"Financial technology" is the key to breaking the circle.

Written by: airtightfish

Translated by: AididiaoJP, Foresight News

The North Star is a fixed celestial body used by navigators to maintain direction. What would be the "North Star" in the bubble-ridden crypto market?

Although BTC is close to its historical high, "financial technology" is the key to breaking the circle.

University crypto clubs struggle to attract participants because nihilism is pervasive in this industry. People have seen through the predatory speculative plays and are weary of them, and the views from outside the circle are even more dismal.

But this misalignment of perception creates huge opportunities: people overemphasize short-term speculation while underestimating long-term structural trends, which may be one of the greatest opportunities of our time.

The predatory market structure is the problem, not the future

Memecoins reward influence rather than cognition. When the market is driven by speculation, those with influence control the narrative. When no external funds are coming in (PvP environment), over time, those closely tied to influence have a sustained advantage, leading to extreme wealth disparity. Trump made dozens of wallets earn over $10 million each, while thousands of small wallets lost money. This situation occurs daily in the "trenches" on a small scale. By design, it is a zero-sum game and cannot be sustained long-term. The days of frequent PvE markets are gone, and this is not just a problem for Memecoins.

High FDV and low circulation games are even worse. High FDV, low circulation listings, structured market-making trades, exchange listings, paid KOLs, teams selling off-market at significant discounts, supply control, and now "DATs"…

In too many cases, tokens are just a source of income, and retail investors become exit liquidity. If a project has no revenue (or no path to revenue), then the token is likely just that.

This nihilism stems from the market model in the crypto space; people have understood this game and are weary of it. This is not anyone's "fault," but rather a result of the market evolving over time. This structure is unsustainable, and as the industry continues to mature, predation in the market will play an increasingly smaller role as the market continues to refine itself.

"In the short term, the market is a voting machine; but in the long term, it is a weighing machine."

Revenue Trends

Narratives will still drive prices up, but participants now see it as trading rather than investing. Speculative premiums are compressed as wealth shifts from outsiders to insiders, leading to a continuous price decline. For projects without fundamentals, that bottom is infinitesimal.

BLAST token price chart

Revenue is the baseline. In traditional finance, if a company makes money, when the equity return exceeds the internal rate of return, they can and are motivated to buy back shares (this holds under a certain valuation, which will grow with growth). In the crypto space, it is a bit more nuanced because you have to consider the structure of labs versus foundations and dig deep to ensure no one is cooking the key performance indicators. Nevertheless, cash flow is king.

The crypto market will not only be PVP; scaling is on the horizon

The market will expand at a faster pace

Replacing analyst reports are tweet authors, liquidity funds, and proprietary traders, who will become the main marketing roles in the market.

Companies can be built in weeks, and revenue can grow tenfold in months. If I see a liquidity fund focused on fundamentals achieving 1000% returns in a year, I wouldn't be surprised.

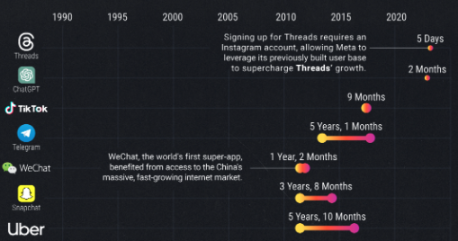

Social media has continuously shortened the time required to gain 100 million users.

Internet-based native dissemination

Social platforms have eliminated friction in entering the market, and people are spending more time online than ever before. We have seen applications reach 100 million users in just weeks (ChatGPT, Threads). Remini's AI avatar app surpassed tens of millions of downloads in about 30 days. The same goes for crypto technology: programmable incentives to reward users, creators, and referrers. Small teams with good products can scale faster than ever before.

