Some DATs are expected to become the "profit-oriented public company benchmarks" for cryptocurrency foundations.

Written by: Ryan Watkins, Co-founder of Syncracy Capital

Translated by: Chopper, Foresight News

Digital Asset Treasuries (DAT) currently hold $105 billion in assets and control a significant portion of the token supply of mainstream blockchains. The rapid expansion of DAT is astonishing, yet few have paused to consider the deeper implications behind Wall Street's latest "gold rush."

So far, discussions about DAT in the market have been limited to a short-term speculative perspective: how much funding has been raised, how long can the premium be maintained, and which asset will attract the market's attention next.

This is not without reason, as most DATs lack substantial value beyond financial engineering design, and once market enthusiasm wanes, they are likely to fade into obscurity. However, an excessive focus on short-term speculative factors has led the market to overlook the long-term economic potential of those DATs that ultimately stand out.

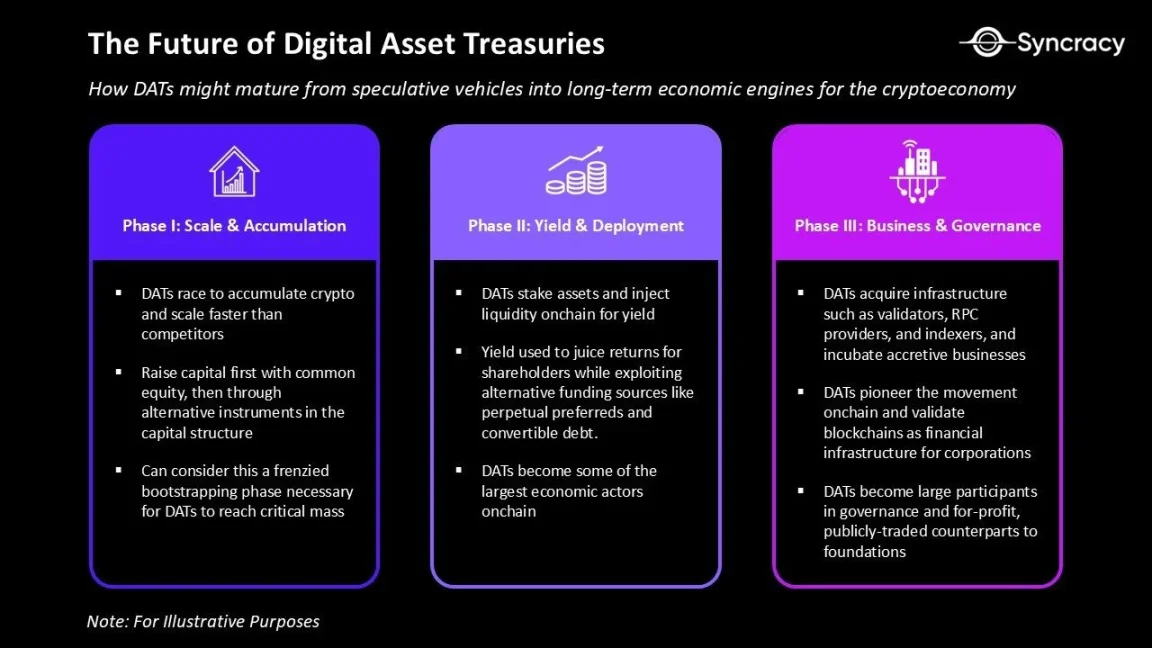

We believe that this period will eventually be seen as the "frenzied launch phase" of DAT—this is a necessary beginning for DAT to reach critical scale and surpass its peers. In the coming quarters, leading DATs will optimize their capital structures, adopt more complex asset management strategies, and expand into service areas beyond capital management.

In short, we believe that some DATs are expected to become the "profit-oriented public company benchmarks" for cryptocurrency foundations. Unlike foundations, they will undertake a broader mission: injecting capital into their ecosystems and leveraging the scale of their asset pools to conduct business and participate in governance. Currently, a few DATs hold assets that exceed the scale of the protocol foundations they rely on, and their ambitions for further expansion are accelerating.

However, to understand the future of DAT, we must first trace back to the core attributes of cryptocurrency itself. Only by doing so can we see how DAT can grow from a speculative tool into a long-term economic engine of the crypto economy.

Programmable Money

The code of Bitcoin contains a series of principles, such as deterministic issuance and peer-to-peer transfers, which make it digital gold. The proof-of-work (PoW) consensus mechanism of Bitcoin, along with the small block concept, ensures sovereign-level censorship resistance and end-user verifiability, maximizing system credibility through simplicity.

