Flowers bloom in two, each in a different place.

Author: Nick Sawinyh

Translation: Deep Tide TechFlow

The decentralized finance (DeFi) ecosystem is continuously evolving, with innovative protocols pushing the boundaries of on-chain trading and financial services. Hyperliquid and Aster are two of the most notable newcomers; although both operate within the DeFi space, they adopt distinctly different strategies to address the key issues of decentralized trading and liquidity provision.

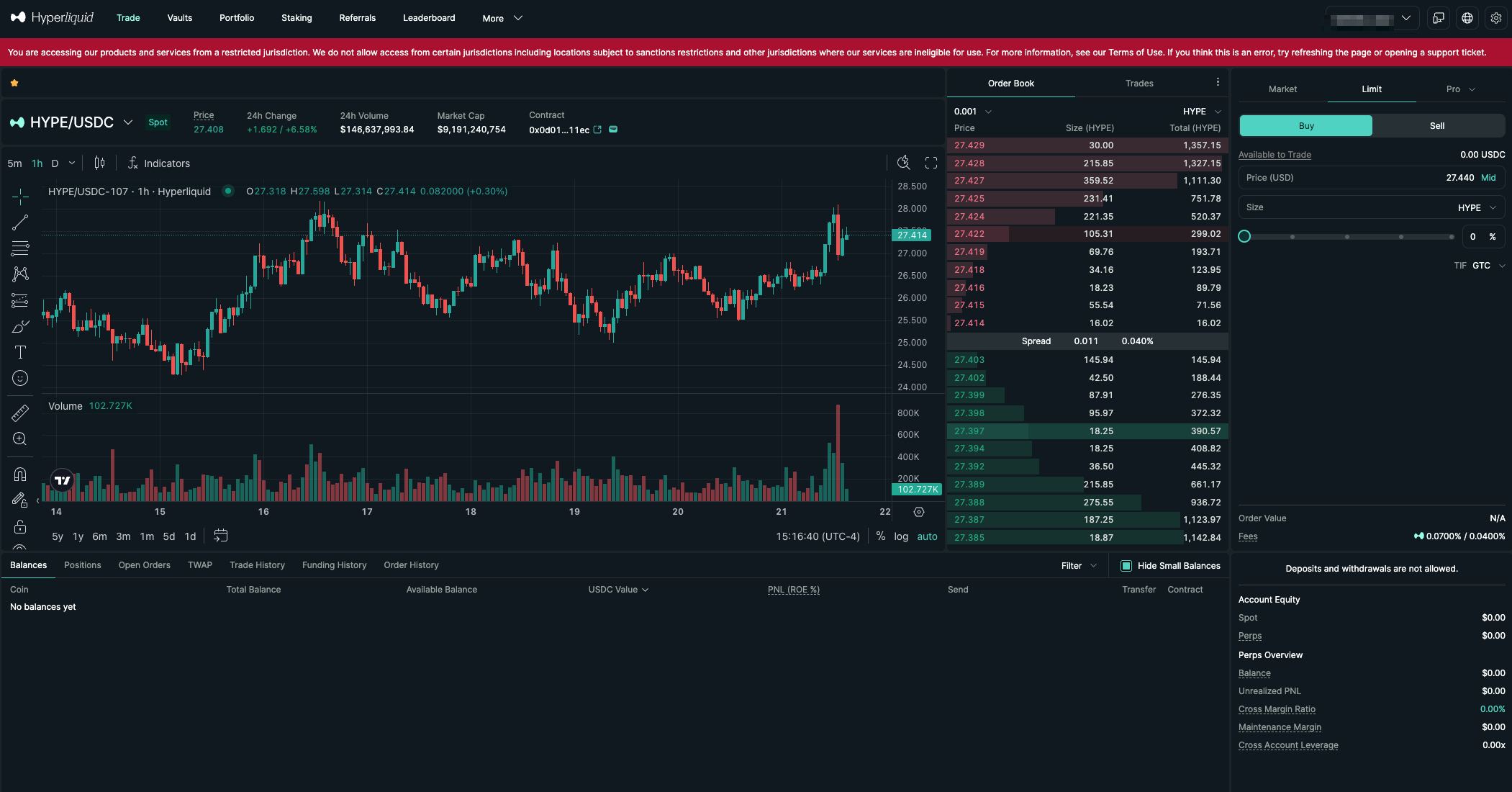

Hyperliquid: Performance-First DEX

Hyperliquid represents a new generation of decentralized exchanges, built to rival the performance of centralized exchanges. Launched in 2023, it is a fully on-chain order book exchange operating on its own L1 blockchain, specifically optimized for trading. The protocol has garnered significant attention among professional traders and market makers, who previously found the execution quality and speed of decentralized exchanges lacking. Hyperliquid's architecture is designed for high-frequency trading, featuring sub-second block times and the ability to process over 100,000 orders per second. This is not just a different curve automated market maker (AMM), but a completely new conception of decentralized trading infrastructure. The protocol supports spot and perpetual contract trading, with some trading pairs offering up to 50x leverage.