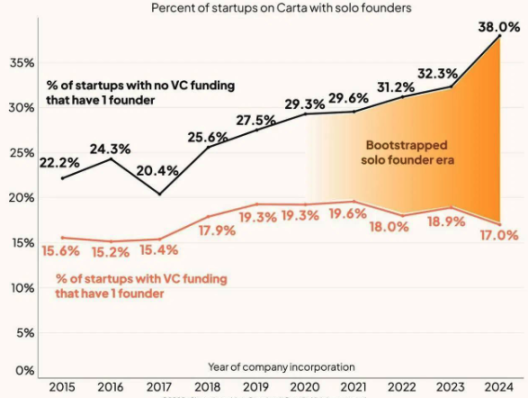

Fewer resources are needed to start a business, less funding is required, and more independent founders are emerging.

AI accelerates the building of startups

AI has changed the boundaries of production possibilities. "Atmosphere coders" can build very complex businesses. Agents are responsible for coding, building marketing, support, analysis, and even part of operations. These tools are accelerating changes in market structure, with over 60% of adults expressing a desire to build their own things. Tools lower the barriers; ambition fills the gaps. The long tail of startups is rapidly growing, and crypto technology can help address the early capital formation issues for this new group of enterprises. The ideas entering the market are more numerous than ever, and smaller teams can achieve scaling.

Cryptocurrency is the cornerstone of scaling

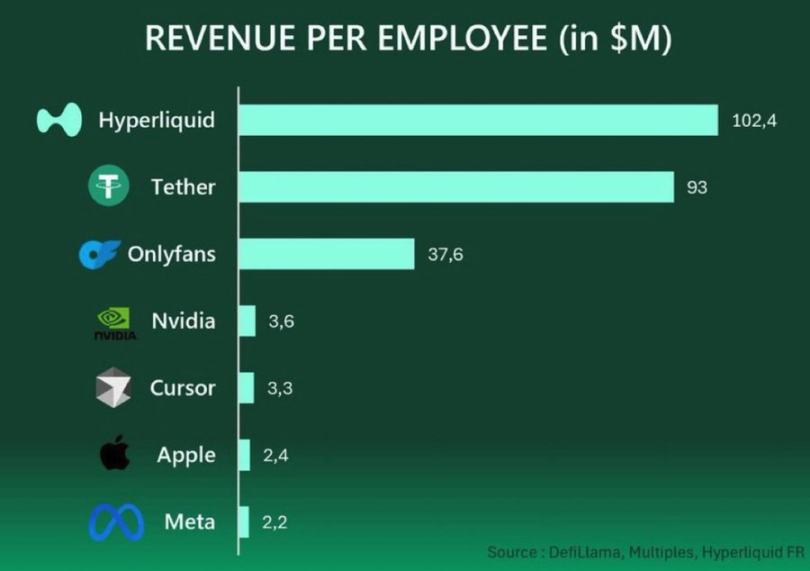

The companies with the highest per capita income in the world are Tether and Hyperliquid (both with per capita income exceeding $100 million), with others like PUMP and Axiom also in the top ten. Compared to other industries, the crypto market is still relatively small, and I expect to see more crypto companies on this list in the coming years. Crypto infrastructure enables trustless scalable automation; they are composable and globally borderless. Teams can be small yet still achieve scaling, and with the advantages of early capital formation and incentive mechanisms, you will see companies that can go from financing (optional to product) to achieving daily revenues of $1 million in just a few weeks. This trend will only accelerate, and in the next decade, hundreds or even thousands of unicorns will be created on-chain.

Internet Capital Markets (ICM)

The first wave of ICM led by Believe has the right direction but poor execution. The mechanism design is flawed, and more importantly, the "companies" launched are closer to Memecoins than real businesses. Nevertheless, ICM is inevitable.

If you were to design a market from scratch, you would build a single universal layer that enables the native issuance, trading, and settlement of any asset on a public chain, accessible to anyone in the world. I firmly believe this is the ultimate state of the market, and crypto technology provides us with a clear path to achieve this. Coupled with internet dissemination, accelerated corporate expansion, and reduced startup costs, you can envision a scenario where millions of internet-native enterprises can be built and invested in on-chain. It may take time to realize, but I genuinely believe people underestimate the scale of opportunity here.

"We tend to overestimate the impact of a technology in the short run and underestimate its long-term impact." — Amara's Law

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。