However, this conservatism comes with trade-offs: Bitcoin's security is unmatched, but its design limitations lead to insufficient scalability, ultimately allowing only for simple transfer functions.

In contrast, Ethereum is positioned as a world computer, with its smart contracts allowing developers to create new assets and set arbitrary custodial logic, while the proof-of-stake (PoS) consensus mechanism enables final settlement and higher scalability. These features collectively lay the foundation for a fully programmable financial system.

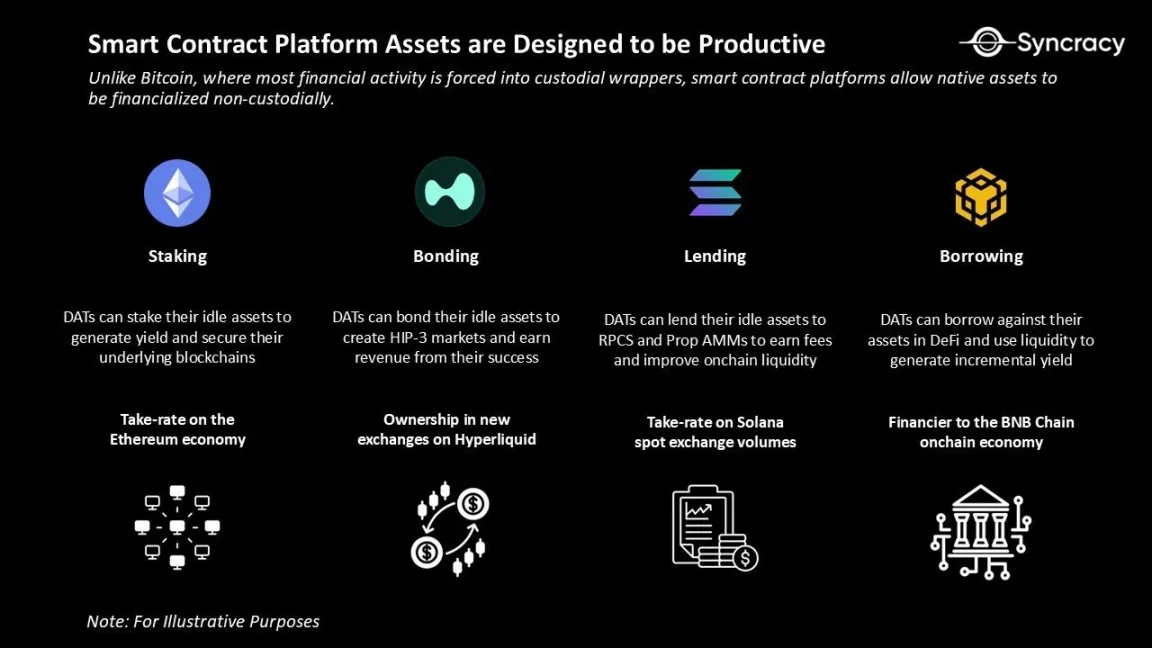

Today, the scalability of Ethereum and other smart contract platforms (such as Solana and Hyperliquid) is enabling money itself to become programmable. Unlike Bitcoin, smart contract platforms allow native assets to be monetized in a non-custodial manner. This not only reduces counterparty risk but also creates more possibilities for "activating value" of assets.

From a fundamental application perspective, this means "staking assets to secure network safety and earn transaction fees," or "using native assets as collateral for lending and generating yields." But these are just the tip of the iceberg: programmability also allows for re-staking of assets and extends into entirely new forms of financial activities.

The uniqueness of these on-chain applications lies in their need for substantial native capital to initiate operations, improve product quality, and scale.

For example, on Solana, RPC service providers and market makers that stake more SOL tokens have advantages in transaction confirmation stability and capturing spread profits; on Hyperliquid, exchanges that stake more HYPE tokens can offer lower fees or obtain higher revenue shares without increasing user costs. These native capital requirements may limit the growth of smaller enterprises, while many businesses will greatly benefit from direct access to permanent native asset pools.