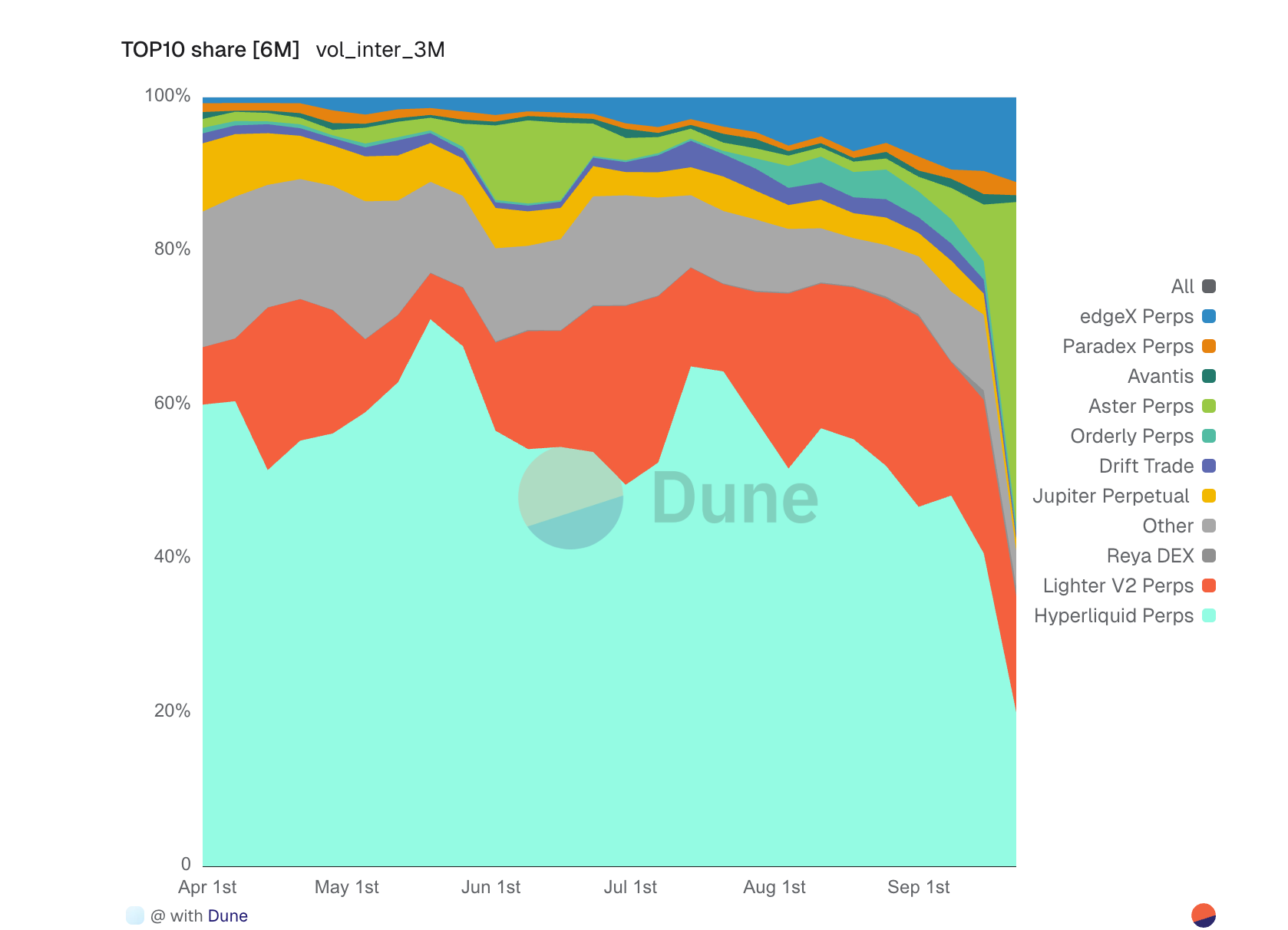

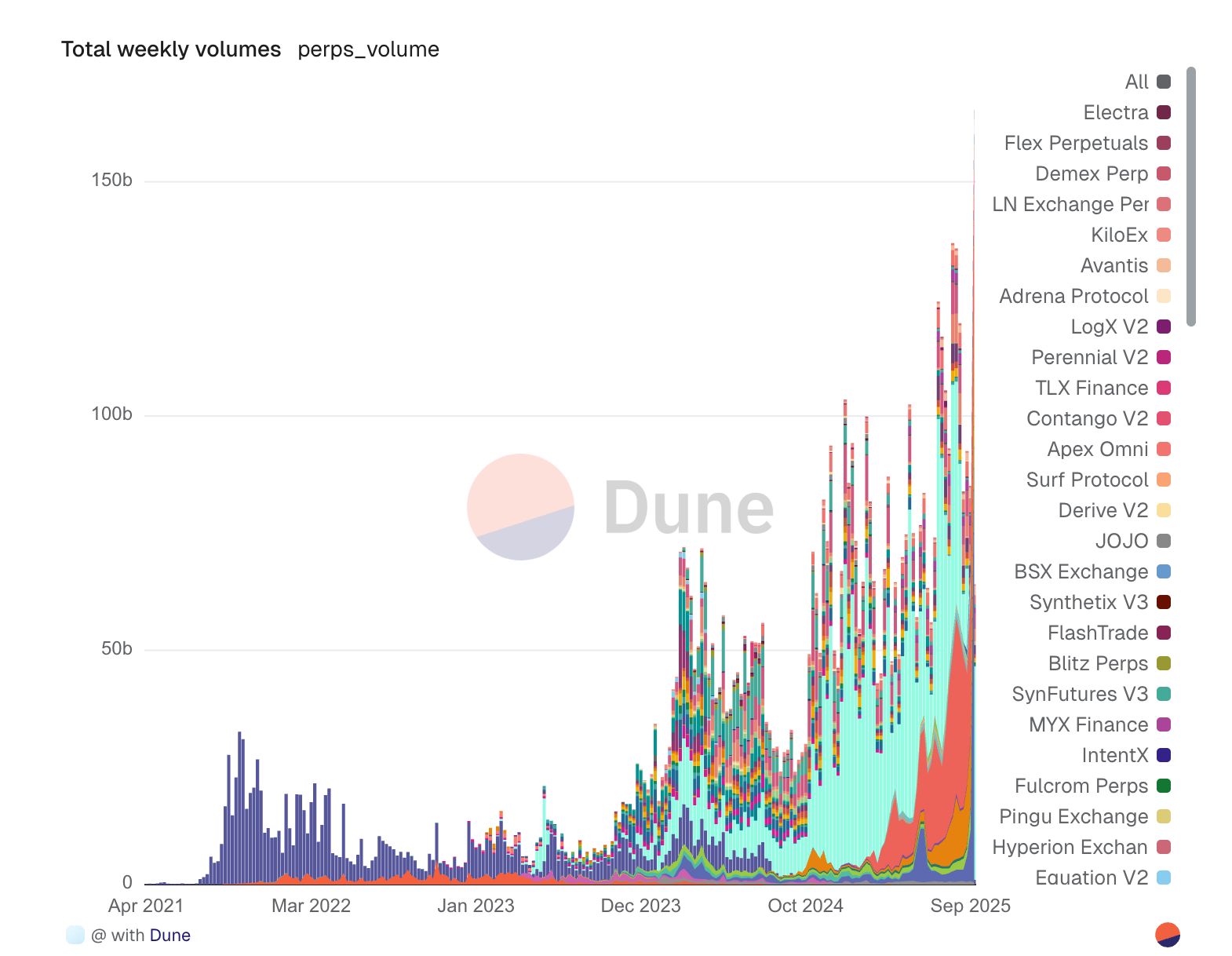

More perpetual contract market data on Dune

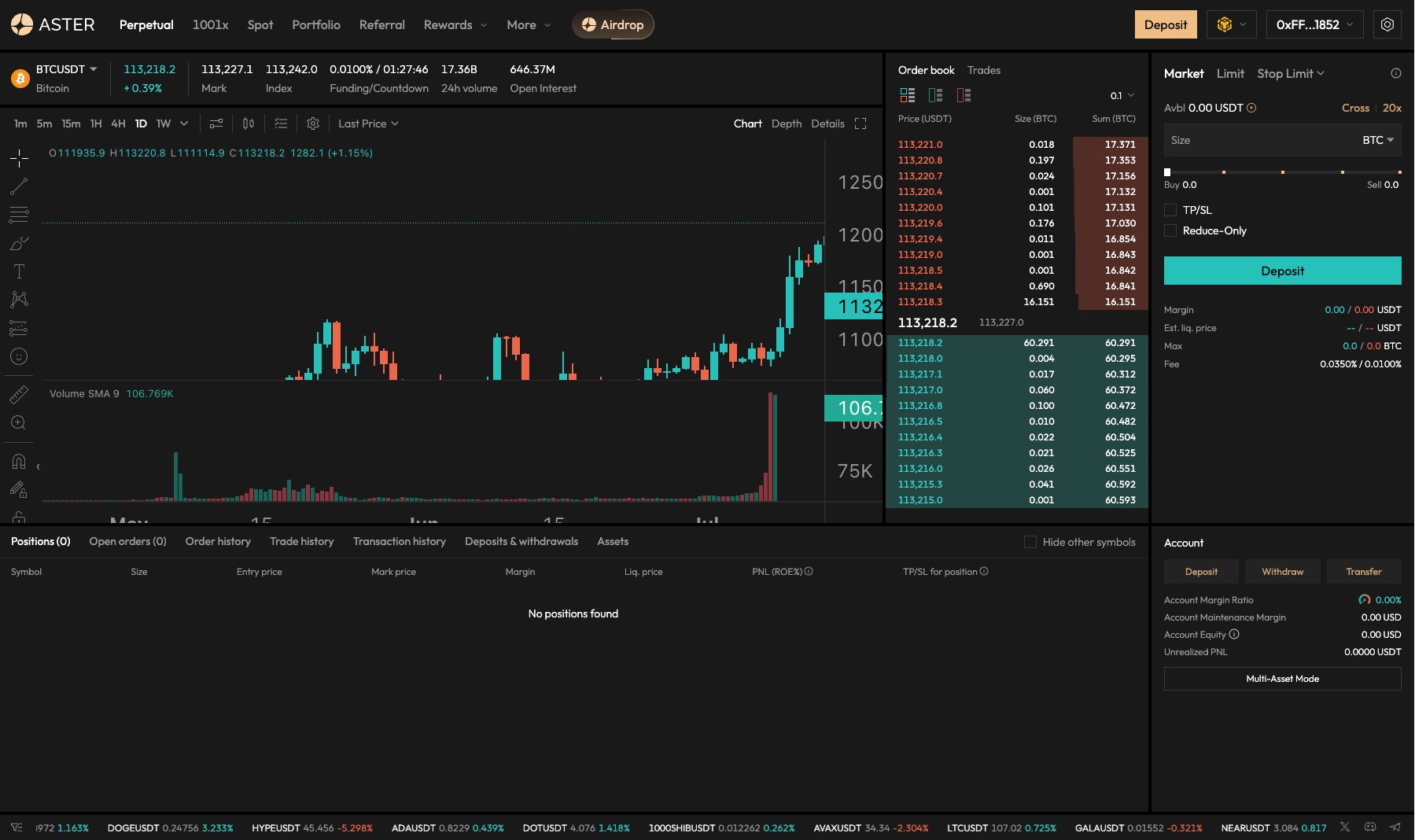

Aster: Liquidity Aggregation Layer

Aster, while not as well-known as Hyperliquid, takes a distinctly different approach to DeFi infrastructure. Aster does not directly compete with Hyperliquid but positions itself as a liquidity aggregation and optimization protocol. The platform focuses on solving the fragmentation issues across chains and protocols, providing users with optimal routing and execution across various liquidity sources. The protocol employs complex algorithms to source liquidity from multiple DEXs, lending protocols, and other DeFi primitives, simplifying operations for end users. In the current multi-chain environment, liquidity is increasingly fragmented across different ecosystems, making Aster's approach particularly valuable.

