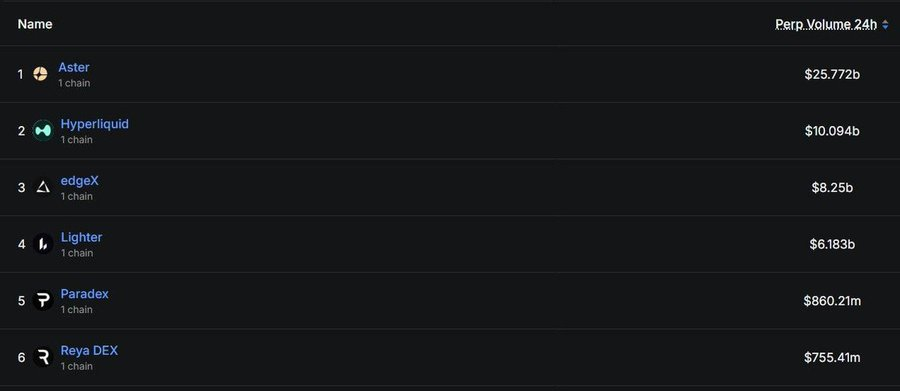

Today, its 24-hour perpetual contract trading volume and revenue have surpassed Hyperliquid. So what happened?

Similar to Hyperliquid, Aster offers spot and perpetual contract trading. It also plans to launch its own stablecoin and L1 public chain. Like $HYPE, $ASTER will allocate over 50% of its supply for community airdrops and incentives.

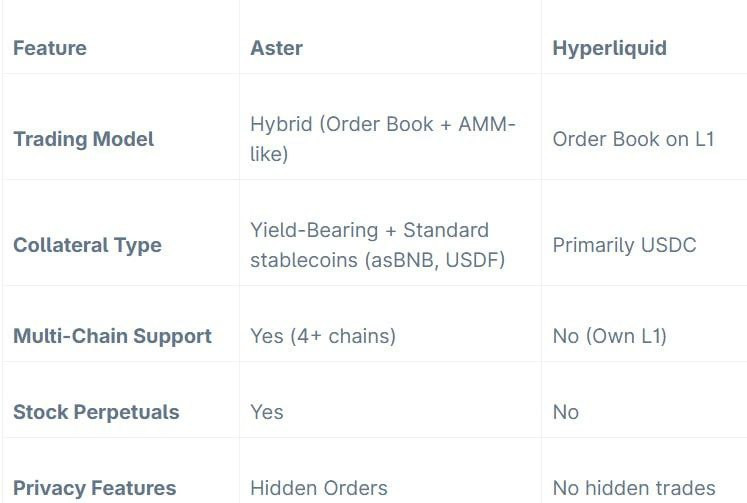

However, there are some differences that set it apart from Hyperliquid:

Original tweet link: click here

Firstly, Aster's trading model is hybrid (order book + automated market maker).

Additionally, Aster supports 4+ chains and offers stock perpetual contracts.

Unlike Hyperliquid, where everyone can see your orders and liquidate you, Aster has dark pools to prevent front-running and liquidation manipulation.

But can't other DEXs do that?

There is one particular aspect that makes ASTER stand out:

“ @cz_binance CZ's support.”

CZ is the founder of Binance, having built it into a $100 billion company with over 300 million users, and now he supports $ASTER.

This is undoubtedly an important signal.

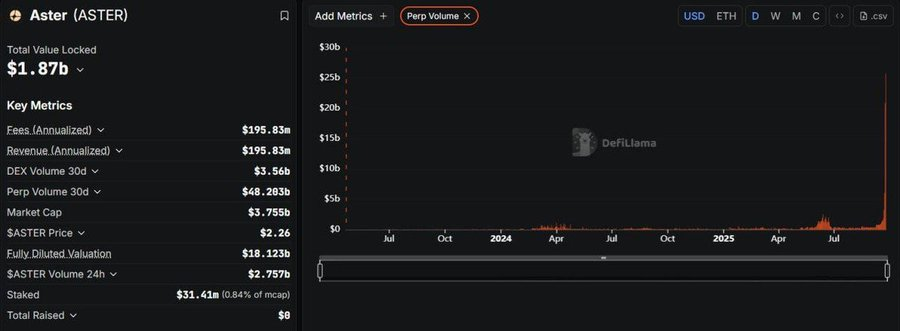

The market has felt this, which is why Aster's data is showing explosive growth:

TVL: $1.82 billion (weekly growth of 380%)

7-day DEX trading volume: $3.56 billion

30-day perpetual contract trading volume: $70.9 billion (monthly growth of 700%)

Annual revenue: $195 million

If this data is not enough to demonstrate ASTER's potential, I don't know what else could.

How to participate in the airdrop:click here for the link

@avantisfi

Every chain has a dominant DEX.

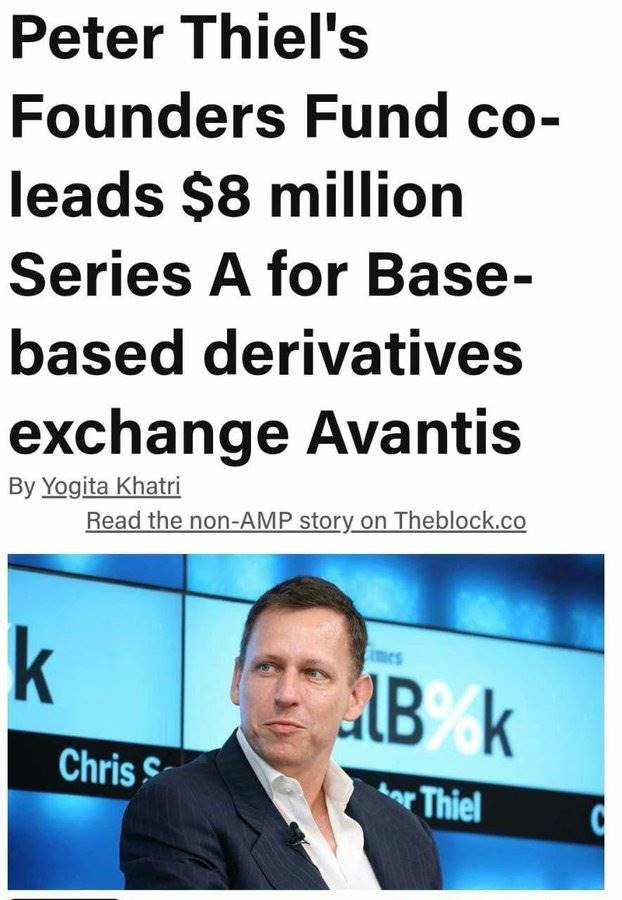

Solana has Jupiter, BNB Chain has Aster, and Base chain has Avantis, with the token symbol $AVNT. It is the largest perpetual contract exchange on the Base chain, supported by Peter Thiel's crypto fund.

In the past 30 days, Avantis' perpetual contract trading volume has reached $7.3 billion.

I believe this growth will continue unabated. Recently, Base announced plans to launch a network token. The airdrop criteria for $BASE are simple: use the network and its top applications.

Currently, Avantis is one of the largest applications, so usage will increase due to airdrop expectations. But that's not all.

Yesterday, Avantis announced it will airdrop 4% of its total supply at the end of the third quarter, over a period of 5 months.

This will undoubtedly drive massive trading volume while increasing demand for $AVNT, as staking the token can unlock more rewards.

Currently, $AVNT is listed on all major exchanges, with a market cap still at $500 million.

How to participate in the airdrop:click here for the link

That's all.

If you have any questions about this series of content, feel free to leave a comment, and I will be happy to help you!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。