Capital Allocation Game

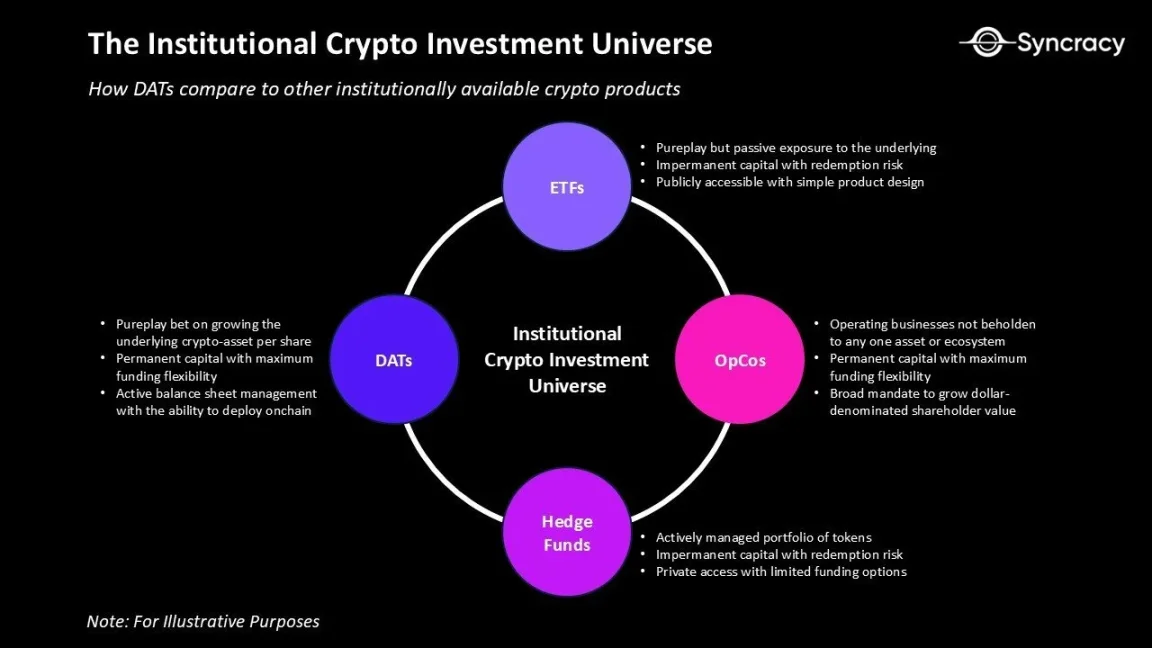

Programmable money has fundamentally changed the asset-liability management logic of DAT. Taking Strategy (MSTR) as an example, it can only adjust its capital structure around "holding Bitcoin"; whereas DATs focused on assets like ETH and SOL can operate flexibly on both sides of the balance sheet.

These DATs integrate core characteristics of multiple traditional business models: they draw from the long-term capital structure of closed-end funds and real estate investment trusts, the balance sheet orientation of banks, and the long-term compounding philosophy of Berkshire Hathaway.

Their uniqueness lies in the fact that returns are calculated on a "per share of cryptocurrency" basis, making them pure investment tools for the underlying projects rather than asset management institutions that charge fees. The capital allocation advantages brought by this structure are not replicable by traditional funds or foundations.

Long-term capital: Similar to closed-end funds or real estate investment trusts, the capital raised by DAT is long-term funding, not supporting investors' redemption at any time. This shields them from liquidity pressures, allowing them to avoid being forced to sell assets during market downturns and instead take advantage of opportunities to increase holdings during market fluctuations, focusing on "per share cryptocurrency compounding growth."

Flexible financing tools: DAT can expand their balance sheets by issuing common stock, convertible bonds, or preferred stock. These financing channels are inaccessible to traditional funds, providing structural advantages for enhancing investor returns. For example, after obtaining low-cost funding, they can engage in arbitrage trading between traditional finance (TradFi) and decentralized finance (DeFi); the yields from assets like ETH and SOL also enable DAT to manage financing costs better than "static asset pools" like Strategy.

High-yield balance sheets: As DAT begins to stake tokens, inject liquidity into DeFi, and acquire core ecosystem assets (such as validator nodes, RPC service providers, and indexers), their asset pools gradually become "high-yield engines." This not only creates a continuous revenue stream but also allows DAT to hold economic and governance influence within the ecosystem. For instance, a leading DAT could leverage its asset pool to push through a controversial governance proposal.

Ecosystem compounding: The mission of foundations is to maintain ecosystems, but they are limited by their non-profit nature; whereas DAT, as "profit-oriented benchmarks," can reinvest profits into asset accumulation, product development, and ecosystem expansion. In the long run, the best-managed DATs may grow to become the Berkshire Hathaway of the blockchain space, achieving not only capital compounding but also leading the direction of ecosystem development.