More perpetual contract market data on Dune

Technical Architecture

Hyperliquid's Proprietary L1 Blockchain

Hyperliquid decided to build its own Layer 1 blockchain due to the limitations of existing infrastructure. The HyperBFT consensus mechanism is an improved version of Tendermint, enabling the protocol to achieve consistent 0.2-second block times and instant finality. This performance is crucial for maintaining low spreads and executing complex trading strategies that were previously only achievable on centralized exchanges. The order book itself is fully maintained on-chain, with every order, cancellation, and trade transparently recorded. This differs from many "hybrid" decentralized exchanges, which maintain order books off-chain but settle trades on-chain. The fully on-chain approach ensures complete transparency and eliminates any centralized points of failure, although it requires significant engineering design to achieve acceptable performance. The protocol employs an innovative margin system that allows cross-margining across all positions, enhancing capital efficiency for traders. The liquidation engine operates entirely on-chain through a guardian bot network, ensuring that position liquidations are fair and transparent, without granting privileged access to any participants.

Aster's Cross-Chain Infrastructure

Aster's technical architecture revolves around its proprietary routing engine and cross-chain messaging system. The protocol maintains indexers across multiple blockchains, monitoring liquidity conditions, gas prices, and execution costs to determine the best trading paths. This real-time data is fed into a complex routing algorithm that can split trades across multiple platforms and blockchains, minimizing slippage and total execution costs. Cross-chain functionality relies on existing bridging infrastructure and Aster's own validation network. Aster does not need to build new bridging services but aggregates multiple bridging service providers to select the most reliable and cost-effective option for each transfer. This pragmatic approach reduces technical risks while maintaining flexibility as the bridging landscape evolves. The smart contract architecture on Aster emphasizes modularity and upgradability, with different components handling routing, execution, and settlement separately. This allows the protocol to quickly adapt to new liquidity sources and optimize individual components without affecting the entire system.

Trading Experience and Performance

Hyperliquid's CEX-like Experience

Users transitioning from centralized exchanges to Hyperliquid often mention the platform's familiarity. The order book interface, along with its real-time depth charts and order flow, aligns perfectly with traders' expectations from platforms like Binance or Bybit. Order execution is nearly instantaneous, with market orders typically completed within the same block they are submitted. The implementation of perpetual contracts is particularly complex, with funding rates calculated hourly based on the premium or discount of the perpetual contract price relative to the index price. This mechanism keeps perpetual contract prices closely aligned with spot market prices while providing opportunities for funding rate arbitrage. The protocol supports advanced order types, including stop-loss, take-profit, and more complex conditional orders. Latency measurements indicate that for users well-connected to validation nodes, Hyperliquid can process orders with less than 250 milliseconds of end-to-end latency. While this cannot compare to the microsecond latencies of centralized exchanges, it is revolutionary for a fully decentralized system and sufficient to meet the needs of most trading strategies.

Aster's Aggregation Advantages

Aster's user experience emphasizes simplicity and optimal execution rather than real-time trading. Users specify the desired trade, and the protocol handles all the complexities in the background. For large trades that could incur significant slippage on any single platform, Aster can distribute execution across multiple DEXs or even different blockchains, often achieving better prices than any single platform. The protocol excels at handling complex multi-hop trades, automatically routing through intermediary tokens when direct trading pairs are unavailable or liquidity is insufficient. This is particularly important for long-tail assets that are scarce and fragmented in liquidity. Aster's algorithms consider not only price impact when determining routes but also gas costs, bridging fees, and execution risks. Performance metrics show that for trades over $100,000, Aster typically achieves a 2-5% execution price advantage compared to simple single-platform trades, with the advantage increasing as trade size grows. However, this optimization comes at the cost of execution time—Hyperliquid can complete executions in seconds, while Aster trades involving cross-chain hops may take several minutes to fully settle.

Token Economics and Value Accumulation

Hyperliquid's HYPE Token

The HYPE token serves multiple functions within the Hyperliquid ecosystem. As the native gas token of the Layer 1 blockchain, it is a prerequisite for all transactions. Additionally, HYPE tokens can be staked to validation nodes, allowing stakers to earn a portion of the transaction fees generated by the protocol. This token economics establishes a direct link between protocol usage and token value, as increased trading volume drives gas demand and generates more transaction fees for stakers. The initial distribution of HYPE is community-focused, with 40% allocated through various community initiatives, including trading competitions, liquidity provision incentives, and retroactive rewards for early users. The allocation for the team and investors is subject to long-term lock-up restrictions, alleviating immediate sell pressure. The fee distribution mechanism is particularly attractive to token holders, as validators and stakers will receive 50% of all transaction fees. Given the protocol's growing trading volume, this will provide substantial real returns for participants. Currently, the annual percentage yield (APY) for staking ranges from 15% to 25%, depending on the total amount staked and trading volume.