Experimentation and innovation: DAT is one of the most dynamic groups of public companies driving "on-chain transformation." Initially, this may involve tokenizing equity and executing market acquisitions on-chain; in the long run, it may even migrate entire processes such as payroll and vendor payments on-chain. If executed properly, DAT could provide a roadmap for other public companies to transition on-chain and validate the value of blockchain as corporate financial infrastructure.

Understanding DAT from this perspective clarifies the key to its success: teams cannot rely solely on announcing asset acquisitions and repeatedly "shouting orders" on television to win. As competition intensifies, the winners must rely on professional capital allocators and efficient operators to enhance shareholder value.

The first generation of DAT focuses on financial engineering, using Strategy as a model; the next generation of DAT will become active capital allocators, creating returns through on-chain asset pools.

However, in the long run, the DATs that survive will not merely be holders of tokens. They will gradually approach operational companies in many aspects, leveraging the scale of their asset pools to conduct business; otherwise, their net asset value premiums will ultimately collapse.

Crisis Risks

As the frenzied launch phase of DAT progresses, greed is heating up, and speculators are flocking in. We expect this to lead to increased risk-taking behavior, ultimately triggering industry consolidation.

Currently, DAT activities are concentrated on three major assets: BTC, ETH, and SOL. However, the model of "financing to increase their own tokens and then selling to public equity investors at a premium" is highly tempting for speculators. Once the paths of mainstream assets are validated, the flow of funds into high-risk assets will be inevitable. This mirrors the logic of the 2017 ICO boom and the 2021 "Web 3.0" venture capital frenzy. Now, it is Wall Street's turn to take the baton.

As of the writing of this article, DAT's capital is primarily raised through common stock, with low leverage and minimal forced liquidation risk. Additionally, the behavior of "supporting buybacks by liquidating underlying assets at a discount" is also facing strong constraints: structurally, existing tools do not require this; socially, selling core assets contradicts the "social contract" of DAT to "long-term hold and align with token holders."

But this may just be a matter of expectation. If a crisis truly occurs, shareholders may believe that "regardless of the method, as long as it can enhance per-share net value." When premiums turn into discounts, balance sheet experiments increase, and new financing tools emerge, "prudent compounding" may be replaced by "aggressive financial engineering."

In fact, we believe this trend is hard to avoid: most DAT operators either lack experience or only have a vision that remains at the current frenzy. Ultimately, we expect to see a wave of DAT mergers and acquisitions; excessive trading will also become frequent, and struggling DATs may even sell off less favored assets in pursuit of market hotspots.

Bubble or Prosperity?

The deeper one studies DAT, the more one may question: is this exploration of long-term fundamentals merely a post-facto justification for their existence? Can these tools truly become the "Berkshire Hathaway of the blockchain space," or are they merely speculative packaging products born from the "crazy leveraged buyout of a declining software company and buying Bitcoin" craze?

At least compared to previous financing booms in the crypto industry (such as ICOs), DAT represents progress: they are subject to regulatory constraints, align with investor interests, and significantly reduce fraud risks. Moreover, DAT brings positive changes to market structure, reducing market supply without affecting prices. The meme coin frenzy and the slump of altcoins over the past few years have destroyed retail confidence, leading to the spread of short-termism and pessimism in the market; therefore, any form of "long-term, steadfast buyers" emerging is a positive signal.

But perhaps the question of "whether it is post-facto justification" is not important. The development of the world has "path dependency"; whether we agree or not, public companies now hold substantial amounts of cryptocurrency on their balance sheets. The real question is: what will happen next?

Now, Wall Street is gradually understanding the achievements of the crypto industry over the past few years, while the blockchain space is coincidentally reaching a point of regulatory clarity and the emergence of killer applications. If even a small portion of this value can be integrated into the operating models of public companies and financial institutions, DAT will become a significant victory for the category of crypto assets; even if it can only attract a new batch of buyers for crypto assets, it is already highly meaningful.

On Twitter and mainstream media, there are many voices expressing concerns about DAT. The short-term market is already filled with noise, but if you zoom out, you may find reasons for optimism. History has shown that, in the long run, the market often favors the optimists.

Not all DATs will reach the ideal shore, but a few successful ones will undoubtedly leave a profound impact on the crypto economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。