Aster's Governance and Fee Model

Aster adopts a more conservative approach to token economics, with the ASTR token primarily serving governance functions initially. Token holders can vote on protocol parameters, including which liquidity sources to integrate, fee structures, and fund management. The protocol generates value by charging a small fee on each transaction on the platform, currently set at 0.05% of the transaction value. This fee model aims for sustainability without relying on token issuance to incentivize liquidity. Instead, Aster focuses on providing real value through superior execution and believes users are willing to pay modest fees for better prices and convenience. This approach may limit growth in the short term, but in the long run, it will create a more sustainable economic model. Fund management is governed, and fees accumulate in various tokens based on trading activity. A diversified fund reserve can buffer against market volatility and provide funding for ongoing development without the need for token sales.

Risk Assessment

Hyperliquid Risk Factors

Despite Hyperliquid's outstanding performance, it faces several risks. The custom L1 blockchain, while high-performing, poses validation risks if validator nodes are compromised or face censorship. Currently, the validator node scale is relatively small and permissioned, but there are plans to gradually achieve decentralization. Smart contract risks are mitigated through extensive audits and bug bounty programs, but the system's complexity, particularly regarding on-chain margin and liquidation engines, still presents potential attack surfaces. Since its launch, the protocol has not experienced any significant incidents, but the risk of undiscovered vulnerabilities remains. Market risk is significant due to the presence of leveraged trading. Although the liquidation system performs well during market volatility, extreme events could overload the insurance fund, leading to socialized losses. The protocol maintains transparency regarding the level of the insurance fund, but users must still be aware of the risks associated with leveraged trading.

Aster Risk Considerations

Aster's primary risks stem from its reliance on external infrastructure. Bridging risks are particularly concerning, as the protocol depends on third-party bridges to achieve cross-chain functionality. While aggregating multiple bridges can provide redundancy, catastrophic failures of major bridges could impact users engaged in ongoing transactions. As Aster interacts with numerous external protocols, the risk of smart contract integration also increases. Each integrated DEX or liquidity source could become a potential vulnerability. The protocol mitigates this risk through careful integration processes and monitoring, but its attack surface is inherently larger than that of a single-protocol system. If the routing algorithm fails to account for rapid market fluctuations or manipulative behavior, it could lead to poor execution outcomes. Although Aster has implemented various security measures, including maximum slippage protection and integrity checks, experienced attackers may still find ways to exploit the routing logic.

Market Position and Competitive Landscape

Hyperliquid's Competitive Position

Hyperliquid has quickly become a leading decentralized exchange (DEX) for perpetual contracts, consistently ranking among the top five in trading volume. Its main competitors include dYdX, GMX, and Synthetix Perps, each employing different decentralized derivatives trading strategies. Hyperliquid's advantage lies in its exceptional performance and user experience, attracting traders who prioritize execution quality. The protocol has been particularly successful in attracting market maker traffic, with several well-known trading firms providing liquidity. This creates a virtuous cycle: better liquidity attracts more traders, generating more fees for market makers, which further enhances liquidity. Currently, the depth and spreads of major trading pairs are approaching those of secondary centralized exchanges. As other protocols recognize the importance of performance, competition is intensifying. Several new DEXs based on L1 and L2 are launching with performance goals similar to Hyperliquid's. Hyperliquid's first-mover advantage and mature liquidity provide it with a moat, but maintaining a technological edge is crucial for long-term success.

Aster's Niche Market and Growth Potential

Aster occupies a different competitive space, competing more with aggregators like 1inch and Matcha rather than directly with DEXs. Aster focuses on cross-chain aggregation, which is distinctly different from competitors that typically concentrate on single-chain optimization. As multi-chain theory evolves and liquidity continues to fragment within ecosystems, Aster's value proposition becomes increasingly important. The protocol has achieved significant success with institutional users and DAOs executing large trades, as execution quality has a substantial impact on returns. The ability to access cross-chain liquidity from a single interface without directly managing the complexities of bridging provides significant value to these users. As cross-chain activity increases, its growth potential becomes more apparent. The protocol is well-positioned to benefit from the surge in L2 and alternative L1s, which will create new liquidity pools that need to be efficiently connected to broader markets. Aster's neutral stance towards blockchains and protocols allows it to quickly adapt to changing market dynamics.

Recent Developments and Catalysts

Hyperliquid has accelerated its roadmap through several community-approved initiatives:

HIP-1 and HIP-2 Stablecoin Proposals: In 2025, Hyperliquid launched its native stablecoin USDH through the HIP-1 standard and ERC-20 version. Validators chose to issue USDH in native markets, starting from a capped minting/redeeming phase before a full rollout. The reserve model combines off-chain assets like government bonds with on-chain reserves, generating returns to support HYPE token buybacks and validator rewards.

Circle / USDC Integration: Circle launched native USDC on HyperEVM, supported by CCTP V2 interoperability. This enhanced dollar liquidity on Hyperliquid and introduced interesting dynamics between third-party USDC and Hyperliquid's own USDH.

HIP-3 Governance Expansion: The new proposal outlines mechanisms for permissionless market listings through auctions, potentially democratizing asset listings while adjusting incentive mechanisms through HYPE staking.

These initiatives indicate that Hyperliquid is striving for its own liquidity and deeper financial integration, setting it apart from competitors that rely solely on external stablecoins.

In contrast, Aster has yet to launch a native stablecoin. Instead, it relies on established assets like USDC and USDT for trading routing. While this avoids the regulatory and operational risks associated with stablecoin issuance, it also means Aster cannot generate direct fees or buyback mechanisms like USDH does for Hyperliquid.

Future Developments and Roadmap

Hyperliquid's Development Direction

Hyperliquid's roadmap primarily focuses on three areas: decentralization, feature expansion, and ecosystem development. Gradually achieving decentralization of the validator set is a top priority, with plans to transition to a permissionless validation mechanism once the network stabilizes. This process must be carefully managed to enhance censorship resistance while maintaining performance. Feature expansion includes adding more trading pairs (especially spot trading) and introducing more complex order types and trading strategies. The protocol is also exploring integrations with other DeFi protocols, potentially allowing Hyperliquid positions to be used as collateral elsewhere or supporting the construction of structured products on top of exchanges. Ecosystem development involves building a developer community around Hyperliquid. The team is developing comprehensive APIs and SDKs to enable algorithmic trading and integration with trading bots and platforms. A funding program aims to incentivize the development of tools and applications that enhance the trading experience through reward schemes.

Aster's Strategic Direction

Aster's development focus is on expanding blockchain coverage and enhancing routing intelligence. The protocol plans to integrate with emerging L2s and application chains to maintain its position as the most comprehensive aggregation layer. Each integration requires careful design to ensure security and optimal routing, but this also expands the protocol's potential market. Development is underway for AI and machine learning enhancements to the routing algorithm, which aim to improve execution quality by better predicting market impacts and optimizing split strategies. The team is also exploring integrations with private mempools and order flow auctions to access more liquidity sources. Establishing strategic partnerships with wallets and other DeFi interfaces can significantly expand Aster's user base. By providing aggregation infrastructure for other protocols and applications, Aster has the potential to become the default execution layer for a large volume of DeFi trades, with users potentially unaware that they are using the protocol.

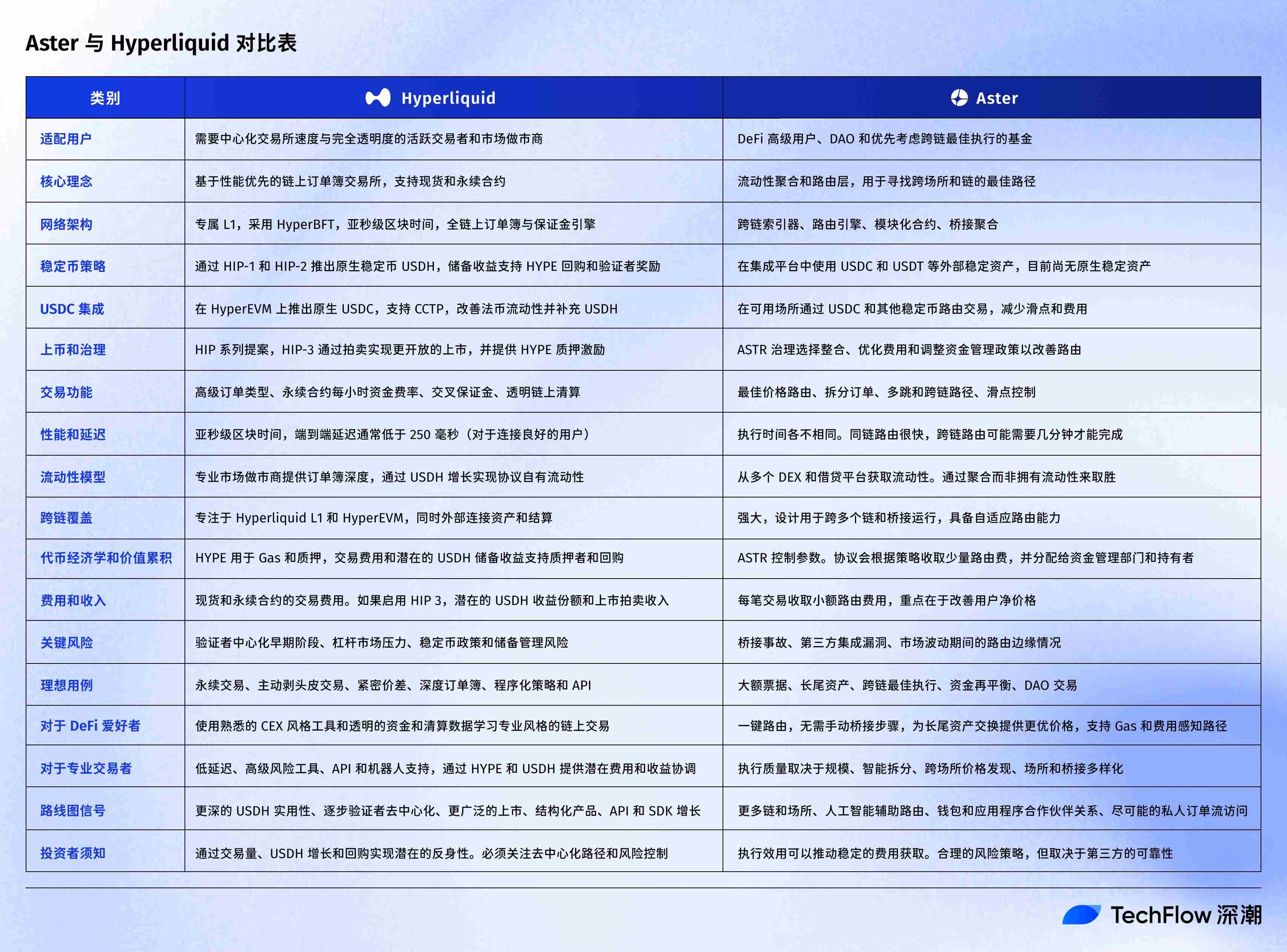

Aster vs. Hyperliquid Comparison Table

Conclusion

Hyperliquid and Aster represent two successful yet distinctly different approaches to improving decentralized trading. Hyperliquid focuses on replicating and surpassing the performance of centralized exchanges on a fully decentralized platform to meet the needs of active traders and market makers requiring exceptional execution quality. Its success demonstrates that decentralized exchanges can compete with centralized exchanges on their own merits, rather than solely on the basis of decentralization ideology. Aster's aggregation approach addresses another equally important issue—the fragmentation of liquidity in an increasingly complex multi-chain environment. By abstracting complexity and optimizing cross-platform execution, Aster provides value even to users who may not care about the underlying infrastructure. This pragmatic approach to improving user outcomes, rather than building another decentralized exchange, signifies the maturation of the DeFi space. Both protocols face challenges. Hyperliquid must find a delicate balance between performance and decentralization while fending off intensifying competition. Aster must manage the complexity and risks associated with integrating an expanding array of blockchains and protocols while maintaining security and reliability.

The success of both protocols will ultimately benefit the entire DeFi ecosystem. Hyperliquid proves that the performance of decentralized infrastructure can rival that of centralized exchanges and has the potential to accelerate the migration of trading volume on-chain. Aster indicates that the multi-chain future does not necessarily mean market fragmentation and inefficiency—intelligent infrastructure can maintain or even enhance capital efficiency as ecosystems become more complex. For users and investors evaluating these protocols, the choice does not have to be binary. Hyperliquid serves traders needing high-performance perpetual contracts and spot trading, providing a centralized exchange (CEX)-like experience. Aster serves users seeking optimal execution solutions for large trades or accessing fragmented cross-chain liquidity. Both protocols are pushing the boundaries of DeFi, striving to build a more efficient, convenient, and robust decentralized financial system. The ongoing development of both protocols is worth watching, as they represent a broader trend in DeFi: the pursuit of performance parity with traditional finance and the demand for infrastructure capable of managing increasing complexity. Their successes and failures will provide important lessons for the next generation of DeFi protocols and shape the future landscape of decentralized markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。